On February 8, the Brazilian Supreme Court (STF) concluded the trial of Extraordinary Appeals no. 949,297 and 955,227, listed in Themes no. 881 and 885 of the general repercussion (with binding effects), which discussed the impact of STF decisions in direct actions of unconstitutionality or general repercussion appeals on recurring tax levies, when there is a final decision in an individual claim against a levy that is subsequently upheld by the STF.

According to the thesis established by the STF, the individual decisions obtained by taxpayers lose their effects after a ruling of the STF in the opposite way. The STF established the following thesis:

"1. The decisions of the STF in incidental control of

constitutionality, prior to the general repercussion regime, do not

automatically impact res judicata, even in the case of recurring

tax relations.

2. Decisions issued in direct actions of unconstitutionality or in

appeals with general repercussion shall automatically interrupt the

effects of the res judicata in recurring tax relations, but

observing the Principles of Non-Retroactivity and Anteriority,

according to the nature of the tax."

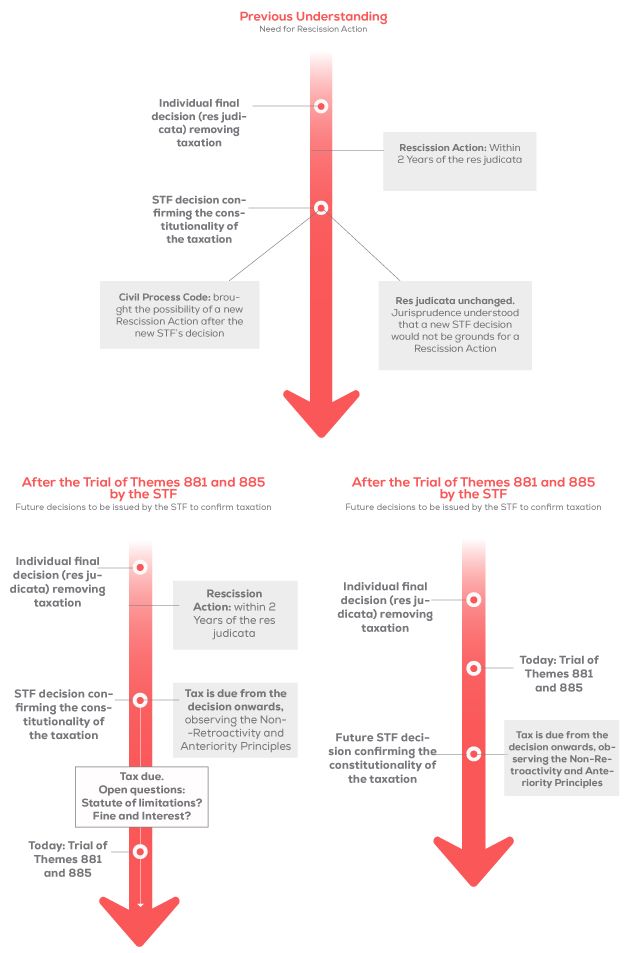

The specific case analyzed by the STF dealt with taxpayers who had res judicata recognizing the unconstitutionality of the Contribution on Net Profit (CSLL). However, after the individual cases became res judicata, the STF decided in 2007, in a direct action, for the constitutionality of this tax. According to the new understanding issued by the STF, such tax should be paid by all taxpayers since such trial in 2007. The STF did not modulate the effects of its decision, meaning that all its decisions in centralized control of constitutionality validating a certain tax produce the effect of automatic revocation of the individual taxpayers' res judicata.

However, such revocation must respect the Principles of Non-Retroactivity and Anteriority, according to the nature of the tax, because the STF decision that confirms the constitutionality of a certain taxation would have the same effect of a new law creating or increasing a tax, in relation to taxpayers who were not obliged to pay it pursuant to an individual res judicata.

The Non-Retroactivity excludes the possibility of the tax authorities charging the tax referring to periods prior to the decision of the STF that confirms the constitutionality of the taxation.

The Anteriority Principle establishes an initial term for the collection of the tax after its creation or increase, which may be of 90 days, the first day of the subsequent year, both or none of these criteria, depending on the tax in discussion.

It is expected that taxpayers will file a motion for clarification against the STF decision to discuss, among other topics, the need for modulation, as well as to address some points that remain unclear, such as the application or not of statute of limitations, penalties, and interest on amounts not collected in the past (in the case of STF decisions issued before this judgement).

In summary, the decision of the STF means that:

– Taxpayers who have final and unappealable decisions that

exclude certain recurring taxation may have to resume the

collection of such tax if the STF declares it constitutional in

general repercussion appeals or in direct actions of

(un)constitutionality.

– The reestablishment of taxation will occur for periods

after this new decision issued by the STF, observing the Principle

of Anteriority, according to the nature of the tax.

– For taxes that have already been the subject of a decision

by the STF in these situations, as there was no modulation, the

amounts not collected between this decision and today are due

(observing the anteriority principle), and it is still undefined

whether the statute of limitations will be applicable and if the

amounts will be charged with penalties and interest.

To better demonstrate the effects of the trial, please refer to the following infographic:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.