Health Care Cases Drive FCA Recoveries

Mintz's annual report on False Claims Act case activity analyzes data from the DOJ and the firm's Health Care Qui Tam Database, and explores the 2023 spike in FCA case activity, the ongoing moderate decline in health care–related activity, and continuing robust recoveries in health care cases.

A LETTER FROM THE CO-CHAIRS

In this edition of EnforceMintz, we analyze trends in False Claims Act (FCA) investigations and lawsuits using data compiled by Mintz in its Qui Tam Database, the annual report of FCA statistics published by the Department of Justice (DOJ), and DOJ's discussion of FCA enforcement trends and recoveries that accompanied its annual report.

We also utilize the FCA statistics to provide insights on the trends and government priorities driving FCA cases and offer our predictions on the future of health care FCA cases.

New FCA cases exceeded 1,000 in a single fiscal year (FY) for the first time, with a total volume of 1,212 cases being filed in FY 2023. This marked increase seems to be driven by government-initiated cases related to COVID-19 pandemic relief fraud. Qui tam case volume nevertheless remained high and continues to account for the majority of FCA cases. While health care case volume moderately declined, health care recoveries remained robust.

For additional health care enforcement analysis, view our recently released Health Care Enforcement Trends & 2024 Outlook, which reports on qui tam FCA cases, other government enforcement actions, and significant regulatory developments from the past year.

Karen Lovitch and Brian Dunphy

Co-Chairs, Health Care Enforcement Defense Practice

2023 Data Shows Health Care Case Volume Continues Moderate Decline, While Pandemic Relief Cases Drive Overall Case Spike

False Claims Act (FCA) case activity spiked sharply upward in 2023, even as health care–related activity continued its moderate recent decline. These trends appear in both the annual statistical report published by the Department of Justice (DOJ) (for the federal fiscal year ended September 30, 2023) and in the health care–related qui tam litigation activity for the 2023 calendar year tracked in Mintz's internal Health Care Qui Tam Database (the "Mintz Database"). While the number of health care–related FCA cases remains high, the government's 2023 statistics for all cases indicate a seven-year trend in declining health care FCA case volume. Even so, health care–related FCA volume remains high and shows no signs of meaningfully declining in the foreseeable future.

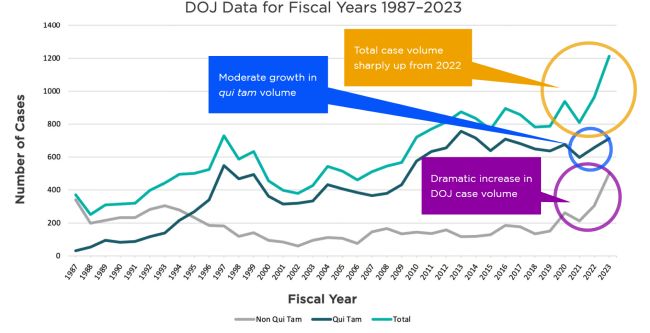

Paycheck Protection Program (PPP) Cases Appear to Drive the Spike in Total Case Volume: DOJ reported an astonishing spike in total FCA cases in 2023. For the first time ever, DOJ recorded more than 1,000 FCA cases being commenced in a single year, with the total volume for FY 2023 surging to 1,212 cases. This was a total increase of 249 cases over the record volume of cases in 2022, an astounding 26% increase in case volume. Notably, this growth resulted primarily from a large increase in government-initiated cases. Even though qui tam case volume increased in 2023 and still accounts for the majority of FCA cases — as it has for the past 30 years — the main driver for the increase was a huge spike in government-initiated cases. This is easily visible in the following chart, which graphs government, qui tam, and total case volume from 1987 to 2023:

As depicted visually here, DOJ case activity in FY 2023 was almost twice the already high number of cases initiated in FY 2022. The 500 new cases initiated in 2023 far surpassed the highest previously recorded DOJ-initiated annual FCA new case volume (340 cases in FY 1987, the first year tracked).

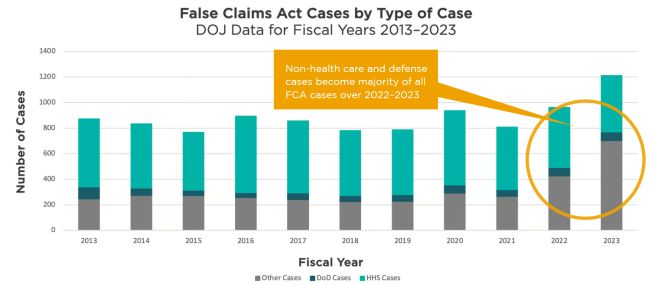

So where did those cases come from? A look at the past 10 years of activity shows that case filings in 2022 and 2023 reversed a long-term trend, with non–health care and defense cases supplanting health care–related cases as the largest component of overall FCA enforcement activity.

This trend appears to have been driven by aggressive enforcement directed toward fraudulent claims for COVID-19 pandemic relief. According to DOJ's annual FCA report, DOJ enforcement efforts in 2022 "included the pursuit of cases involving improper payments under the PPP, which was enacted to provide loans guaranteed by the U.S. Small Business Administration (SBA) to eligible small businesses for payroll, rent, utility payments, and other business-related costs." During FY 2023 DOJ reportedly "resolved approximately 270 False Claims Act matters, recovering over $48.3 million in connection with improper PPP loans." That large volume of case resolutions tracks the commensurately large volume of new non–health care and defense cases shown in this table. As the pandemic continues to recede into the past, we expect the volume of PPP fraud cases to decline, resulting in a decrease in the volume of non–health care and defense FCA cases to its historical level.

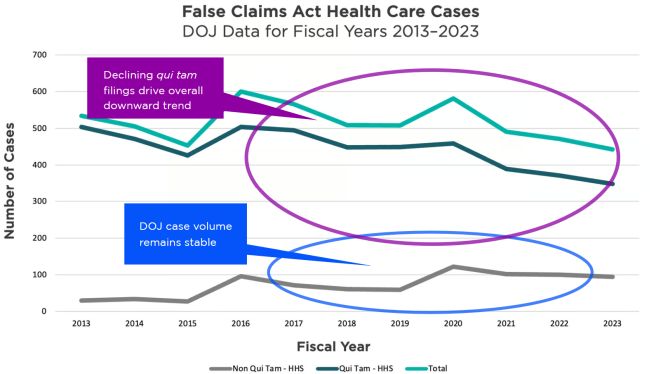

Health care case volume continues its moderate decline, but health care case recoveries remain robust. After peaking in 2016, health care case volume has been decreasing over the past seven years. During that time, annual new case volume fell from 600 new cases in 2016 to 442 new cases in 2023, a decline of about 26%. This decline has occurred even as the number of health care cases initiated by DOJ has remained stable, at about 100 cases per year. As the following chart reveals, this decline has been driven by a reduction in qui tam case activity:

As we have previously noted, these declines started from a remarkably high number of health care FCA cases in 2016 — there were 600 total cases that year — so the volume of cases remains robust, even after a 26% decline. With 442 new cases being initiated in FY 2023, health care–related entities are continuing to confront a high volume of new case activity and project to continue to do so for the foreseeable future.

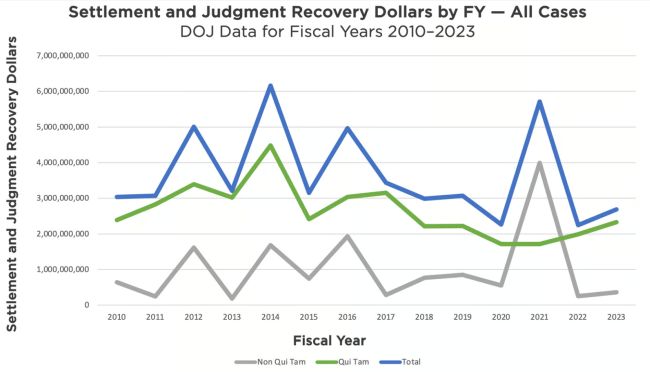

Moreover, irrespective of case volume, the relative significance of health care cases is reflected in the amounts recovered in those cases. As this chart shows, over the past 14 years, the vast majority of dollars paid to the government for FCA claims have occurred in health care cases:

As can be seen, in only one of the past 14 years — 2014 — did recoveries in non–health care cases exceed those in health care cases. Further, the relative significance of health care–related cases as a driver of government recoveries has increased over the seven-year period in which case volume has declined. The main reason for this is that health care case recoveries dwarf those in other types of cases on a per-case basis. Note, for example, that the DOJ press release accompanying the FY 2023 statistics indicates that its resolution of 270 PPP cases yielded $48.3 million in recoveries, a relative drop in the bucket compared to total FY 2023 health care case recoveries of over $1.8 billion. The relative dollars at stake for health care–related claims will continue to drive the significance of that sector more than just the sheer volume of cases.

Analysis of Unsealed Cases in the Mintz Database

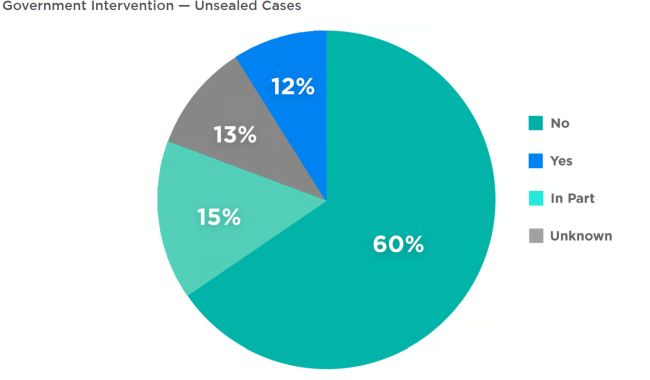

Government intervention rate remains within historical range. One thing that has not declined is the rate at which the government intervenes in unsealed cases, as tracked in the Mintz Database. While isolated years may see intervention rates as high as 30%, in most years the rate of intervention ranges between 20% and 25%. The 2023 intervention rate of 27% falls squarely within that normal range.

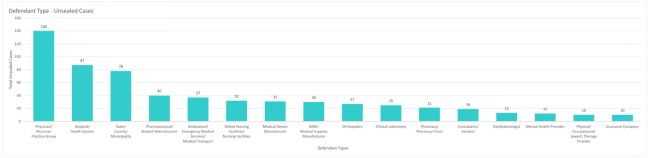

Types of defendants being sued remained consistent with historical experience. Hospitals, doctors, and pharmacies continue to be the most frequently sued entities. For unsealed cases in the Mintz Database, the list of most frequently sued defendants in health care qui tam actions unsealed in 2023 holds few surprises:

As in most years, physicians and hospitals continue to top the table for the most frequently sued defendant type. Interestingly, 2023 saw a large number of cases unsealed against state, county, and municipal-affiliated entities. Also interesting is the absence of hospice care facilities from this year's table. In a number of recent years, those entities had been a growing category of FCA defendants in our internal data. It will be interesting if continuing growth in that sector leads to hospice providers resuming their place in this lineup in the near future.

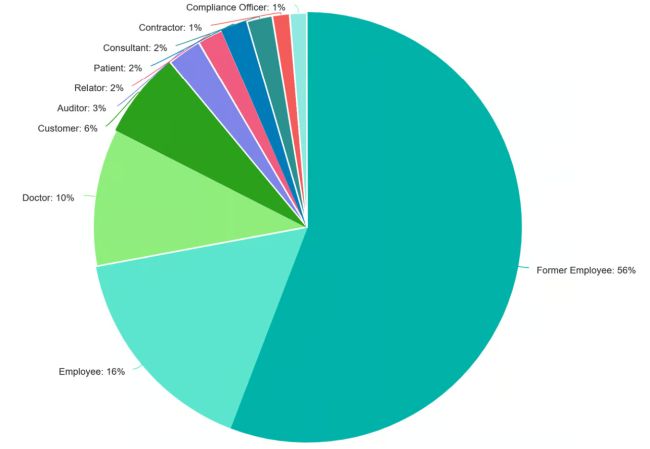

Whistleblowers are overwhelmingly current or former employees. Meanwhile, the typical qui tam relator continues to be an employee. Current and former employees are always the most common source of whistleblower lawsuits. This fact continued to be true for cases tracked in the Mintz Database in 2023, where 72% of qui tam relators are current or former employees.

Relator's Relationship to Defendant — Unsealed Cases

It is interesting to note that treating physicians make up a large number of the whistleblowers in the Mintz Database, accounting for 10% of all relators in cases unsealed in 2023. Doctors are increasingly willing to become relators if they believe that FCA violations are occurring in connection with their treatment of patients.

The diversity of non-employee relator types is somewhat interesting, including the fact that this year (as in many years), at least one relator was a compliance officer. But the main takeaway here is the same as always: employee relations are critically important for mitigating qui tam risk. Health care companies should, among other things, maintain a robust compliance structure to respond to employee concerns, and a strong human resources function to ensure that employee discipline and termination decisions are well-grounded and are executed with firmness and respect.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.