AMT is committed to delivering up-to-date insights on Japanese legal matters to our clients. Our Japan Legal Update provides comprehensive summaries of recent legislative changes, court precedents, and industry trends in Japan across various practice areas. For those seeking more in-depth information, we invite you to explore our newsletter.

The time of writing is as noted in each article.

Overview of Guidelines for Corporate Takeovers

- Corporate

- M&A

This article was written as of January 2024.

On August 31, 2023, the Ministry of Economy, Trade and Industry ("METI") published its "Guidelines for Corporate Takeovers (Enhancing Corporate Value and Securing Shareholders' Interests)" ("Takeover Guidelines") . In November 2022, METI launched the "Fair Acquisition Study Group" in order to improve predictability and present best practices both for parties involved in acquisitions and for capital market participants. The Takeover Guidelines were compiled through discussions at this Study Group.

The Takeover Guidelines primarily provide a new code of conduct for directors and other parties involved in the acquisition of corporate control of a listed company, and also summarize issues related to takeover response policies and countermeasures (the "Takeover Response Policies and Countermeasures")1, including those adopted after an acquiring party appears, in light of recent court cases. It is expected to have a significant impact on Japanese M&A practice in the future.

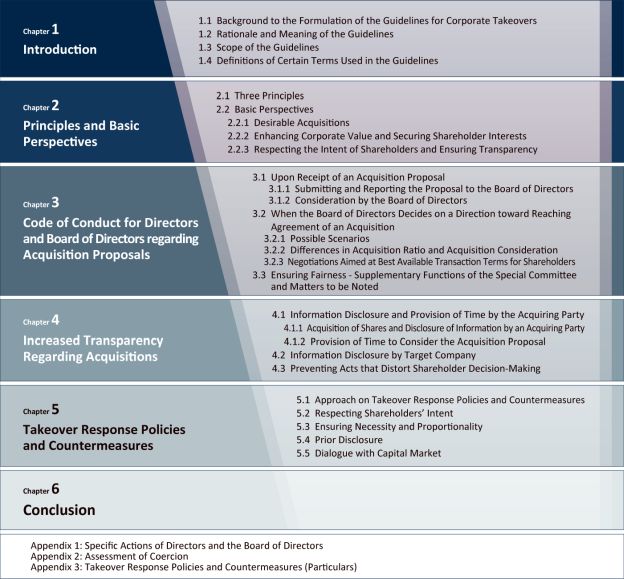

The table of contents of the Takeover Guidelines is as follows.

1. Chapter 1 (Introduction)

In Chapter 1, the position and the scope of the Takeover Guideline are described. It should be noted that the Takeover Guidelines are intended to present best practices as soft law, and not to be legally binding or punitive in any way. Nevertheless, in practice, it is expected to have an important impact not only as a code of conduct during the acquisition phase, but also as a guideline for interpretation before the courts, etc.

2. Chapter 2 (Principles and Basic Perspectives)

Chapter 2 presents the following three principles that should be respected in acquisitions of corporate control of listed companies in general:

- Principle 1: Principle of Corporate Value and Shareholders' Common Interests

- Principle 2: Principle of Shareholders' Intent

- Principle 3: Principle of Transparency

As basic perspectives, the Takeover Guidelines emphasizes that when the board of directors decides on a direction toward reaching agreement of an acquisition, the target company directors should act with reasonable effort to ensure that the acquisition will be carried out on terms that will secure the interests which are due shareholders, in addition to determining whether the acquisition is appropriate from the perspective of enhancing the company's corporate value. It further points out that, in principle, the rational intent of shareholders should be relied upon in matters involving the corporate control of a company, but that sufficient information must be provided so that the shareholders can make the correct decision regarding the merits of the acquisition and the transaction terms.

3. Chapter 3 (Code of Conduct for Directors and Board of Directors regarding Acquisition Proposals)

Chapter 3 organizes the code of conduct for each director and the board of directors regarding acquisition proposals to acquire corporate control, on a phase basis, such as when an acquisition proposal is received and when the board of directors decides on a direction toward reaching agreement of an acquisition. Appendix 1 presents a summary of basic perspectives that should be considered and discussed with respect to the acquisition proposal. Chapter 3 also describes the role and function of the special committees to ensure fairness in transactions.

4. Chapter 4 (Increased Transparency Regarding Acquisitions)

In Chapter 4, ways to improve transparency regarding

acquisitions are summarized from the perspective of both the

acquiring party and the target company. In particular, it is

noteworthy that specific guidelines are provided as best practices

for how information should be disclosed by both the acquiring party

and the target company, taking in consideration various

circumstances that may go beyond the disclosure requirements under

the Financial Instruments and Exchange Act and by financial

instruments exchanges. It also lists actions that are not advisable

as distorting shareholder decision-making.

It should be noted that the tender offer regulations, the large

shareholding reporting regulations, as well as the regime for

identifying beneficial shareholders, are currently being discussed

by the "Working Group on Tender Offer Rule and Large

Shareholding Reporting Rule of the Financial System Council"

of the Financial Services Agency, and the relevant parts of the

Takeover Guidelines may be revised in the future according to the

outcome of the discussions there.

5. Chapter 5 (Takeover Response Policies and Countermeasures)

Chapter 5 and Appendix 3 present guidelines outlining the Takeover Response Policies and Countermeasures against acquisitions from the perspectives of respecting shareholders' intent, ensuring necessity and proportionality, prior disclosure, and dialogue with the capital market. In addition to the Takeover Response Policies and Countermeasures adopted during the normal phase, the Takeover Guidelines also touch on the Takeover Response Policies and Countermeasures adopted for the period following the appearance of an acquiring party, and organize them in light of a series of recent court cases.

Recent Development of the Japanese Continuous Disclosure Regulations

- Capital Markets

This article was written as of February 2024.

1. Introduction

The recent amendments to the Financial Instruments and Exchange Act and relevant regulations thereunder (the "FIEA") strengthen the continuous disclosure requirements, while the obligation to submit quarterly reports under the FIEA was abolished.

2. Disclosure requirements recently introduced

2.1 Sustainability and human capital

The FIEA newly introduced disclosure requirements concerning "Policy and Efforts towards Sustainability", including for sustainability governance, risk management, strategies, and indices and targets.

Also, the FIEA newly focused on disclosure requirements concerning the deployment of human capital. The FIEA requests that issuers disclose their strategies, indices and targets for the deployment of human capital in its disclosure requirements concerning "Policy and Efforts towards Sustainability". Certain statistical data relating to human capital issues, such as the difference in wages between men and women, must also now be disclosed under the FIEA.

2.2 Corporate governance

The FIEA has strengthened the existing corporate governance disclosure requirements. For example, the recent amendment requests the issuer to disclose the "specific" contents of discussions of the board of directors and the board of corporate auditors, in addition to the frequency of meetings and attendance.

Also, the FIEA requests the issuer to disclose a summary of the purpose of holding other issuer's shares, namely, whether such purpose is to conduct a business transaction or a business alliance with such issuer.

3. Disclosure requirements that will become effective in the near future

In addition to 2, above, the FIEA will further strengthen disclosure requirements beginning 2025. According to the recent amendments to the FIEA, such additional requirements include the following:

3.1 Agreements with shareholders regarding the issuer's governance

In order to ensure the disclosure of agreements which may affect such issuer's governance, the FIEA requests that the issuer disclose a summary of agreements entered into with a shareholder: (i) to give such shareholder a right to nominate candidates to the issuer's board of directors or to corporate auditor positions; (ii) to restrict the exercise of the voting rights by such shareholders; and (iii) to request such shareholder's prior approval for matters to be resolved by the issuer's shareholder meetings or board of directors meetings. Also, the FIEA requests disclosure of the process followed by the issuer when entering into such agreements, and the effect that such agreements have on the corporate governance of the issuer.

3.2 Agreements with shareholders regarding an increase/decrease in their holdings of the issuer's shares

The FIEA also requests that the issuer submit a summary of the agreements entered into with the shareholder, disclosing: (i) whether the issuer's prior approval is required for the disposal of the issuer's shares held by such shareholder; (ii) whether the purchase of the issuer's shares above the shareholding ratio agreed between the issuer and such shareholder is restricted; and (iii) whether such shareholder may subscribe to additional shares in the case where there is an issuance of shares by the issuer or where some other event that decreases the shareholding ratio of such shareholder occurs. Similar to (2) above, the FIEA requests the disclosure of the process followed by the issuer for entering into such agreements.

3.3 Financial covenants

The FIEA requests the issuer to disclose certain financial covenants contained in the loan ageements and bonds issued by such issuer.

It should be noted that the FIEA currently requests disclosure of the issuer's "material contracts for its business", and the above items could therefore be disclosed even under the current regulations. However, the recent amendments expressly request a form of disclosure that specifies the items to be disclosed.

4. Abolition of quarterly reports

Although listed companies in Japan have been required to submit quarterly reports, the recent amendments to the FIEA abolish the obligation to submit such quarterly reports in order to improve the efficiency of corporate disclosure requirements. Quarterly corporate disclosures will now be consolidated into the quarterly disclosure required by stock exchange rules

Amendment to the Financial Instruments and Exchange Act

- Finance and Financial Institutions

This article was written as of January 2024.

1. Introduction

The bill to amend the Financial Instruments and Exchange Act (the "FIEA"), etc. (the "Bill") was promulgated on November 20, 2023. The purposes of the Bill include (a) ensuring customer-oriented business operations by financial service providers, and (b) abolishing quarterly reports by listed companies, etc. The effective date of the entering into force of the FIEA amendments contained in the Bill (the "Amended Act") has not yet been determined.

2. Customer-oriented business operations by financial service providers

Under the Bill, a duty of candor, which was previously imposed only on certain financial service providers such as securities firms and investment management companies, will be extended to almost all financial service providers and to those involved in the operation of corporate pension plans.

In Japan, a principles-based approach has been promoted, whereby if a financial service provider adopts the Principles for Customer-oriented Business Practice published by the Financial Services Agency (the "FSA"), it must endeavor to comply with said principles. It can be evaluated that the Bill will upgrade a part of these principles to a rule-based approach. Supervisory guidelines by the FSA may give details of the rules, but a draft of said guidelines are not yet published by the FSA.

3. Abolition of quarterly reports of listed companies, etc.

Although listed companies, etc. have until now been required to submit quarterly reports, the Amended Act abolishes the obligation to submit such quarterly reports in order to improve the efficiency of corporate disclosure requirements. Quarterly corporate disclosures will now be consolidated into the quarterly disclosure required by stock exchange rules.

On the other hand, regulations on corporate disclosure will be partially strengthened. Specifically, the publication period for semiannual reports will be extended from three (3) years to five (5) years, and the publication period for extraordinary reports will be extended from one (1) year to five (5) years.

4. Other amendments

In addition to the above, there are several other amendments. The major amendments are as follows:

- In reaction to the large number of cases where the FSA has imposed administrative penalties on social lending businesses, social lending businesses will now be required to report on their business to investors.

- Until now, investment funds that invest in physical real estate have been regulated under the Act on Specified Joint Real Estate Ventures (the "ASJREV") rather than under the FIEA, but those investment funds in which interests are tokenized will now be uniformly regulated under the FIEA in addition to the ASJREV.

Freelance Act

- Competition/Antitrust

This article was written as of January 2024.

1. Introduction

On April 28, 2023, the Act on Optimization, etc., of Transactions concerning Specified Outsourcees (特定受託事業者に係る取引の適正化等に関する法律 in Japanese; hereinafter referred to as the "Freelance Act") was enacted by the Japanese Diet.

Before drafting the Freelance Act, the government of Japan conducted some extensive surveys on the status of freelance workers from 2019 to 2020. The results of that survey and other findings revealed the following facts.

- In recent years, the diversification of work styles has progressed and the freelance work style has become popular in Japan.

- On the other hand, freelancers have experienced various troubles in dealings with their business partners as reported in the surveys.

In light of these circumstances, the purpose of the Freelance Act is to optimize transactions involving freelancers and to improve their working environment. Therefore, the Freelance Act has been separated into two main parts, with the first part setting out the regulations regarding the optimization of transactions involving freelancers (Chapter 2) and the second part setting out the regulations regarding the freelancers' work environment (Chapter 3).

2. Target

The Freelance Act covers the outsourcing of transactions to freelancers. In addition, the Freelance Act defines a freelancer as a "specified outsourcee", which means a party to whom business is outsourced that is a sole proprietorship (without employees) or a one-person corporation (Article 2 Paragraph 1). The terms "freelancer" and "specified outsourcee" are thus used interchangeably in this summary.

3. Optimization of transactions

There are three main regulations regarding the optimization of transactions as follows.

3.1 Obligation to clearly indicate the details of consignment, etc.

When a service provider (the "Outsourcer") outsources transactions to a freelancer, the Outsourcer must, in principle, immediately provide the freelancer with the details of the outsourcing, amount of compensation, payment date and other matters specified by the Rules of the Japan Fair Trade Commission, in writing or by electromagnetic means (Article 3).

3.2 Obligation to fix the date to pay compensation

When an Outsourcer which has employees ("Specified Outsourcer") outsources transactions to a freelancer, the Specified Outsourcer must fix the date on which to pay compensation to the freelancer, and the date must be within a period of sixty (60) days from the date of receipt of the work from the specified outsourcee, and must be as short as possible (Article 4 Paragraph 1).

3.3 Prohibition of certain acts

When a Specified Outsourcer outsources transactions to a freelancer continuously for a period longer than the period to be specified by Cabinet Order, the Specified Outsourcer must not conduct any of the prohibited acts prescribed in the Freelance Act (Article 5).

Specifically, the following acts are prohibited.

- Refusal to receive the work without reasons attributable to the freelancer

- Reduction of the compensation without reasons attributable to the freelancer

- Return of the goods after receiving it without reasons attributable to the freelancer

- Unjust setting the amount of compensation that is significantly lower than the compensation normally paid for work of the same or similar nature

- Causing the freelancer to purchase designated goods or to use designated services without justifiable reasons

- Causing the freelancer to provide economic gains that unjustly injure the interests of the freelancer

- Causing the freelancer to change the content of the work or to re-work without reasons attributable to the freelancer that unjustly injure the interests of the freelancer

4. Work Environment

To improve the working environment for freelancers, the Freelance Act imposes on a Specified Outsourcer (i) the obligation to accurately display recruitment information (Article 12 Paragraph 1), (ii) the obligation to establish a system to prevent harassment (Article 14 Paragraph 1), (iii) the obligation to allow freelancers to balance work with childcare, nursing care, etc. (Article 13 Paragraph 1), and (iv) the obligation to give freelancers notice in the case of mid-course termination, etc. (Article 16 Paragraph 1).

The latter two obligations are applicable only when the transaction is conducted continuously for a period longer than the period to be specified by Cabinet Order.

5. Enforcement

The Japan Fair Trade Commission, the Director-General of the Small and Medium Enterprise Agency, or the Minister of Health, Labor and Welfare may give advice and guidance, collect reports, conduct on-site inspections, issue cautions, make public announcements, or give orders to a Specified Outsourcer, etc.

6. Future Outlook

Various preparations are currently underway with the aim of enabling the Freelance Act to come into effect in the fall of 2024, and by November 12, 2024 at the latest. Based on publicly available information regarding the budgets and staffing of the relevant authorities, it appears that active enforcement of the Freelance Act is expected in the future. Therefore, companies that do business with freelancers should pay close attention to the Freelance Act once it comes into effect.

The Outline of the Amendments to the Act against Unjustifiable Premiums and Misleading Representations

- Competition/Antitrust

- Takeshi Ishida

- Shuntaro Fujii

This article was written as of January 2024.

1. Overview

On May 10, 2023, the Act on Partial Revision of the Act against Unjustifiable Premiums and Misleading Representations (the "Amendments") was enacted. The purpose of the Act against Unjustifiable Premiums and Misleading Representations is to protect consumers by limiting or prohibiting enterprises from offering excessive premiums or making misleading representations that portray goods or services to general consumers as being significantly superior to that of the actual goods or services. The Amendments create provisions for fines and other provisions for unscrupulous enterprises because the development of digital platforms has led to problems arising, for example, from misleading internet advertisements. The main points of the Amendments are as follows:

- Introduction of a commitment procedure system and flexible refunding in the surcharge system;

- Changes in the surcharge system and expansion of penalty provisions; and

- Improvement of procedures for smooth law enforcement.

The effective date of the Amendments has not been determined as of January 2024, but they are expected to come into effect in 2024.

2. Introduction of a Commitment Procedure System and Flexible Refunding in the Surcharge System

With the aim of encouraging enterprises to make voluntary efforts to correct violations and recover damages to consumers, the following amendments were made to provide incentives for enterprises to do so.

2.1. Commitment Procedure System

The commitment procedure system is a process where an enterprise, who receives a notice from the authority that it is suspected of violating the Act against Unjustifiable Premiums and Misleading Representations, submits a corrective action plan to the authority. If the authority certifies that the content of the plan is sufficient for correction and that the plan will be implemented with certainty, the authority promises not to take any further action under the Act against Unjustifiable Premiums and Misleading Representations, such as an order for action or a payment order for surcharge (Articles 26 to 33 of the Amendments). The commitment procedure system was introduced to the procedure under the Act on Prohibition of Private Monopolization and Maintenance of Fair Trade in 2018, and this Amendment will also be introduced to the procedures laid out in the Act against Unjustifiable Premiums and Misleading Representations.

2.2. Flexible Refunding in the Surcharge System

Electronic money, etc., as well as money, are allowed as a method for an enterprise who receives a draft of payment order for surcharge due to misrepresentation to refund transactions with consumers during the period subject to the surcharge (Article 10, paragraph 1 of the Amendments).

3. Changes in the Surcharge System and Expansion of Penalty Provisions

The following Amendments were made to strengthen sanctions against violations of the Act against Unjustifiable Premiums and Misleading Representations.

3.1. Changes in the Surcharge System

If an enterprise makes misleading representations with respect to goods or services, the enterprise is obliged to pay a surcharge calculated based on the sales amount of the goods or services during the period in which the misleading representation was made. However, the amount of the surcharge cannot be accurately calculated if the enterprise does not keep sufficient data on the amount of sales. In order to address this situation, the authority shall be able to estimate the amount of sales from the relevant data even if there is no direct sales amount data and to order the payment of a surcharge (Article 8, paragraph 4 of the Amendments). In addition, in the case of repeated violations, the amount of the surcharge will be increased by one-and-a-half times (Article 8, paragraph 5 of the Amendments).

Many of the changes to the surcharge system in these Amendments, including those mentioned above, are based on the surcharge system of the Act on Prohibition of Private Monopolization and Maintenance of Fair Trade.

3.2. Expansion of Penalty Provisions

Penalties under the Act against Unjustifiable Premiums and Misleading Representations could only be applied in cases where the enterprise violated an order for action issued by the authority. Under the Amendments, a fine of up to one million yen may be imposed directly on a malicious enterprise, who makes a representation while recognizing or accepting that it is an improper representation, without an order for action being issued by the authority (Article 48 of the Amendments).

4. Improvement of Procedures for Smooth Law Enforcement

The Act against Unjustifiable Premiums and Misleading Representations applies to enterprises located outside Japan. In order to strengthen the enforcement of this Act for foreign entities, provisions allowing Japanese authorities to provide information to foreign authorities have newly been prescribed for the purpose of strengthening cooperation with foreign authorities (Article 41 of the Amendments). In addition, provisions for service procedures were improved and expanded to facilitate enforcement by Japanese authorities against foreign entities (Article 7, paragraph 3, and Articles 42 to 45 of the Amendments).

Furthermore, a new procedure has been established under which a Specified Qualified Consumer Organization certified by the relevant governmental authority under the Consumer Contract Act may request that an enterprise suspected of making misleading representations submit materials on which the representations are based (Article 35 of the Amendments).

Recent Changes in the Carbon Offset Markets in Japan: Towards a Carbon Neutral Society

- Energy and Natural Resources

- Others (SDGs)

This article was written as of January 2024.

A voluntary emission trading system called GX League ("J-ETS") was preliminarily launched in September 2022 and was officially launched in April 2023 based on "Carbon Credit Report" published by Ministry of Economy, Industry and Trade ("METI") in June 20222. Compared to other emission trading schemes (e.g., EUETS), J-ETS has unique aspects as set out below:

1. Key features of J-ETS

- It is understood that J-ETS is a platform in which any company/financial institution in Japan can join and contribute to drafting rules in connection with carbon credit trading in Japan. Although it is voluntary to participate in J-ETS, as of November 30, 2023, more than 600 companies from many industries, such as manufacturing, service, and financial institution, have participated in J-ETS, the total amount of greenhouse gasses emitted by such participants are roughly 40% of the total amount of greenhouse gasses emitted by Japan as a whole.

- Although J-ETS is a voluntary scheme in Phase 1 (i.e., from

2023 to 2025), it is expected that participants of J-ETS may be

subject to more stringent rules in Phase 2 (i.e., from 2026 to

2032). Although it is still subject to review of the detailed

rules, the basic concept of J-ETS are as follows:

- J-ETS participants will be required to set their own targets for direct/indirect emissions reductions in Japan and to calculate and report their actual amount of emissions.

- Sell-side: From 2030 onward, allowances will be allocated to certain J-ETS participants who will achieve GHG reduction/removal at a level which is higher than NDC equivalent (e.g., 46% GHG reduction by 2030). After the end of October 2024, the trading of allowances will be launched and such J-ETS participants will be able to sell such allowances to other J-ETS participants.

- Buy-side: If certain J-ETS participants will not be able to achieve GHG reduction/removal at a level which is higher than NDC equivalent, such J-ETS participants will need to take certain actions (including off-setting their GHG emissions against "eligible carbon credits" (including J-credits, JCM credits)).

- Separate from J-ETS, an emission trading platform3

("Carbon Trading Markets (TSE)") has been officially

launched at Tokyo Stock Exchange in October 2023. It can be said

that Carbon Trading Markets (TSE) is a trading market in order to

(a) activate carbon credit tradings in Japan and (b) provide price

indications to various players in Japan/outside of Japan. The

differences between Carbon Trading Markets (TSE) and J-ETS are as

follows:

- As of November 2023, only J Credits are traded in Carbon Trading Markets (TSE) on the Tokyo Stock Exchange.

- In order to become a participant of Carbon Trading Markets (TSE), it is necessary to apply to and be registered with the Tokyo Stock Exchange.

2. Expected Timeline

It is expected that J-ETS will be developed in a timeline set out below:

- From April 2023 to March 2026: Phase 1 (J-ETS will be operated on a voluntary basis);

- From April 2026 to March 2033: Phase 2 (J-ETS will be operated with certain compliance obligations); and

- After April 2033: Phase 3 (J-ETS will be operated with further developments (e.g., auction of allowances in energy sector)).

3. Carbon credits to be traded at J-ETS

J-ETS plays a key role in Japanese carbon markets and one of the key questions is what kind of carbon credits can be traded at J-ETS. It is understood that eligible carbon credits at J-ETS are currently limited to J-credits and JCM credits only, but there are on-going discussions to expand the scope of eligible carbon credits at J-ETS. Development of such discussions should be carefully watched in order to assess demands of various carbon credits by Japanese companies.

Recent Changes in the Energy Industry: Towards a Carbon Neutral Society

- Energy and Natural Resources

- Others (SDGs)

This article was written as of March 2024.

Many changes have occurred recently in the energy industry that are leading towards carbon neutrality, as outlined below.

1. Commencement of Long-Term Decarbonized Power Plant Auction

The Organization for Cross-regional Coordination of Transmission Operators (the "OCCTO") announced a Long-Term Decarbonization Power Plant Auction (the "Auction") schedule in September 2023. The deadline for the bidders to make their bids for the first Auction is scheduled for January 2024, and the registration process for power plants for the Auction began in October 2023.

In Japan, the capacity market (yoryo shijyo, "Capacity Market") already opened in 2020. In this market, an auction is conducted 4 years prior to the fiscal year when the supply capacity is actuallydelivered and the awarded power plants will supply electricity and receive corresponding payments for each upcoming one-year period, as long as they comply with the requirements listed under the capacity reserve agreement made between the awarded power plant and the OCCTO.

The Auction is being held as a special auction within the Capacity Market. The power plants eligible for this Auction are (i) decarbonized power plants (including for rechargeable batteries), and (ii) LNG-fired thermal power plants which plan to mix hydrogen or ammonia into the natural gas component (including after replacement), each of which fulfill certain requirement to be qualified respectively, such as capacity requirements prescribed per power source.

The winning Auction bidder will be determined by a "multi-price system". In other words, each bidder will bid by providing information on (i) capacity of the planned power plant, and (ii) bidding price (yen/kW/year) for each bidding power plant. In principle, all the bids are lined up in descending order of bidding price, and the bids are to be awarded in such order until the total capacity achieves the pre-determined aggregated planned capacity.

The awarded bidder will be entitled to receive its bidding price during the applicable period (20 years or longer) as long as it continues to fulfill the stated requirements, such as the requirement to maintain supplies and to comply with the decarbonization roadmap that it submits at the timing of the Auction.

2. Introduction of Generation-Side Tariff

A Generation-Side Tariff has been discussed since 2020 (see our previous newsletter) and now is slated for introduction in FY2024. This new Tariff requires power generation operators to pay part of the wheeling charges necessary for the maintenance and expansion of the power transmission and distribution system. As of the date of this Legal Update, the Ministry of Economy, Trade and Industry ("METI") has already reflected this framework in the relevant regulatory regime, and the affected transmission system operators (i.e., utility companies) are in the process of applying for METI's approval to revise their general terms and conditions (including wheeling charges) for wheeling services in accordance with the regulation.

Although the regulation clearly provides that the power plants which utilize a FIT or FIP scheme will not be subject to the Generation-Side Tariff during the FIT or FIP applicable period, the payment obligations of the Generation-Side Tariff will be generally applied to all the power plants that provide electricity to the transmission and distribution system.

Therefore, operators that are interested in or planning for a non-FIT/FIP electricity generation business will need to take the Generation-Side Tariff into account when planning and conducting their business.

3. Discussion of Legal Framework on Carbon Dioxide Capture and Storage ("CCS")

Carbon Dioxide Capture and Storage ("CCS") is a collective designation used to describe a range of methods used to capture emitted carbon dioxide (CO₂) and to transfer and store it in underground or in sub-seafloor reservoirs. CCS is considered essential to achieve carbon neutrality by 2050, especially in Japan.

The Japanese Government, mainly the Agency for Natural Resources and Energy ("ANRE") and the Ministry of Environment ("MoE"), discussed a legal framework and regulatory regime for CCS and these authorities published, respectively, a "(Draft) Interim Summary Report on Institutional Measures for CCS" ("ANRE Report") on December 5, 2023, and a "(Draft) Preservation of Marine Environment in relation to CCS under the Seabed" ("MoE Report") on December 12, 2023.

In the ANRE Report, ANRE has drafted an outline of a legal framework for CCS. This legal framework covers the CO₂ storage business and pipeline transportation business. With respect to the CO₂ storage business in particular, the ANRE Report introduces a number of new concepts, such as (i) the concept of a "Trial Drilling Right" and a "Storage Right", which allows right holders to prevent and remove a third parties' interference or infringements on the right holders' trial drilling and/or storage activities, and (ii) new third party access rights, according to the operation of which an operator of a storage business may not reject a third party's offer to utilize CO₂ storage methods without a reasonable ground. Also, the ANRE Report refers to a storage business operator's monitoring obligations; to governmental obligations to be put in place relating to the management of CCS storage businesses after an operator closes its storage business; and to safety measures for conducting a CCS business.

On the other hand, CCS operations in sub-seafloor reservoirs is already regulated under the Act on Prevention of Marine Pollution and Maritime Disaster. In the MoE Report, the MoE suggests certain amendments and adjustments to the existing legal framework for the storage of materials under the seabed, such as (i) establishing a permit system that covers the entire project for operations that last longer than 5 years, and reviewing the contents of the permit at regular intervals, (ii) not limiting the specific CO₂ capture methods (e.g., the use of a chemical absorption process using amine) and reducing the concentration levels of the CO₂ to be stored, (iii) updating monitoring regulations to reflect the best available technologies, (iv) enabling the permitted operators to close their storage business by taking measures in accordance with a plan prepared in advance, (v) (for the case of a business transfer) establishing a mechanism to appropriately transfer obligations imposed on the original operator, and (vi) preparing a scheme which ensures that the project will be properly terminated in the same manner as was permitted for the original operator, even if permission is revoked or the original operators are no longer in business due to bankruptcy or other reasons, and (vii) establishing a system for the export of CO₂ for a CCS business to a sub-seafloor location overseas.

Both of these reports underwent a public comments process, and on February 13, 2024, the Government submitted to the Diet a new Bill to set up the legal framework for CCS businesses.

4. Regulatory Framework on Rechargeable Batteries

Many business operators have continued paying attention to the business of rechargeable batteries in Japan.

Under the amendment to the Electricity Business Act, which was enacted in April 2023, grid storage batteries (i.e., those batteries that are directly connected to the grid rather than being attached to a power plant), the operational discharge of which have a capacity of 10 MW or more, are included in the definition of a "Power Generation Business" (hatsuden jigyo). Accordingly, these are subject to the same regulations as those in force for other business operators that conduct a Power Generation Business. Such regulations include notification requirements to METI that apply to the time of the commencement of the business, and to the obligation of such businesses to participate in the OCCTO. In addition, beginning December 2022, grid storage batteries have been treated as "power storage facilities" under a Ministerial Ordinance stipulating technical standards for electrical facilities. As a result, grid storage batteries will be subject to the same level of safety regulations as solar power generation facilities.

In terms of the safe operation of rechargeable batteries, based on the diversification of types of rechargeable batteries, the Fire Service Act and its ordinances have changed the unit for the threshold applied to rechargeable batteries from an Ampere-hour (Ah) basis to a kilowatt-hour (kWh) basis.

5. Discussion of Support Systems and Safety Measures for the Transition to a Hydrogen-based Society

The Japanese Government has recently revised its Basic Hydrogen Strategy in June 2023, which includes a hydrogen industry strategy and a hydrogen safety strategy. On December 8, 2023, a "(Draft) Interim Summary Report" on hydrogen was published. The report mainly refers to (i) a support system covering price gaps between hydrogen and other energy sources, (ii) a support system on the creation and development of hydrogen hubs, and (iii) safety measures on the production, transportation, and utilization of hydrogen. On February 13, 2024, based on the report, the Government submitted to the Diet a Bill to set up a new legal framework for hydrogen businesses. This Bill aims to promote a hydrogen-based society, in which a certified hydrogen business operator can be subsidized to close such price gaps and to create and develop hydrogen hubs.

Digitalization of Civil Court Proceedings other than Civil Litigation by Enactment of Act on Establishment of Related Laws to Promote the Utilization of Information and Communication Technology in Civil Proceedings

- Restructuring/Insolvency and Bankruptcy

This article was written as of January 2024.

On June 6, 2023, the Act No. 53 of 2023, titled "The Act on Establishment of Related Laws to Promote the Utilization of Information and Communication Technology in Civil Proceedings" ("Act of 2023"), was promulgated. The primary object of this legislation is to expedite and streamline civil court proceedings other than civil litigation, including insolvency proceedings. The Act of 2023 will become fully effective as of a date specified by a government ordinance within 5 years of the promulgation.

1. Historical Context

Over the past few years, Japan has grappled with significant challenges in aligning with international standards related to the digitalization of court proceedings. In May 2022, the Act No. 48 of 2022 ("Act of 2022") was enacted, whereby a comprehensive digitalization of civil litigation procedures involving the resolution of cases through court judgments, was successfully achieved. The Act of 2022 did not deal with the digitalization of other litigation-related procedures, such as civil enforcement, insolvency proceedings and domestic relations proceedings.

2. Digitalization of Various Civil Court Proceedings

The Act of 2023 addresses the digitalization of insolvency proceedings as well as other proceedings. The following are the main items that relate to insolvency proceedings.

2.1. Online Filings and Submissions

Online filings and submissions will be enabled. This includes

the online service of documents from the court, creating a

mandatory requirement for representatives (such as attorneys and

legal professionals) to submit and receive documents online. In

bankruptcy proceedings, it will be possible to file a petition for

the commencement of bankruptcy proceedings and to file proofs of

bankruptcy claims online. The methods of submission will be

specified in detail by the Supreme Court rules in due course.

Additionally, bankruptcy trustees are, in principle, obligated to

submit applications for approval of the court, statements of

approval or rejection of bankruptcy claims, lists of properties,

and distribution tables, etc., via the internet. Trustees in

rehabilitation and reorganization proceedings are also subject to

the same obligations.

2.2. Utilizing Web Conferencing

If the court deems it appropriate, web conferences can be used for major hearing dates of insolvency proceedings, such as creditors' meetings, investigations, and determinations of claims, in which a debtor, a bankruptcy trustee and creditors may participate in the hearing dates remotely.

2.3. Digitization of Case Records

In principle, case records will be stored in electronic format. The parties involved in the proceedings and third parties demonstrating a prima facie showing of interest will be granted online access to the court's server for inspecting case records.

3. Conclusion

These amendments will be particularly helpful for foreign creditors involved in insolvency proceedings in Japan. Although most documentation still requires the assistance of Japanese attorneys due to the language barrier and the need to understand Japanese laws and practices, these changes will facilitate the submission of documents to the court and will allow for a more convenient review of case records than before.

Updates of the Economic Security Promotion Act

- Economic Security and International Trade

This article was written as of February 2024.

The Economic Security Promotion Act, enacted in May 2022, has four pillars. Two of the pillars, (i) the strengthening of the supply chains of important items and raw materials, and (ii) the implementing of systems to develop and support key technologies by public and private sectors, have already been implemented, but the remaining two pillars will be implemented in May 2024.

As an update to our previous newsletter, this provides an overview of one of the two remaining pillars, namely, ensuring the stable provision of essential infrastructure services, as well as an overview of the security clearance mechanism that is expected to be introduced by enacting new legislation that will be introduced during the ordinary session of the Diet in 2024, and by amending the implementation guidelines for the existing information security legislation, namely, the Act on the Protection of Specially Designated Secrets.

1. Ensuring Stable Provision of Essential Infrastructure Services

1.1. Overview

In order to mitigate the risk that an infrastructure provider cannot stably provide its essential services due to cyber-attacks directed against their critical facilities by foreign governments, screening for the installation and entrustment of maintenance, management, or operation of the critical facilities supporting essential domestic infrastructure will be implemented in May, 2024.

1.2. Scope of Screening

Among the operators conducting essential infrastructure businesses, such as electricity, gas, water, telecommunications, financial services, and credit card providers, the Japanese Government has designated 210 operators as specified essential infrastructure providers that must file prior notification of a plan related to the installation or entrustment of the maintenance, management, or operation of said critical facilities.4

The critical facilities subject to the screening when installing or entrusting maintenance, management, and operation are mainly the information processing systems used in the provision of essential infrastructure. During the screening process, suppliers of the critical facilities as final products are required to provide the information mentioned in 1.3 below to the Government, and suppliers of the facilities, equipment, devices, or programs that comprise certain parts of such critical facilities, such as operating systems, middleware, business applications, and servers of the information processing systems, are also required to provide the specified information to the government. In addition, entrusted parties as well as re-entrusted parties of the maintenance, management and operation of the critical facilities are required to provide the specified information to the Government. Thus, it should be noted that suppliers of facilities, equipment, devices, or programs that comprise certain parts of the critical facilities and the re-entrusted parties are also affected by the screening.

1.3. Information that needs to be provided to the Government

The suppliers, entrusted parties, and re-entrusted parities aforementioned in 1.2 above are required to report to the Government the name, date of birth, and nationality of each of its directors. In addition, if their sales to a foreign government, foreign government agency, foreign local government, foreign central bank, or foreign political organization account for 25% or more of their total sales, it is necessary to report the names of the applicable foreign bodies and the ratio that such sales account for out of their total sales.

The suppliers are required to report to the Government the location of the factory or workplace where the suppliers manufacture the critical facilities or the facilities, equipment, devices, or programs that comprise certain parts of the critical facilities.

2. Security Clearance

2.1. Overview

The Japanese Government plans to submit a bill to introduce in the ordinary session of the Diet in 2024 a security clearance mechanism which allows an individual to qualify for access to specified confidential information with economic security implications. The Government intends to implement the new law seamlessly together with the existing information security law.

A security clearance is a system in which, as part of national information security measures, the Government examines an individual who needs to access national security information held by the Government that is specified as Classified Information (hereinafter referred to as "CI"), confirms the credibility of such individual, and grants such individual a security clearance which makes such individual eligible to access CI.

In order to access CI, not only is a security clearance for individuals who need to access CI (hereinafter referred to as "personnel security clearance") needed, but also required is a security clearance for membership in and access to the premises and facilities of the entity to which such individuals belong (hereinafter referred to as "facility security clearance").

2.2. Purpose of Introduction of Security Clearance System

One of the purposes of the introduction of the security clearance system is to enable Japanese companies and their employees to obtain security clearances and share CI within international joint development programs and with the government procurement agencies of allied countries. In order to achieve this, the Japanese government aims to establish a system that can be trusted by partner countries, including the United States and the United Kingdom; that is, a system substantially equivalent to the security clearance systems of the partner countries.

2.3. Direction of Discussions on a Security Clearance System in Japan

Although the bill has not been made public, the panel of experts considering the security clearance system in Japan discussed the following options:

(a) Personnel Security Clearance

In principle, an individual who is granted personnel security

clearance must be a Japanese national.

(b) Facility Security Clearance

A Japanese subsidiary of a foreign company will be eligible for

security clearance if it is registered as a Japanese

corporation.

From the perspective of FOCI (Foreign ownership, control, or influence), the panel discussed whether directors of clearance-seeking entities, including the chairperson of the Board and the CEO, should be required to obtain personnel security clearance as a requirement for obtaining facility security clearance, even if they do not access CI themselves. If a director or other officer subject to personnel security clearance requirements does not have Japanese nationality, such person may not be able to obtain personnel security clearance.

Legislation related to LGBTQ Matters

- Others (Diversity)

This article was written as of January 2024.

1. Introduction

On June 16, 2023, the "Act on the Promotion of Citizens' Understanding of Diversity of Sexual Orientation and Gender Identity" (hereinafter referred to as "the Act") was enacted by the Diet and promulgated and enforced soon thereafter on June 23.

Japan's legal system for protecting its LGBTQ minorities is considered insufficient compared to other developed countries. For this reason, LGBTQ persons and support groups have pushed for legislation that prohibits discrimination against persons who self-identify as LGBTQ. In 2023, in the run-up to the G7 Summit which was chaired by Japan, the situation regarding LGBTQ persons in Japan received attention from other countries, prompting accelerated discussions on improving legislation. However, mainly due to opposition from conservative lawmakers, this Act, which was passed as a result, does not stipulate the prohibition of discrimination, but only promotes citizens' understanding of the diversity of sexual orientation and gender identity.

2. Overview of the Act

This Act, with the exception of the supplementary provisions, consists of a total of 12 articles. There is no provision for penalties for violation of the Act. The main contents are as follows.

2.1. Basic Principles (related to Article 3)

Measures to promote understanding must be implemented based on the principle that all citizens, regardless of their sexual orientation or gender identity, should be respected as irreplaceable individuals who equally enjoy fundamental human rights, and with the recognition that there should be no unjust discrimination on the grounds of sexual orientation or gender identity.

2.2. Roles of the State and local governments, Formulation of the Basic Plan by the Government, etc. (related to Articles 4, 5, 7, 8, 9 and 10)

The State and local governments shall endeavor to formulate and implement measures for promoting understanding and to take necessary measures (e.g., steady dissemination of knowledge and development of consultation systems) in light of the progress made in research promoted by the State regarding the diversity of sexual orientation and gender identity.

The Government must publicize the status of its implementation of the measures that it takes to promote understanding once a year. Furthermore, the Government must formulate a "Basic Plan" for the promotion of understanding, must review the Plan approximately every three years, and must make changes to the Plan if deemed necessary.

2.3. Efforts of Employers and Establishers of Schools (related to Articles 6 and 10)

Employers must endeavor to promote their workers' understanding of the relevant issues by carrying out dissemination and enlightenment activities, developing an appropriate working environment, securing consultation opportunities, and to cooperate with the measures taken by the State and local governments. Employers must also endeavor to take necessary measures such as providing their workers with information to promote understanding of the relevant issues.

Establishers of schools (excluding kindergarten and the kindergarten sections of special-needs schools; the same hereinafter) must endeavor to promote their students' understanding of the relevant issues, with the cooperation of families, local residents and other relevant persons, by carrying out education or enlightenment activities, developing a positive educational environment, securing consultation opportunities, and to cooperate with the measures taken by the State and local governments. Establishers of schools must also endeavor to take necessary measures such as developing consultation mechanisms regarding the educational environment for their students.

2.4. Attention (related to Article 12)

In implementing the measures provided for in this Act, attention must be paid to ensure that all citizens, regardless of their sexual orientation or gender identity, can live in peace. The Government will formulate the "Guidelines" necessary to ensure the smooth implementation of these policies.

3. Outlook

This Act does not directly provide for the prohibition of discriminatory treatment and basically does not directly affect the rights and obligations of private persons. Some members of LGBTQ communities and support groups have expressed dismay over the fact that this Act was designed to promote understanding rather than prohibiting discrimination.

However, this Act is nonetheless significant in that it provides that the State and local governments, employers and establishers of schools must make efforts to promote understanding. While there are many points to be monitored, including the content of the Basic Plan and Guidelines to be formulated by the Government, it is hoped that the purpose of this Act will not ultimately be misconstrued and that activities to promote understanding will be further expanded.

Footnotes

1. In the Takeover Guidelines, takeover defense measures are referred to as "takeover response policies" or simply "response policies".

2. Please refer to our newsletter published in June 2022 for further details in connection with Carbon Credit Report.

3. Please refer to JPX website below for further details.

4. As of November 16, 2023. For example, for the specified essential infrastructure providers in the financial services sector, see https://www.fsa.go.jp/news/r5/economicsecurity/tokuteishakaikiban.pdf (Japanese only).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.