Find out the steps to incorporate a company in Guatemala, a rising hotspot for expanding multinationals in Central America.

Guatemala is the third largest country in Central America, with just over 108,000 square meters. The country possesses a richness in natural wealth, and is a valuable hub for international trade, with access to the Caribbean Sea and the Pacific Ocean. The country also has a land connection with economic giant Mexico and is connected with the rest of Central America through a cultural history that dates back to around 2000 BC.

Guatemala's connection between its seaports and container terminal presents clear international trade opportunities for businesses operating from for this country. Incorporating a company in Guatemala is therefore an important consideration to make when expanding to Central America.

SEE ALSO: Employment Law in Guatemala: a Guide

Steps to incorporate a company in Guatemala

Generally, there are 6 key steps to incorporate your company in Guatemala.

1. Seek advice from local market entry and legal experts

Before expanding a business, it's important to establish a road map or market entry strategy. Seek advice from local legal and market entry experts to incorporate a company in Guatemala, in order to ensure you can set up and begin operations in full compliance with the law. These experts will help you choose the most appropriate pathway to expansion for your business needs.

Biz Latin Hub can assist you in how to Incorporate a Company in Guatemala. Company formation Guatemala

Appointing a legal representative

Companies in Guatemala require a Legal Representative to act on their behalf on local legal matters. The Legal Representative is responsible for ensuring the legal compliance of the company with local regulations. They are obliged to act in the company's best interests in this role.

It's recommended to engage with local experts in appointing this role, as they are able to fully understand the company's obligations in accordance with commercial and corporate law, and ensure your company's compliance.

2. Choose the appropriate legal entity based on your business needs

When it comes to scaling your business to other countries and incorporating a company in Guatemala, you must decide on the:

- Size of the company

- Number of partners

- Company's objectives

- Capital contribution you must make upfront to start operations.

From this information, you can select the appropriate legal entity to incorporate in Guatemala.

In Guatemala, as in other countries in the region, there are various types of companies. Of the entities on offer in Guatemala, 2 entities typically offer the best opportunities to foreign executives in terms of protection of their assets. These are the Limited Liability Company (Sociedad de Responsabilidad Limitada) and the Public Limited Company (Sociedad Anónima).

Limited Liability Company – Sociedad de Responsabilidad Limitada (SRL)

This commercial company can be constituted with a minimum of 2 partners and a maximum of 20. The SRL in Guatemala allows executives to appoint a board of directors for its governing body or be managed by a single Director.

Public Limited Company – Sociedad Anónima (SA)

The Sociedad Anónima or SA is a legal entity which can be constituted through 2 or more shareholders. This offers the opportunity to scale the number of partners.

These shareholders can be natural or legal persons. An SA can appoint a Board of Directors or a single individual or Manager as its governance structure.

The capital contribution will be represented by negotiable titles called shares, and there is no limit to the maximum share capital or number of shareholders.

The Sociedad Anónima entity tends to be more popular for multinationals when seeking to incorporate a company in Guatemala.

3. Choose the company name

Highlight your product or the quality of your service by choosing a relevant, suitable name for your company. For SRL and SA entities, the company name choice has few restrictions, except that in for the Limited Liability Company (SRL), the name must refer to its commercial objective.

Company names must be unique. It is therefore recommended to think of at least 3 possible names for your company in Guatemala to ensure the availability of a preferred name.

4. Register company statutes and incorporation articles with the Public Notary

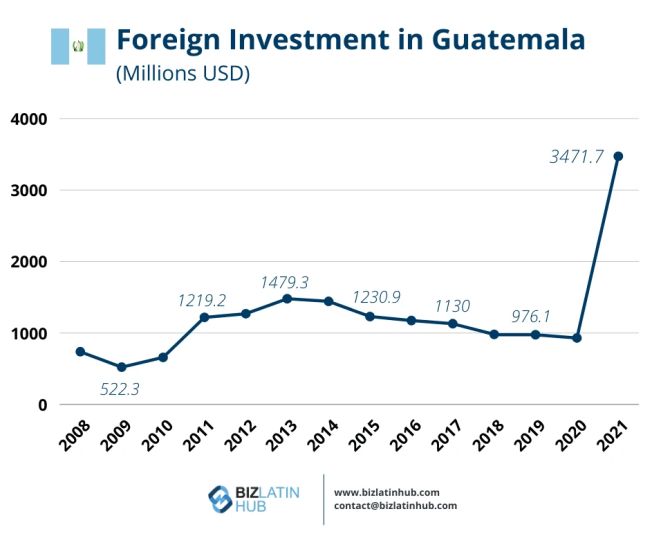

If you plan to incorporate a company in Guatemala, learn the facts about foreign investment. Company formation Guatemala

A key institution that supports company incorporation in Guatemala is the Public Notary. This person (a professional with the public notary title) will formalize the company statutes – the internal regulations of the company – in a public deed. These statutes outline the details decided upon in Step 1 (company size, shareholders, objective and capital, and the governance of the company.

Shareholders must also sign the articles of incorporation so that the new company can be duly registered before the Guatemalan Mercantile Registry.

The Notary will also formalize the appointment of the company's legal representative. This document will be required at the time of registering the company in the Mercantile Registry.

5. Payment of fees, edicts, appointments and registration

Companies must pay certain fees associated with company incorporation in Guatemala, including the right to register the company, publication of the company, and also appointment rights.

6. Register the company with the Mercantile Registry

The final step to incorporate a company in Guatemala is to register the company with the Mercantile Registry (Registro Mercantil). This can be done in person or through the agency's online portal.

Required documentation for this step includes:

- Public deed of constitution

- Certificate of appointment of the legal representative(s)

- Identification of business owner(s)

- Tax domicile of the company

- Receipts or other proof of payment of fees.

The Mercantile Registry will then authorize the company's books, the printing company that will process the invoices and the details of the company's tax system.

Once the process is approved by the Mercantile Registry and the country's tax authority, the decision will be published.

Common FAQs when forming a company in Guatemala

In our experience, these are the common questions and doubtful points of our Clients.

Yes, a business can be 100% foreign owned by either legal persons ("legal entities") or natural persons ("individuals").

Registering a company in Guatemala takes 4 to 6 weeks.

The S.A. in a company name in Guatemala refers to a "Sociedad Anónima," which translates to a "Joint Stock Company." This legal framework establishes the company as a separate entity from its shareholders, with each shareholder possessing shares that represent their ownership stake. Importantly, the financial responsibility of shareholders is confined solely to the value of their shares, crafting a safeguarded boundary. The S.A. structure holds substantial prominence in Guatemala due to its exceptional adaptability and flexibility, rendering it the favored option for a diverse range of business ventures.

In Guatemala, the Sociedad Anónima (S.A.) is the Limited Liability Company.

A. Personal element and capital stock: In the

corporation, shareholders participate (with a minimum of two legal

entities or individuals, foreign or Guatemalan) and the capital

stock is made up of shares, while in the LLC, partners participate

(a maximum of 20) through contributions.

B. Type of Commercial Company: The type of

company of the SA is capitalist while in the SRL it is of Mixed

type (personalist and capitalist).

C. Identification: The SA is identified with a

freely formed corporate name (any name available in the Mercantile

Registry) to which is added the slogan "Sociedad

Anónima" and abbreviated "S.A.", while the

SRL can be identified through a corporate name.

D. Liability of the shareholders: This would be a

similarity, since on the side of the LLC the liability is limited

to the payment of its contributions, and in the corporation it is

limited to the paid subscribed shares.

Originally published by 11 April 2020 | Updated On: 10 October, 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.