The Italian Government has approved a new Law Decree, endorsing the National Recovery and Resilience Plan (hereinafter also "NRRP"), which introduced a new tax incentive aimed at sustaining the corporate investments in digitalization and green transition, the s.c. 5.0 industrial technology transition.

Here below is a brief recap of the benefit:

- Subjective conditions: Italian resident companies and Italian permanent establishments of foreign entities are eligible for the incentive;

- Investment Requirements: eligible taxpayers must carry out new investments aimed at reducing the energy consumption in operating sites located in Italy during FYs 2024 and 2025;

- Eligible investments: the eligible investments are related to new instrumental tangible and intangible assets:

- listed in annex A and B of the Law No 232/2016;

- interconnected with the IT system related to the production or supply chain;

- ensuring a reduction in the energy consumption of the industrial site at least equal to 3% or (as an alternative) a reduction in the energy consumption of the operating processes related to the investment at least equal to 5%.

Furthermore, the following investments are expressively included in the facilitation: (i) purchase of new capex for the internal production of renewable energies, and (ii) expenses related to training courses for employees aimed at obtaining or improving proficiency in the field of digital and energy transition of the production processes.

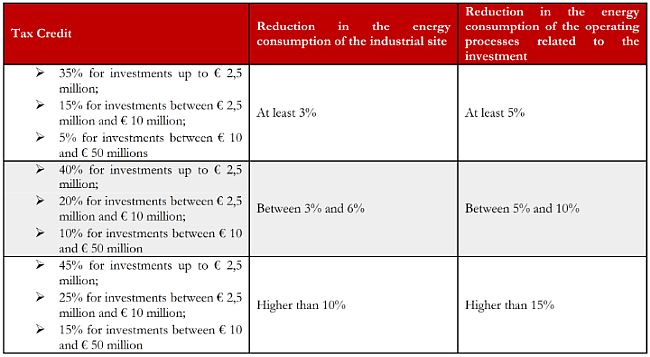

- The incentive: the benefit consist of a tax credit amounting to:

- 35% of the total costs for investments up to € 2,5 million;

- 15% of the total costs for investments between € 2,5 million and € 10 million;

- 5% of the total costs for investments over € 10 million and up to the maximum amount of € 50 million. Such limit shall be determined on an annual basis and for each beneficiary.

The tax credit is respectively increased to:

- 40%, 20% and 10% in case of reduction in the energy consumption of the industrial site higher than 6% or (as an alternative) reduction in the energy consumption of the operating processes related to the investment higher than 10%;

- 45%, 25% and 15% in case of reduction in the energy consumption of the industrial site higher than 10% or (as an alternative) reduction in the energy consumption of the operating processes related to the investment higher than 15%.

- Calculation method: the reduction in the energy consumption, apportioned on an annual basis, shall be calculated comparing the fiscal year when the investments are carried out, with the previous year without taking into account the variations of the production capacity as well as any external conditions affecting the energy consumption.

- Implementation: the Italian Ministry of Economics will release in the incoming months an implementation decree.

- Documental requirements: beneficiaries must store the documents supporting the expenses sustained and the duly identification of the eligible costs. To this extent, all the documents related to the investment (inter alia, invoices and shipping documents) must expressively expose a reference to art. 38 of Law Decree No 19/2024.

- How to apply: eligible taxpayers shall file a specific application form to the Italian National Energy Authority (GSE). Operating instructions will be provided by the GSE together with the Ministry of Economy.

- Further requirements: an independent expert must certify:

- prior to the application, the energy consumption reduction thanks to the new 5.0 eligible investments;

- after the application, the effective achievement of the investments and the necessary interconnection with the IT system, related to the production or supply chain.

For SMEs only, the expenses related to the certification above can be included in the calculation of the tax credit up to an amount of € 10,000.

Furthermore, the auditor of the beneficiary must certify that the eligible expenses are effectively borne and compliant with the accounting books.

In case the beneficiary is not subject to legal audit, such certification must be released by an independent auditor or audit company; in this circumstance, the auditor's fee can be included in the tax credit calculation up to an amount of € 5,000.

- How to benefit from the tax credit: the tax credit can be exclusively offset with other tax payables and duties through the dedicated payment form (F24 Form) within December the 31st 2025. Eventual portion of the tax credit not offset within the above deadline, can be carried forward and used in five equal instalment, on a yearly basis.

- Combination with other incentives: the new tax credit cannot be combined with the following incentives related to the same expenses: tax credit for new capital investment (art 1 § 1051 of Law 178/2020) and ZES tax credit for Southern Italy (art 16 of Law Decree No 124/2023).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.