During a licence application or variation, ASIC has the discretion to impose a Key Person condition on an Australian Credit Licence or an Australian Financial Services Licence where the licensee is dependent upon a particular Responsible Manager to demonstrate organisational competence in some or all of the authorisations listed on the licence.

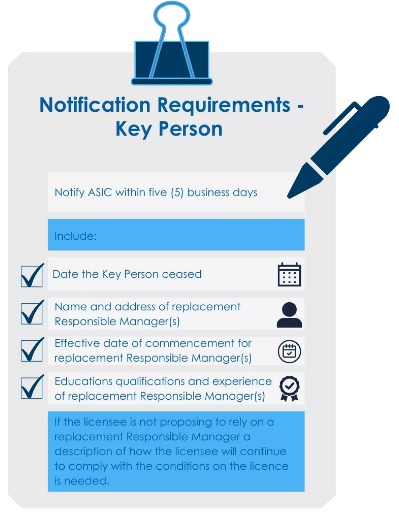

Where a Key Person condition has been placed on the licence, certain notification obligations apply where that Key Person resigns. A licensee is required to notify ASIC in writing within five business days of the following:

- the date that the Key Person ceased as Responsible Manager;

- any replacement Responsible Managers, their educational qualifications and experience and date of commencement;

- where the licensee does not have a replacement Responsible Manager, detailed reasons for this;

- how the licensee will continue to comply with the relevant legislation and conditions on its licence.

What does this mean for licensees?

The sudden resignation of a Responsible Manager who is a Key Person can have a significant impact on the licensee and its ability to continue to provide financial services or engage in credit activities. It is possible ASIC may determine that the licensee no longer has the organisational competence to provide financial services or engage in credit activities. Where ASIC makes this determination, ASIC has the power to:

- remove authorisations on the licence for which the licensee cannot demonstrate organisation competence;

- cancel the licence.

Where licensees have failed to:

- maintain organisational competence;

- advise ASIC of the resignation of a Key Person and the commencement of a suitable replacement Responsible Manager,

the licensee will need to consider lodging a breach report with ASIC.

How do I know if I have a Key Person on my licence?

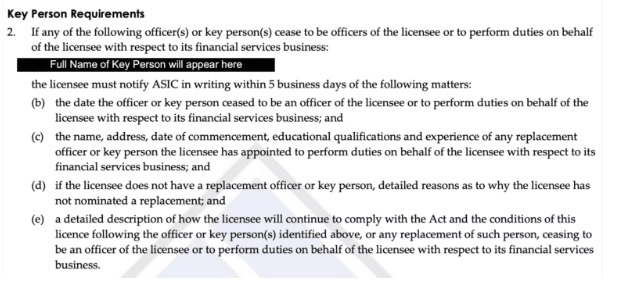

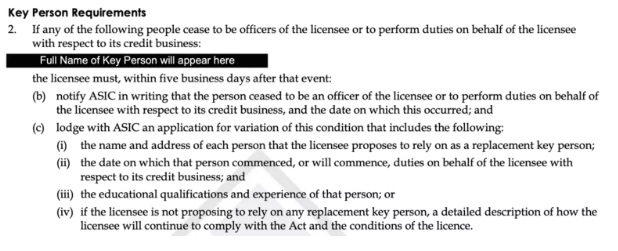

Where you have a Key Person condition, it will appear on your licence as condition 2. It will specifically list any Responsible Managers who are Key People. Please see below as an example:

Australian Financial Services Licence:

Australian Credit Licence:

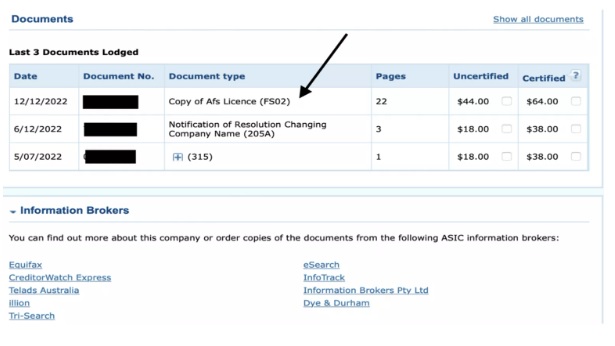

If you do not have a full copy of your licence, you can purchase this from ASIC's Companies Register here. You will need to search through the 'Documents' section to find the most recently issued AFSL or credit licence for the company. Please also see the below screenshot example:

Next Steps

Licensees should review their arrangements to maintain organisational competence including:

- is there more than one Responsible Manager on the licence to demonstrate competence in all authorisations listed;

- where there is only one Responsible Manager, what are the timeframes and ability to terminate this position under their employment contract or contracting agreement;

- ensuring adequate succession plans are in place to minimise the risk that the resignation of a Responsible Manager may pose to the licence. This can be achieved by undertaking a skills assessment of other employees or directors not currently appointed as Responsible Managers; and

- where a Key Person condition has been imposed on the licence, consider whether an application to remove this condition can be lodged.

Background

Section 912A of the Corporations Act 2001 (Cth) and section 47 of the National Consumer Credit Protection Act 2009 (Cth) requires licensees to maintain the competence to provide financial services or engage in credit activities as covered by the licence.

ASIC's Regulatory Guide 105 and 206 requires Responsible Managers to have:

- direct responsibility for significant day to day decisions of the business;

- have appropriate knowledge and skills of all credit and financial services and products;

- be fit and proper people.

Further Reading