The Australian Financial Complaints Authority (AFCA) has released its Systemic Issues Insight Report for Quarters 1 and 2 of financial year 2023-24 (FY24) ("Insights Report").

In the first two quarters of FY24, AFCA conducted 111 investigations into possible systemic issues and delivered more than $40 million in refunds to consumers. Of these investigations, 49 systemic issues and 44 other matters were reported to regulators.

Common systemic issues AFCA identified across industry sectors

Before looking at the common systemic issues AFCA identified in the Insight Report, it is important to understand what a systemic issue is. A systemic issue is an issue that is likely to have an affect on one or more consumers or small businesses, in addition to a complainant. Some systemic issues impact large numbers of consumers while others impact only a small group.

The common systemic issues AFCA identified for the first half of FY24 are summarised below:

|

Banking and Finance |

· Compliance with Regulatory Guide 271: Internal Dispute Resolution (RG271) · AFCA engagement: collection activity during open AFCA complaints · Dealing with third party representatives · Failure of an automatic system causing an error · Dealing with scams including elements of prevention, investment, recovery and communications |

|

General Insurance |

· Dealing with third party representatives · AFCA engagement: collection activity during open AFCA complaints · Policy interpretation |

|

Life Insurance |

· Breach of policy terms |

|

Investments and Advice |

· Processing error |

|

Superannuation |

· Adequacy of claims handing process · Breach of obligation under SIS Act and SIS Regulations · Cancellation of policies |

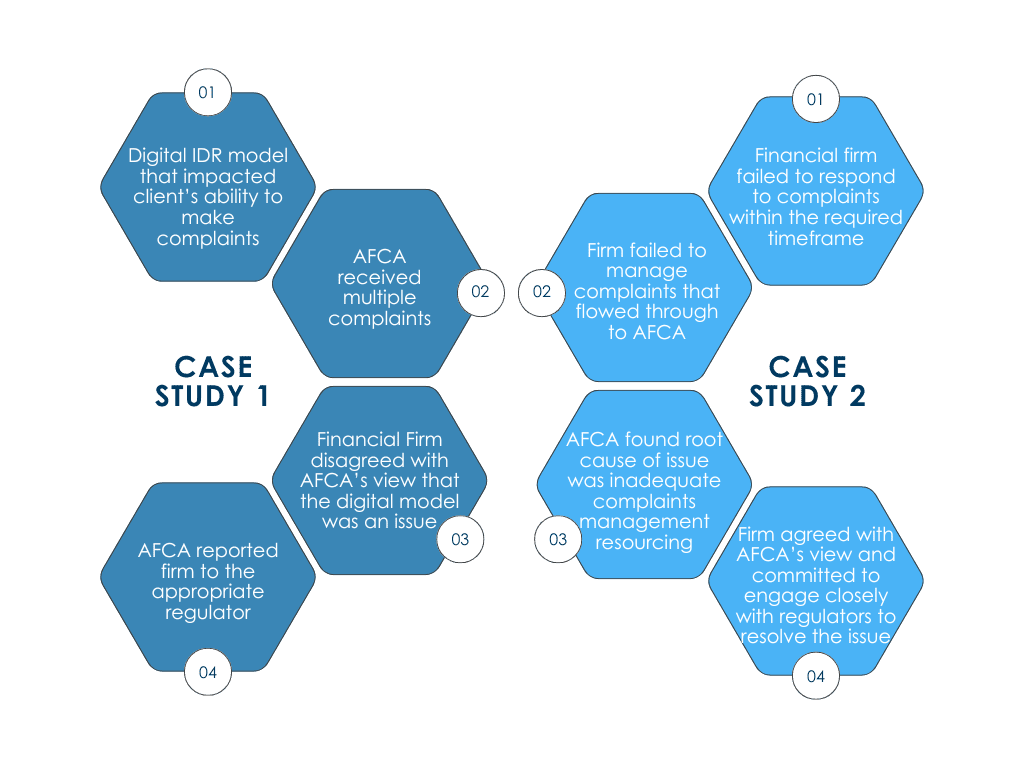

Amongst these common systemic issues, we took a deeper look into the issue of non-compliance with RG271 Internal Dispute Resolution ("IDR"). In the Insights Report, AFCA provided two case studies, summarised below, in relation to financial firms' compliance with IDR requirements:

Case Study 1 – Digital-based IDR process

A financial firm moved to a "digital first" IDR model which only allows consumers to submit complaints via mobile app and website, and removed the ability to make inbound calls. This digital model significantly impacted consumers' ability to make complaints. Soon after its adoption, AFCA received many complaints about stressful experiences of clients dealing with the financial firm from an IDR standpoint.

RG271 has enforceable paragraphs requiring a financial firm to have an IDR process that is accessible, including for people with disability or language difficulties, and flexible, with multiple complaint lodgement methods (including telephone, email, letter, in person and online).

AFCA's view is that the digital model was the cause of the poor experience for consumers from an IDR perspective, but the financial firm disagreed with AFCA's view. AFCA reported the systemic issue to the regulator for it to action.

Case Study 2 – Failure to manage IDR and External Dispute Resolution (EDR) complaints

A financial firm was repeatedly failing to respond to complaints which were brought to it at an IDR level within the required timeframes and failing to manage complaints that flowed through to AFCA.

AFCA found that the root cause of the systemic issue was inadequate complaints management resourcing and responsiveness when an external event caused a surge of consumer complaints.

The financial firm agreed with AFCA's view and committed to engage closely with the regulators to resolve its IDR and EDR performance issues.

Key check points for financial firms:

- How do you accept complaints? Are you using a variety of methods?

- Is your IDR process helpful, easy to use and accessible?

- When you intend to implement a new IDR process, do you conduct testing of the new process prior to putting it into use? Do you conduct regular monitoring for any impacts to consumers and unintended consequences?

- Do you have adequate resources to manage complaints at IDR and EDR stages? Who is responsible for dealing with complaints at an IDR level? Who is responsible for dealing with and responding to AFCA?

- Are you meeting the required timeframes at both IDR and EDR stages? Are the relevant staff aware of these timeframes?

- Have you tested the scalability and responsiveness of your complaints handling systems and processes?

Background

AFCA has a statutory responsibility to identify, refer and report systemic issues, serious contraventions of the law and other reportable matters (set out under section 1052E of the Corporations Act (2001) (Cth)) to regulators including the Australian Securities & Investment Commission (ASIC), the Australian Prudential Regulation Authority (APRA) and the Australian Taxation Office (ATO). The primary purpose of AFCA's reporting obligation is to ensure that the regulators have the information they need to take regulatory action as they see necessary.

In the first half of FY24, AFCA reported 93 matters (including but not limited to systemic issues) to ASIC, 47 matters to APRA and 8 matters to other regulators including the ATO.

AFCA's process for dealing with a potential systemic issue is:

- Identify: AFCA identifies a possible systemic issue from its consideration of an AFCA complaint

- Refer: AFCA refers the possible systemic issue to the financial firm so the financial firm can provide us with further information and evidence about the issue

- Form a View: After reviewing the financial firm's response, AFCA will form its view and advise the outcome in writing. An AFCA decision maker is usually involved in making this decision

- Report: If the issue is systemic, AFCA reports it to the regulators as required under RG267 and section 1052E of the Corporations Act 2001 (Cth).