Revenue recognition has been the topic of conversation in the accounting world for a few years now. Implementation is looming for FASB Accounting Standards Update (ASU) 2014-09, Revenue from Contracts with Customers (Topic 606), and many are wondering how this update impacts the process of recognizing revenue for exchange transactions. Luckily for us in the nonprofit industry, there is a second revenue recognition standard that will have an impact. FASB issued ASU 2018-08, Clarifying the Scope and Accounting Guidance for Contributions Received and Contributions Made (Topic 958-605). For those nonprofits that are engaging in both contribution and exchange transactions, both standards will have an impact on how nonprofits recognize revenue.

When do I need to worry about this?

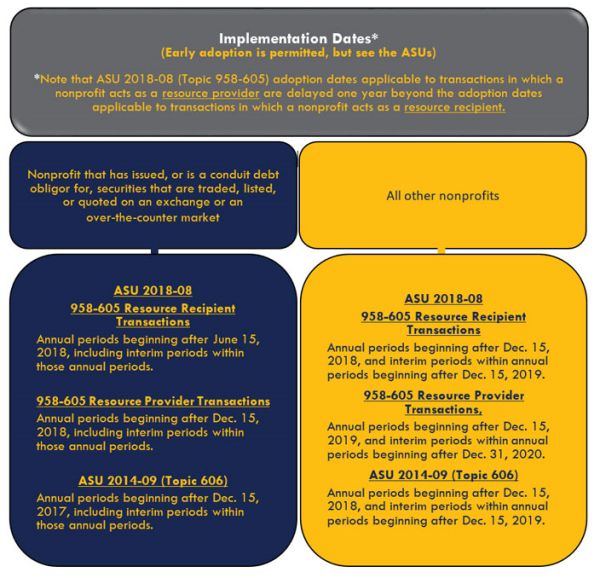

The following chart shows the final implementation dates for ASU 2014-09 and ASU 2018-08. The implementation dates are similar between the two standards but not identical in all cases.

What do I need to know?

ASU 2018-08 (Topic 605)

Nonprofits will need to examine their contracts with customers and other revenue sources to determine how the revenue will be recognized under the new revenue recognition rules. The first step is to identify whether the revenue stream is exchange vs. nonexchange revenues. If it is determined to be an exchange revenue, the guidance for ASU 2014-09, as amended, will be followed, and if it is determined to be a nonexchange (contribution), the guidance for ASU 2018-08 will be followed. There can be transactions that will have elements of both contribution and exchange, and in those circumstances the revenue will need to be bifurcated with each element of the transaction following the appropriate guidance.

ASU 2018-08 clarifies and refines existing guidance to help explain the scope of contributions. One revenue area that has caused longstanding difficulty and diversity in practice is accounting for government grants and contracts. Under existing guidance, there is diversity in practice when determining if the revenue is a contribution (nonreciprocal) or an exchange (reciprocal) transaction. ASU 2018-08 clarifies that, in the case of grants and similar contracts with government agencies, unless the resource provider receives commensurate value from the resource recipient, the transaction is most likely a contribution, not an exchange transaction.

The ASU provides examples of indirect benefits that do not constitute commensurate value, which have resulted in confusion in the past. This determination comes down to the question of "who is receiving the benefit?" The following do not constitute commensurate value and, as a result, would be considered nonexchange (contribution) transactions:

- Indirect benefit(s) received by the public.

- Indirect benefit(s) received by a resource provider; i.e. societal benefit is not direct commensurate value.

- Furthering a resource provider's mission or positive sentiment from acting as a donor.

Once you have determined that your revenue source is considered a contribution (nonexchange) transaction, the next step is to distinguish between conditional and unconditional contributions. For contributions that are conditional, the revenue will be recognized as the conditions are met. For a donor-imposed condition to exist, it must have both:

- A right of return of the gift to the donor or a release from the donor's promise to give. Look for statements such as "payments are subject to your compliance" or "any unused assets are forfeited, and any unpermitted costs that have been drawn down by the Organization must be refunded."

- A measurable barrier that must be overcome. Some indications that a barrier exists include a measurable performance-related barrier or other measurable barrier; whether the stipulation is related to the purpose of the agreement or the extent to which a stipulation limits discretion by the recipient on the conduct of an activity. Things to look for in contracts related to measurable performance barriers would be that the transfer of goods is related to an achievement of a specified level of service, units of output or a specific outcome. Items that would limit discretion would be items related to how the activity is conducted, such as a requirement to follow specific guidelines about incurring qualifying expenses (e.g. compliance with the cost principles issued by the OMB).

ASU 2018-08 provides a variety of indicators of barriers and right of returns to be aware of. A stipulation that is unrelated to the purpose of the agreement (trivial or administrative conditions) is not indicative of a barrier. Examples of trivial or administrative conditions would be items such as a requirement to provide an annual report, submit a budget or budget to actual reporting.

Many federal awards currently are treated as exchange transactions, and under the new standard, most federal award contracts will be treated as conditional contributions. The result of how the revenue is recognized may not change. Donors and donees will need to consider whether stipulations in grant agreements, such as objectives and milestones, are measurable performance barriers or simply guidelines and mutually agreed-upon goals. For a right of return to exist, it must be evident from the gift agreement or another document referred to in the gift agreement; its existence cannot simply be implied.

ASU 2014-09 (Topic 606)

ASU 2014-09 establishes a new model for all entities, including nonprofits, for recognizing revenue arising from contracts with customers (exchange transactions), and it eliminates previous differences scattered throughout the Accounting Standards Codification. The new model consists of a five-step process as follows:

The objective of the new model is to recognize revenue in a manner that depicts the transfers of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. Nonprofits will need to re-examine their contracts with customers to be sure they recognize the related revenues in accordance with this new standard. All program-related products or services for which a fee is charged, and all other sales of any goods or services, whether program-related or not, are subject to the new standard.

How does my nonprofit begin implementation?

The first steps in implementing these standards is to review current practices, which includes reviewing current policies and accounting procedures. With the new standards, there may need to be updates to current practices. These new standards not only impact accounting; others in your nonprofit should be engaged as well. There are many other employees within an entity that receive grant agreements, contracts, etc. and they are crucial to determining the revenue recognition process. Engage the other departments that receive these documents: Development, Foundation Relations, Program Managers, etc., and educate your staff on the changes! The changes could impact processes in your organization anywhere from developing a practice aid to assist in the revenue recognition process to considering current system capabilities.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.