Uniformity, or rather the lack thereof, in procedures and practices within U.S. Customs and Border Protection's (CBP) Centers of Excellence and Expertise (Centers) is evidently harming compliant companies within the trade community. The audit report from the Department of Homeland Security's (DHS) Office of Inspector General (OIG) in March 2022 poignantly revealed significant weaknesses in CBP's operational processes and internal controls and has left the trade community justifiably concerned, particularly companies committed to paying their duties in full.

However, the effectiveness of these Centers has been brought into question following the OIG's audit, which was initially intended to rate the Centers' impact on revenue protection.

Objective of the Audit

The primary objective of the audit was to gauge the effectiveness of CBP's Centers of Excellence and Expertise in safeguarding trade revenues. The assessment was carried out in line with the requirements outlined in Section 112 of the Trade Facilitation and Trade Enforcement Act (TFTEA). As a result of the audit, the DHS Office of Inspector General issued five crucial recommendations aimed at enhancing CBP's revenue assessment, collection, and protection procedures.

The Centers of Excellence and Expertise

The Centers, designed to streamline trade functions, were initially implemented by CBP as an answer to inconsistent treatment of goods across various ports of entry. The Centers aim to focus on specific industries and streamline trade functions. They are managed by CBP's Office of Field Operations and Office of Trade, and importers are assigned to a Center based on the type of goods they import. Center Directors now handle key trade functions that were previously the responsibility of port directors, making them "virtual ports of entry." They perform various post-release trade activities, including processing entry summaries, collections, and petitions, among other tasks. Center personnel make decisions on merchandise from assigned importers, regardless of the entry point into the U.S. There are ten (10) Centers that are separated into (1) Apparel, Footwear & Textiles, (2) Electronics, (3) Machinery, (4) Petroleum, Natural Gas & Minerals, (5) Base Metals, (6) Consumer Products & Mass Merchandising, (7) Automotive & Aerospace, (8) Industrial & Manufacturing Materials, (9) Agriculture & Prepared products, and (10 Pharmaceutical Health & Chemicals.

The DHS Audit Identified Lack of Oversight and Performance Standards

The audit identified several critical deficiencies in CBP's revenue protection practices, notably:

The CBP's efficiency in revenue protection is marred by three key issues:

- Absence of Performance Standards: CBP's failure to establish performance metrics for the Centers has impeded its capacity to evaluate their revenue protection effectiveness. Oversight into the Centers' roles in trade penalty enforcement is unclear, preventing regular assessment of their operations and performance.

- Insufficient Oversight and Coordination: Inadequate procedural clarity and poor interoffice coordination have curtailed the Centers' ability to safeguard trade revenue competently. The lack of well-defined roles pertaining to trade penalty proceedings has resulted in potential operational inefficiencies.

- Non-adherence to TFTEA Directives: CBP's disregard for the TFTEA's regulations, particularly in setting up performance measurements for the Centers and conducting regular assessments of their operations, has resulted in insufficient risk evaluations.

The audit revealed that CBP has not defined performance standards in line with the TFTEA mandate. These standards were meant to gauge the progress of the Centers of Excellence and Expertise, focused on customs modernization, trade facilitation, and enforcement, and include efficiency, outcome, output, and other criteria. In collaboration with congressional committees and the Commercial Operations Advisory Committee, CBP should devise performance measures to fulfill internal efficiency and goals.

Despite this, the audit found that CBP hasn't developed performance standards for evaluating the Centers' strategies for revenue protection, including assessment, collection, and mitigation. CBP failed to provide substantiating documents when asked. OFO managers viewed the Centers more as a structural change than a program, hence did not establish performance metrics. The audit also underscored that CBP didn't conduct consistent evaluations or risk assessments of the Centers' operations. After a one-off review for the Fiscal Year 2017 Report to Congress, documenting only their pilot years, CBP hasn't conducted any additional assessment of the Centers' performance, even though all 10 Centers are fully operational.

This lack of monitoring and evaluation could significantly affect the trade community because without performance measures, it is challenging to assess whether these Centers are facilitating and enforcing trade as effectively and efficiently as intended. It also creates an unstable and unpredictable working environment for trade companies, especially those vigilant about following the law. In the absence of clear guidance on enforcing trade penalties, the trade community suffers from inconsistent enforcement actions.

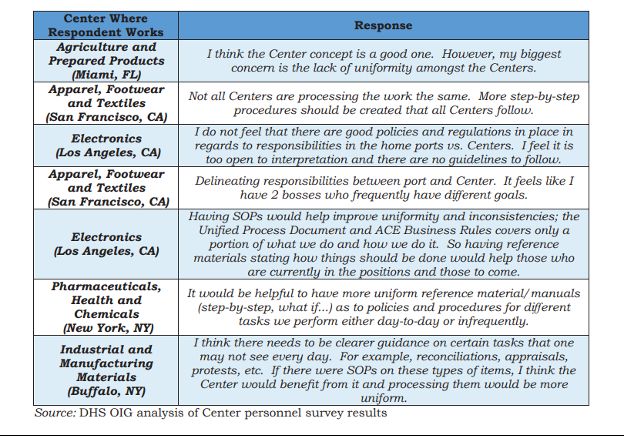

Below is a table of responses from the various Center personnel based on surveys conducted during the audit, which represent a lack of uniformity in procedures and practices among the Centers, leading to general confusion among the Center personnel:

Addressing the Deficiencies: Recommendations for Strengthening Procedures

The DHS OIG directs these five steps to improve shortcomings and enhance revenue protection:

- Set Performance Standards: CBP should formulate detailed performance standards for the Centers of Excellence and Expertise. This development in sync with customs modernization and trade facilitation objectives should involve the collaboration of CBP's Trade and Field Operations departments.

- Periodic Evaluations: Regular assessments of the Centers' performance, operations, and risk should be conducted to assure revenue protection. This will ensure they meet goals and evaluate related financial risks.

- Approval of Clear SOPs: CBP should develop uniform Standard Operating Procedures (SOPs) for revenue protection. The Trade and Field Operations departments should work together to define clear roles and responsibilities, promoting consistency and providing personnel training on updated procedures.

- Strengthened Oversight: CBP should boost the oversight of operations, facilitating timely enforcement actions and effective revenue collection. This involves creating a set of enforcement procedures and ensuring a prompt resolution of importer violations.

- Improved Data Management: The CBP should revise procedures for initiating, analyzing, tracking, and managing penalty cases, providing comprehensive insights into revenue protection actions and clear guidance for the Centers.

Conclusion

The lack of uniform operational standards and subpar oversight of the CBP's Centers is hurting the trade community significantly. Companies abiding by trade laws may feel penalized for their compliance as others find ways to avoid their duties, made easier by the inconsistent enforcement of trade penalties. To rectify this, CBP needs to adopt the recommendations of the DHS OIG's audit, thereby strengthening their position in trade facilitation and enforcement and providing a level playing field to the entire trade community.

Check out our new Digital Magazine Get the inside scoop on the Braumiller Law Group & Braumiller Consulting Group "peeps." Expertise in International Trade Compliance.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.