INTRODUCTION

If you are a tax professional, you know your client is in a pickle if a tax provision disallows a deduction and another provision subjects the corresponding income to U.S. tax. If you are the client, read on to avoid a situation which can prove to be a nightmare if not addressed at the time of structuring the business.

This article focuses on the potential issues of operating a group financing function through a fiscally transparent entity to cater to the financial needs of operating U.S. subsidiaries of a foreign multinational group. Fact patterns that result in a deduction/ no inclusion scenario are identified, the scope of the problems explained, possible solutions are proposed. Good-bye to the reverse hybrid entity.

BACKGROUND

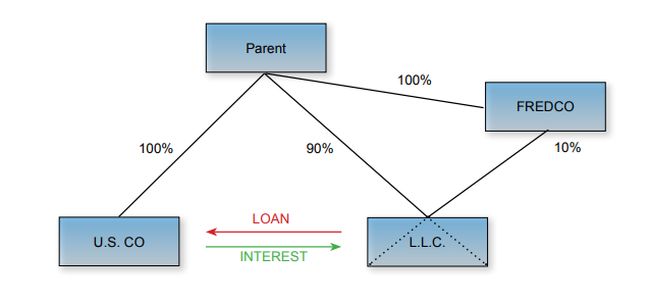

The following fact pattern is used to describe the tax issue.

- A parent corporation ("Parent") is tax resident in the fictional country of Fredonia.1

- Parent is the sole shareholder of a subsidiary in the U.S. ("U.S. Co") and a subsidiary in Fredonia ("FREDCO").

- Parent and FREDCO are members of an L.L.C. in the U.S. ("L.L.C.") to serve as a group financing entity in the U.S.

- L.L.C. raises funds from Parent and lends those funds to U.S. Co and related corporations it owns in the U.S.

- L.L.C. is treated as a partnership for U.S. tax purposes.

- L.L.C. is treated as a foreign corporation for Fredonian tax purposes.

- Dividends received by a Fredonian corporation from a foreign subsidiary enjoy from a dividends received deduction ("D.R.D.") where the Fredonian corporation owns at least 10% of the shares of the corporation paying the dividend.

- The anti-deferral rules in Fredonia for C.F.C.'s apply only when the C.F.C. is resident in a country with which Fredonia does not have a comprehensive income tax treaty in effect.

The facts are illustrated in the following diagram where the subsidiaries of U.S. CO are ignored:

U.S. ANTI-HYBRID RULES

In General

Generally, interest expense is allowed as a deduction when computing U.S. taxable income when and as it accrues, subject to various limitations.2 For a taxpayer that reports income on the accrual basis, actual payment generally is irrelevant. However, when the lender is a related foreign entity, interest expense is deductible only when included in the gross income of the recipient.3 For interest income received by a foreign corporation, income is recognized when and as paid.4 Stated otherwise, the interest expense is allowed as a deduction to the payor in the year in which it is paid.5

The Anti-Hybrid Rules Restrict the Ability of a U.S. Person to Deduct Interest Expense When Paid to a Related Reverse Hybrid Entity if Certain Conditions Exist

An entity that is treated as fiscally transparent in the country of organization but not fiscally transparent under the tax law of the country of residence of an investor is classified as a reverse hybrid entity for purposes of the anti-hybrid rules.6

L.L.C. is treated as a fiscally transparent entity for U.S. tax purposes in the absence of an election under U.S. tax law commonly known as a "check-the box-election."7 It is classified as a partnership because it is a domestic eligible entity8 that has more than one member.9 However, it is treated as a corporation for purposes of Fredonian tax law, the tax law of the country of residence of the investor in the L.L.C. Therefore, (a) L.L.C. is a reverse hybrid entity for purposes of the anti-hybrid rules and (b) the deductibility of any interest payment made by a related U.S. payor to L.L.C. will be subject to the anti-hybrid rules of Code §267A.

The Anti-Hybrid Rules Under Code §267A Disallow a Deduction of the Interest Payments by U.S. Operating Companies to a Reverse Hybrid Entity if the Interest Payments are not Currently Distributed to Parent

The anti-hybrid rules are designed to disallow – not defer – a deduction for interest expense paid to a reverse hybrid entity when certain conditions exist. In general, the anti-hybrid rules aim to prevent a current tax benefit in the U.S. by disallowing a deduction for a payment to a related reverse hybrid entity if the corresponding income is not subject to tax in the same year in the foreign country of residence of the investor. The problem is typically referred to as a "deduction/no inclusion" scenario.

Under the anti-hybrid rules, an interest payment made to a reverse hybrid entity is disallowed if the following four conditions are satisfied:10

First, the U.S. payor and the reverse hybrid entity are related to each other. That will occur if the reverse hybrid entity and the U.S. payor are controlled by the same person.11 Control is defined to mean the direct or indirect ownership of more than 50% of a corporation's stock, by vote or by attribution from other related persons.

Second, the investor's country of residence treats the reverse hybrid as a taxpayer in its own right, meaning it is not fiscally transparent. Under a no-harm, no-foul rule, the second condition is not met if an anti-deferral regime in the country of residence requires the investor to include in its taxable income the interest payment made to the reverse hybrid entity. For no-harm, no-foul rule to apply, the anti-deferral regime must tax the included income at the full marginal rate imposed on ordinary income and the amount must not be reduced or offset by any relief particular to the amount.12

Third, a "no-inclusion" event occurs. This means the investor does not include the payment in income in its country of residence in the same year the interest is paid to the reverse hybrid. Under an ameliorative rule, an investor is treated as if it timely included the interest payment in income if it actually does so in a taxable year that ends within 36 months following the close of the payor's tax year in which a deduction would otherwise be allowed.

For the ameliorative rule to apply, the amount distributed to the foreign investor must be taxed at the full marginal rate imposed on ordinary income in its country of residence or, if different, the full marginal rate imposed on interest income. Moreover, the tax base cannot be reduced or offset indirectly by an exemption, exclusion, deduction, credit, or similar relief. Examples include the following:

- A participation exemption

- A dividend received deduction

- An indirect foreign tax credit for corporate income taxes paid by the corporation from which a distribution is received

- A rule calling for the recovery of basis in shares before dividend income is recognized

- A rule calling for the recovery of principal with respect to indebtedness so that principal is recovered in its entirely before interest income is taxed.

Generally applicable deductions such as net operating losses or depreciation are acceptable and do not defeat the exception. When an indirect reduction reduces 90% or more of the payment, it is considered to reduce 100% of the payment. On the other hand, if it reduces or offsets 10% or less of the payment, it is considered to reduce or offset none of the payment.13

Fourth, the investor's no-inclusion result is directly connected to the payment made to the reverse hybrid entity. The investor's no-inclusion event is considered to be directly connected if the interest is not included in the income of the investor because the reverse hybrid entity is treated as an opaque entity under the tax law of the country of residence of the investor.

The 36-month Exception is not Available With Respect to Payments Made to a Reverse Hybrid; Rather the Anti-Hybrid Rules Call for a More Restrictive Condition Requiring a Current Distribution by the Reverse Hybrid Entity of the Interest Payments to its Investor to Allow a Deduction

A more restrictive and specific rule is applicable to reverse hybrids, which makes any subsequent distributions by the reverse hybrid irrelevant when determining deductibility.14 Under the more restrictive rule, the reverse hybrid must distribute all its income for the taxable year during the year. To the extent an investor includes in income one or more current-year distributions from the reverse hybrid, the investor is treated as including in income all or a portion of interest payments made to the reverse hybrid during the year. As a result of the investor's income inclusion, the U.S. payor is allowed a deduction when computing U.S. taxable income.15

U.S. F.D.A.P.16 Withholding Tax Imposed on the Investor in a Reverse Hybrid is not Relevant in Determining Whether a Distribution Triggers Full Tax for the Investor

The preamble to regulations issued under Code §267A provides that the determination of whether a deduction of interest payment is disallowed under Code §267A is made without regard to the collection of U.S. withholding tax imposed on F.D.A.P. income.17 The Preamble explains that the purpose of U.S. withholding taxes is generally not to address mismatches in tax outcomes, but rather to allow the source jurisdiction to retain its right to tax a payment.18

APPLICATION OF THE ANTI-HYBRID RULE TO HYPOTHETICAL FACT PATTERN

In the hypothetical, U.S. CO and L.L.C. are related to each other within the meaning of the anti-hybrid rules. Parent controls both U.S. CO and L.L.C., a reverse hybrid. Consequently, interest payments made by U.S. CO to L.L.C. will be deductible only if the conditions explained above are met. In the hypothetical, those conditions are not met:

- Parent and FREDCO are members of L.L.C. In the language of the regulations, each is the investor in the L.L.C.

- Fredonian tax law treats L.L.C. as an opaque entity that is not resident in Fredonia.

- L.L.C. is not taxed in Fredonia as a resident under concepts of management and control.

- Fredonian anti-deferral rules for C.F.C.'s are not applicable.

- When and as income is received by L.L.C., Parent and FREDCO are not required to treat that income as taxable for Fredonian tax purposes.

- U.S. CO will not be allowed a deduction for the interest payments made to L.L.C. even if L.L.C. distributes all of its income to Parent and FREDCO. Fredonian tax law allows Parent and FREDCO to claim a D.R.D. that reduces the tax base in Fredonia. Consequently, the distribution is not subject to the general rate of income tax in Fredonia.

CODE §894(C) – ADDING INSULT TO INJURY

Until this point, the article focused on the anti-hybrid rules of Code §267A and its adverse effect on deductions claimed by U.S. Co for interest paid to L.L.C., a related party and a pass-through entity for U.S. income tax purposes, but not for Fredonian purposes. Assuming that an income tax treaty between the U.S. and Fredonia is in effect and the treaty does not address the status of hybrid entities, the problem grows for the members of Parent's group. The interest payment to L.L.C. that flows through to Parent and FREDCO will not benefit from the reduced rates of withholding tax that provided by the income tax treaty between Fredonia and the U.S. A 30% withholding tax must be collected from the payments of F.D.A.P. income to which Parent and FREDCO are entitled. The adverse consequences stem from Code §894(c) and Treasury Department regulations issued in furtherance of that provision. The result of no deduction as a result of Code §267A and income inclusion due to the application of Code §897 result in consequences that are too bad to be true.

Fiscal Transparency

Code §894(a) provides that income of any kind will not be included in gross income and will be exempt from tax in the U.S., to the extent required by any treaty obligation of the U.S. Eligibility for treaty benefits is limited under Code §894(c) when income is derived through an entity that is treated as transparent under U.S. tax law, but as the beneficial owner under the tax laws of the treaty country.

The U.S. tax regulations19 that address the effect of income tax treaties on U.S. domestic tax law were designed to clarify the circumstances when a payment of U.S. source income to a fiscally transparent entity such as a partnership are entitled to reduced tax by reason of an income tax treaty. Under these rules, eligibility for benefits depends on whether a payment received by a fiscally transparent entity is derived by a resident of the other Contracting State – either the tax transparent entity such as partnership or its members.20 Since the L.L.C. is a U.S. entity, the focus is on the taxation of the members of the L.L.C. under the laws of the jurisdictions in which members of the L.L.C. are tax resident.

Under the applicable provision in the regulations, for an entity to be treated as fiscally transparent by the jurisdiction in which a member resides, the tax law in that jurisdiction must require that the member to take into account separately its share of the various items of income of the entity on a current basis and to determine the character and source of the items as if they were realized directly from the source.21 Thus, the rules applicable under the laws of the jurisdiction in which the member is resident must be analogous to the U.S. rules applicable to entities that are treated as partnerships. Where such treatment exists under the laws of that jurisdiction, the entity is treated as transparent. Current inclusion under tax regimes similar to Subpart F of the Code, or as a result of current distributions, is not sufficient to meet this requirement.22

Because foreign laws are not often identical to provisions of U.S. tax law, the regulations provide an alternative test to determine fiscal transparency. Under the alternative, an entity will be fiscally transparent with respect to an item of income even if the item of income is not separately taken into account by the interest holder when the tax liability of the member is unaffected by the character or source of the income. For this alternative to apply, the item of income, if separately taken into account, must not result in an income tax liability that is different from the liability which would result if the interest holder did not take the item into account separately. In addition, the interest holder must be required to take into account on a current basis the interest holder's share of all such non-separately stated items of income paid to the entity, whether or not distributed. Simply stated, this means that a bottom line inclusion of a share of all income to the member may be acceptable if there is no difference in tax for the member as a result of separate inclusions on an itemby-item basis or one inclusion of a bottom line amount.23 This view is confirmed in the preamble to the Treasury Decision24 that adopted the alternative provision of the regulations addressing fiscal transparency.

If an entity that is owned by one or more residents of a treaty partner jurisdiction is not treated as fiscally transparent where the members reside, the payment to that entity will not qualify for treaty benefits based on the income tax treaty between the U.S. and the jurisdiction of tax residence.

Based on the foregoing discussion, the entity (L.L.C.) deriving the income is a U.S. entity, its members (Parent and Fredco) are foreign, and since the members are not reporting the distributive share of the entity's income in the tax returns of jurisdiction in which they reside, the ordinary domestic rules for the collection of income tax by U.S. partnerships will apply. Withholding tax will be collected at the statutory rate of 30% for F.D.A.P. income. Withholding tax must be collected and paid over to the I.R.S. at the time distributions are made. If a foreign partner's distributive share of income subject to withholding is not actually distributed, the U.S. partnership must withhold on the foreign partner's distributive share of the income on the earlier of the date that a Schedule K-1 to Form 1065 is furnished or mailed to the partner or the due date for furnishing that schedule.25

Application of Fiscal Transparency Requirement to Parent and FREDCO

The regulations discussed above apply to all income tax treaties that are in force between the U.S. and foreign jurisdictions.26 Consequently, the regulations apply to the income tax treaty between the U.S. and Fredonia. Because Fredonia does not treat L.L.C. as fiscally transparent, no treaty relief will be granted to interest income that is paid by U.S. CO to L.L.C. As a result, L.L.C. has an obligation to collect 30% withholding tax from the respective shares of Parent and FREDCO of F.D.A.P. income it receives from U.S. CO. Withholding tax imposed at the rate of 30% will be due and payable at the time specified above.

Path Forward

One last path forward exists to solve the problem faced by U.S. CO, L.L.C., Parent, and FREDCO – a request for competent authority relief under the income tax treaty between Fredonia and the U.S.

As mentioned above, the income tax regulations defining fiscal transparency state that the competent authorities of the U.S. and its treaty partner may agree to modify the position in competent authority proceedings under a relevant income tax treaty. Specifically, the regulations state:

* * [T]he competent authorities may agree on a mutual basis to depart from the rules contained in this paragraph (d) in appropriate circumstances. However, a reduced rate under a tax treaty for an item of U.S. source income paid will not be available irrespective of the provisions in this paragraph (d) to the extent that the applicable treaty jurisdiction would not grant a reduced rate under the tax treaty to a U.S. resident in similar circumstances, as evidenced by a mutual agreement between the relevant competent authorities or by a public notice of the treaty jurisdiction. The Internal Revenue Service shall announce the terms of any such mutual agreement or public notice of the treaty jurisdiction. Any denial of tax treaty benefits as a consequence of such a mutual agreement or notice shall affect only payment of U.S. source items of income made after announcement of the terms of the agreement or of the notice.

Precedent exists for that type of relief in the form of a competent authority agreement between the U.S. and France that was reached in 2019 relating to the ability of a U.S. citizen residing in France to claim a foreign tax credit on a U.S. tax return for French social security charges (C.S.G. and C.R.D.S.). The I.R.S. regularly challenged the creditable nature of those taxes under provisions of U.S. tax law that deny foreign tax credits for foreign social security taxes that are covered by a Social Security Totalization Agreement between the U.S. and a foreign country. The agreement followed a decision of a U.S. Court of Appeals that reversed an I.R.S. victory in U.S. Tax Court.27

SOMETIMES ALL IT TAKES IS CHECKING A BOX

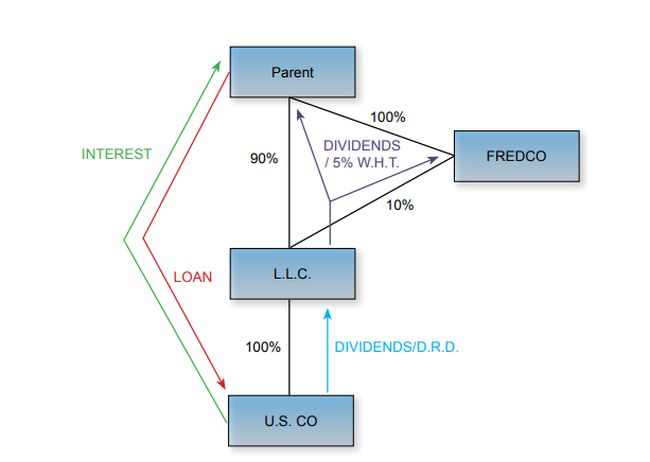

The balance of the article looks to ways by which Parent, L.L.C., and U.S. CO can adopt a plan of self-help in neutralizing the adverse effects of a deduction/no inclusion plan in a post B.E.P.S. world. The basic premise is for L.L.C. to elect to be treated as a corporation for U.S. tax purposes combined with a normalization of the structure between a foreign parent and its U.S. subsidiaries. Self-help entails a simple check-the-box election under which L.L.C. check the box on Form 8832 (Entity Classification Election) to be treated as a corporation for U.S. tax purposes. It would be accompanied by a contribution of the U.S. CO shares to L.L.C.

D.R.D. Available to L.L.C. in Relation to Dividends Received from U.S. Subsidiaries

The U.S. allows a D.R.D. to a domestic corporate shareholder that receives a dividend from a domestic subsidiary. The D.R.D. is applied at different rates depending on the percentage of ownership that is maintained in the corporation distributing the dividend.

A corporate shareholder is allowed to deduct the following percentages of a dividend received from a domestic corporation:28

- 50%, if it owns less than 20% of the paying corporation's stock, measured by vote or by value

- 65%, if it owns 20% or more of the paying corporation's stock, measured by vote or by value

- 100%, in case of qualifying dividends

A dividend constitutes a qualifying dividend if certain requirements are met:29 The first requirement is that, at the close of the day on which the dividend is received, the recipient and the corporation making the distribution30 are members of the same affiliated group of corporations. For this purpose, the term "affiliated group" includes a group of corporations in which one corporation, the common parent, directly owns 80% of the voting power and value of the stock of at least one other member of the group and 80% of the stock (measured by vote and value) of the other members is held in the aggregate directly by one or more corporations within the group.31

The balance of the requirements are (a) the common parent of the group files an election to which all members consent (a wholly owned subsidiary is deemed to consent),32 (b) qualifying dividends are paid from the earnings and profits accumulated during the period of affiliation, and (c) both the distributing and receiving corporations have been members of the affiliated group for each day of the year in order for the earnings of the year to be taken into account.33

Application of the D.R.D. Provisions to L.L.C. and U.S. CO

If L.L.C. were treated as a corporation for U.S. tax purposes, L.L.C. and U.S. CO would be entitled to a 100% D.R.D. with respect to intragroup dividends. L.L.C. (as a corporation) and U.S. CO would be treated as members of the same affiliated group of companies. L.L.C. would be the common parent since it would directly own at least 80% of voting power and value of the stock of the U.S. CO. If more companies are added, 100% of the stock (measured by vote and value) of all members other than L.L.C. would be held directly by the one or more members. L.L.C. would make an election for application of the D.R.D. to which all members would consent (a wholly owned subsidiary is deemed to consent).34 The election would be made by filing a statement with the I.R.S.

If the group elects to file a consolidated income tax return,35 losses in one company can be used to offset profits in other companies that are members of the group.36

No Disallowance Under The Anti-Hybrid Rules

Because L.L.C. elects to be treated as a corporation for U.S. tax purposes, the anti-hybrid rules become inapplicable. U.S. CO can borrow directly from Parent. Although Parent may be taxable in Fredonia on interest income received from U.S. CO, that tax exposure is offset against the deduction that is now allowed in the U.S. to U.S. CO, at least to the extent the deduction is not capped by limitations.37

Entitlement of Treaty Relief to Reduce U.S. Withholding Tax on Dividend Distribution From U.S. CO to Parent

If L.L.C. is treated as a corporation for U.S. tax purposes and Parent meets one of the tests of the limitation on benefits article, dividend distributions made by L.L.C. to Parent should qualify for treaty benefits, typically 5% of the amount distributed rather than 30%, the rate provided under U.S. domestic law on F.D.A.P. income.

CONCLUSION

The enactment of Code §267A attacking tax benefits for hybrid entities and hybrid payments combined with the Treasury regulations issued under Code §894 effectively put an end to cross border tax planning based on different treatment of entities and transactions. As illustrated above, use of hybrid plans can result in a loss of deductions by a U.S. entity combined with a loss of access to treaty benefits for the recipient of payments. While some pundits may complain that the U.S. is an outlier as to the O.E.C.D. pillars, the U.S. is at the top of the class with regard to putting an end to abusive hybrid arrangements.

Footnotes

1. In the 1933 movie "Duck Soup," Fredonia was a mythical country and Groucho Marx portrayed its president.

2. Code §163(j) limits the deduction to 30% of E.B.I.T. for most businesses. Code §263A requires construction period interest to be capitalized.

3. Code §267(a)(2).

4. Code §§881(a)(1) and 1441(a) and (b).

5. Code §267.

6. Treas. Reg. §§1.267A-2(d)(2); 1.267A-1(b)(1). Note the definition the term "reverse hybrid" is different for purposes of Code §894(c).

7. Treas. Reg. §301.7701-3(b)(1)(i).

8. Treas. Reg. §301.7701-3(a). It is eligible because it is not required to be treated as a corporation under Treas. Reg. §301.7701-2(b)(1).

9. Id.

10. Treas. Reg. §1.267A-2(d)(1).

11. Code §§ 267A(b)(2), 954(d)(3)

12. Treas. Reg. §1.267A-6(c), Example 5(iii).

13. Treas. Reg. §1.267A-3(a)(5).

14. Treas. Reg. §1.267A-3(a)(3).

15. Id.

16. Fixed and determinable, annual and period income, such as interest, dividends, and royalties.

17. Code §§1441 in general and 1442 in particular

18. TD 9896 ( April 7, 2020) Section II, B, 3.

19. Treas. Reg. §1.894-1(d)(1).

20. The regulations address only the treatment of U.S.-source F.D.A.P. income that is not E.C.I.

21. Treas. Reg. §1.894-1(d)(3)(ii).

22. Treas. Reg. §1.894-1(d)(5), Examples 6 and 9.

23. Treas. Reg. § 1.702-1 requires that each partner of a U.S. domestic partnership is required to take into account separately the partner's distributive share, whether or not distributed, of each class or item of partnership income, gain, loss, deduction, or credit that could affect the computation of income on the partner's tax return. This rule is intended to ensure that specific items of the partnership income, gain, deduction, or loss are taken into account when the partner's tax return is computed; the partnership cannot be used as a vehicle to avoid limitations at the partner level. However, if the partnership reports income, gain, loss, or expense that are not subject to special rules or limitations, the opportunity for abusive tax planning is absent. The policy for this rule is the basis for the alternative relating to fiscal transparency in Treas. Reg. §1.894- 1(d)(3)(ii).

24. T.D. 8889, Income affected by treaty – U.S. source payments to entities, Code Sec. 894, 7/03/2000.

25. Treas. Reg. § 1.1441-5(b)(2)(i)(A).

26. Treas. Reg. 1.894-1(d)(4).

27. Eshel v. Commr., 831 F.3d 512 (D.C. Cir. 2016) revg. 142 T.C. 197 (2014).

28. Code §243(a).

29. Code §243(b).

30. Code §1504(b)(3). Each corporation must be a U.S. corporation.

31. Code §1504(a)(1).

32. Treas. Reg. §1.243-4(c). A wholly owned subsidiary is deemed to consent.

33. Id.

34. Treas. Reg. §1.243-4(c).

35. Form 1122 (Authorization and Consent of Subsidiary Corporation To Be Included in a Consolidated Income Tax Return) is the form on which a subsidiary authorizes the common parent to file a consolidated tax return. Form 851 (Affiliations Schedule) is the form on which the common parent corporation and each member of the affiliated group is identified, the amount of overpayment credits, estimated tax payments, and tax deposits attributable to each corporation are reported, and each subsidiary corporation determines whether it qualifies as a member of the affiliated group.

36. The consolidated tax return rules appear in Code §§1501 to 1563. The treasury regulations that implement the Code provides the detail. A discussion of those provisions is beyond the scope of this article.

37. For instance, Code §163(j) which limits the ability of a corporation to claim an interest deduction to 30% of earnings before interest and tax.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.