Following the 2018 Wayfair decision, many sellers are required to collect sales tax from their customers in more U.S. jurisdictions. Additionally, some companies are planning for a not-so-far-off future of making purchases in new U.S. jurisdictions due to planned reshoring or tooling up for roboticized operations. Even for companies whose reporting jurisdictions haven't changed much, the daily proximity of sales tax needs, coupled with the fast pace of proposed sales tax legislation and regulatory changes, calls for close management of the sales tax function.

The Human Component

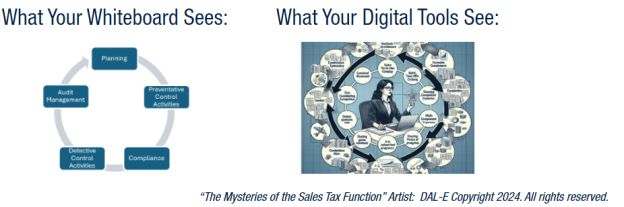

While sales tax automation solutions are handy tools that have changed how a company's finance organization complies with sales tax, the human component remains irreplaceable: a well-managed sales tax function, even though bolstered by automation tools, requires the guidance and supervision of a human sales tax professional.

Though the sales and use tax function "life cycle" can be conceptualized as distinct areas, the management of the sales tax function overlaps each area and can occur at such a pace that even companies with in-house sales tax professionals and full automation need assistance in one or all of the areas to keep their sales tax functions in control.

Sales Tax Nexus

The sales tax function should be aware of the company's U.S. sales and use tax reporting obligations, preferably before the company acquires sales tax nexus. In some states, city-level sales tax is administered at city level rather than by the state taxing authority. Sales tax nexus rules can differ from a jurisdiction's nexus rules for other tax types such as income/franchise tax. Identifying new jurisdictions to report and remit sales and use tax before the transaction occurs is key to timely billing sales tax to customers and for avoiding late payment interest and penalties.

Determining Taxability and Sourcing of Products

Characterization of the product for sales tax purposes is key to applying the correct sales tax rules. Although sales tax automation solutions know the applicable tax rate once the product's characterization has been mapped into the solution, the solution can only do what it's told. For complex technology products, in particular, the company's customers generally expect their vendors to fully understand the characterization and sourcing of the vendor's products and will likely expect the vendors to field the customer's questions about why sales tax is or isn't on the customer's sales invoice, when customer's own sales tax function has questions.

Determining Taxability and Sourcing of Purchases

Characterization of purchases is key to paying only the tax that is due on a purchase. Transaction-level exemptions, which differ by jurisdiction, may apply and generally must be claimed by the purchaser, including exemptions on resale, manufacturing, and research and development, and certain industry-specific incentives. In general, a purchaser must self-assess and report tax on taxable purchases if the vendor has not collected it; failure to do so may result in audit assessments for unreported use tax.

Exemption Certificate Management

Reviewing and tracking customers' sales tax exemption certificates is one of the most important aspects of sales tax compliance. Not all customers understand whether their exemption certificate is appropriate for their purchase, and not all vendors understand when it is inappropriate to request their customer's transaction-level exemption certificate. While sales tax automation tools can support part of the exemption certificate management process, human professionals are still the resource for recognizing nuances in transaction-level exemptions which, if not detected, can result in repercussions in a future sales tax audit.

Tax Reporting and Remittance; Detecting Overpayments and Underpayments

Sales and use tax returns are typically due and payable for monthly or quarterly reporting periods. While sales tax automated solutions have removed the time and motion of calculating tax on invoices and preparing sales tax returns, the sales tax function is responsible for timely identifying any overpayments or underpayments. In addition to controlling the configuration of sales tax automated solutions, the sales tax function is responsible for taking action to claim refunds of overpaid tax or remediate underpaid tax. Self-audits, overpayment reviews and tax exposure analyses should be part of a sales tax function's periodic control activities to detect and mitigate overpayments and underpayments.

Sales Tax Audit Management

Sales tax audits should be carefully addressed and tracked, so that the sales tax function retains the company's most expedient opportunity for a favorable audit outcome and can meet deadlines to appeal assessments, if needed. Some jurisdictions offer "managed audit" programs which can provide a means to reduce penalties and, sometimes, interest.

A&M Says: Prevention is the best medicine, but when sales tax underpayments or overpayments occur, detection is the next best thing. Let A&M support your sales tax function by conducting sales tax process optimization reviews; updating your sales tax nexus analyses, product characterization and sourcing, and purchase characterization and sourcing; providing sales tax exposure analyses and exposure remediation strategies; providing sales tax audit defense services; and helping to identify and recover sales tax overpayments. We can also help you keep your sales tax automation solutions up-to-date as product facts and purchase types change, and we can coordinate with A&M's Digital Tax Services teams to offer your sales tax function every digital modernization and convenience.

Originally published 05 April 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.