In Short

The Background: On October 10, 2023, the U.S. Securities and Exchange Commission (the "SEC") adopted amendments to the rules that govern beneficial ownership reporting for investors, marking the first update to the beneficial ownership rules in more than 50 years.

The Result: The key impacts of the amended rules are:

- The filing deadlines for Schedules 13D and 13G are significantly shorter, meaning investors will need to update their internal reporting procedures, and issuers will be better positioned to know when activist shareholders have acquired a material stake.

- Schedules 13D and 13G must be structured in a uniform, machine-readable format.

- The SEC has given investors guidance as to when common shareholder engagement practices among two or more shareholders may create a "group" that is subject the beneficial ownership reporting requirements.

- Schedule 13D is revised to clarify that derivative securities that use an issuer's equity security as a reference security must be disclosed.

Looking Ahead: Investors will need to update their internal compliance procedures to ensure that the shorter filing deadlines are met.

The obligation to file a Schedule 13D or 13G applies to beneficial owners of voting classes of equity securities registered under Section 12 of the Securities Exchange Act of 1934 (e.g., common shares listed on the NYSE or Nasdaq) once they own 5% or more of such securities. Generally speaking, investors who have "control intent" must file reports on Schedule 13D, while "exempt investors" and investors without control intent, such as "qualified institutional investors" and "passive investors," must file simpler reports on Schedule 13G.

The SEC cited recent changes to financial markets and technology that warranted a reassessment of the relevant reporting rules so that they better met the needs of today's investors and other market participants. According to SEC Chair Gary Gensler, the amendments will "reduce information asymmetries" and ensure "investors receive material information in a timely way."

Disclosure Timelines and Triggering Events

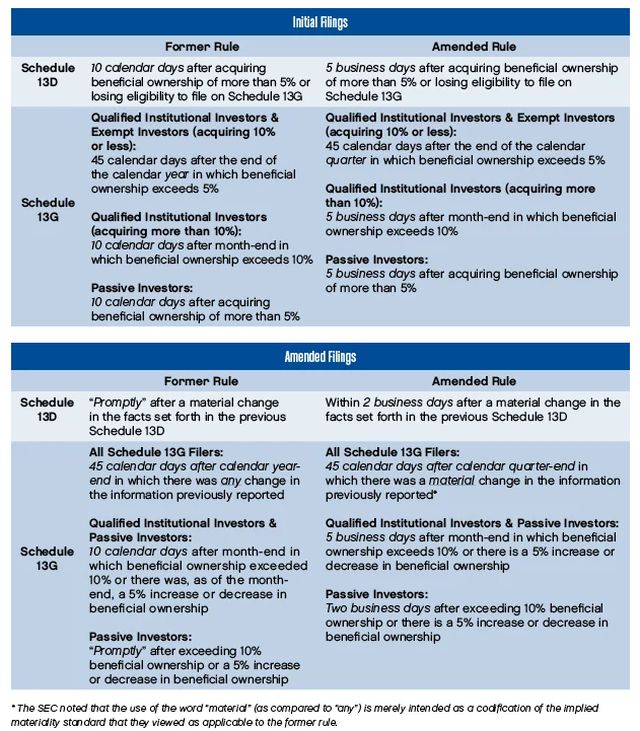

The amended rules significantly shorten the deadlines for the initial disclosure of beneficial ownership and for amendments to previously filed reports on Schedule 13D or 13G. Percentages below refer percentages of the outstanding securities of a covered class.

The end-of-day cut-off time for filing Schedules 13G and 13D will be 10:00 p.m. Eastern time instead of the current cut-off time of 5:30 p.m. Eastern time.

Structured Data Format

Under the amended rules, filers will be required to use a machine-readable XML-based language that is "structured" and specific to Schedules 13D and 13G. As a result, filers will be able to submit filings directly to EDGAR in the Schedule 13D/G-specific XML-based language or use a web-based reporting application developed by the SEC that will generate Schedules 13D and 13G in the specific XML-based language that will be required.

Guidance on What Constitutes a "Group" of Beneficial Owners

In its proposal, the SEC had suggested certain amendments to codify aspects of beneficial reporting for Section 13(d)/(g) "groups," which are generally two or more investors who agree to act together with respect to their investments in covered securities. Importantly, individual investors who do not beneficially own in excess of Schedule 13G or 13D reporting thresholds may, nonetheless, incur reporting obligations if the entire group owns in excess of such thresholds in the aggregate.

The SEC gave the following examples as instances of shareholder engagement that would not necessarily form a "group." While these are fairly ordinary course examples of shareholder engagement, issuers should be mindful that smaller shareholders may feel emboldened to coordinate with other activists behind the scenes if they feel more confident that their actions will not trigger any reporting obligations.

- Two or more shareholders communicate with each other regarding an issuer or its securities, including discussions that relate to improvement of the long-term performance of the issuer, changes in issuer practices, submissions, or solicitations in support of a nonbinding shareholder proposal, a joint engagement strategy (that is not control-related), or a "vote no" campaign against individual directors in uncontested elections.

- Two or more shareholders engage in discussions with an issuer's management.

- Shareholders jointly make a recommendation to an issuer regarding the structure and composition of the issuer's board of directors where (i) no discussion of individual directors or board expansion occurs and (ii) no commitments or agreements are made among the shareholders regarding the potential withholding of their votes to approve or vote against management's director candidates.

- Shareholders jointly submit a nonbinding shareholder proposal to an issuer pursuant to Rule 14a-8 of the Exchange Act.

- A shareholder communicates with an activist investor that is seeking support for its proposals to an issuer's board or management, without consenting or committing to a course of action.

- A shareholder announces that it intends to vote in favor of an unaffiliated activist investor's director nominees.

In contrast, the SEC explained that a group may be formed where a beneficial owner intentionally communicates to other market participants that it will make a Schedule 13D filing or amendment and does so with the intention of causing such persons to also purchase the securities.

Derivatives Rule Updates and Guidance

Schedule 13D was amended to expressly require the disclosure of interests in all derivative securities that use the relevant equity security as a reference. Given cash-settled derivatives may already have been disclosed as "material contracts," some filers may not experience a meaningful change in what they report.

The adopting release provides additional guidance regarding when "cash settled derivative securities" give rise to beneficial ownership. This guidance is in lieu of proposed rules that would have been more rigid and largely reiterates existing principles that derivatives can confer beneficial ownership.

Compliance Dates

The amended rules will go into effect as follows:

- Schedule 13D: 90 days after publication of the amended rules in the Federal Register. To note, any changes that would cause a filer to switch from a Schedule 13G to a Schedule 13D prior to September 30, 2024, would cause the filer to have to comply with the updated Schedule 13D deadlines.

- Schedule 13G: September 30, 2024. For example, a Schedule 13G filer will be required to file an amendment by November 14, 2024, if, as of September 30, 2024, there were any material changes in the information the filer previously reported on Schedule 13G.

- Structured Data Formatting: December 18, 2024. Early compliance will be allowed as soon as December 18, 2023.

Four Key Takeaways

- The shorter filing deadlines mean that issuers will have earlier insight into when individuals or groups have acquired a material stake in their securities.

- Investors will need to update their internal compliance procedures to ensure that the shorter filing deadlines are met—especially for investors that currently, or will potentially, need to file Schedule 13Ds.

- Investors who are active in the shareholder engagement space now have welcomed clarity as to what might constitute "group" activity under Section 13(d); however, with this additional clarity comes potential heightened scrutiny as to what will constitute a "group." For issuers, this also means that they may have to think more seriously about smaller shareholders who may have historically avoided coordinating due to a concern that they would trigger a filing obligation.

- Investors who hold derivatives should reassess whether there is any change to their beneficial ownership calculations or disclosures in light of the new guidance.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.