US Market Review and Outlook

REVIEW

Pessimism surrounding the Federal Reserve's interest rate hikes, combined with subdued business and consumer confidence as well as geopolitical concerns, weighed heavily on the IPO market in 2023.

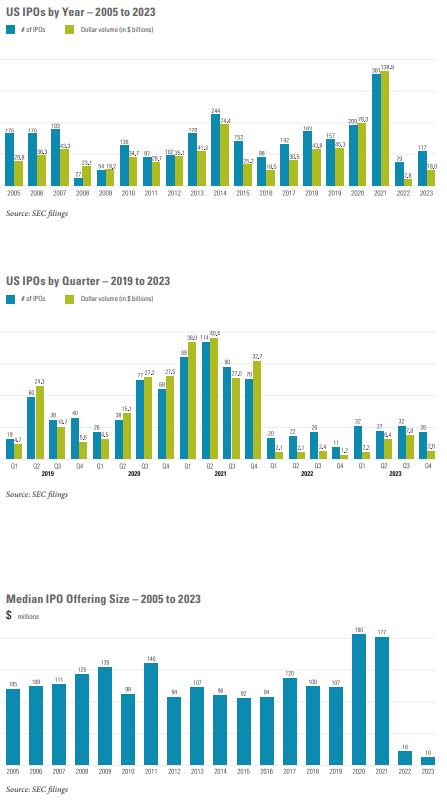

With 117 IPOs in 2023 (excluding IPOs by special purpose acquisition companies (SPACs) and direct listings), deal activity increased 48% from the mere 79 IPOs completed in 2022, but still accounted for less than one-third of the 2021 total of 381 IPOs. Total gross proceeds in 2023 were $19.0 billion, up 144% from the $7.8 billion in 2022.

The gross proceeds figure in 2023 was buoyed by the $4.9 billion offering by Arm Holdings—the fourth-largest US IPO in the past 10 years behind the IPOs of Alibaba ($21.8 billion), Rivian ($11.9 billion) and Uber ($8.1 billion)—and the $3.8 billion Kenvue offering, which was the seventh-largest IPO in the past 10 years.

IPOs by emerging growth companies (EGCs) accounted for 91% of the year's IPOs, up from 87% in 2022 and above the 89% average that has prevailed since enactment of the JOBS Act in 2012.

In addition to the overall pace of new offerings being well below the median of 183 over the five-year period from 2017 to 2021, the profile of the average IPO in 2022 and 2023 was also markedly different.

The median offering size for IPOs in 2023 was $10.0 million, 43% lower than the $17.6 million for 2022 and a fraction of the $144.2 million median that prevailed over the five-year period from 2017 to 2021.

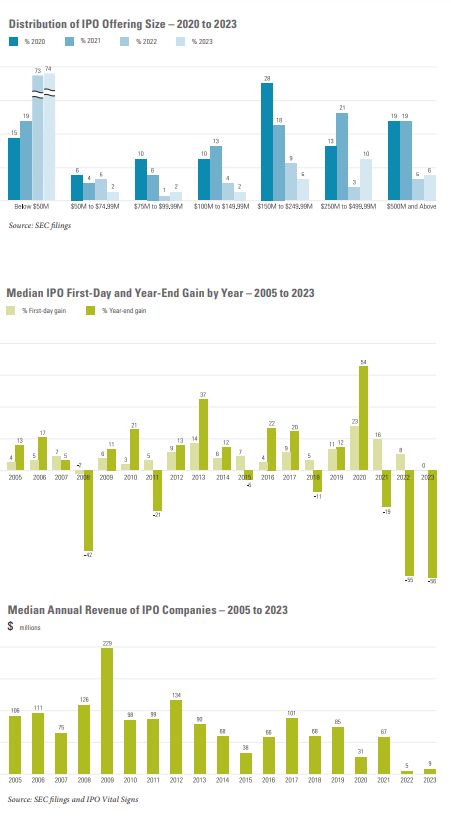

The percentage of IPOs raising gross proceeds of less than $25 million increased to 68% in 2023 from 61% in 2022. In comparison, IPOs of that size accounted for only 8% of all IPOs between 2017 and 2021.

The median annual revenue of IPO companies in 2023 was $9.0 million, up from $4.7 million for 2022, but well below the $66.9 million median that prevailed during the five-year period from 2017 to 2021.

In 2023, only 33% of life sciences IPO companies had revenue—nearly double the 17% figure for 2022, but down from 46% over the five-year period from 2017 to 2021. At $21.9 million, the median annual revenue of non-life sciences IPO companies in 2023 was almost double the $12.0 million in 2022 but well short of the $192.7 million median from 2017 to 2021.

The percentage of profitable IPO companies increased to 42% in 2023 from 34% in 2022 and from 28% of all IPO companies between 2017 and 2021. None of the 21 life sciences IPO companies in 2023 were profitable, compared to 56% of the non-life sciences IPO companies—the highest percentage for non-life sciences IPO companies since the 61% in 2012.

The median IPO company in 2023 ended its first day of trading unchanged from its offering price, compared to a gain of 8% in 2022 and a gain of 16% in 2021. The 2023 median first-day gain figure is the secondlowest annual figure in the past 25 years.

There were six "moonshots" (IPOs in which the stock price doubles on the opening day) in 2023, compared to 20 in 2022 (an anomaly given the small number of 2022 IPOs). Similar to 2022, only one 2023 moonshot ended the year above its offering price. The other five ended the year down a median of 83% from their offering price.

The percentage of "broken" IPOs (in which the stock closes below the offering price on the first trading day) rose to 50% in 2023 from 37% in 2022 and 24% over the fiveyear period from 2017 to 2021. The 2023 figure represents the highest level of broken IPOs since 2008, when almost two-thirds of the year's IPOs were broken. A slightly lower percentage of 2023 life sciences IPOs (48%) than non-life sciences IPOs (50%) were broken.

2023 IPO companies ended the year trading a median of 56% below their offering price, only slightly down from 2022 IPO companies, which ended that year down 55%. In comparison, 2021 IPO companies were only down 19% in the year of their debut.

The year's best-performing IPOs were by Jin Medical International (trading an astounding 3,000% above its offering price at year-end), Atlas Lithium (up 421%), RayzeBio (up 245%), Alpha Technology Group (up 218%) and Structure Therapeutics (up 172%).

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.