On May 3, 2023, the Securities and Exchange Commission (the "SEC") adopted amendments to its rules regarding disclosure of repurchases of an issuer's equity securities, commonly referred to as buybacks. The amendments are intended to enhance transparency, enable investors to better assess the purpose and effects of issuer share repurchases and reduce information asymmetry. The additional disclosure is also intended to enable investors to assess whether repurchases could have been motivated by factors other than maximizing shareholder value, e.g., to impact accounting metrics or management compensation.

Overview of the Amendments

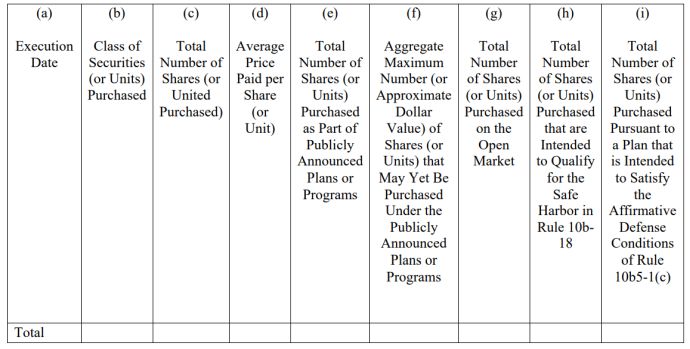

- Quarterly Quantitative Disclosure of Daily Repurchase Data: issuers that are subject to the reporting requirements of the Securities Exchange Act of 1934 (the "Exchange Act"), will, on a quarterly basis, be required to provide tabular disclosure of such issuer's repurchase activity aggregated on a daily basis for each day on which purchases occur (see Exhibit A attached hereto for a form attached to the SEC final rules). For domestic registrants, amended Item 601 of Regulation S-K will require this disclosure on a quarterly basis in a new Exhibit 26 to Forms 10-K and 10-Q. For foreign private issuers ("FPIs"), the information will be required in a new Form F-SR filed within 45-days after each fiscal quarter.1 Despite comments urging more clarity, the SEC declined to provide any further clarification around the information required, stating that the transactions used for, and applicable to, the current Item 703 disclosure requirements (which require issuers to report aggregated monthly data on their share repurchases) should be applied to the final amendments.

- The new Exhibit 26 and Form F-SR will require disclosure of the following information (in XBRL format):

- the date of the repurchase;

- the class of securities repurchased;

- the total number of shares repurchased;

- the average price paid per share, which must be disclosed in U.S. dollars;

- the total number of shares purchased on the open market;

- the total number of shares repurchased that are intended to qualify for the safe harbor provided in Rule 10b-18 under the Exchange Act; and

- the total number of shares repurchased pursuant to an Exchange Act Rule 10b5-1 plan and the date such plan was adopted or terminated.

- Trading by Officers and Directors: issuers will also be required to include in the new exhibit a checkbox indicating whether any directors and officers subject to reporting under Section 16(a) of the Exchange Act, or in the case of FPIs, directors or senior management that would be identified pursuant to Item 1 of Form 20-F, traded in the relevant securities in the four business days before or after an announcement of the implementation of a repurchase plan or program or an announcement of an increase of an existing share repurchase plan or program. In providing this information, domestic issuers may rely on Forms 3, 4, and 5 filed with the SEC, unless the issuer knows or has reason to believe that a form was filed inappropriately or that a form should have been filed but was not. Form F-SR contains a comparable provision for FPIs. Form F-SR permits a FPI to rely on written representations from its directors and senior management provided that the reliance is reasonable.

- Qualitative Disclosure: with the adoption of Exhibit 26 and Form F-SR, the final rules make revisions to existing Rule 703 of Regulation S-K (which requires issuers to report aggregated monthly data about their share repurchases) by eliminating the monthly table and relocating the required footnote information to the text. In addition, amended Item 703 and Item 16E of Form 20-F will require issuers to provide new information in the form of narrative disclosure detailing the following:

- the objectives or rationales for each share repurchase plan or program;

- the process or criteria used to determine the amount of repurchases; and

- any policies and procedures relating to the purchases and sales of an issuer's securities during a repurchase program by its officers and directors, including any restrictions on such transactions.

The SEC cautioned against the use of boilerplate narrative disclosure and pointed to the many "helpful suggestions" from commentators on what issuers might discuss, including:

- other possible ways to use the funds allocated for the repurchases;

- a comparison with other investment opportunities;

- the expected impact of the repurchases on the value of remaining shares;

- whether the stock is undervalued, prospective internal growth opportunities are economically viable, or the valuation for potential targets is attractive; and

- the sources of funding for the repurchase, where material.

- Disclosure of Rule 10b5-1 Trading Arrangements: the amendments add a new Item 408(d) to Regulation S-K, which requires domestic issuers to disclose in their periodic reports on Forms 10-Q and 10-K whether they adopted or terminated any Rule 10b5-1 trading arrangements during the covered fiscal quarter. The disclosure must include a description of the material terms of the Rule 10b5-1 trading arrangements (other than the price at which the trading is authorized) such as:

- the date on which the issuer adopted or terminated a Rule 10b5-1 trading arrangement;

- the duration of the Rule 10b5-1 trading arrangement; and

- the aggregate number of securities to be purchased or sold pursuant to a Rule 10b5-1 trading arrangement.

Important Compliance Dates

- Domestic Issuers: domestic issuers are required to comply with the new disclosure requirements in their Form10-Q filing that covers the first full fiscal quarter that begins on or after October 1, 2023, and for each quarter thereafter in the relevant Form 10-Q and, for the fourth quarter, in their Form 10-K.

- FPIs: FPIs are required to disclose daily quantitative repurchase data at the end of every quarter on Form F[1]SR, which will be due 45-days after the end of each of the FPI's fiscal quarters, beginning with the first full fiscal quarter that begins on or after April 1, 2024. The Form 20-F narrative disclosure required by Item 16E of that form will be required starting in the first Form 20-F filed after their first Form F-SR has been filed.

Exhibit A

ISSUER PURCHASES OF EQUITY SECURITIES

Use the checkbox to indicate if any officer or director reporting pursuant to Section 16(a) of the Exchange Act (15 U.S.C. 78p(a)), or for foreign private issuers as defined by Rule 3b-4(c) (§ 240.3b-4(c) of this chapter), any director or member of senior management who would be identified pursuant to Item 1 of Form 20-F (§ 249.220f of this chapter), purchased or sold shares or other units of the class of the issuer's equity securities that are registered pursuant to section 12 of the Exchange Act and subject of a publicly announced plan or program within four (4) business days before or after the issuer's announcement of such repurchase plan or program or the announcement of an increase of an existing share repurchase plan or program.

Footnotes

1 Listed-closed end funds will be required to comply with the new disclosure requirements beginning with the Form N-CSR that covers the first six-month period that begins on or after January 1, 2024.

To subscribe to Cahill Publications Click Here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.