The Securities and Exchange Commission's Small Business Capital Formation Advisory Committee held a panel discussion on recent trends in taking a company public during its October 13, 2022 meeting. The panel, "Update on the Going Public Market: A 12-month lookback at the state of play of the IPO market," began with an equity markets overview from Refinitiv.

Over the last twelve months, companies raised capital through a diverse array of transactions, including "traditional IPOs," follow-on offerings, convertible note offerings, and also accessed the public markets through initial business combinations with SPACs, traditional reverse mergers, and direct listings. However, overall equity capital markets activity in the United States has sharply declined. According to Refinitiv data, companies raised $89.3 billion in all of these equity offerings in the first nine months of 2022, which is an 80% year-over-year decline.

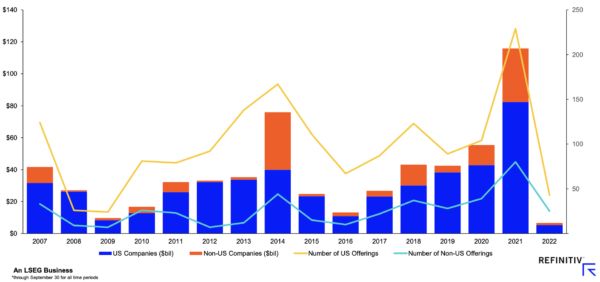

The IPO market was similarly affected. In 2021, 318 US companies went public on US exchanges, which was the highest number of IPOs since 2000. In the first nine months of 2022, however, the number of IPOs declined by 94%, compared to the first three quarters of 2021. This is the slowest IPO market since 2009. Companies have raised $6.6 billion in the first nine months of 2022, the lowest levels of capital raised since 1990. With regard to SPACs, Refinitiv estimates that while approximately 400 SPACs are still seeking merger targets, overall capital raising by SPACs has slowed significantly.

US-Listed Traditional IPOs

Source: Refinitiv

As in prior years, technology, healthcare, and industrials companies continue to account for a large portion of IPOs. Between January 2021 and September 2022, the technology sector raised $43.0 billion in 82 deals; the healthcare section raised $26.8 billion in 151 deals; and the industrials sector raised $19.7 billion in 21 deals. Initial IPO filings have also declined from 293 in the first nine months in 2021 to 80 in the comparable 2022 period. There have been 17 initial IPO filings in September 2022, over 21% of all filings in 2022, which may indicate a renewed interest in accessing the public markets.

The panel discussion followed with perspectives provided by PwC. Based on market insight and ongoing concerns over the difficulties of accessing the public markets, the Committee voted to recommend to the SEC a harmonization of the rules for IPOs, SPACs, and direct listings.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe - Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.