On January 27, 2022, the US Securities and Exchange Commission (SEC) voted to reopen the comment period on the pay versus performance rule that it proposed in 2015 (2015 Proposal).1 The proposed rule being contemplated would require SEC reporting companies to make expanded disclosure of the relationship between executive pay and a company's financial performance. The original comment period on the 2015 Proposal ended on July 6, 2015. Interested parties may submit comments on any aspect of the 2015 Proposal, as well as on the additional requests for comments raised in the new proposing release on the reopening of the comment period (Reopening Release).2 The new comment period closes 30 days after publication of the Reopening Release in the Federal Register.

Background

The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) added Section 14(i) to the Securities Exchange Act of 1934 (Exchange Act), directing the SEC to adopt a rule requiring SEC reporting companies to disclose in a clear manner the relationship between executive compensation actually paid and the financial performance of the company in proxy or information statements in which executive compensation information is required to be included pursuant to Item 402 of Regulation S-K. The 2015 Proposal proposed new subsection (v) to Item 402 of Regulation S-K, which would require a new compensation table, showing the relationship between compensation actually paid to named executive officers and a company's performance, with performance measured both by the company's total shareholder return (TSR) and peer group TSR. The disclosure would also have to include a description of the relationship of pay to performance. For more information on the 2015 Proposal, see our Legal Update, "US Securities and Exchange Commission Proposes Pay Versus Performance Disclosure Rule," dated May 13, 2015.3 Although Dodd-Frank mandated that the SEC adopt a pay versus performance rule, the 2015 Proposal was never adopted.

In addition to fulfilling a remaining Dodd-Frank mandate, developments in executive compensation since 2015 have provided an impetus for the SEC to reopen the comment period for the 2015 Proposal. In particular, the Reopening Release noted "a continued increase in the prevalence of performance-contingent share plans and a decrease in the use of stock options to compensate CEOs among S&P 500 and Russell 3000 companies." In addition, it observed that "the COVID-19 pandemic has affected both how and the extent to which companies recently have tied executive compensation to company performance."

Additional Disclosures

The Reopening Release goes beyond asking for comments on the 2015 Proposal by contemplating additional disclosures that were not previously proposed.

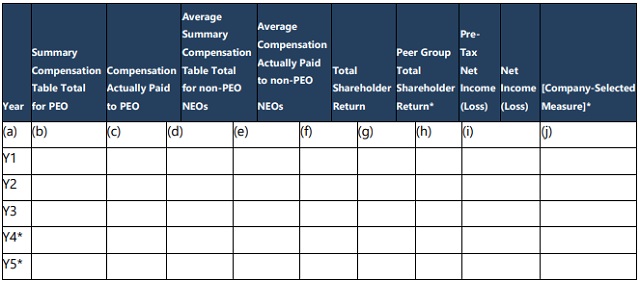

Additional Required Measures. The SEC is also considering expanding the proposed tabular pay versus performance disclosure so that it would include the following performance measures, in addition to the company's TSR and the TSR of its peer group:

- pre-tax net income,

- net income and

- a measure specific to, and chosen by, the particular company (Company-Selected Measure).

The SEC believes that because the first two net income measures of financial performance under consideration reflect the company's overall profits and are net of costs and expenses, they may be relevant to investors in evaluating executive compensation, complementing the market-based TSR performance measure required in the 2015 Proposal.

The Company-Selected Measure would require the company's assessment of the most important performance measure (not already otherwise included in the table) that it uses to link executive compensation actually paid during the fiscal year to company performance over the time horizon of the disclosure. It would be a numerically quantifiable performance measure for the company to be disclosed for each covered fiscal year.

As contemplated, the three new measures would be added as additional columns of the table originally proposed by the 2015 Proposal so that the table would be in the following form, with the column titled "Company-Selected Measure" replaced with the name of the most important measure chosen by the company:

(*The SEC is considering not requiring smaller reporting companies to provide the asterisked disclosures.)

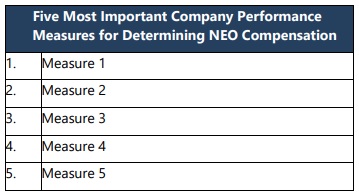

Five Most Important Measures. In addition to inclusion of a Company-Selected Measure in the tabular presentation of pay versus performance, the SEC is considering a separate requirement for companies to provide a list of the five most important performance measures—in order of importance—that they use to link executive compensation actually paid during the fiscal year to company performance for the time horizon of the disclosure. If the company considers fewer than five performance measures, it would only have to disclose the number of measures it actually considers. The SEC is considering having this list presented as a tabular disclosure in the following format:

Requests for Comment

The Reopening Release specified that the SEC is seeking comments on all aspects of the 2015 Proposal, but it raised a number of requests for comment with respect to the expanded disclosure it is contemplating. A sampling of the specific comment requests is provided below:

The SEC has asked if additional performance measures beyond TSR should be required to be disclosed.

The SEC is seeking input on whether pre-tax net income and net income would be useful financial measures and whether there are other measures of company performance that should be used in addition to or in lieu of those net income measures.

The SEC asked whether the Company-Selected Measure would provide useful information to investors. Related questions include whether the SEC should require disclosure of the methodology used to calculate the Company-Selected Measure, as well as whether the Company-Selected Measure must be the most important measure used by the company in a performance or market condition in the context of an incentive plan.

The SEC requested comment on whether the Company-Selected Measure should be limited to the financial performance of the company or whether it could include environmental, social and governance-related measures or any other measures that a company actually uses to link executive compensation to company performance.

The SEC asked if a tabular list of a registrant's five most important performance measures used to determine compensation actually paid would be useful to investors. In this context, the Reopening Release asked how "importance" should be defined and how performance measures should be ranked, particularly if multiple performance targets apply to the same elements of compensation.

Another request for comments asked if Item 402 of Regulation S-K should explicitly require companies to disclose all of the performance measures that actually determine executive compensation.

Practical Considerations

Given the timing of the Reopening Proposal, the proposed and potentially expanded pay versus performance disclosure requirement won't be in effect for the 2022 proxy season, at least for calendar year companies. However, while this pay versus performance disclosure may not be directly applicable for upcoming proxy statements, the expanded disclosures—particularly with respect to company-specific performance measures—should be considered by public companies, and their compensation committees, now. In light of the SEC's direction, as reflected in the Reopening Release, companies may want to evaluate how they are currently measuring performance for the purposes of executive compensation and whether it would be appropriate to consider any additional metrics. Companies may find it useful to discuss internally and with their outside advisors how their investors may react to the expanded disclosures that they would need to prepare if the SEC adopts a final rule in line with what it has suggested in the Reopening Release.

The reopened comment period provides interested parties with a mechanism to provide input on, and perhaps influence, the new disclosure requirement before it is finalized. Those with opinions on the proposed and potentially expanded pay versus performance disclosure rule should consider taking advantage of this opportunity to engage with the SEC on the topic by submitting comment letters. Because the new comment period will close 30 days after publication in the Federal Register, interested persons should start thinking about possible comments right away.

Comments previously submitted on the 2015 Proposal do not have to be re-submitted.

Footnotes

1 https://www.sec.gov/rules/proposed/2015/34-74835.pdf

2 https://www.sec.gov/rules/proposed/2022/34-94074.pdf

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

Visit us at mayerbrown.com

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.