In the Midwest, America's heartland, we are home to more than one-third of all manufacturing jobs in the United States and generate more than $100 billion in revenue from exports each year. Considering the recent history of trade deficits, unemployment and the weakening U.S. dollar, exports are a key positive aspect of the U.S. economy.

Many Wisconsin companies are obtaining tax savings by taking advantage of the Interest Charge-Domestic International Sales Corporation ("IC-DISC"), a little-known provision in the Internal Revenue Code. An IC-DISC permits an exporter to pay tax on a portion of its exports at only the 20% dividend rate. With the compromise in Washington effective beginning in January 2013, which has created a permanent rate differential between ordinary income (taxed at a top rate of approximately 40%) and dividends (taxed at 20%), now is the time to form an IC-DISC.

"Several of our portfolio companies have benefited from forming an IC-DISC and will continue to benefit," said Paul Stewart of PS Capital, LLC. "By using an IC-DISC to produce tax savings on exported products, these companies enjoy enhanced cash flows that are generally used to fund capital investment, job creation and other working capital needs, thereby allowing them to further grow their businesses.

"The increase in U.S. manufacturing jobs is good for our overall economy," Stewart added. "The IC-DISC is a no-brainer for those businesses that qualify to use this vehicle."

To achieve these benefits, (1) the owners of the exporter form an IC-DISC, (2) the exporter pays a tax-deductible commission to the IC-DISC and (3) the IC-DISC pays a dividend to the owners of the IC-DISC.

Under the Internal Revenue Code, an IC-DISC is a U.S. corporation that is not subject to the regular U.S. corporate income tax and, as a result, the IC-DISC does not pay tax on the commission received from the exporter. When the IC-DISC pays a dividend to the owners, the owners will pay tax at a 20% rate. If the exporter is a flow-through entity, such as an S corporation, a partnership or most limited liability companies ("LLCs"), the reduction in tax is twenty percentage points. In effect, the exporter is converting a 40% tax on income representing the amount of the commission to a 20% tax.

Calculating the Tax Savings

T he commission that a manufacturing company pays an ICDISC from sales of exported property should generally be an amount constituting either:

- 4% of gross export sales or

- 50% of the pre-tax income from exports.

An exporter can use either method to achieve the greatest IC-DISC commission possible. The IC-DISC rules permit using different methods of paying commissions based on different product line sales, by recognized industry or trade usage, or even by transaction. As a rule of thumb, the "pre-tax income from exports" method results in the largest IC-DISC commission when exports have a net pre-tax margin of 8% or greater (producing a benefit of approximately $100,000 for every $1 million of pre-tax income from exports). On the other hand, the "gross export sales" method provides the largest IC-DISC commission when the net pre-tax margin is less than 8% (producing a benefit of approximately $8,000 for every $1 million of gross export sales).

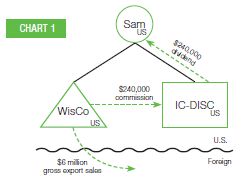

Case Study 1:

Sam, a U.S. citizen, owns WisCo, a Wisconsin LLC that is disregarded for U.S. tax purposes. WisCo has gross export sales of $6 million of low-margin products. Using 4% of the "gross export sales" method, WisCo will deduct a commission paid of $240,000, reducing Sam's U.S. tax by $96,000 (40% of $240,000). When the IC-DISC distributes the cash representing this commission as a dividend to Sam, Sam pays U.S. tax of $48,000 ($240,000 at a 20% tax rate on the dividend). As a result, the impact of the 4% of "gross export sales" method when combined with the 20% tax rate yields a tax savings of $48,000 ($96,000 less $48,000). T he tax savings would be even greater if WisCo were a C corporation because the earnings that are shielded by the IC-DISC commission and then converted to dividend tax rates when distributed from the IC-DISC create tax efficiency that would otherwise not exist within a C corporation.

Requirements for Export Property

Sales of export property qualify for the IC-DISC benefit. Export property includes traditional U.S. manufactured products. There are three requirements for a sale of export property to result in paying a commission to an IC-DISC:

- The property must be manufactured, produced, grown or extracted in the United States. The exporter can satisfy this requirement via the safe harbor of the cost of its U.S. activities constituting 20% of the cost of goods sold. In the alternative, the exporter may try to satisfy this requirement under subjective standards, using either the substantial transformation test (the product looks different than the materials) or by establishing that the U.S. activities are generally considered manufacturing in the industry.

- The export property must have a maximum foreign content of 50%. The exporter can satisfy this requirement by showing that the cost of foreign materials does not exceed 50% of the exporter's sales price.

- The export property must be held primarily for sale, consumption or disposition outside the United States. The exporter can satisfy this requirement with proof that the export property leaves the United States within twelve months of it being manufactured. Although this is a requirement, it is also an opportunity to expand the amount of sales that qualify for the benefit by including sales to U.S. distributors who sell the product abroad.

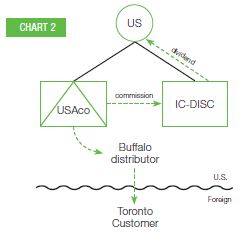

Case Study 2:

USAco sells widgets to a widget distributor in Buffalo. One of the Buffalo distributor's biggest customers is a Toronto company. If properly documented, the widgets re-sold by the Buffalo distributor to the Toronto company satisfy the destination test, thereby allowing USAco to use the IC-DISC vehicle even though it is not the direct exporter. In addition, if the Buffalo distributor is unrelated to USAco, the Buffalo distributor could also take advantage of an IC-DISC on the resale.

Moreover, even if the Buffalo distributor conducts an assembly activity that attaches the widgets to another product for export, USAco could still receive the IC-DISC benefit.

It is further noted that many exporters inadvertently fail to include products sold to Canadian customers because they transport these products by ground freight as opposed to air or boat.

Requirements to Qualify the IC-DISC

To qualify as an IC-DISC, the domestic corporation must pass both a "qualified export receipts" test and a "qualified export assets" test. The IC-DISC entity passes both tests if (1) it only receives a commission for export sales and (2) it distributes the cash representing that commission to its shareholders prior to the end of the year. The ICDISC rules require that the shares have a par value of $2,500 and its owners should deposit that amount in a bank account for the IC-DISC. The IC-DISC must elect IC-DISC status by filing a Form 4876-A with the IRS within 90 days of incorporation.

The IC-DISC Structure

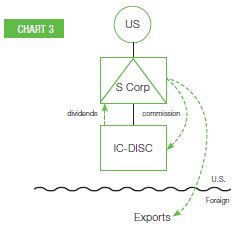

As the previous case studies have illustrated, an IC-DISC can be a brother-sister entity of a flow-through entity (S corporation, LLC or partnership) that exports its manufactured products. The same federal tax benefits are available if the IC-DISC is a subsidiary of an exporting flow-through entity.

Case Study 3:

The owner of an S corporation, U.S. individual, would like to implement an IC-DISC to save taxes on exports. However, due to covenants in a line of credit with its bank, the S corporation cannot form an IC-DISC as a brother-sister entity because the commission would siphon funds from the bank's potential lien. As a result, the S corporation owns the IC-DISC. The commission reduces the ordinary income of the S corporation that would otherwise be taxed to U.S. individual at a 40% rate. The subsequent dividend is a separately stated item of income of the S corporation such that the U.S. individual pays tax at only a 20% rate.

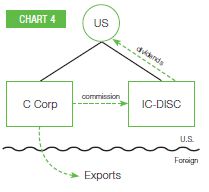

An IC-DISC should not be a subsidiary of a C corporation because the IC-DISC dividend is not eligible for a dividends received deduction. As a result, the C corporation would pay tax on the IC-DISC dividend and, accordingly, would not receive a benefit. However, the owners of the C corporation may own the IC-DISC as a brother-sister entity. If the exporter is a C corporation, the current reduction in tax is generally 32 percentage points as a result of only a single level of tax on the corporate earnings that the commission represents.

Case Study 4:

U.S. individual owns a C corporation. By forming an ICDISC as a brother-sister entity, U.S. individual moves earnings away from the C corporation and pays only a single level of tax at a 20% rate.

If a C corporation has many owners, the IC-DISC could be owned by a trust, whose beneficiaries would be the owners of a C corporation. Under this structure, the trust would be able to distribute the dividends to the beneficiaries without having to worry about constantly changing the ownership of the IC-DISC to replicate the ownership of the C corporation's shares.

Implementation

Many manufacturing companies do not realize that direct and indirect exports of manufactured products qualify for IC-DISC treatment. A detailed analysis of the sales channels for manufactured products often results in the conclusion that the IC-DISC vehicle is available to yield tax savings. However, execution is critical to ensure that the ICDISC and the export sales qualify for this benefit. Implementation considerations should include the following:

- incorporate the IC-DISC before the export sales begin (waiting until December to form the IC-DISC will result in only December sales qualifying);

- analyze the export sales, which includes sales of parts to (1) U.S. customers that attach such parts to products that the U.S. customers ultimately export and (2) Canadian customers that receive shipment by ground transportation;

- prepare a commission agreement between the IC-DISC and the exporter;

- prepare and file the Form 4876-A that elects IC-DISC status within 90 days of incorporation; and

- prepare a manual that contains guidelines for the exporter's operating procedures, which includes a checklist/calendar to determine when the client should complete various activities – such as how the exporter should determine that the IC-DISC has satisfied the various requirements.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.