Executive Summary

An aftercare facility may be a viable alternative to traditional financing arrangements. In this Legal Update, we explain:

- the differences between aftercare facilities and other credit facilities

- how aftercare facilities can be used by lenders and funds when financing is needed after the investment period has expired; and

- how lenders can protect themselves when entering into these facilities.

Background

After the investment period of a private equity fund, a significant portion of the committed capital has usually been called down. As a result, there are often insufficient uncalled capital commitments to support a traditional subscription-backed credit facility. While this situation is not new, the current economic headwinds have exacerbated the challenges of investment exits, creating a growing demand for post-investment period liquidity and leverage options to bridge the gap until investments are realized. While considerable attention has been given to net asset value ("NAV") credit facilities and "hybrid" fund financings as solutions to this trend, another option -known as an "aftercare facility" - is sometimes overlooked.

What to Know

An aftercare facility is essentially a subscription credit facility that calculates the borrowing base using higher advance rates and/or relaxed concentration limits compared to a traditional subscription facility. To mitigate the risks associated with a more aggressive borrowing base, these facilities often include asset-level covenants similar to those found in NAV facilities. However, unlike NAV facilities, aftercare facilities do not require an equity pledge over the assets as collateral (although some may include lender control over an investment proceeds account as additional support).

On the spectrum of fund finance products, aftercare facilities can be considered a "hybrid-light" option. They involve significant asset-level covenants and underwriting, but the collateral is exclusively the "subscription facility" collateral (unless an investment proceeds account is also provided, as noted above). Aftercare facilities are a suitable choice for lenders and borrowers when there is sufficient uncalled capital available to fulfill the obligations in their entirety, particularly when there is enough asset value within the asset pool to justify the more aggressive borrowing base. In such cases, investors are financially motivated to continue funding their capital commitments to avoid missing out on the significant existing asset value.

Asset-level covenants utilized in aftercare facilities vary, but commonly include:

- Loan-to-Value Triggers. Similar to NAV facilities, aftercare facilities often incorporate loan-to-value ("LTV") triggers that can lead to various consequences, such as mandatory prepayments, cash sweep mechanics for distributions, events of default, or pricing adjustments, if the LTV falls below a specific threshold.

- Asset Level Diversification. Aftercare facilities typically require a minimum number of assets and may include traditional NAV-like diversification standards.

- Restrictions on Distributions. Aftercare facilities may impose NAV-like restrictions on cash distributions to investors, such as a requirement to allocate a certain percentage of any distributable cash to pay down the facility, outside of regular course borrowing base compliance.

- Asset Negative Pledge. Aftercare facilities generally require that the equity interest of the fund's investments remain unencumbered, effectively prohibiting a NAV facility at the fund level.

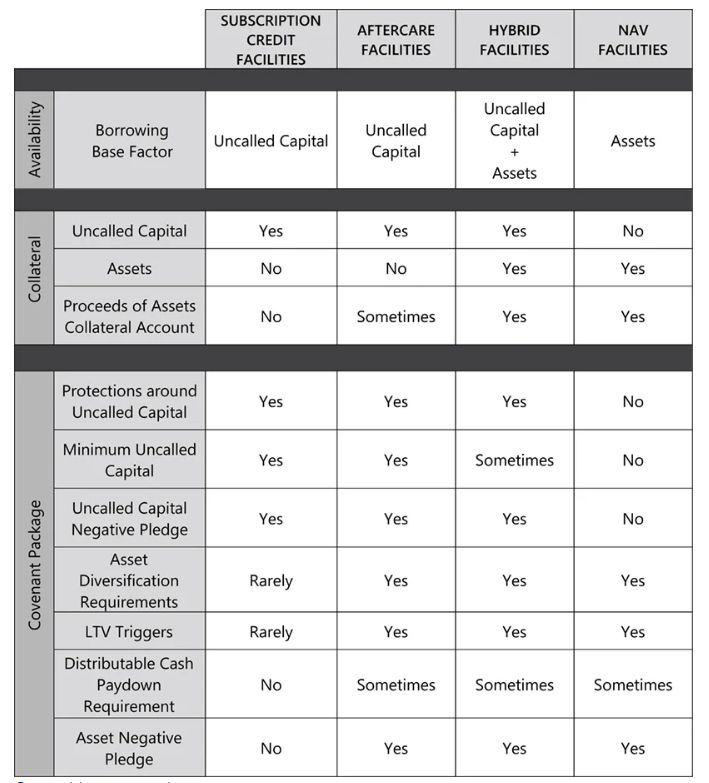

The below chart compares the key elements of subscription, aftercare, hybrid, and NAV facilities, facilitating a clear understanding of their differences and similarities.

Looking Ahead

While it remains unclear whether this is merely an anecdotal observation or an actual emerging trend, Mayer Brown has noticed an increase in requests for aftercare facilities from funds, compared to our historical data. As the market increasingly adopts NAV, it is logical for the frequency of aftercare facilities to also rise, particularly in cases where a NAV/hybrid facility is not feasible due to contractual restrictions, burdensome holding structures that make asset pledges cost prohibitive, or limitations imposed by the partnership agreement of the borrower that may prohibit the pledge of equity interests in the fund's investments.

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2023. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.