I. Introduction.

Any company that has experience borrowing money is also almost certainly familiar with the voluminous stack of documents that must be executed in connection with the taking out of a new loan. Many borrowers carefully review such documents, perhaps engaging a team of lawyers and accountants to negotiate and explain the terms. Others simply sign without a second thought, with an expectation that everything will work out as long as payments are made. Many, perhaps most, throw the documents in a folder or on a thumb drive without a second look after the loan is closed.

However, corporate borrowers should be aware that each stack of loan documents contains numerous promises that prescribe ongoing obligations that continue for the life of the loan. Due to tightening economic conditions and the current interest rate climate, those ongoing obligations may be more pressing now than they have been for much of the past decade.

Accountants and financial advisors working with leveraged companies play an important role in preventing such companies from inadvertently tripping loan covenants, as financial professionals are almost always among the first people contacted when a business considers major changes such as engaging in some sort of ownership transfer, launching a new business line, restructuring, or taking on new debt. When a company undertakes any of these endeavors, it is prudent for those companies and their financial professionals to consult existing loan documents, and where required, seek the consent of their lenders, in order to avoid accidental default.

This paper will provide an overview of common loan covenants, typical events in the life of a business that may trigger potential defaults under those covenants, the repercussions of defaults, and potential negotiation tools that businesses and their financial professionals may use on the front end when entering into new loan transactions.

II. Trends in Commercial Lending

Due to drastically increased interest rates and quantitative tightening driven by Federal Reserve policies, the early 2023 bank crisis, and general economic conditions, the lending climate now is drastically different than it was even one year ago. For example, the Prime Rate, as published by the Wall Street Journal, has climbed from 3.50% as of March of 2022, to 8.50% as of the date of this paper. In addition to the rising cost of borrowing funds, lenders have largely lost their appetite for making new loans.

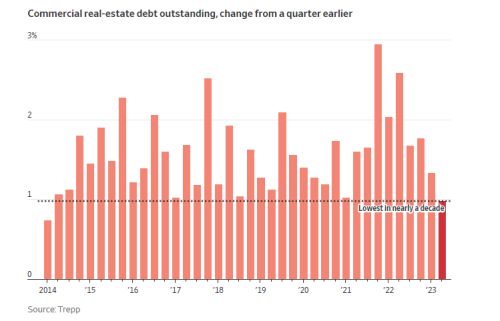

Commercial real estate lending, in particular, has been hit very hard. For only the second time in ten years, the aggregate outstanding real estate debt increased by less than 1% quarter-over-quarter. Figure 1, below, depicts how substantial and rapid the decrease in commercial real estate lending growth has been.

Source: Peter Grant, The Money Has Stopped Flowing in Commercial Real Estate, Wall Street Journal, Oct. 31, 2023

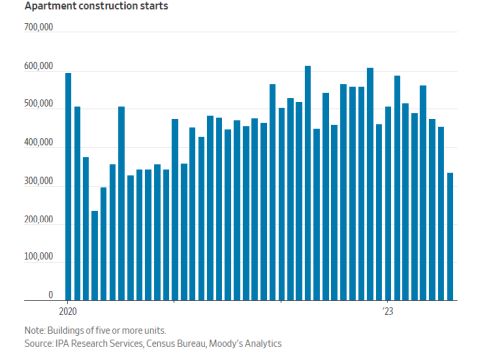

Increased lending rates and tightening purse strings have real-time impacts. New construction starts for multi-family projects, for instance, have come to a jolting halt, as seen in Figure 2, below, which depicts the number of new construction starts each month from January of 2020 through August of 2023. This has an obvious impact on builders and developers, but the impact also flows through to countless other industries prevalent in central North Carolina. The construction, lumber, furniture, and transportation industries, all bread-and-butter industries for the North Carolina economy, are all feeling the impact of this tightening.

Source: Will Parker, The Apartment Market is Hitting a Construction Lull, Wall Street Journal, Oct. 2, 2023

The significance of these trends should not be overlooked when thinking about the current lending environment for local companies. Many local businesses have benefited from the opportunity to leverage real estate holdings to help finance their operations. For those borrowers, refinancing may be challenging, or even impossible. Other borrowers with more typical business loans may already be feeling the squeeze of higher interest rates. Across all industries, there is no question that it is harder and more expensive to acquire debt now than it was just a few months ago. That applies both for both new debt and for refinances.

To read this article in full, please click here.

Originally published December 06, 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.