The economic environment has mostly stabilized following the inflationary shocks of 2021-2022, and a strong Q4 2023 suggests that M&A may be in line for a comeback in 2024. The following trends demonstrate why now is likely a great time to sell your business.

M&A Activity Fell to a 10-Year Low in 2023

After hitting an all-time peak in 2021, M&A activity declined in 2022 and 2023. Both the number and value of transactions completed in 2023 represented 10-year lows. Pricing was down for much of the year, although a strong Q4 in 2023 boosted yearlong average EBITDA multiples to approximately 8.5x-9.0x (with transactions in the core middle market of US$100 million-US$250 million as the strongest performers).

Expect an M&A Resurgence in 2024

The initial Q1 2024 transaction pipeline is strong. Pricing should improve by approximately 0.5x-1.0x EBITDA for the middle market. There is significant buyer "dry powder" available for deployment — up to US$4 trillion.

The second half of 2024 could see a "super-charged" market if it appears that President Biden will win second term and Democrats will control congress — there may be concern over a significant capital gains tax increase.

The majority of CEOs expect at least one M&A transaction in the next three years. Small- and middle-market deals will continue to form the bedrock of M&A because:

- It's easier to find financing to support smaller transactions.

- Private equity can still accomplish the desired returns through a series of small- and middle-market deals and platform buildouts versus large standalone transactions.

- Private equity firms and family-owned businesses will continue to look for exit sales.

Macroeconomic Picture Continues to Brighten into 2024

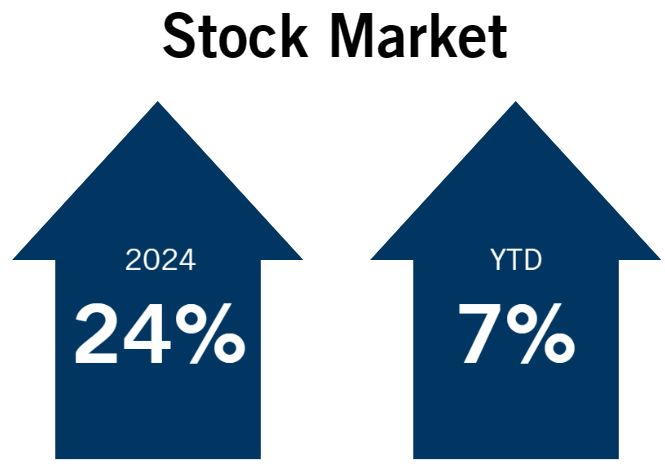

Investors' long-term confidence remains strong — the stock market is up approximately 24% in 2023 and 7% YTD 2024. Inflation has cooled to the low 3% range, although it's still stubbornly above the Fed's preferred 2% target1. The Fed currently expected to maintain interest rates at 5.00-5.25% until at least June 2024, but may cut rates to approximately 4.50% by the end of 2024.

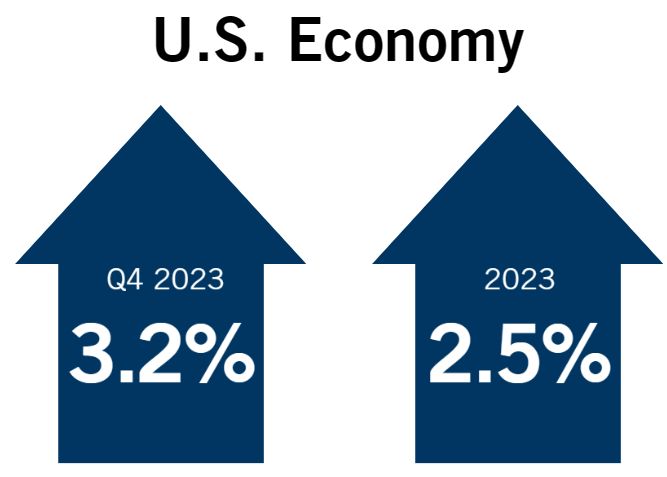

The economy grew by 3.2% in Q4 2023 and 2.5% overall in 2023[2] — and many forecasts for 2024 growth are now in the mid-2% range, which further quieting fears of a recession and suggesting we may see the hoped-for "soft landing."

Financing Headwinds

Transaction financing continues to be a significant challenge — driven by high interest rates, pricing is at a 10-year high, and private credit is not fully able to fill the vacuum. Private equity firms continued to show a preference for smaller transactions with less or no debt financing. Transactions continue to make use of seller financing, rollovers, and earnouts. Strategic firms may look to M&A exits as a less expensive source of cash.

M&A financing is currently at its most expensive level in 10 years. Over the past year, senior financing is 2.5 to 3.0 times adjusted EBITDA (down 0.5x-1.0x vs. historical norms); junior/mezzanine financing is 0.5 to 1.0 times adjusted EBITDA (down 1.5x-2.5x); and interest rates up 200-300 basis points. Bank failures in 2023 led to lower risk tolerance from lenders – increased scrutiny over deals and tougher, more restrictive covenants in credit agreements. More equity may be required to complete certain transactions. Most deals still close to the historical norm of a 50/50 mix of debt versus equity. Many buyers are bridging the gap through a higher percentage of rollovers, seller financing, and earn outs.

Key Trends in M&A Execution and Transaction Terms

Representation and warranty insurance (RWI) has become standard — and slowdown in M&A activity has made pricing and other terms more attractive to both buyers and sellers. RWI has helped make limited-indemnity or "walk-away" transactions increasingly common — and some buyers have even begun to offer true zero-indemnity deals.

Buyers increasingly make use of relatively higher amounts of seller financing, rollovers, and earn outs to protect against risk and keep sellers invested. In competitive, auction-style transactions, timelines have shortened considerably — parties will move very quickly and often without exclusivity. This emphasizes the importance of pre-launch planning and preparation. Buyers now often push to resolve key terms after a transaction is signed, while sellers should ensure important items are addressed up front while leverage is at its highest.

Footnotes

1 From the U.S. Bureau of Economic Analysis (BEA): https://www.bea.gov/

2 From the BEA

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.