In 2016, the Financial Accounting Standards Board issued Accounting Standards Update (ASU) 2016-13 Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, otherwise known as "the new credit loss standard" or "CECL." The new credit loss standard was issued largely in response to the banking crises experienced over the past decade plus. As a result, this ASU significantly impacts financing reporting for banks and financial institutions. However, this does not mean that other types of entities will not be impacted. Most other entities will be impacted by the amendments in the ASU, just at a much lesser extent than banks and financial institutions.

WHO DOES THIS APPLY TO?

All entities are subject to the provisions of the new credit loss standard. This includes public companies, private companies, not-for-profit organizations and employee benefit plans.

WHAT DOES THIS APPLY TO?

All financial assets measured at amortized cost, net investment in leases recognized by a lessor (i.e., sales-type or direct financing lease) and off-balance-sheet credit exposures not accounted for as insurance are subject to the provisions of the new credit loss standard. Off-balance-sheet credit exposures include credit exposures on off-balance-sheet loan commitments, standby letters of credit, financial guarantees not accounted for as insurance and other similar instruments.

Common examples of financial assets measured at amortized cost include:

- Trade accounts receivable;

- Contract assets, including retainage receivables;

- Loans and notes receivables, including loans to officers or employees; and

- Held-to-maturity debt securities.

WHAT DOES THIS NOT APPLY TO?

The following items are not subject to the new credit loss standard:

- Financial assets measured at fair value (e.g. investments measured at fair value);

- Available-for-sale debt securities;

- Loans made to participants by defined contribution employee benefit plans;

- Promises to give (pledges receivable) of not-for-profit organizations;

- Loans and other receivables between entities under common control; and

- Receivables from operating leases accounted for under Topic 842, Leases (i.e., the new lease standard).

TERMINOLOGY CHANGES

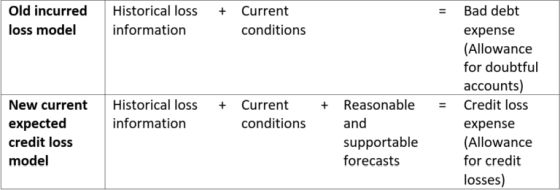

In the past, the estimate of uncollectible accounts receivable was recorded to an "allowance for doubtful accounts" with adjustments to the estimate recorded through earnings as "bad debt expense." Under CECL, items historically referred to as "bad debt expense" and "allowance for doubtful accounts" have been modernized to "credit loss expense" and "allowance for credit losses."

The remainder of this article will reference the updated terminology.

ACCOUNTING CHANGES

In the past, entities estimated credit losses using an "incurred loss model." In other words, entities looked at historical loss information and current economic conditions to determine the likelihood of an incurred loss, using information like customer payment history, customer creditworthiness and industry analysis, and recorded the loss when it was probable that it had been incurred. Under the new credit loss model, entities are also required to consider future forecasts, in addition to historical loss information and current economic conditions, when estimating expected credit losses, and those forecasts must be reasonable and supportable. Additionally, under CECL, the threshold of "probable" is removed and credit losses are recognized when such losses are "expected".

It is important to note that the FASB has not prescribed a specific model for calculating expected credit losses due to the judgmental nature of the standard. Two of the commonly used models are an aging schedule approach and discounted cash flows approach. While an aging schedule approach may sound similar to the old model, remember that the old model is a look-back approach with losses recognized when probable of being incurred. CECL is a forward-looking approach with losses recognized when expected. This is a much lower threshold than probable and could require a reserve for losses even if the risk of loss is remote. As a result, most entities will recognize credit losses earlier, and for a different amount, under CECL as compared to the old model.

Additionally, there is a requirement to pool assets that share similar risk characteristics when evaluating expected credit losses. The determination of those similar risk characteristics will be unique to an entity. Such entity-level factors include entity type and the industry and geographic location(s) in which the entity operates. An entity should also consider customer-level factors, such as internal or external credit scores/ratings and standard billing practices, including term and age of receivables. For example, do some customers have terms of net 30 and other customers have terms of net 60? Maybe these are similar risk characteristics of trade accounts receivable determined by your entity. In other words, in this example, two separate pools, net 30 term customers and net 60 term customers, are used for purposes of the entity's expected credit loss analysis. It is also possible that there are several similar risk characteristics that determine the pools of assets for credit loss analysis. If pooling is not possible, because the financial assets do not share similar risk characteristics with other financial assets, then those assets should be evaluated for credit loss individually. Additionally, pooling for credit loss measurement should be consistent with the entity's policies for monitoring credit risk. In other words, an entity cannot use one set of risk characteristics for estimating expected credit losses and another, separate, set of risk characteristics for monitoring credit risk.

PRESENTATION CHANGES

Under the new credit loss standard, an entity is required to present, on the face of its balance sheet, its allowance for credit losses separate from the amortized cost of the related financial asset(s). The presentation must be in one of the following formats:

- Gross Presentation

Allowance for credit losses is presented as a separate line, deducted from the assets' amortized cost basis, to arrive at a net amount; or

- Net Presentation

A single financial statement line with the asset presented at its net amount and the allowance for credit losses disclosed in a parenthetical description within the line's description.

Under the old credit loss standard, there were no specific presentation requirements for the allowance for bad debts.

DISCLOSURE CHANGES

Several new disclosures and enhancement of existing disclosures are required as a result of the new credit loss standard. The enhanced and additional disclosures are intended to enable a user of the financial statements to understand the credit risk inherent in a portfolio and how management monitors the credit quality of the portfolio of financial assets, management's estimate of expected credit losses and changes in the credit loss estimate during the reporting period.

Some of the new disclosures that will be common to many entities are listed below.

- Qualitative and quantitative information about the credit quality of an entity's financial assets;

- Enhanced qualitative disclosures to enable a user to understand management's method for estimating its allowance for credit losses, the information used to develop the estimate and the circumstances that caused changes to the allowance for credit losses;

- Quantitative information detailing the roll forward activity in the allowance for credit losses during the reporting period; and

- An aging analysis of financial assets that are past due as of the reporting date and management's policy for when it considers a financial asset to be past due. Excluded from this disclosure requirement are trade receivables due in one year or less, except for credit card receivables and receivables measured at the lower of amortized cost or fair value.

Additionally, new qualitative and quantitative disclosures are required for financial assets on nonaccrual status, purchased financial assets with credit deterioration, collateral-dependent financial assets and off-balance-sheet credit exposures. Lastly, a reminder that an entity's significant accounting policies will also need to be revised for the effects of CECL.

TRANSITION

Similar to the new leases standard that became effective in 2022, a full retrospective transition method is not permitted. Instead, for most financial assets, entities will record a cumulative effect adjustment to opening retained earnings as of the beginning of the first reporting period in which CECL is effective (e.g. January 1, 2023 for calendar year ends). Certain financial assets, in specific situations, are to apply CECL on a prospective basis; however, these items are typically limited to banks and other financial institutions.

Effective Date – Calendar Year End 2023

CECL is effective for nonpublic entities with fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. Early adoption is permitted. CECL has been effective for public companies since 2020.

NEXT STEPS

Consider your entity's financial assets, what specific assets will be subject to the new credit loss standard and start thinking about risk characteristics of those financial assets. Then, reach out to your trusted advisors at ORBA to continue the implementation process.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.