Following the significant uptick in US Collateralised Loan Obligation ("CLO") activity over the last three quarters, European CLO activity appears to have recently followed this trend.

European arrangers and CLO managers are welcoming the fact that Pramerica Investment Management is marketing their new €315.8 million CLO and that Cairn Capital successfully launched the first recent European CLO since the financial crisis. These new deals are perhaps the first real indicators that the European CLO market is on the way back.

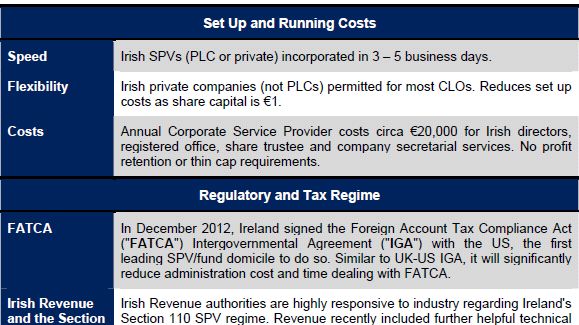

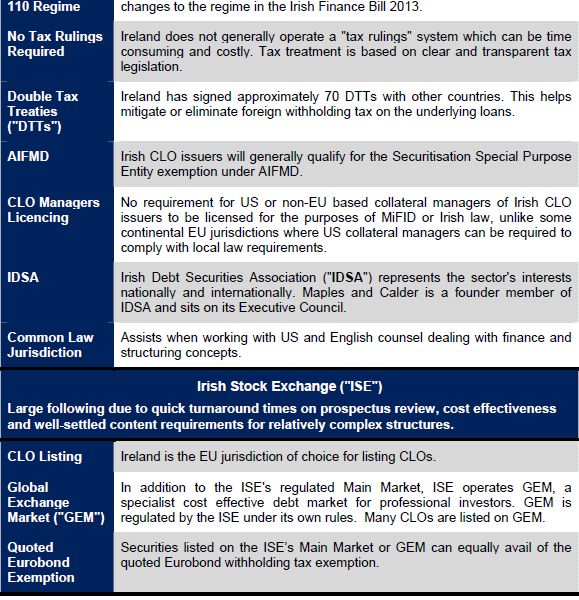

Ireland is one of the most popular jurisdictions for the establishment of European CLO issuers. In 2012 approximately 100 CLOs (mostly US) listed on the Irish Stock Exchange. The benefits of using Irish Special Purpose Vehicles ("SPVs") for CLO transactions are set out below.

Maples and Calder has acted as Issuer Counsel for deals involving managers and underwriters such as Guggenheim, ICE Canyon, Morgan Stanley and Jefferies on some of the largest European CLO transactions in 2011 and 2012 and are market leaders as Issuer Counsel with respect to Cayman Islands law on US CLO transactions.

Our affiliate business MaplesFS is an independent global provider of specialised fiduciary, accounting and administration services for structured finance vehicles including CLO issuers. This close working relationship offers clients the maximum convenience, speed and efficiency in establishing and administering SPVs for transactions.

Originally published 14 March 2013

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.