INTRODUCTION

Highworth (Cyprus) Ltd, a trusted leader in financial services, proudly presents the Tax Facts of 2024.

In this annual report, we aim to equip businesses, individuals, and industry professionals with the latest updates, analysis, and key considerations pertaining to the tax landscape of Cyprus in 2024.

In this year's edition, we explore Cyprus tax laws and local regulations. Our goal is to provide clarity on complex issues, offer insights into emerging trends, and empower our readers to navigate the intricate web of tax implications seamlessly.

As advocates for transparency and compliance, Highworth (Cyprus) Ltd remains dedicated to helping our clients optimize their financial strategies while ensuring adherence to all relevant tax laws. We invite you to explore the Cyprus Tax Facts of 2024 and discover valuable insights that can shape your financial planning and decision-making in the year ahead.

Thank you for entrusting Highworth (Cyprus) Ltd as your partner in navigating the intricate world of taxation. We are committed to delivering excellence and adding value to your financial journey.

- CORPORATION TAX

1.1 Basis of Taxation

A company that is considered a tax resident in Cyprus will be subject to taxation on income generated from both domestic and international sources. On the other hand, a company that is not a tax resident in the Republic will only be taxed on income generated from domestic sources within the Republic.

A company incorporated in Cyprus will be automatically regarded as a tax resident of Cyprus unless it holds tax residency in another jurisdiction.

Starting from January 1, 2024, Cyprus, being a member of the European Union, will incorporate the EU Directive on global minimum tax for multinational enterprise groups and large-scale domestic groups into its national legislation.

The corporate income tax rate is 12,5%.

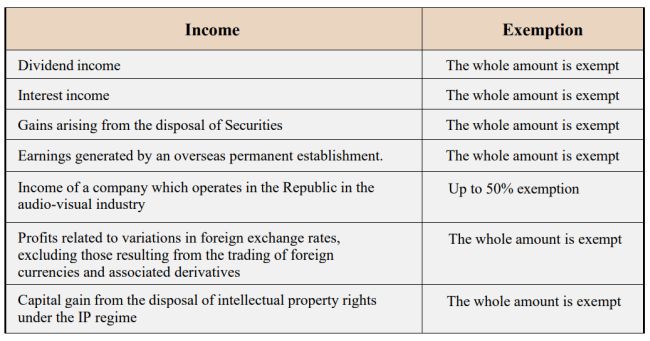

1.2 Exemptions

Corporate tax does not apply to the following:

1.3 Tax Benefits

Businesses have the option to use tax losses from the past five years to reduce their taxable income in the current year.

Tax losses incurred by a company in the present year can be offset against the taxable profits of another company in the same tax year, as long as both companies are part of the same group for the entire tax year.

Investors can receive a deduction of 50% from their taxable income (up to a maximum of €150,000 per year) when they invest in innovative small and medium enterprises (SMEs). If the deduction is not fully utilized in a given tax year, it can be carried over and claimed in the following five years.

Company reorganizations conducted in compliance with the regulations stated in the Income Tax Law have no impact on taxes.

Download - Tax Facts 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.