In October 2021, the European Union ("EU") placed Hong Kong ("HK") on its "watchlist" of non-cooperative jurisdictions for tax purposes ("EU List") over potential harmful tax practices arising from the traditional exemption from tax granted to offshore passive income, particularly where payment or recipient companies are not required to demonstrate a substantial economic presence in HK. The EU expressed its concerns over the possible exploitation of such arrangements by HK shell companies, which often resulted in an erosion to the tax base of its constituent member states.

In response to the concerns raised by the EU, the HKSAR government moved quickly to gazette the Inland Revenue (Amendment) (Taxation on Specified Foreign-sourced Income) Bill 2022 (the "Bill" or "FSIE Regime") on 28 October 2022. 1 After the gazette of the Bill and subsequent discussion with the EU, the HKSAR government has proposed two amendments 2 in November 2022 to the Bill in the Committee Stage Amendments ("CSAs"), specifically: (1) removing the exclusion of certain entities from the FSIE Regime; and (2) exempting the specified foreign sourced income (see definition below) derived from or incidental to the profit producing activities as required under the preferential tax regimes. The Bill targets Multinational Enterprises ("MNE") with the intention of preventing tax structures that allow for the double non-taxation of offshore passive income, and introduces substance-based conditions that need to be satisfied for certain foreign sourced income to continue enjoying tax exemption in HK.

Following the passage of the Bill by the Legislative Council on 14 December 2022, the new FSIE regime for passive income will be effective from 1 January 2023. Both proposed amendments in the CSAs have been taken into account in the Bill passed by the Legislative Council.

How does the refined FSIE Regime impact your company/ investment portfolios?

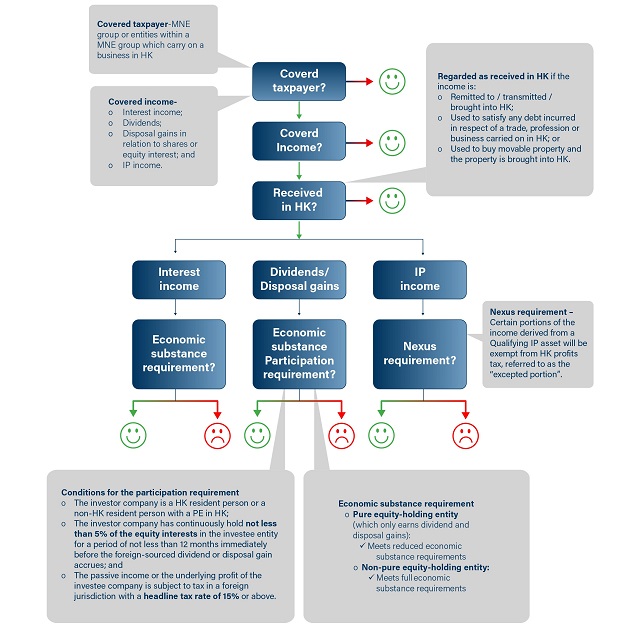

Under the FSIE Regime, entities within an MNE group that carries on a trade or business in HK would be covered as an in-scope entity. An MNE group refers to a group with at least one of the entities or permanent establishment within the group that is not located within the same jurisdiction of the ultimate parent company ("UPE") of the group, where UPE means an entity who owns a controlling interest in another entity. In this regard, pure domestic groups (i.e., all entities within the group are HK tax residents) or an HK company holding a minor non-controlling interest in foreign entities are not in-scope entities.

What is "in-scope income" under the refined FSIE Regime?

The FSIE Regime targets "specified foreign-sourced income" (i.e., passive income including interest, dividend, disposal gains and income from intellectual property), which under the new rules will now be deemed HK sourced income and subject to HK Profits Tax at 16.5% if it is received in HK. "Received in HK" is defined as follows:

i. remitted to/ transmitted/ brought into HK;

ii. used to satisfy any debt incurred in respect of a trade, profession or business carried on in HK; or

iii. used to buy movable property and the property is brought into HK.

For private equity funds and their SPVs who are deriving assessable profits that are exempt from tax under the existing exemption regimes, the specified foreign-sourced income may be excluded from the FSIE Regime to the extent the income is derived from or incidental to the production of such assessable profits.

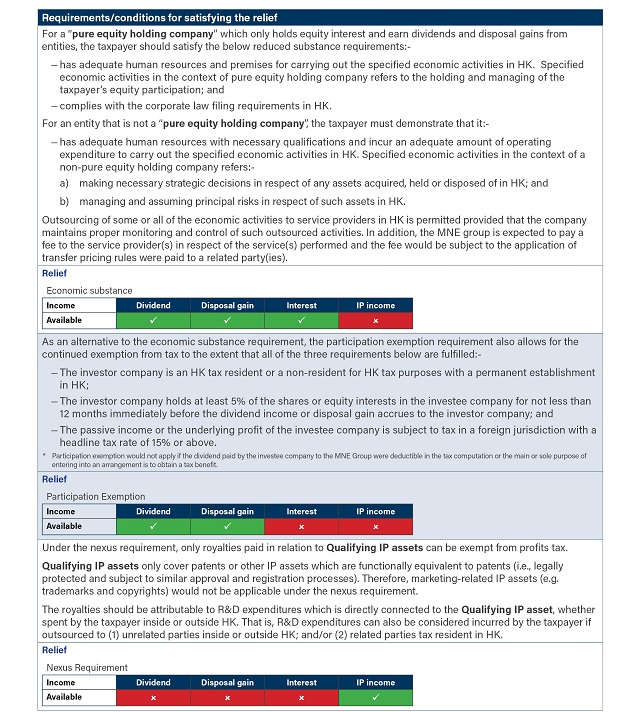

Is any relief/ exemption available under the FSIE Regime if the income is deemed as sourced in HK?

In order for an in-scope company to continue adopting the offshore non-taxable treatment on specified foreign-sourced income, it would need to satisfy the newly introduced conditions relevant to the characterisation of that income:-

What if the conditions of the above relief/ exemption requirement cannot be met?

Double taxation relief should be available for in-scope entities who have paid tax on the specified foreign-sourced income where the tax paid is substantial of the same nature as profits tax in a foreign jurisdiction outside of HK, regardless of whether that foreign jurisdiction has entered into a comprehensive double taxation arrangement ("CDTA") with HK or not. A tax credit can be granted either as a bilateral tax credit under a CDTA or as a unilateral tax credit for HK tax residents who receive income from a non-CDTA jurisdiction.

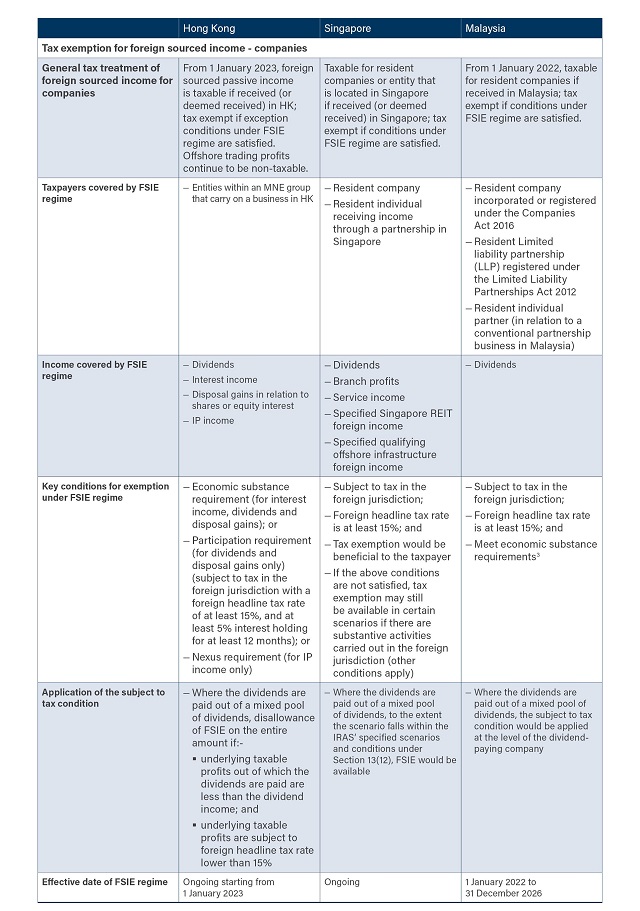

Summary of FSIE regime

Comparison of FSIE regimes in Hong Kong, Singapore and Malaysia

Our Comments

Although tax exemption would not be available under the FSIE regime if the relevant conditions are not satisfied, there may still be avenues to pursue a non-taxable claim and/or achieve tax neutrality on certain types of income in certain cases.

For instance, even in the absence of the FSIE regime, we would expect gains arising from the disposal of investments that have been held for long-term investment purposes to be non-taxable in HK, Singapore and Malaysia on the basis that these jurisdictions do not impose tax on capital gains. In Singapore, a safe harbour rule is also available whereby disposal gains (regardless of whether revenue or capital in nature) are exempted if certain conditions are met.

For foreign-sourced interest income and IP income, although not specifically covered under the respective FSIE regimes in Singapore or Malaysia, it may be possible to keep such income offshore such that they would not be subject to tax in Singapore and Malaysia. In Singapore, a reduced tax rate for qualifying IP income may be available under the IP Development Incentive for IP income that is received in Singapore.

For HK, to the extent that the MNE entities foresee the relevant exemption conditions are not satisfied, it may also be possible to treat the foreign-sourced passive income as offshore sourced and not subject to tax in HK by (1) keeping the income outside of HK; (2) not using the income to satisfy any debt in relation to their profit-generating activities; and not using the income to buy any movable property in HK.

How can we help?

If you have any questions on the refined FSIE Regime; and/or need any assistance in ascertaining your position in the refined FSIE Regime; please feel free to contact us and we would be happy to discuss and provide further assistance.

Footnotes

1 The FSIE bill can be accessed via this link: https://www.gld.gov.hk/egazette/pdf/20222643/es32022264319.pdf

2 The proposed amendments can be accessed via this link: https://www.legco.gov.hk/yr2022/english/bc/bc06/papers/bc0620221111cb1-760-1-e.pdf

3 On 30 December 2022, the Malaysia Inland Revenue Board announced economic substance requirements with respect to tax exemption on foreign sourced dividend income. Under the new economic substance requirements, resident companies, resident LLPs and resident individuals in relation to a partnership business in Malaysia will need to employ a sufficient number of qualified workers and incur sufficient operating expenses for the purposes of carrying out certain economic activities in Malaysia. The determination of the minimum threshold values (e.g., what constitutes "sufficient") will be based on the specific facts of each case given the level of operations required vary from industry to industry.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.