Are the incentives aligned correctly? The choice of employee participation is crucial for the success of your company - Part 2

The following two-part article is intended to provide an overview of the most important forms of employee stock option programs that can be considered for Swiss growth companies. The primar focus will be on the tax and social security aspects. This two-part article is intended to help you decide on the option that best meets the needs of your company, your employees and other stakeholders.

While the first part dealt with the motives for employee participations, the types of employee participation commonly used in Switzerland and their Swiss tax consequences, in the second part we now address the treatment of employee participation programs under Swiss social security laws and regulations and provide tips on the design of employee participation programs.

How are employee participations treated for social security purposes?

The treatment of employee shareholdings in terms of social security is basically the same as for income taxes. This means that social security contributions are due on the taxable income from employee participations. In any case, AHV/IV/EO and unemployment insurance contributions of currently 12.8 % (up to an income of CHF 148,200) and 10.6 % (from an income of CHF 148,200) are due on this income. The social security contributions are in principle to be borne half by the employee and half by the employer. Up to a total income of CHF 148,200 per year, ordinary earned income plus income from employee participations, mandatory accident insurance and any daily sickness benefit insurance contributions must also be paid on the entire income. Whether the income from employee participations is also subject to the occupational pension plan or whether accident insurance and daily sickness benefit contributions are also due from an income of over CHF 148,200 depends on the contracts that the company has concluded with the insurance companies and the pension fund.

What are the tax and social security options, what should be considered?

Although the tax treatment of each type of employee participation varies widely, the following conclusions can be drawn:

Tax advantages of employee options are often not utilized in practice:

In the case of options, shares and entitlements, employees pay taxes at the time of realization (exercise of the option or receipt of the shares) on income that they have not yet received or cannot yet realize (so-called "dry income"). If the employees are subsequently unable to sell on the employee participations, they have to fall back on their own assets to pay the income taxes without knowing whether they will actually realize the increase in value at a later date. In practice, we find that employees often wait until it becomes apparent that the company will go public (IPO) or be sold to third parties (so-called corporate transaction) before exercising employee stock options, as they can then sell on the shares they have received directly. In this way, employees often forego the opportunity to realize a tax-free capital gain, as they would have had to purchase the employee participations in advance and pay tax on them, without knowing whether their value would increase. Thus, employees often prefer a secure but taxable monetary benefit from exercising the options to a possible but uncertain tax-free capital gain. However, there can be differences in the risk affinity of employees. Younger employees are often willing to take greater risks than older employees.

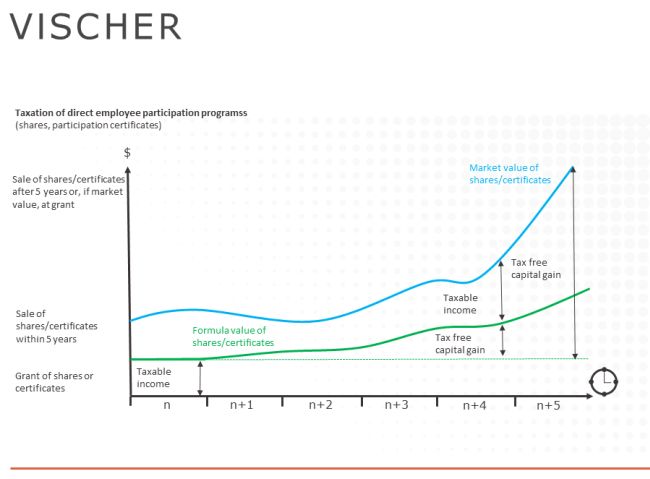

The following chart shows the relationship between the holding period and the tax consequences for direct employee participations:

From the company's point of view, the tax documentation requirements and company law regulations for granting options are also time-consuming and tend to be forgotten. For this reason, we always recommend checking whether phantom stocks or stock appreciation rights would be suitable instead of options. These have the same tax consequences for employees as if they had received options and sold them only at the time of the IPO or corporate transaction. In addition, the documentation requirements for non-direct employee participations are much less onerous for the company. However, the payment of the non-direct employee participations always leads to an outflow of valuable liquid funds for the company, which the company may miss later for future investments. This outflow of liquid funds is particularly problematic for companies in the start-up or expansion phase, e.g. start-ups, which is why these companies nevertheless usually rely on direct employee participations in practice.

It should be noted, however, that especially company founders and employees who joined the company at an early stage appreciate direct participation in the company and are also prepared to take risks. Experience has shown that employees who hold direct employee participations identify more with the company than those who are only contractually entitled to future profits - employees with direct employee participations have more "skin in the game".

Formula value must be chosen carefully:

In the rarest of cases, a market value of the shares, ordinary shares or participation certificates is available in the case of unlisted, young companies, so that a subsequent sale of the acquired employee participations often results in taxation of the excess profit, i.e. the difference between the sale price of the employee participation and the formula value at the time of sale. If there is a change from the formula value valuation to the market value valuation or a sale of the employee participations within five years, only the increase in the formula value is tax-free. We therefore recommend choosing the applicable formula value carefully. Once a formula value has been selected, it must be applied over the entire term of the respective employee participation program. To ensure that the formula value is also accepted by the tax administration, we also recommend that the applicability of the formula value be confirmed in a tax ruling with the tax administration of the company's canton of domicile and preferably also by the tax administrations of the employees' cantons of domicile. Otherwise, there is a risk that the tax administrations will not recognize the formula value. In such a case, the tax administration will determine the value on the basis of the tax value of the shares, ordinary shares or participation certificates. It should be noted that the formula value is also used to determine the wealth tax value of the shares, ordinary shares or participation certificates.

If a market value is available, this is generally to be applied:

If the fair value of an employee participation is very high, this may discourage employees from purchasing participations or exercising options. In such cases, it may be appropriate to value the award at its formula value. Using a formula value despite the existence of a market value is only possible if the employer has an unlimited right to repurchase the participations from the employees at the identically calculated formula value. However, such a decision must be carefully considered. Since the employer can always buy back the employee participation at the formula value, the excess profit, i.e. the (positive) difference between the market value and the formula value at the time of sale, always constitutes taxable income. This is the case even if the employee participation has already been held for more than five years. The company's unlimited right to repurchase thus makes a fully tax-free capital gain impossible.

Increase the chance of a tax-free capital gain by confirming the market value and reducing the taxable income by means of lock-up periods:

If the employer wishes to give employees the opportunity of a tax-free capital gain and there is no stock market price available, we recommend, if possible, to have the tax administration of the company's canton of domicile and the canton of residence of the employee(s) confirm their market value by means of a ruling before handing over the shares, ordinary shares or participation certificates. However, confirmation of the market value of employee participations not traded on a stock exchange is not possible in all cantons. In addition, the requirements for the proof of the market value are high. Usually, a current valuation of the value of the granted employee participation by an experienced valuation company is assumed. Typically, the reliance on the market value is particularly advantageous in the case of still very young companies, as here the market values are usually still relatively low.

Alternatively or in addition, shares, ordinary shares or participation certificates with a five-year blocking period may be issued to employees. A discount of 6% per year can be claimed on the value of blocked employee participations, for a maximum of ten years. This at least reduces the tax burden at the time of realization. Once the blocking period has expired and the holding period of five years has been reached, employees have the opportunity to realize a tax-free capital gain. As already mentioned, it should be noted that the opportunity for a tax-free capital gain is also accompanied by the risk of a capital loss that is not tax-deductible.

Precisely clarify matters with an international connection:

For employees domiciled abroad, it should be noted that employee participations are often taxed differently abroad, at a different point in time or at a different value than in Switzerland. In the case of an international connection, it is always worth clarifying the tax consequences with a local tax advisor in order to avoid double taxation of this income. This also applies in particular to cases where employees move abroad or arrive from abroad, where under certain circumstances the income from employee participations is taxed partly abroad and partly in Switzerland (import or export of employee participations). In particular, if the employees are subject to withholding tax, the company must carefully examine such circumstances in order to avoid excessive or insufficient withholding tax payments.

Check contracts with pension funds and insurance companies and adjust if necessary:

With regard to social security contributions, it is essential to check which social security contributions are due in connection with employee participations. In order to avoid high employer contributions, it may be worthwhile adjusting the contracts / regulations with the pension fund and the supplementary accident and daily allowance insurance so that income from employee participations, which together with the other income exceeds a certain amount or flows irregularly, is not insured.

Ensure payment of social security contributions and withholding taxes even after employees participations have been surrendered:

In principle, the employer must pay at least half of the social security contributions on all income from employee participations, i.e. also on taxable income from subsequent milestone payments or any generated taxable excess profits. The employer thus continues to have a latent liability during this period. Under certain restrictive conditions, an agreement can be reached between the employee and the employer with regard to this income so that the employee will fully assume the social security contributions due on the income from employee participations. Whether this is possible, however, must be thoroughly clarified in each individual case. If the employee is also subject to withholding tax, the employer is also responsible for the correct accounting of the withholding tax at the time of the milestone payment or the realization of the excess profit. In any case, the employer must ensure that it receives and correctly accounts for the social security contributions owed by the employees as well as any withholding tax owed on the taxable income from employee participations, if subject to withholding tax, even if the employee is no longer employed by the employer at the time it is due. Since taxation of the excess profit is possible within five years after the granting of the participation or exercise of the options, or in certain cases for even longer (see taxation at formula value despite the existence of a fair market value), this is a challenge in practice which must be regulated in an employee participation plan.

An overview of the tax treatment of privately held direct and non-direct employee participations can be requested here.

Recommendation

There is no such thing as "the" best way to involve employees in the success of the company. What is important is that the type of employee participation is in line with the corporate culture and attracts those employees that the company needs for its further development. The four parameters for compensation models must be taken into account.

It makes sense to take your time setting up the employee participation program. In Switzerland, many types of employee participation programs are possible. An off-the-shelf employee participation program is typically the wrong choice. The program, the plan and the form of employee participation must be adapted to the company's strategy and objectives and take into account the specific tax and social security circumstances of the company and its employees. If the employees receive shares in the company, it is also worth drawing up a shareholder agreement tailored to the employee participation program.

As soon as the value of the shares, ordinary shares or participation certificates issued to employees cannot be based on a stock market price and the formula value is not to be determined on the basis of the tax value, it is worth obtaining a tax ruling to confirm the formula value or a market value of these employee participations.

VISCHER will be happy to advise you on the choice of employee participation program suitable for your company and assist you in setting up of your individual program including a suitable shareholder agreement and the clarification and confirmation of the tax and social security consequences of your program.

Originally published 28 September 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.