The time will come for any foreign business, large or small, when they have to work with an accounting firm in Brazil. Whether they are domiciling in the South American economic powerhouse, or just opening a satellite office there, it matters not. Accounting best practices are inevitably going to be a major feature of any expansion strategy in Brazil.

As Latin America's largest economy and the 9th largest in the world, Brazil is a force to be reckoned with. Regardless of how you feel about Brazil's previous president, Bolsonaro's administration enacted business-friendly policies that helped cut back on government intervention in the market, took steps to reign in excessive bureaucracy, and opened up the Brazilian economy to more foreign participation and investment. The South American hegemon has never looked so attractive to foreign investors as it does today.

What does all this have to do with accounting firms in Brazil? Like anywhere else, any economic activity will be taxed, and it can be difficult for foreign businesses to comply with regulatory requirements and pay taxes correctly if they try to go it alone. Aside from professional bookkeeping, foreigners need to hire on-the-ground attorneys to ensure they're meeting all the legal requirements to start a business in Brazil.

With hundreds of accounting firms and thousands of CFC-qualified accountants out there selling their professional services, how can foreign investors, entrepreneurs and companies who are new to Brazil know which accountancy is right for them?

Before finding an accounting firm in Brazil, you have to understand Brazilian taxes

Top 7 accounting firms in Brazil

Here are some of the largest accounting firms in Brazil, according to a number of industry analysts. Many accounting firms provide much more than simple bookkeeping for your company.* Corporate accounting firms in Brazil charge anywhere between $10,000 USD to $25,000 USD and up, depending on the size, complexity and number of hours needed to deliver on a project or set of services.

- Gescon Consultoria – One of the most reputable accountancies in the country, this mid-sized firm offers corporate accounting, internal auditing services, and finance & accounting outsourcing (FAO) services.

- CLM Controller – Based in São Paulo, Brazil, this large accounting firm provides accounting, auditing, tax compliance, financial, payroll, HR, and other business services.

- Solutta – Established in 2008, this firm has grown to one of the biggest Brazil-born accountancies in the country. With offices in Rio de Janeiro and Suzano, its primary focus is accounting, tax compliance and FAO services.

- Confiare Assessoria Contábil – An accounting and consulting firm based in Rio de Janeiro, this firm of good repute makes available FAO services, accounting, HR consulting and staffing services to its client companies.

- Mapah – Headquartered in the city of Americano do Brasil, this mid-sized accounting firm in Brazil provides accounting, FAO and business consulting services to large corporate clients and small- and medium-sized enterprises (SMEs).

- PwC Brasil – This is a large multinational accounting conglomerate based in Rio de Janeiro. Aside from accounting and auditing, it also acts as a tax consultancy for companies in the agribusiness, energy, pharmaceutical and automotives sectors, among others.

- Grant Thornton Brazil – Another multinational accounting conglomerate, its Brazil arm of the company is headquartered in São Paulo. The large team of professionals specializes in accounting, auditing, business consulting, taxation and Environmental, Social, and Governance (ESG) compliance.

*This in no way should be considered an exhaustive list. The Clutch and Glassdoor websites have more extensive lists of accountancies in Brazil.

What kind of services do accounting firms in Brazil offer?

Some of the largest and most well-established accounting firms in Brazil do so much more than accounting (though that remains their bread-and-butter revenue stream) and can provide a full slate of business services, such as:

- Accounting services

- Business setup and incorporation

- Compliance with tax regulations

- Internal company auditing

- Payroll management

- HR services and consulting

- Employee recruiting

- Compliance with ESG international standards

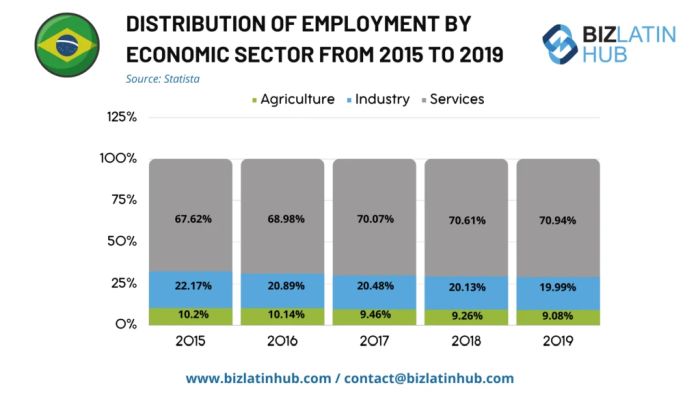

An accounting firm in Brazil would keep the distribution of employment of the country in mind

What you should look for in an accounting firm in Brazil

The ideal accounting firm in Brazil should be connecting you with their most capable people who are specialists in their field. They will provide you with knowledge and a plan of action on:

- Compliance with local, state and federal tax regulations

- What if any tax returns your company is entitled to

- Know by heart which supporting tax documents your company must submit

- Corporate accounting requirements and standards

- How to remain in good standing with Brazilian regulatory authorities

- Fluency in English, the ability to explain complex regulations in an easy-to-understand way

- (Ideally) has recommendations on business strategies that empowers your company to maximize its chances of commercial success in Brazil

Originally published 23 February 2023 | Updated On: 21 June 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.