On 3 October 2012, the Danish Ministry of Taxation presented a bill containing - inter alia - anti-avoidance rules regarding withholding tax on dividends. The new rules could have negative consequences in particular for multinationals and others with Danish holding companies.

Withholding tax on dividends - the beneficial owner campaign

Under the Danish holding company regime dividends distributed by a Danish company to a foreign parent company (a company holding at least 10% of the shares in the Danish company) are as a starting point exempt from Danish withholding tax, provided that the foreign parent company is resident within the EU or in a jurisdiction that has entered into a double tax treaty with Denmark.

However, in recent years the Danish tax authorities has aggressively sought to deny this benefit of the Danish holding company regime to foreign parent companies if the foreign parent companies - in the opinion of the Danish tax authorities - are conduit companies that have been established for treaty shopping purposes. The way the Danish tax authorities have sought to do this has been by arguing that the foreign parent companies are not the beneficial owner of the dividends.

So far the Danish tax authorities have initiated cases concerning dividends paid to foreign parent companies claiming more than 5 billion DKK in withholding taxes.

New rule aimed at Danish "stepping stone" companies being used for treaty shopping

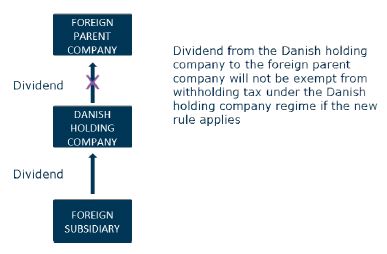

Until now, the Danish tax authorities have focused on foreign parent companies being used as stepping stones to avoid Danish withholding tax. However, the bill proposed by the Danish Ministry of Taxation contains a new rule aimed at Danish companies being used as stepping stones to avoid or reduce foreign withholding tax.

According to the proposal the exemption from Danish withholding tax on dividends paid by a Danish company to a foreign parent company shall no longer apply if:

1. the dividends paid from the Danish company to the foreign parent company stems from dividends that the Danish company has received from a foreign subsidiary and

2. the Danish company is not the beneficial owner of the dividends received from the foreign subsidiary.

Instead, a withholding tax of 27% shall in such cases be applied to the dividends paid by the Danish company to the foreign parent company (or such lower rate as is provided for in a double tax treaty between Denmark and the jurisdiction of the foreign parent company, provided that the foreign parent company fulfils the beneficial owner requirement, etc. in such double tax treaty).

The new withholding tax does not apply if withholding tax must be waived pursuant to Directive 90/435 EEC regarding the taxation of dividends between parent companies and subsidiaries within the EU.

According to the bill, it is for the Danish tax authorities to determine whether or not the Danish company is the beneficial owner of the dividends received from a foreign subsidiary, and the Danish tax authorities must in this respect take into consideration the factual circumstances of each case, including whether or not the Danish company was established with the purpose of obtaining a lower withholding tax rate, and if the foreign parent company is exercising a control over the Danish company which goes beyond the planning and control usually exercised in a group context.

It is proposed that this new rule shall take effect for distributions of dividends made on or after 1 January 2013.

A large number of multinationals, etc. currently have Danish holding companies in their group structure. These multinationals, etc. should urgently consider the potential effect of the new rules.

New rule to close loop-hole used to avoid Danish withhold tax on dividends

In the bill the Danish Ministry of Taxation also proposes a new rule to close a loop-hole that according to the Ministry has been used to circumvent Danish withholding tax on dividends paid to foreign parent companies that are not able to benefit from the Danish withholding tax exemption.

The loop-hole is in the bill described as a conversion of dividends into repayment of principal as follows: A foreign parent company (A) sells all the shares in a Danish company (B) to another Danish company owned by the foreign parent company (C) against consideration in the form of a receivable. Following the sale of the shares in B, B declares a dividend to C, (such dividend not being subject to Danish withholding tax as it is as dividend between Danish companies). C then uses the dividend amount received from B to repay the principal under the receivable held by A. Such repayment of principal is not subject to withholding tax.

To close this loop-hole a new rule is proposed which effectively will deem such repayment of principal to be a dividend.

It is proposed that this new rule shall take effect as from 3 October 2012.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.