OUR INSIGHTS AT A GLANCE

- On 14 June 2023, the Administrative Tribunal ruled on whether the use of classes of shares can be considered as an abuse of law.

- The transaction challenged by the tax authorities was the redemption by a Luxembourg company of the class "J" shares and the class "JJ" shares, respectively held by its two Russian individual shareholders, immediately followed by the cancellation of said shares.

- The Tribunal decided that the LTA was right to confirm the existence of an abuse of rights and, consequently, the application of a 15% withholding tax to the entire amount paid.

- Hereafter, we analyse the grounds on which the Tribunal considered the existence of an abuse and put this judgment into

On 14 June 2023, the Administrative Tribunal (the "Tribunal") ruled on whether the use of classes of shares can be considered as an abuse of law. The transaction challenged by the tax authorities was the redemption by a Luxembourg company of the class "J" shares and the class "JJ" shares, respectively held by its two Russian individual shareholders, immediately followed by the cancellation of these shares.

In the case at hand, the Tribunal decided that the Director was right to confirm the existence of an abuse of law within the meaning of Paragraph 6 of the Tax Adaptation Law ("Steueranpassungsgesetz" or "StAnpG") and, consequently, the application of a 15% withholding tax to the amount of the redemption price of the shares exceeding their nominal value.

This article aims at providing a clear and concise overview of the judgment of the Tribunal and considers its potential implications notably taking into consideration previous Luxembourg case law on the topic.

Fact pattern of the case

On 22 April 2016, Company A (the Luxembourg taxpayer) transferred its registered office and central administration from Cyprus to Luxembourg. On the same day, Company A set its share capital in euros, divided into ordinary shares. Company A was held by two Russian individual shareholders, Mr. B and Mr. C.

From October until the end of 2017, Company A received several dividends from its wholly - directly and indirectly - owned subsidiary.

On 6 November 2017, i.e. concomitantly with the distribution of dividends received by Company A from its subsidiary, the two shareholders of Company A converted the ordinary shares into 20 classes of shares, all subscribed by the two shareholders themselves - Mr. B subscribed to the A to J share classes and Mr. C subscribed to the AA to JJ share classes. These share classes had no different economic rights amongst themselves. In addition, the rights and obligations of the shareholders remained identical to the ones existing prior to the introduction of share classes.

The Articles of Association of Company A, in their original version of 22 April 2016, were amended, on 6 November 2017 as follows:

- "5.1 [...] Les droits et obligations attachés

aux parts sociales de chaque classe, comme défini dans les

présents statuts, sont identiques, hormis dans la mesure

où la loi ou les statuts prévoiraient

autrement" [...];

- "8.7. Dans le cas d'une réduction du capital social par le rachat et l'annulation d'une Classe de Parts Sociales (dans l'ordre prévu à l'article 8.6), cette Classe de Parts Sociales donne droit à ses détenteurs au prorata de leur participation dans cette Classe au Montant Disponible (dans la limite toutefois du Montant Total d'Annulation tel que déterminé par l'assemblée générale des associés) et les détenteurs de parts sociales de la Classe de Parts Sociales rachetée et annulée recevront de la part de la Société un montant égal à la Valeur d'Annulation Par Part Sociale pour chaque part sociale de la Classe en question qu'ils détiennent et qui est annulée », les termes « Montant Disponible » étant définis comme englobant notamment « le montant total des bénéfices nets de la Société (y compris les bénéfices reportés)".

On 29 December 2017, so less than two months after the introduction of the share classes but after receipt of dividends from its subsidiary, Company A repurchased and immediately cancelled the class J shares and the class JJ shares, using its distributable reserves. In accordance with the calculation method set out in the bylaws, the buy-back price enabled the extraction of Company A's net profits, i.e. substantially the amount of the dividends previously received from its subsidiary. The cancellation of the repurchased shares resulted in a subsequent reduction of Company A's share capital.

As from 2019, Company A adopted the status of a Luxembourg private wealth management company ("SPF" – société de gestion de patrimoine familial).

Argument of the tax authorities

The transaction challenged by the tax authorities was the redemption, by Company A, of the 25 class "J" shares and the 25 class "JJ" shares, each with the same par value, held respectively by its two Russian individual shareholders, immediately followed by the cancellation of these shares.

The tax authorities considered this transaction as an abuse of law on the grounds that:

- this transaction took place within a two-month period, during which the Company A (1) converted all its ordinary shares into 20-class shares subscribed by its two shareholders in equal shares and having the same par value as the ordinary shares, and (2) received dividends from its subsidiary; and

- said class "J" and "JJ" shares conferred the same legal and economic rights to its two shareholders and these rights were identical to the ones they would have enjoyed with the ordinary shares.

The tax authorities concluded that this transaction constituted a "repatriation" of profits to the two Russian shareholders, avoiding the 15% withholding tax applicable to dividend distributions.

The tax authorities did not argue that the acquisition price of the two classes of shares "J" and "JJ" was overstated and that the transaction had to be seen as a hidden dividend distribution (like in the case law n°42432 dated 27 January 2023 and commented in a previous article). In this case, the only argument of the tax authorities was that the transaction was an inappropriate way of "repatriating profits" to the shareholders of Company A and therefore the transaction should be treated as an abuse of law in accordance with § 6 StAnpG.

Ruling of the Tribunal

- Qualification of the share class redemption from a Luxembourg tax point of view

The Tribunal ruled that a redemption of a class of shares is, in principle, a transaction triggering a capital gain that is not subject to withholding tax. To that aim, the Tribunal reiterated the principle that all transactions between a company and its shareholder that affect the substance of the shares within the meaning of article 101 of the Luxembourg income tax law ("LITL"), including the repurchase of a shareholding by a company with a corresponding capital decrease, fall within the scope of article 101, (1) of the LITL (i.e. "proceeds of a disposal of the participation" within the meaning of article 100 of the LITL). According to the Tribunal, this characterisation applies to the present case insofar as the redemption of share classes by Company A gave rise to a reduction in its share capital corresponding to the nominal value of said shares.

However, the Tribunal considered that, in principle, this qualification does not preclude the application of the concept of hidden dividend distributions in the event that the price actually paid by the company to its shareholder for the repurchase of its shareholding exceeds the real value of this shareholding and where the overpricing is not justified by a valid economic reason but is solely explained by the existence of the shareholder relationship.

- Implications

The Tribunal ruled in accordance with the previous judgments of the Administrative Court dated 23 November 2017 and of the Tribunal dated 27 January 2023 dealing with the qualification of share class redemptions from a Luxembourg tax point of view.

In the present case, it was not even disputed by the tax authorities that the redemption of a class of shares was likely a transaction triggering a capital gain that is not subject to withholding tax, under the provisions of articles 97, paragraph (3) and 101 of the LITL.

Consequently, it should be accepted that the question of whether the repurchase of "a" shareholding referred to in article 101 of the LITL also includes the redemption of a class of shares, including from an investor who may hold other classes of shares, is no longer in doubt and can be taken as settled. A share class redemption is thus not a profit distribution and therefore not subject to Luxembourg withholding tax, as long as the redemption price adheres to the arm's length standard. Hence, the determination of the fair market value of share classes will be crucial even though in most cases following the mechanism provided in the bylaws will lead to an arms length price.

The fact that the redemption of a class of shares would not be followed by a capital reduction should have no impact on that qualification. Indeed, in 2017, the Luxembourg Administrative Court held that the net proceeds received by a shareholder upon the redemption by a company of all or part of his/her shares without a corresponding cancellation of the shares so redeemed should not qualify as income from capital (i.e. dividend) falling in the scope of Article 97 of the LITL, but as income from the realisation of a participation (i.e. capital gain) falling in the scope of Article 100 of the LITL or Article 99bis of the LITL.

- On the existence of an abuse of law

The Tribunal then analysed whether the four criteria required to qualify a transaction as an abuse of law under § 6 StAnpG (version prior to the 2019 amendments) were met. Following an detailed reasoning, it concluded as follows:

First criterion: the use of forms and institutions of private law

This point was not challenged by the parties and the Tribunal concluded that the operation as described above in the facts met this first criterion.

|

In 2019, the Luxembourg abuse of law concept as defined in § 6 StAnpG was replaced by a new GAAR that keeps the key aspects of the previous abuse of law concept (according to which "the tax law cannot be circumvented by an abuse of forms and legal constructions") whilst introducing the concepts of the GAAR provided under ATAD. Under the new § 6 StAnpG as amended in 2019, this first criterion was replaced so that now "a transaction must be implemented using the legal forms and institutions". As the new version of § 6 StAnpG now targets any kind of abuse of legal forms and institutions (those of private and public law), we doubt that the Tribunal would conclude differently if it had to apply this new provision. |

Second criterion: the purpose of the arrangement is to obtain an

elimination or a reduction of its tax charge

Company A argued, implausibly, that it did not seek tax savings of any kind and that a dividend distribution would also not have been subject to withholding tax notably on the basis of Article 147, point 3, of the LITL because Company A would qualify as a Holding29, and on the basis of Articles 10 and 23 of the Luxembourg/Russia Double Taxation Treaty ("DTT"). Secondly, according to Company A, the transaction would qualify as liquidation proceeds ("produit de partage") which, in any case, would not be subject to any withholding tax based on Article 97 of the LITL.

However, according to the Tribunal, the qualification of "société de participations financière", or "holding company" within the meaning of the 1929 law, which Company A relied on, was repealed by a law of 22 December 2006 - ten years before the tax year at stake. In addition, it was common ground that Company A was not one of the qualified entities referred to in Article 147, point 3 of the LITL, including the status of an SPF, a status it adopted only as of the 2019 tax year – two years after the tax year at stake. Finally, it was common ground, according to the Tribunal, that the two shareholders of Company A were individuals who could not therefore benefit from a reduced rate, or an exemption, based on the DTT.

On the contrary, the Tribunal considered that if, in the course of 2017, Company A had made a dividend distribution to its two partners in respect of their original ordinary shares, such payment would have been subject to a withholding tax of 15% in accordance with Article 10 of the DTT and Articles 146, 148 and 156 of the LITL.

By carrying out the repurchase and cancellation of the two classes of shares "J" and "JJ", the two shareholders received, in an undisputed manner, a certain amount without withholding tax in Luxembourg, given that it follows from the concordant explanations of Company A and the tax authorities that the income generated by the challenged transaction does not qualify as income from movable capital, but as miscellaneous net income (i.e. "proceeds of a disposal of the participation").

As a result, such income falls within the scope of the provisions of Article 13 (Capital Gains) of the DTT attributing exclusive taxing rights to the Russian Federation in its capacity as the country of residence of the "transferor", in this case the two shareholders of Company A, and thus excluding any taxation in Luxembourg.

In addition, according to the Tribunal, neither the entirely theoretical arguments about the company's competence to decide on the distribution of dividends, interim dividends, or share buybacks, nor the fact that the disputed transaction was validly decided by the board of directors or that it would have complied with the principle of equal treatment of associates, are of such a nature as to influence the question of the existence of a tax saving within the meaning of § 6 StAnpG.

Finally, the fact that the shareholders would have been taxed in Russia on a capital gain (which was not proven in the case at hand) and created a double taxation that should be solved by Russia in application of Article 23 of the DTT, would not call into question the possibility for Luxembourg to exercise its taxing powers in accordance with the DTT, nor to exclude the existence of a possible abuse of rights within the meaning of § 6 StAnpG. In this respect, it would be interesting to understand whether the conclusion of the Tribunal would have been the same if it was proven that the shareholders suffered an effective taxation in Russia of at least 15%, and thus that their global tax bills – and not solely their Luxembourg tax bills - have not been reduced.

On the basis of this finding, the Tribunal concluded that the purpose of the transaction was to avoid or a reduce the tax charge.

|

Under the new version of § 6, the Tribunal would have to assess whether the main or one of the main purposes of the challenged transaction is to obtain a circumvention or a reduction of the tax burden against the purpose of the tax law. The circumvention or reduction of the tax burden is assessed by comparing the tax burden resulting from the legal route used with that which would be due if the non-genuine legal route were not taken into account, which is exactly what the Tribunal has done. Thus, it is unlikely that the Tribunal would have concluded differently on the existence of a circumvention or a reduction of the tax burden, if it had to apply the new version of § 6 StAnpG. |

Third criterion: the use of an inappropriate

"path"

With regard to the criterion relating to the use of an inappropriate path, it is settled case law that purely unusual forms, constructions or operations of private laws are not in themselves considered inappropriate, in view of the taxpayer's freedom, in principle, to opt for the least taxed route ("choix de la voie la moins imposée"). To be inappropriate, the path must achieve an economic objective in a given economic context in such a way as to allow a tax effect to be obtained which the legislator cannot be considered to have intended to grant in the context of an application of the tax law consistent with their intention. It would cover the case of a taxpayer who did not use the means that the legislator would have considered typical to achieve defined economic objectives, but chose other means to achieve them, means that reasonable parties would not have used given the circumstances of the case insofar as they did not conform to generally accepted approaches, i.e. not typical.

According to the tax authorities, the transaction was set up for the sole purpose of "repatriating profits" from Company A to its two shareholders instead of distributing a dividend, which would have been the appropriate way to choose in the absence of any tax considerations. The tax authorities concluded that the transaction was an inappropriate path on the grounds that the shares divided into 20 classes, including the disputed "J" and "JJ" classes, would be characterised by an absence of economic advantages between them and compared with the former ordinary shares. In addition, there was a temporal connection between the conversion of the shares into 20-class shares, the prior receipt of dividends from the subsidiary and the redemption of the "J" and "JJ" classes for a corresponding amount.

The Tribunal confirmed that conclusion taking into consideration the following facts:

- the 20 classes of shares subscribed by each of the two shareholders were indistinguishable in terms of the legal and economic rights;

- the reduction of the share capital following the cancellation of a class of shares entitled the shareholders, in proportion to their holding in that class, to an identically determined amount, irrespective of the class of shares and the selling shareholder concerned;

- the "J" and "JJ" class shares granted the same legal and economic rights to the two shareholders of Company A from the date of their creation until the date of their redemption and neither Company A nor its two shareholders had any intention to attribute different legal and economic rights to the newly created share classes;

- Company A's articles of association provided, in their versions of 22 April 2016, 6 November 2017 and 29 December 2017, that the right of each shareholder in the assets and profits of Company A was proportional to the number of shares held in the share capital;

- by subscribing to "J" and "JJ" class, the shareholders of Company A retained the same legal and economic rights as the ones they enjoyed in respect of their ordinary shares; and

- by simultaneously purchasing said shares of classes "J" and "JJ", each representing 25 shares, followed by their cancellation and a corresponding reduction in its share capital up to their par value, Company A proceeded to a proportional and equal reduction in the shareholding of its two shareholders, and correlatively of their respective rights in its share capital.

The above facts led the Tribunal to conclude that the two shareholders of Company A had neither an intention to withdraw completely from the share capital of the Company nor a desire to withdraw partially. As a result, the challenged transaction could not be seen as an act of disposal affecting the substance of their shareholding in Company A since they have not lost any right to a portion of the specified source of underlying income from their investment in Company A's capital. The Tribunal considered thus that the transaction constituted, from an economic point of view, a distribution of dividends.

It seems thus that the criteria based on which the Tribunal assessed the economic character of a share class redemption was notably the intention of shareholders to withdraw completely, or partially from the share capital of the company buying back its shares. It also assesses whether the transaction can be seen as an act of disposal affecting the substance of the asset sold (i.e. the shareholding); i.e. whether the shareholder lost any right to a portion of the specified source of underlying income from its investment in the company's capital.

The Tribunal did not identify expressly the temporal connection between the conversion of the shares into 20-class shares, the prior receipt of dividends from the subsidiary and the redemption of the "J" and "JJ" classes for a corresponding amount as a criterion based on which the path used constituted a distribution of dividends from an economic point of view. At most, the Tribunal considered that the transaction reflects the intention of Company A to transfer dividends received less than two months before to its shareholders.

As it did not address the point, it is unclear whether another conclusion would be reached if the timing between the receipt of dividends and the share classes redemption was different (i.e. longer). It probably would not as it does not influence, as such, the economic character of the share classes buy-back which only refers to the legal and economic characteristics of the classes of shares bought back (i.e. equal share of shareholdings bought-back, identical legal and economic rights, etc.) in order to determine whether the transaction is a dividend distribution from an economic point of view.

Regarding Company A's assertion according to which no tax savings would be recognised based on the premise that the challenged transaction would not generate income from movable capital in accordance with article 97, paragraph 3, point d) of the LITL, the Tribunal decided, by reference to the parliamentary work regarding article 97 of the LITL, that the particular circumstances in which Company A set up the classes of shares and subsequently redeemed the "J" and "JJ" classes correspond precisely to a situation in which the legislator intended to exclude the classification as capital gain for a transaction which, at first glance be qualified as such, but which, in fact, turns out to be a "disguising of a profit distribution".

As a result, the Tribunal concluded that Company A used an inappropriate "path".

Even if not clearly stated by the Tribunal, we cannot exclude that the temporal connection was taken into consideration to assess whether the path used by Company A was inappropriate, as well as the fact that Company A itself had indicated that the transaction was financed by "distributable reserves recorded as a result of dividends received in 2017" and the notes to the company financial statements mentioned: "Therefore, [an] amount of EUR ... from the Profit of 2017 was distributed to each of the Shareholders of the company".

Indeed, the Tribunal refers to "particular circumstances" of the case and thus to the challenged transaction as a whole. However, as it did not clearly express the point, it is unclear whether another conclusion would be taken if the timing between the creation of the shared classes, receipt of dividends and the share classes redemption was different (i.e. longer).

Similarly, would the conclusion be different if only part of the distributable reserves recorded as a result of dividends received in 2017 was used to finance the transaction? Probably not if the transaction can be seen as a "disguising of a profit distribution" which is the situation in which the legislator intended to exclude the classification as capital gain and intended to treat the payment as a dividend distribution from a tax point of view.

|

Under the new version of § 6 StAnpG, the Tribunal would have to assess whether the main or one of the main purposes of the challenged transaction is to obtain a circumvention or a reduction of the tax burden against the purpose of the tax law. As the Tribunal confirmed the tax authorities' position according to which the challenged transaction, to be classified in principle as a capital gain, was set up for the sole purpose of "repatriating profits", instead of distributing a dividend subject to a 15% WHT, which would have been the appropriate way to choose in the absence of any tax considerations, and that in the case at hand, it corresponds precisely to a situation in which the legislator intended to exclude the classification as capital gain, it is unlikely that the Tribunal would have concluded differently, if it had to apply § 6 StAnpG in its new version. |

Fourth criterion: the absence of non-tax reasons justifying the use of the chosen "path"

To justify the transaction, Company A invoked the freedom to choose "la voie la moins imposée" and argued that the use of share classes is a technique known and used in the Grand Duchy of Luxembourg. In addition, Company A mentioned that the decision to repurchase the "J" and "JJ" classes of shares followed by their cancellation would fall within the scope of its financial management policy and its freedom of investment, as well as the one of its shareholders.

Company A also argued that the economic objective of this legal operation could not be reduced to purely fiscal considerations and that any decision relating to a company's investment and financial management policy would be justified by the desire to derive a real and sufficient economic advantage in the future through the reduction, increase or reorganisation of invested capital.

However, the argument that the profits were "repatriated" on the grounds that Company A had not planned to reinvest these funds in accordance with its investment policy, which it had the intention to reorganise, did not convince the Tribunal notably because no evidence of any investment or financial management policy was presented and Company A's only corporate purpose consisted essentially in holding of shareholdings.

Finally, the Tribunal considered that any decision relating to investment policy and financial management would not demonstrate ipso facto the existence of a real and sufficient economic advantage, given that it is precisely the economic reality of the challenged transaction that is called into question by the tax authorities. To justify the use of the chosen "path" with non-tax reasons, it is not sufficient to "simply" state economic reasons but concrete proof of the existence of these economic reasons must be provided, which Company A was not able to do.

Thus, the Tribunal concluded there was an absence of non-tax reasons justifying the use of the chosen "path". As a result, the Tribunal confirmed the position of the tax authorities and confirmed that the challenged transaction was an abuse of law within § 6 StAnpG.

|

Under the new version of § 6 StAnpG, the Tribunal would have to assess whether the legal route used has been non-genuine, i.e. not put in place for valid commercial reasons, and, for that purpose, the Tribunal would have to assess whether the commercial reasons highlighted by the taxpayer are real and of sufficient economic benefit to the taxpayer beyond the mere tax benefit obtained. In the case at hand, it corresponds precisely to the analysis made by the Tribunal. |

Implications

In our view, this case law may be interpreted positively when it comes to the redemption of a class of shares with specific economic rights tracking specific underlying investments, which should be considered as a capital gain and therefore not subject to Luxembourg withholding tax. In such a case, it s unlikely that the redemption of a class of shares would not be seen "as a desire of the taxpayer to divest an underlying investment".

Based on the current case law, it should be ensured that the repurchase of a class of shares can be seen as an act of disposal affecting the substance of the shareholding in the taxpayer. For that purpose, shareholders should lose the "right to a portion of the specified source of underlying income from their investment in the taxpayer's capital". The articles of incorporation should be carefully reviewed when classes of shares are implemented, notably on the different legal and economic rights of each share class.

In addition, when the redemption of share classes is seen as a distribution of dividends from an economic point of view, circumstances in which the taxpayer sets up and subsequently redeemed classes of shares should not correspond to a situation in which the legislator intended to exclude the classification as capital gain for a transaction which, in fact, turns out to be a "disguising of a profit distribution" and thus be seen as an abuse of law.

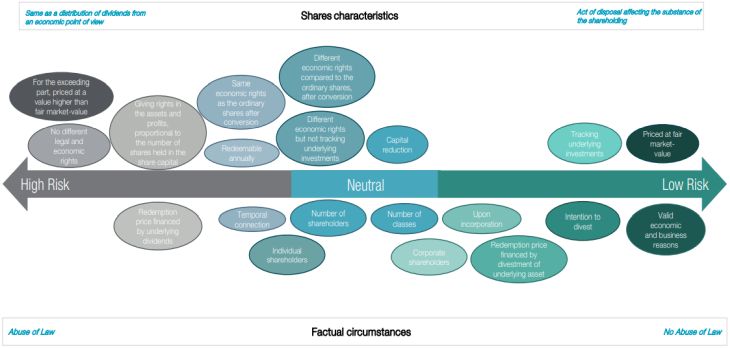

For that purpose, various criteria which could positively or negatively influence the analysis of the redemption of a class of shares as an act of disposal affecting the substance of the shareholding should be taken into account. Please find below certain characteristics and circumstances that, based on the current case law, taxpayers should consider when setting up share classes: on the left, characteristics and circumstances that may raise the attention of the tax authorities - on the right, characteristics and circumstances that should reduce the risk of successful challenge by the tax authorities.

Risk analysis of a share classes redemption based on relevant characteristics and circumstances

No single characteristic or circumstance should be considered as decisive in itself. The analysis of the economic characteristics of classes of shares and whether the set-up and the use of these shares is abusive will need to be analysed on a case-by-case basis. However, share classes structures tracking underlying investments should be "on the safe side" when the redemption price of the shares is set up in the by-laws at fair market-value and the transaction is justified by valid commercial reasons.

Additionally, classes of shares themselves should ideally be used for the repatriation of irregular cash flows to the shareholders (for example, a refinancing or a partial exit) and should ideally not be used for the repatriation of ordinary dividends from underlying investments. In the latter case, there is a risk that the transaction could be seen as the "disguising of a profit distribution" subject to Luxembourg withholding tax.

Conclusion

The decision of the Tribunal reiterates that a share class redemption should, in principle, be treated as a disposal of shares from a Luxembourg tax point of view and therefore should not be subject to Luxembourg withholding tax. In light of the three cases on the subject, this tax classification of the redemption of a class of shares should now be taken as settled law and should not raise any more controversy, which is positive regarding legal certainty for taxpayers.

In this case, the Tribunal also provides us with the first detailed analysis as to whether the use of share classes could be considered as an abuse of law for tax purposes in Luxembourg. In this respect, it should not be overlooked that the present case was very particular and involved some unfavorable facts such as the issuance of share classes without different economic rights, the short time between the creation of the classes of shares and the redemption of the first classes of shares, and the absence of genuine economic reasons for the transaction, which may have led the Tribunal to decide as it did. Even if it might be difficult to derive a definitive conclusion with respect to the risk of abuse of law in the case of classes of shares and their redemption on the basis of this sole ruling, one can nevertheless draw certain lessons from it.

The redemption of classes of shares was assessed taking into account their terms and conditions, as well as the context in which they are set up and their redemption occurs. In this respect, in our view, the current case law should be interpreted positively when it comes to the redemption of a class of shares, in particular with respect to share classes that are equipped with specific economic rights tracking certain underlying investments. The intention to divest, whether at shareholder level or in relation to an underlying investment, should also be considered favorably when it comes to the redemption of a class of shares.

Taxpayers have to carefully draft the articles of incorporation when classes of shares are implemented and review the existing share classes structures. The mechanisms of share classes may vary significantly from one case to another and should be tailored to the situation of the company. The different classes of shares should generally be vested with different economic rights (for example, classes of shares tracking specific investments). Ultimately, the financing of a Luxembourg company should always provide for sufficient flexibility in terms of cash repatriation (considering the expected cash flows and lifetime of the investments) and classes of shares should ideally be used for the repatriation of irregular cash flows to the shareholders (for example, a refinancing or a partial exit).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.