A recent study by KPMG yielded some interesting insights on tax laws worldwide in the area of family business wealth transfers. Specifically, the study looked at how different countries taxed family business that changed hands after retirement or via inheritance, and how those tax rates changed after the available exemptions and reliefs were taken into account. Pre-exemption rates ranged from over 50% down to 0% in both retirement and inheritance scenarios, and many of them dropped sharply post-exemption.

Of course, when it comes to the specific family involved, there are plenty of factors that need to be considered beyond geographical location. The nature of specific tax treatments and the available exemptions and reliefs could considerably affect a family's attitude when it comes to when and how to transfer the family business. Whereas sometimes it's more beneficial to transfer the business upon the owner's decease instead of during his/her lifetime, this can lead to the younger generation feeling disadvantaged by the fact that they do not "own" the business that they are helping to grow.

It is heartening to see that, generally, countries are supporting and encouraging investment and growth in family businesses, with low tax liabilities for the transfer of businesses to the next generation either upon retirement or inheritance. Where tax is due, many countries have mechanisms that allow for payments to be paid in instalments or deferred.

Family business succession through inheritance

Consider a fictional businessperson, John Smith, who has owned his family business, Oakwood, for over ten years. After investing €1 million to establish the company, he has worked hard over the years increase its value to €10 million on an arm's-length, third-party basis (which includes €5 million of goodwill). All assets in the company are used for the purposes of the business.

John's wife Sarah died in 2010 and he has one daughter, Anna, who is 35 years old. Unfortunately, John died in early 2015 and his will passes the company to Anna, who intends to continue the business for the next 20 years or so. What is the tax impact of John's death?

The answer depends heavily on where the inheritance or retirement occurs. The chart below maps the taxes that would be levied on Anne across the 42 countries surveyed by KPMG. It does not take into account (for the moment) any exemptions or reliefs that may be available due to the asset's nature or to the relationship between the parties involved. 1

As you can see, the disparity is quite big—from over €4 million (40%) in the US, France, the Netherlands, and Australia, all the way down to nil in Poland, Luxembourg, and Croatia—and nearly nil in Norway and Austria.

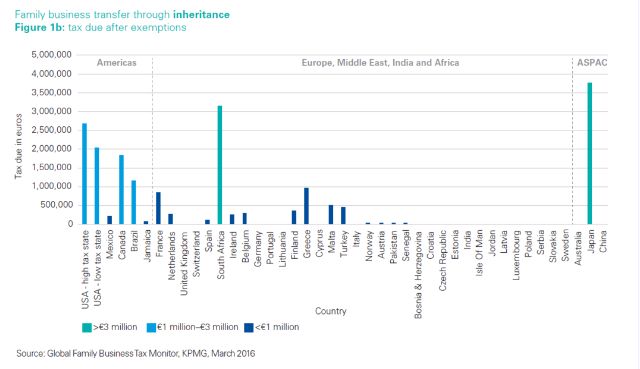

The next chart, however, shows how this outlook changes when exemptions and reliefs are taken into account. As more advanced economies tend to provide generous exemptions to business assets, the end result is often that their treatment of such transfers is closely aligned to that of emerging economies.

We have also presented these findings in map form:

Family business succession upon retirement

Let's return to our fictional friend, John. We'll suppose that his business achievements are the same (with his family business valued at €10 million on an arm's length, third-party basis which includes €5 million of goodwill) but that his health is markedly more stable. He wishes to retire in 2015 and give Oakwood to his 35-year-old daughter, Anna, who intends to keep the business going for the next 20 years or so. The gift is not related to any employment of Anna in the business. What's the tax impact of such a gift, assuming that John lives for at least another decade?

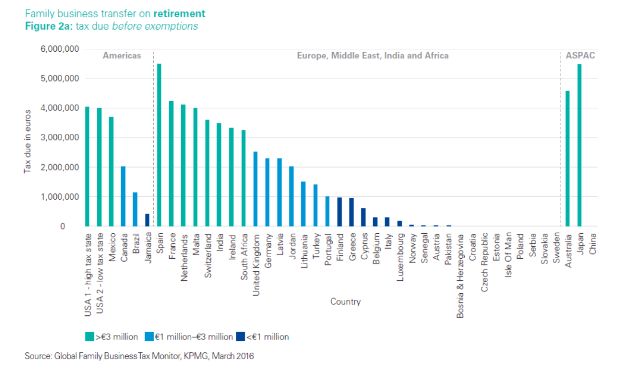

The answer, again, lies in the part of the world where the company is. The graph below again charts the outcome across 42 countries before the application of any exemptions or reliefs, and features a similarly large spread of taxes that would be levied.

p>

p>

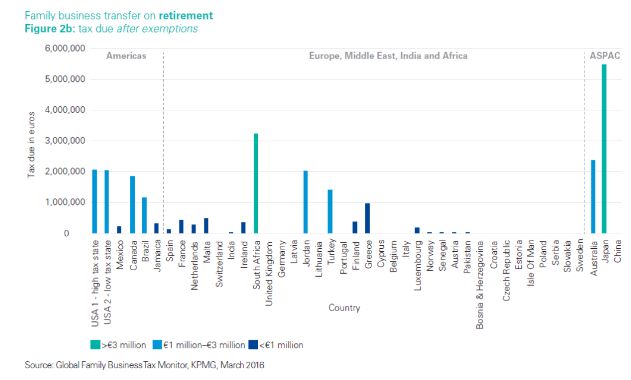

Before any exemptions are applied, greater tax is generally imposed on lifetime gifts of business assets compared to transfers on inheritance (interestingly, the reverse is true post-exemption). The majority of the more advanced economies do offer substantial exemptions in relation to such lifetime gifts, but they often require complex conditions to be fulfilled, calling for the need for proper advice.

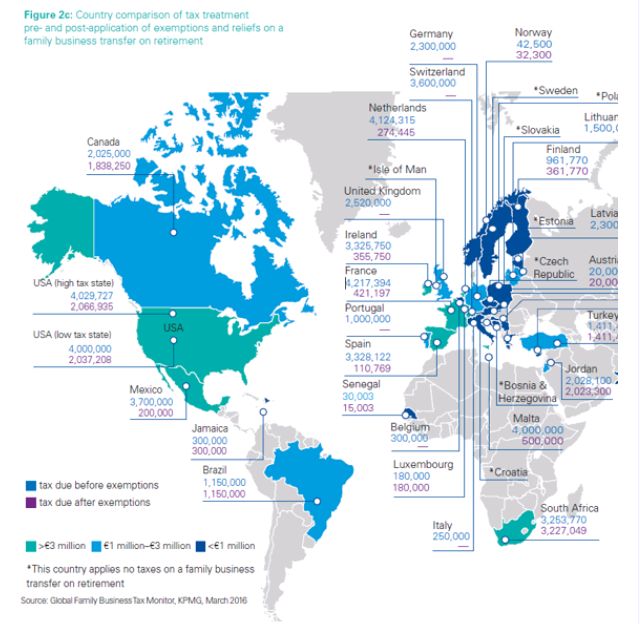

We have also presented these findings in map form:

Read the full report (including the case studies specificities) here.

What to do next?

Families should think ahead about structuring their affairs so as to enjoy the applicable exemptions and reliefs both in inheritance and retirement scenarios. Preparation in this area can go a long way in saving costs. KPMG Luxembourg has a team of dedicated advisors who can help by analysing the ideal moment to transfer the enterprise, with a mind to keep business and family objectives aligned.

Footnotes

1 The exchange rates used for all the graphs in this article were current during the period from June to August, 2015.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.