One-stop-shop approach

Why KPMG?

Our team is specialised in family businesses and cross-border tax, and we are passionate about addressing the needs of family offices and about helping the actors in Luxembourg's private banking / wealth management landscape. We want to become your adviser of choice, and to offer you the strategic support needed to help you win clients' and your own daily business success.

Our values

Our strongly committed team is what makes KPMG the idea adviser to help you find and implement the solutions best suited to your business challenges.

We bring:

- extensive experience in private banking

- established communication channels among the relevant players in Luxembourg finance

- close and long-term relationships with our clients

Our approach

With evolving international tax rules demanding more and more transparency, alongside ever changing economic conditions, the business landscape is only growing in complexity. It has become all the more important to have immediate and innovative answers.

In this context, running a family office comes with a unique set of challenges—but also opportunities.

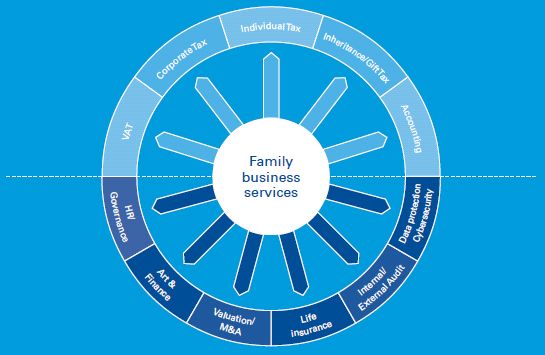

Our 'best in class' value proposition allows you to choose from our palette of integrated services, meaning you can leverage the KPMG difference to work for your needs in the most efficient way.

Our team of experts is ready to step in to support professionals, including family offices and private bankers. We offer:

- a dedicated central point of contact that can align input from multidisciplinary teams

- interconnected cross-border solutions

- personalised and innovative strategies for our clients

- assistance with every step, from the brainstorming to the implementation phase

Our services

Corporate tax

We provide tailor-made national and international corporate tax services, including advising on asset finance, corporate debt issues, all outbound and inbound tax issues, and a complete overview of the risks and opportunities that may arise following a given operation.

Indirect tax

We are devoted to providing you with innovative VAT solutions but also to handling the "day to day" implementation of those VAT solutions. We do not undertake this process without building a close and strong relationship with you, alongside an accurate understanding of your business methods.

Accounting

We see the active management of corporate tax as a core business discipline, and help businesses with tax accounting and provisions.

Individual tax

We provide the full range of mobility services to high-net worth individuals, international firms, local companies, as well as to impatriates and expatriates.

Additional services

We also offer help with human resources, family governance, art and finance, valuation, M&A, internal & external audit, life insurance, data protection and cybersecurity, and other areas.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.