As we approach the end of a tumultuous year, where the UAE in particular has seen a range of legislative measures being introduced focussing on asset protection and safeguarding the wealth of family run businesses in the GCC, I wanted to share the below questions and answers conversation with Dr. Bhaskar Dasgupta of the Abu Dhabi Global Market ("ADGM"), where we discuss the key features of ADGM foundations and illustrate how families can benefit from establishing succession planning structures in the ADGM.

Special edition: questions and answers with the ADGM

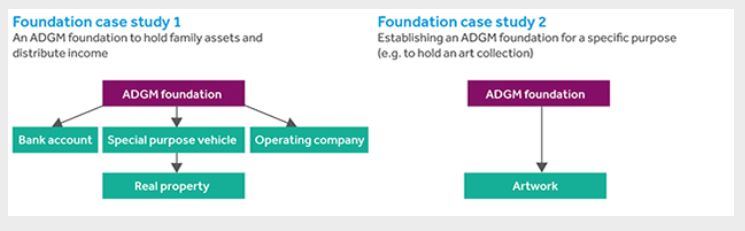

Q.1. How can an ADGM foundation be effectively used for succession planning and restructuring purposes? Please illustrate with an example of a typical structure.

Foundations provide an alternative to trusts for financial planning and structuring. The key difference is that unlike trusts, foundations are incorporated as a legal entity with their own legal personality. They are like companies but without shareholders. A foundation is established by a founder and holds assets in its own name on behalf of beneficiaries and must be established with lawful objectives.

Foundations allow high net worth individuals, families and the corporate community to establish a structure which assists in wealth management and preservation, family succession planning, tax planning, asset protection, segregation of assets, corporate structuring, etc. For example, transferring ownership of assets to a foundation to hold family assets ranging from business interests, property, financial investments, alternative assets, etc. allows very clear, single source, common law governed instructions to be legalised as to the transfer of assets upon succession. This offers a higher degree of certainty and comfort that the assets will be distributed in accordance to the founder's wishes, with the lifespan of the foundation continuing in perpetuity after the founder's death.

Below are two illustrations of how an ADGM foundation can be structured:

Q.2. What types of assets can be owned by an ADGM foundation?

Business assets, immoveable property, financial investments, alternative assets, art, high value possessions etc. can all be held in a foundation, subject to certain conditions.

Q.3. Can ADGM foundations be used for charitable and philanthropic activities?

ADGM foundations can be used for charitable and philanthropic purposes, provided they are properly structured and comply with UAE laws.

Q.4. How can existing operational businesses in the GCC be transferred into an ADGM foundation, without disrupting the existing business set up?

The transfer of existing operational businesses in the GCC or elsewhere is straightforward as, typically, the founder simply transfers ownership of an asset, such as an operating business, provided such change of ownership is permissible. The ADGM Foundations Regulations expressly permit migration of foundations established in certain other jurisdictions into the ADGM.

Q.5. Which land departments in the UAE recognise ADGM foundations as an acceptable entity to hold property?

The ADGM has signed a memorandum of understandings with Abu Dhabi, Dubai, Ajman and Umm Al Quwain. We are discussing potential agreements with other Emirates.

Q.6. Can an ADGM foundation be Sharia' compliant?

ADGM foundations offer sufficient flexibility to enable Sharia' compliant operations when necessary. Provided the foundation complies with the ADGM Foundations Regulations, there is nothing that would prevent the application of general Sharia' principles to the governance of an ADGM foundation.

Q.7. In the event of a conflict between the ADGM laws and Sharia' law, which law would prevail and why?

As a starting point, an ADGM foundation is governed by the ADGM laws and falls within the exclusive jurisdiction of the ADGM Courts. An ADGM foundation should not be used as a tool to circumvent the succession principles of Sharia' law.

If the ADGM foundation is properly structured and Sharia' compliant, (as confirmed by Sharia' scholars), conflicts between Sharia' law and ADGM laws should not arise.

Should a conflict of laws arise, (i.e. in the unlikely event of a dispute), subject to where the foundation assets are located, what claims are made against these assets etc, questions as to which law would prevail and which court would have jurisdiction to determine the matter would depend on the particular facts of each case. Accordingly, we strongly encourage prospective founders to seek independent legal advice prior to establishing a Sharia' compliant foundation.

Q.8. What makes the ADGM foundation a more attractive option for succession planning purposes, as opposed to using a Holding Company or traditional trust structures that we see more often used in other jurisdictions?

The key point of using a foundation is to have a structure with legal presence which insulates the assets from unwanted external influences including death or other life events. A holding company is suitable, however, a foundation that hold the rights and ownership to the holding company or operating company, insulates and protects the assets.

Trusts do not have a legal personality, unlike a foundation, which means that many commercial activities such as signing contracts cannot be completed by trusts. The trustee has a fiduciary duty and is personally accountable whilst a foundation's councillors act on behalf of the foundation but do not assume personal liability. Both are private from the perspective of documents, although the foundation's charter is a public document.

Finally, the foundation's council does not owe duties to beneficiaries (who have very limited rights), whereas trustees must act in the best interests of the beneficiaries. This potentially makes a foundation a far more flexible vehicle than a trust.

Q.9. Are ADGM foundations subject to the amended Economic Substance Regulations (Cabinet Resolution No. 57 of 2020)?

No, foundations are outside the scope of the Economic Substance Regime ("ESR") - please refer to the UAE Ministry of Finance ESR website at: https://www.mof.gov.ae/en/strategicpartnerships/pages/esr.aspx.

Q.10. Have you seen an ADGM Foundation structure being used for other corporate activities? Please illustrate with an example to demonstrate the versatility of the foundation structure.

Foundations in ADGM can be used for a variety of purposes, including wealth management and preservation, family succession planning, tax planning, asset protection, corporate structuring and for public interest purposes. In addition, foundations may be used as a vehicle to hold charitable endowments; please refer to the "Charitable Endowments in ADGM Guidance" paper for further information.

Q.11. What are the additional benefits of establishing a foundation structure in the ADGM, as opposed to other jurisdictions?

We cannot comment on other jurisdictions. However, the ADGM offers a number of structural advantages, including:

- Reputation - ADGM is a world-class, reputable and untainted jurisdiction.

- Tax - ADGM has a very favourable tax environment with 0% corporate tax rate (established by law for 50 years), 0% personal income tax, no withholding taxes, no restrictions on repatriation of profits and the ability to access one of the widest network of Double Tax Treaties in the world.

- Legal framework - world-class legal framework, underpins secure and flexible foundations regime. Common law is directly applicable, which provides high levels of legal certainty with flexibility for additional amendments to regulations as required.

- Independent ADGM Courts - with judges drawn from the most senior levels of the world's leading common law jurisdictions, with extensive experience and long-standing, strong traditions in judicial independence.

- Wealth management focus - ADGM foundations are complimented by ADGM's position as a wealth management centre, including service providers.

- Client confidentiality - ADGM Foundations Regime balances preserving client confidentiality while maintaining transparency of ownership by splitting the formation process into two separate elements - public and private - through the use of the Foundation Charter and by-laws.

- Asset protection - ADGM foundations regime recognises the importance of protecting the rights of beneficiaries and preserving the foundation's assets, and contains important asset protection mechanisms in-built into the regulations to protect foundation assets from bankruptcy claims, from personal claims in the event of divorce and from the effect of forced heirship rules.

- Award winning jurisdiction - ADGM is an award-winning jurisdiction which has leading institutions and advisors, efficient fully digital processes and procedures and a world-class infrastructure.

- Track record and complimentary products - With 76 foundations already setup (as of 26th October 2020), it is clearly the most popular jurisdiction in the wider MEASA region to establish a foundation and run your family office and business. In addition, foundations are complimented by ADGM's best in class SPV regime.

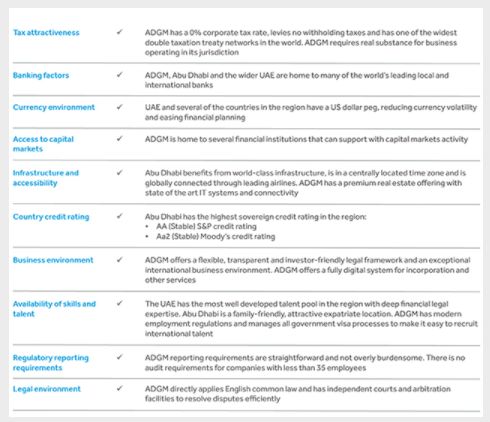

Q.12. Can you tell us why the ADGM provides an excellent ecosystem for foreign businesses who are considering the Middle East as an alternative trade and investment hub?

In addition to the points mentioned above, ADGM firms are considered to be registered UAE firms with 100% foreign ownership allowed. ADGM firms are also allowed to bid for Abu Dhabi inc. firms under the Abu Dhabi In-Country Value Programme adopted by firms such as ADNOC, ADLAR, Mubadala, ADP, AD DED, ENEC, etc. The ADGM is one of the fastest growing regional treasury hubs for the wider region with unparalleled connectivity (one third of the world population within 4 hours flight time and two thirds of the population within 8 hours flight time). In other words, 60% of global GDP is accessible within 7 hours.

The below table also highlights some of the advantages:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.