Seyfarth Synopsis: The data and analysis from workplace class action rulings, case filings, and settlements showed that change is the new normal in 2020-2021. As many pro-business precedents continued to roll out and take hold in 2020, voters elected to turn the White House from red to blue and, as a result, likely precipitated changes in numerous areas that will expand worker rights. Along with changes in the arbitration landscape, the shift in Administrations is likely to bring increased regulation of businesses, renewed enforcement efforts, and policy changes at the agency level that will result in efforts to abandon or overturn pro-business rules of the Trump Administration.

With the final election results in, and the White House set to turn "blue" for the next four years, employers can expect this change to bring shifts to the workplace class action landscape. Employers should anticipate that, while leadership of the EEOC will remain in place through the short-term, the Biden Administration will bring policy changes on other fronts that may take shape through legislative efforts, agency action and regulation, and enforcement litigation.

Contrary to the pro-business approach of the Trump Administration, many of these efforts may be intended to expand the rights, remedies, and procedural avenues available to workers and, as a result, have the potential to shake up the workplace class action landscape in several areas.

The U.S. Supreme Court issued one of the most transformative decisions on class action issues – Epic Systems Corp. v. Lewis, 138 S. Ct. 1612 (2018) – during the Trump Administration. In Epic Systems, the Supreme Court reaffirmed that the Federal Arbitration Act requires courts to enforce agreements to arbitrate according to their terms, including mandatory agreements with terms providing for individual proceedings and class action waivers. Epic Systems profoundly impacted the prosecution and defense of workplace class actions in 2020 as it led to more front-end attacks by employers on proposed class and collective actions, and the dismantling of more workplace class and collective actions. Clearly, workplace arbitration agreements with class action waivers are one of the most potent tools of employers to manage their risks of class action litigation.

As the Biden Administration takes office, however, advocates for workers and labor may ramp up their activities and efforts to shift this landscape. If Democrats regain control of the Senate during the Biden Administration, employers may see new legislative efforts to overturn the Epic Systems regime and eventually may see those efforts gain traction and succeed in altering the force of the Federal Arbitration Act in the workplace.

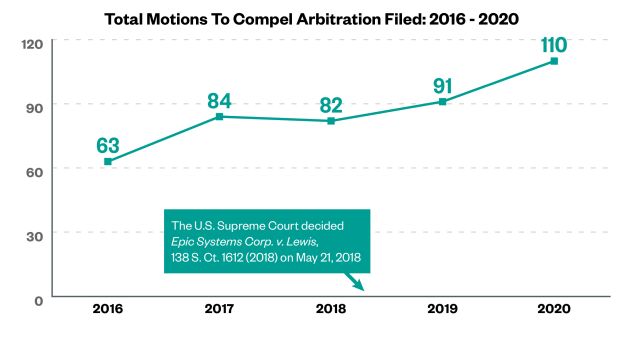

In the time period since the Supreme Court decided Epic Systems, businesses facing class action lawsuits have filed more motions to compel arbitration and with a higher rate of success than in the years before this landmark decision. While this trend was likely fueled by other factors as well – such as the simplicity and cost-effectiveness of arbitration and the Supreme Court's other "pro-business" arbitration rulings in recent years – the latest class action litigation statistics show that motions to compel arbitration have become an increasingly effective defense to class action lawsuits since Epic Systems. The following graphic highlights the number of motions to compel arbitration that were filed, granted, and denied from 2016 to 2020:

Along with the arbitration landscape, the shift in administrations is likely to bring efforts to roll back pro-business rules promulgated under the Trump Administration. The U.S. Department of Labor (the "DOL"), in particular, is apt to attempt to shift priorities on multiple fronts under the Biden Administration. As a key element of Biden's platform, he decried "wage theft" and claimed that employers "steal" billions each year from working people by paying less than the minimum wage. As a candidate, Biden represented that he would build on efforts by the Obama Administration to drive an effort to dramatically reduce worker misclassification. Such statements, among others, signal that the Biden Administration will take efforts to reverse pro-business measures of the DOL under the Trump Administration that arguably narrowed application of minimum wage and overtime requirements.

On January 12, 2020, the DOL announced a final rule to revise and update its regulations interpreting joint employer status under the Fair Labor Standards Act (the "FLSA"). In the joint employer rule, the DOL provided updated guidance for determining joint employer status when an employee performs work for an employer that simultaneously benefits other individuals or entities, including a four-factor balancing test that considers whether the potential joint employer: (i) hires or fires the employee; (ii) supervises and controls the employee's work schedule or conditions of employment to a substantial degree; (iii) determines the employee's rate and method of payment; and (iv) maintains the employee's employment records. Important for employers, the DOL clarified that an employee's "economic dependence" on a potential joint employer does not dictate whether the entity is a joint employer under the FLSA and that a franchise or similar business model does not make joint employer status under the FLSA more or less likely.

After the joint employer rule became effective on March 16, 2020, 17 states and the District of Columbia filed suit alleging that the regulation violated the Administrative Procedures Act. On June 29, 2020, Judge Gregory Wood of the U.S. District Court for the Southern District of New York, in New York v. Scalia, No. 20-CV-1689 (S.D.N.Y. June 29, 2020), granted a motion to intervene filed by several business groups and, on September 8, 2020, vacated a portion of the rule. On November 6, 2020, the DOL and business groups appealed to the U.S. Court of Appeals for the Second Circuit. After Biden takes office, the DOL almost certainly will drop its participation in the appeal and, if the business groups fail, aim to issue joint employer regulations more consistent with Obama-era guidance.

On September 22, 2020, the DOL also unveiled a proposed regulation regarding classification of workers as independent contractors. In the proposed regulation, the DOL adopted a shorter, simpler test for classifying workers as independent contractors rather than employees covered by federal minimum wage and overtime law. It adopted an "economic reality" test and clarified that the concept of economic dependence turns on whether a worker is in business for himself or herself (i.e., as an independent contractor) or is economically dependent on a potential employer for work (i.e., as an employee). The proposed rule described five factors that should be examined as part of the economic reality test, including two "core" factors – (i) the nature and degree of the worker's control over the work; and (ii) the worker's opportunity for profit or loss – that are afforded greater weight in the analysis.

The DOL subsequently fast-tracked the rule-drafting and public-comment process in an effort to solidify the regulation before President Trump left office and thereby provide employers a persuasive tool to fend off class actions accusing them of improperly classifying workers as independent contractors. The DOL under President Biden will have the authority to – and likely will – suspend the rule, along with any other Trump Administration regulation that failed to take effect before the transfer of power on January 20, 2021. Nonetheless, employers can expect business groups to defend the regulation, particularly in light of its favorable impact for the gig economy and other industries.

On November 25, 2020, the DOL also submitted a long-anticipated final rule to the White House Office of Information and Regulatory Affairs that would clarify the tip credit for hospitality industry employers. If adopted as proposed, the rule would allow employers to pay tipped employees a minimum wage of $2.13 per hour regardless of the amount of time they spend on non-tipped duties, such as cleaning their work stations. The new measure would eliminate the so-called 80/20 rule, which first appeared in the DOL's Field Operations Handbook, and required that, when tipped employees spend more than 20% of their workweek performing general preparation work or maintenance, their employers must pay full minimum wage for the time spent in such duties. Even if the DOL completes the rule before January 20, 2021, however, it will face an uncertain future once President Biden takes office. Similar to the joint employer rule, Democratic state attorneys general are likely to challenge the rule under the Administrative Procedure Act, and the Biden DOL is likely to embrace a return to the less-employer-friendly pre-Trump interpretations of the tip credit rules.

In sum, whereas employers saw an array of business-friendly rules promulgated by the Trump Administration, their futures remain uncertain as the Biden Administration takes charge. Employers can expect multiple shifts and realignments of rulemaking and enforcement priorities that may fuel and shape the contours of workplace class action litigation, particularly on the wage & hour front.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.