Editor's Note

As 2012 has now come to a close, there is no dearth of exciting (at least to us) tax events to report in this issue of Tax Talk. Indeed, as we go to print, the final FATCA regulations have been made public and will be published in the Federal Register on January 28, 2013. For more on the final regulations, please see our upcoming client alert. Perhaps the most significant of all is the deal struck by the President and Congress to avert the so-called "fiscal cliff." With heated negotiations continuing until the waning hours of 2012, the American Taxpayer Relief Act of 2012 was enacted and signed into law just as the new year dawned. Tax Talk 5.4 brings you all of the major details of this important year-end tax legislation.

Muffled by the brouhaha surrounding the expiring Bush tax cuts and the fiscal cliff, the new 3.8% Medicare tax on "net investment income" took effect on January 1, 2013. The IRS recently issued proposed regulations fleshing out the specifics of this tax, which was enacted as part of the Patient Protection and Affordable Care Act, known colloquially as "Obamacare." Tax Talk spells out the details on these proposed regulations, and individuals with adjusted gross income of more than $200,000 and married couples filing jointly with adjusted gross income of more than $250,000 will definitely want to pay attention.

The Medicare tax regulations were by no means the only regulations issued by the government this past year. The IRS was also busy publishing regulations concerning when property will be treated as "publicly traded" for purposes of determining the issue price of certain debt instruments. These regulations will have wide reaching implications for assessing whether a debt instrument is issued with original issue discount or whether there is cancellation of debt income on debt-for-debt exchanges.

Continuing Tax Talk's long running love-hate relationship with the Foreign Account Tax Compliance Act ("FATCA") ( www.KNOWFatca.com), this issue also provides updates on a number of FATCA intergovernmental agreements. Most recently, Denmark, Mexico, and Ireland have inked agreements with the U.S. Like the agreement entered into earlier this year with the United Kingdom, these agreements also provide for information sharing and alleviate the burden of complying with FATCA for those participating financial institutions in their respective partner FATCA countries.

The IRS also issue a number of advice memoranda, including field advice regarding what constitutes stock ownership for purposes of determining whether a subsidiary is part of a parent's affiliated group – important stuff when it comes to filing a consolidated income tax return. The IRS also issued field advice concerning application of the common law economic substance doctrine to securities lending transactions. It wouldn't surprise us if these types of stock loans received an increased scrutiny by IRS field personnel.

A recent case, LPCiminelli Interests, Inc. v. United States, provided a taxpayer victory with respect to income allegedly generated by a subsidiary's excess loss account. This case also arose in the context of the consolidated income tax return rules.

As always, our regular section, MoFo in the News, concludes this issue of Tax Talk. On January 1, 2013, the Senate and the House of Representatives passed the American Taxpayer Relief Act of 2012 ("ATRA"), averting the so-called "fiscal cliff." The legislation, which was signed by President Obama on January 2, 2013, includes several major changes to the Internal Revenue Code (the "Code"), the most important of which are outlined below.

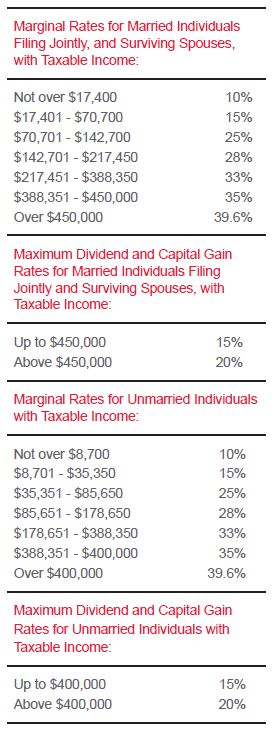

The most contentious part of the year-end "fiscal cliff" negotiations involved whether individual tax rates would increase for "high-income taxpayers," with both parties agreeing early that rates should not be increased for most taxpayers. The Obama administration initially would have defined "high income" for single taxpayers and married joint return filers at taxable incomes of $200,000 and $250,000, respectively. The compromise under ATRA defined high-income single and married taxpayers as those having taxable income above $400,000 and $450,000, respectively. As a result, the regular income tax rate for high-income taxpayers will increase from 35% to 39.6% on taxable income over these thresholds, while rates for other taxpayers will be unchanged.

ATRA also made permanent the 2003 reductions in preferential tax rates applicable to qualified dividends and longterm capital gains, except for high-income taxpayers, so that the highest applicable rate on this type of income will remain at 15% for most taxpayers. For high income taxpayers with taxable income over the $400,000 or $450,000 threshold, the preferential rates for dividends and long-term capital gains will be 20% on the excess of such income over the threshold.

New Tax Rates

The chart below shows the marginal rates for individual taxpayers.1 Other individual tax changes include:

- Before 2010, certain itemized deductions, including deductions for mortgage interest, state and local taxes, and charitable gifts, were reduced based on adjusted gross income in excess of a specified threshold. ATRA revives these deduction phase-outs for single taxpayers with adjusted gross incomes above $250,000 and couples with adjusted gross incomes above $300,000. Similar rules apply to the phase-out of personal exemptions. The total amount of itemized deductions for each such taxpayer is reduced by 3% of the amount by which the taxpayer's adjusted gross income exceeds the threshold amount, with the reduction not to exceed 80 percent of the otherwise allowable itemized deductions. These limitations do not apply to the deductions for medical expenses, investment interest, non-business casualty and theft losses, and gambling losses.

- ATRA does not extend the 2 percent payroll tax holiday that has been in effect for the two years ending December 31, 2012, and payroll tax rates therefore will immediately increase to 6.2 percent (up from 4.2 percent).

- ATRA permanently adjusts the individual alternative minimum tax ("AMT") exemption amount to take into account the effects of inflation. The AMT previously was not automatically adjusted for inflation and therefore had the potential each year to affect more taxpayers who were never intended to be covered by the AMT. ATRA is designed to eliminate the need for periodic "AMT patches" that increased the exemption amount for inflation since its original enactment. The changes to the AMT are effective retroactively to taxable years beginning after December 31, 2011.

- Under ATRA, cancellation of indebtedness income that is from "qualified principal residence indebtedness" will be excluded from income so long as the debt is discharged before January 1, 2014. This represents a one-year extension of prior law. Additionally, taxpayers will continue to be able to deduct state and local sales taxes for taxable years beginning before January 1, 2014, a two-year extension.

- Taxpayers ages 70 ½ or older will continue to be able to make tax-free distributions from individual retirement plans directly to charitable organizations until December 31, 2013. Additionally, ATRA makes it much easier for taxpayers to convert their existing retirement savings into Roth IRAs.

- ATRA makes permanent the unified estate and gift tax exemption that applied during 2012. As a result, taxpayers can make up to $5 million (which will be indexed for inflation, currently $5.12 million) of total gifts during their lifetime and at death without being subject to estate or gift tax. ATRA also increases the top rate on estates that exceed the exemption amount, from 35 percent to 40 percent.

- ATRA extends several tax credits for individuals. In particular, the child tax credit and the earned income tax credit were extended for five years.

- The exclusion from gross income for gains on qualified small business stock was 50 percent for investments made up until February 17, 2009, 75 percent for investments made from February 17, 2009 through September 27, 2010, and 100 percent for investments made from September 28, 2010 through December 31, 2011. ATRA extends the 100% exclusion to gains on all investments in qualified small business stock made through the end of 2013 (provided that the minimum 5-year holding period requirement is satisfied at the time of the sale).

Changes for Businesses

In addition to changes in the taxation of individuals, ATRA contains a number of important business tax provisions:

- Foreign shareholders in regulated investment companies are now allowed to continue to receive "interest-related dividends" free of U.S. withholding tax through taxable years ending in 2013. This represents a two-year extension compared to prior law.

- ATRA extends exclusions from Subpart F income for "exempt interest income" and "qualified banking or financing income."

- ATRA reinstates the Subpart F "lookthrough rule" that excludes samecountry dividends and interest from Subpart F income. This will facilitate tax planning for multinationals.

- Businesses will be able to take advantage of an extension of the research credit under section 41, as well as several energy credits. Most notably, the production tax credit was extended for all wind energy projects that "begin construction" by the end of 2013. In addition to extending the production tax credit, other credits, including those for biodiesel, cellulosic ethanol, electric vehicles, and energy efficient homes and appliances, were also extended.

- Corporations converting to S corporation status are subject to a corporate level tax on certain gains that economically accrued before the conversion to S status ("built-in gains"). This tax is generally imposed if the built-in gain is recognized by the corporation during a subchapter S year that begins during the 10- year period following the effective date of the S election. This 10-year "recognition period" was reduced to seven years for taxable years beginning in 2009 and 2010, and then was reduced to five years for taxable years beginning in 2011. The recognition period was scheduled to revert to the full 10-year period for taxable years beginning in 2012. ATRA extends the application of the five-year recognition period for two more years so that it will apply to taxable years beginning in 2012 and 2013. The shortened recognition period rule also prevents imposition of a built-in gain tax on installment sale gains in later years, provided that the installment sale itself occurred during a taxable year in which the shortened recognition period would have otherwise prevented imposition of a built-in gains tax.

- Significantly more favorable limitations on deductions under section 179 were extended for another year, and were also made applicable retroactively to taxable years beginning in 2012. Whereas prior law limited the amount of bonus depreciation to $25,000 for taxable years beginning after 2012, ATRA extends the $500,000 limitation to taxable years beginning in 2012 and in 2013. In addition, the applicability of "bonus depreciation" under section 168(k) has been extended for another year. "Bonus depreciation" allows taxpayers to immediately deduct 50 percent of the adjusted basis of certain types of property. Under prior law, certain types of property would no longer have been eligible for this deduction as of January 1, 2013.

CoCo Developments

2012 was an active year for issuers and investors in contingent convertible bonds or "CoCo"s. Most significantly in Q4 Barclays priced a $3 billion ten year SEC-registered CoCo on November 13th. Yield starved investors oversubscribed the offering to get at the 7.625% coupon. The price of the coupon, however, is that the instrument's full principal amount is written down if Barclay's common equity tier one capital drops below 7% (it is currently at 11.2%). The only problem from a U.S. perspective is that U.S. regulators have not warmed to the idea of contingent convertible bonds. Instead, they have focused on so-called senior debt "bail in" to bail out U.S. banks in times of trouble. Accordingly, Tax Talk is sitting on the side lines on CoCos, at least from a U.S. tax standpoint. However, our UK colleagues advise that the Barclays instrument is expected to qualify as debt for UK tax purposes and coupon interest would, as a result, be tax deductible. Generally, however, as the UK government has reached no firm policy decision regarding the tax deductibility of convertible instruments, there is a risk of interest on convertible notes not being tax deductible in the future.

Tax Effect of Money Market Fund Proposals

There have been several proposals to reform the regulation of U.S. money market funds ("MMF"s) after the 2008 financial crisis. Some of the proposals would require certain money market funds, particularly so-called "prime" funds, to adopt a floating "net asset value." Not much has been written about the tax consequences of using a floating NAV, however. For existing MMFs that maintain a $1 per share NAV, the tax treatment is fairly simple. The investor does not recognize gain or loss on redemption of the shares when she has purchased and sold them at $1 per share. On the other hand, a floating NAV could be a tax nightmare. Say an investor buys 100,000 MMF shares for $1 each. The next day, she uses the check writing feature on her account to write a $1000 check. Suppose that, on that day, the MMF's NAV is $.99. Investor must redeem 1,011 shares to obtain the necessary $1000. She has suffered a loss on the shares of $.01 per share or $10.11. If she does this every day, her Schedule C (Capital Gains and Losses) would be unmanageable.

In November, the U.S. Financial Stability Oversight Counsel (FSOC) issued a report: "Proposed Recommendations Regarding Money Market Mutual Fund Reform." ("White Paper"). The FSOC White Paper sets forth three alternatives, one of which would be a floating NAV for MMFs.2 In terms of tax consequences, the White Paper notes that "A floating NAV for MMFs also would present certain federal income issues for MMFs and their investors." However, it goes on to say that the FSOC "understands that the Treasury Department and IRS will consider administrative relief for both shareholders and fund sponsors" and that they have indicated they will consider "expansion or modification" of basis reporting rules and administrative relief for de minimis losses on floating-NAV MMF shares. It is unclear, however, whether administrative guidance can prevent a shareholder from recognizing section 1001 gains or losses when it redeem its MMF shares for more or less than the amount paid.

IRS Issues Final Regulations on Publicly Traded Property

On September 12, 2012, the IRS promulgated final regulations detailing when property will be treated as "publicly traded" for purposes of determining the issue price of debt instruments under Section 1273. A debt instrument's issue price has important implications for determining whether there is any original issue discount associated with the debt, or whether cancellation of debt income is recognized on debt-for-debt exchanges.

Under existing law, a debt instrument issued for property will have an issue price equal to its fair market value if the debt instrument is either (i) part of an issue some or all of which is traded on an established securities market, or (ii) issued for publicly traded property. The new regulations expand the number of situations in which property (including debt) is treated as publicly traded.

Under the new regulations, property is "publicly traded" if any of three conditions are met at any time during the 31-day period ending 15 days after the issue date.

First, property is treated as publicly traded if there is a sales price for the property. This condition is met if the sales price (or information sufficient to calculate the sales price) appears in a medium that is made available to issuers of debt instruments, persons that regularly purchase or sell debt instruments, or persons that broker purchases or sales of debt instruments.

Property will also be treated as publicly traded if there are firm quotes for the property. A firm quote exists if there is a price quote that is available from at least one broker, dealer, or pricing service and the quoted price is substantially the same as the price for which the person receiving the quoted price could purchase or sell the property. The identity of the person providing the quote must be reasonably ascertainable.

Finally, property is treated as publicly traded if there are indicative quotes for the property. An indicative quote is a price quote provided by at least one broker, dealer, or pricing service that is not a "firm quote" described above.

Notwithstanding these rules, a debt instrument will not be considered publicly traded if, at the time the determination is made, the outstanding stated principal amount of the issue that includes the debt instrument does not exceed $100 million (or the equivalent of this amount, if the debt is denominated in a foreign currency).

The fair market value of publicly-traded property is presumed to be the sales price, the firm quote price, or the indicative quote price, as the case may be. If more than one of these prices is available, a taxpayer is allowed to use any reasonable method, consistently applied, to determine the fair market value. In cases where there are only indicative quotes of property and a taxpayer determines that the indicative quote materially misrepresents the fair market value of the property, the taxpayer may use any reasonable basis to determine the fair market value of the property, so long as the taxpayer establishes that the method chosen more fairly reflects the value of the property.

The final regulations also liberalize the rules under which an issuance of debt will be treated as a "qualified reopening." Additional debt instruments issued as part of a qualified reopening are treated as part of the original issuance, and as a result, have the same issue date and issue price as the original issuance. The final regulations now permit reopenings for nonpublicly traded debt, as long as the debt is issued for cash and satisfies the other requirements for a qualified reopening. The rules also allow reopenings occurring 6 months or later after the original issuance, as long as the yield of the additional debt instruments is not greater than the yield of the original debt instruments as determined on the date of the original issuance. Under prior law, a qualified reopening was only permitted within six months of the original issuance.

Assessment of Income from Excess Loss Account Barred

In LPCiminelli Interests, Inc. v. United States,3 the taxpayer sued the government to recover approximately $1.2 million in taxes paid. At issue in LPCiminelli was the treatment of approximately $3.5 million in unpaid accounts payable from the taxpayer's wholly-owned subsidiary. The court ultimately ruled that the tax assessment was barred by the applicable statute of limitations, and it awarded a full refund, including interest.

The taxpayer, LPCiminelli Interests, Inc. ("taxpayer"), was a corporation engaged in the construction business. It was the sole owner of a subsidiary, Cowper Construction Company ("Cowper"), which was also engaged in the construction business.

Cowper was a member of a group of companies owned by the taxpayer and consolidated for tax reporting purposes. Although the factual record was not entirely clear, Cowper stopped operating in about 2003. At that time, it had approximately $3.5 million in unpaid accounts payable and a small amount of cash. The IRS audited the consolidated tax return, and issued a tax assessment for approximately $1.2 million in unpaid taxes. The $1.2 million tax assessment arose from the $3.5 million unpaid accounts payable, which the IRS initially claimed was cancellation of indebtedness income for 2004. The taxpayer paid the taxes stated as owed on the assessment and sued for a refund in federal district court.

The taxpayer argued that the cancellation of indebtedness income attributable to the unpaid accounts payable realized by Cowper should have been excluded from the consolidated group's gross income to the extent of Cowper's insolvency. During the course of the litigation, however, the government conceded that the $1.2 million in taxes should not have been assessed on the purported cancellation of indebtedness income. Rather, the government argued that the assessment was proper as a result of income arising from an excess loss account (ELA) related to stock held by the taxpayer. The taxpayer pointed out that the IRS had previously addressed the ELA issue on audit, but had ultimately concluded that the taxpayer had not realized any income in connection with the ELA attributable to Cowper.

In a bench trial, the court found that the taxpayer was entitled to a full refund of the approximately $1.2 million in taxes paid, plus interest. In reaching this conclusion, it addressed two issues. First, an evidentiary issue relating to the government's change of position with respect to the $3.5 million of unpaid accounts payable. Then, when the income arising from the unpaid accounts payable should have been included in the consolidated group's gross income.

With respect to the evidentiary issue, the court held that in reviewing the validity of a tax assessment, a court places itself in the shoes of the IRS. As a result, it did not consider evidence regarding the IRS audit team's underlying opinions, impressions, conclusions, and reasoning for the tax assessment. As a result, although the IRS audit team concluded that no ELA income was realized in 2004, the government was free to raise that argument during litigation.

The court then turned to discuss the ELA income, specifically, when the ELA income was realized and whether the tax assessment related to it was barred by the statute of limitations.

Generally, when the stock of an affiliated subsidiary corporation is disposed of, the remaining members of the affiliated group are required to include the balance in the ELA, if any, as taxable income. Under the relevant rules governing consolidated tax returns, a member is considered to have disposed of all of its shares in the subsidiary on the last day of its taxable in year in which the subsidiary stock is wholly worthless; in other words, when substantially all of the assets of the subsidiary are disposed of, or a debt of the subsidiary is discharged and not included in gross income.

The taxpayer argued that Cowper's stock became worthless before 2004, i.e., in a prior year already foreclosed from tax assessment liability by the applicable statute of limitations. The government countered that the stock became worthless in 2004 and, alternatively, that even if it had become worthless prior to 2004, the assessment was timely by virtue of an "anti-avoidance rule" in the consolidated income tax regulations.

In assessing the relative merits of the parties' arguments, the court noted as a threshold matter that whether stock is worthless is a fact-specific inquiry. Ultimately, the court found that the stock was worthless because Cowper had disposed of virtually all of its assets before 2004, the tax year at issue. The court likewise rejected the government's "anti-avoidance" argument by pointing to the absence of any evidence suggesting that the taxpayer had acted with an improper motive.

As a result, the tax assessment was barred by the statute of limitations, and the taxpayer prevailed.

Covered Bond Act Amended by House Committee

On December 17, 2012, House Ways and Means Committee Chairman Dave Camp sent a letter to the House Committee on Financial Services ("HFSC"), outlining amendments to the Covered Bond Act (the "CBA") that significantly alter the tax treatment of covered bond pools segregated from the issuer's estate after an event of default.

Covered bonds are debt obligations that are recourse either to the issuing entity or to an affiliated group to which the issuing entity belongs, or both. Upon an issuer default, covered bond holders also have recourse to a pool of collateral (known as the "cover pool"), separate from the issuer's other assets.

Currently, the United States does not have any legislation addressing the treatment of covered bonds. Therefore, market participants in the United States have developed a synthetic two-tier structure designed to replicate the protections to covered bond holders afforded by legislation in certain European countries. The CBA, currently under consideration by Congress, seeks to codify the treatment of covered bonds and provide a statutory framework for their issuance.

Under the CBA, an issuer's default results in the issuer's estate being split into two estates with the cover pool being set aside for the benefit of the covered bond holders. This framework would provide certainty to investors as to their rights to payment, and timing of such payments, if the issuer becomes insolvent or is in danger of becoming insolvent.

As originally presented to the HFSC, the CBA provides that the separate estate containing the cover pool is treated as a disregarded entity for tax purposes. Furthermore, the transfer of the cover pool from the issuer to the segregated estate is not treated as a section 1001 event. The proposed amendments to the CBA generally preserve these provisions. Under the amendments, certain transfers of the cover pool continue to be exempt from section 1001. However, the segregated estate is treated as a disregarded entity for tax purposes only if the residual interest in the segregated estate is held by only one person, such person is subject to income tax, and such person is not a regulated investment company or a REIT. Failing these requirements results in the segregated estate being treated as a corporation for tax purposes, subject to corporate level tax on income.

The most significant change to the CBA is the introduction of an excise tax on issuers who default on the covered bonds without subsequently filing for bankruptcy. Such issuers are subject to a tax of one percent of the principal amount of the bonds secured by the cover pool. The tax liability is extinguished (or refunded, if already paid) if the issuer enters conservatorship, receivership, liquidation, or bankruptcy during the 5-year period following the creation of the segregated estate.

Representative Camp and his staff are currently working with the Joint Committee on Taxation to modify the CBA so that it will have minimal or no revenue effect. Therefore, further changes to the CBA may be forthcoming. Representative Camp's letter is a possible indication that the House Committee on Ways and Means is nearing the end of its deliberations and will soon present the bill to the full House for a vote.4

IRS Provides Guidance to the Field on Economic Substance for Securities Lending

On November 5, 2012, the IRS issued guidance to its field personnel regarding application of the common law economic substance doctrine5 to securities lending transactions used to avoid withholding tax.6 The guidance is applicable to certain securities lending transactions entered into by foreign investors before May 20, 2010.

The question at the heart of the IRS's advice memorandum was whether a securities borrower and a foreign securities lender would be liable for gross basis tax under the common law economic substance doctrine when the borrower and lender entered into a securities lending transaction to avoid withholding tax on U.S. source dividends.

In addressing this issue, the IRS concluded that, depending on the facts, the common law economic substance could apply, such that the securities lending transaction would be disregarded. In that case, the putative lender would be subject to the withholding provisions under sections 871 or 881, while the putative borrower could be deemed a withholding agent for purposes of sections 1441 or 1442.

Although the application of the common law economic substance doctrine depends on the specific facts of the securities lending transaction, the IRS described a typical (but complicated) structure of a stock lending transaction designed to avoid U.S. withholding tax.

In the advice memorandum, the parties to the transaction are Foreign Customer and Foreign Affiliate, which is wholly owned by a U.S. financial institution. Foreign Customer owns 3 million shares (the "Reference Shares") of X Corporation, a U.S. corporation. The Reference Shares have a fair market value of $24 million. On March 30, 2007, X Corporation declares a dividend of $0.06 per share, payable on May 4, 2007 to shareholders of record as of April 20, 2007. Then, on April 17, 2007, Foreign Customer lends the Reference Shares to Foreign Affiliate. As part of the stock loan, Foreign Affiliate is required to pay Foreign Customer a substitute dividend equal to 70% of any actual dividends attributable to the Reference Shares. In turn, Foreign Affiliate posts cash collateral with Foreign Customer equal to 102% of the fair market value of the Reference Shares. Foreign Affiliate also agrees to pay Foreign Customer a fee, which is approximately 20% of the gross dividend attributable to the Reference Shares. The fee is structured as a borrowing fee.

Coincident with the stock loan, Foreign Affiliate sells the Reference Shares to a swap dealer for $24 million. Foreign Affiliate then enters into a total return swap with respect to the Reference Shares. The notional amount of the swap equals the price at which Foreign Affiliate sold the Reference Shares to the swap counterparty. Neither Foreign Customer nor Foreign Affiliate will be the record owner of the Reference Shares after the swap. As planned, X Corporation pays a dividend on May 4, 2007, which triggers Foreign Affiliate's obligation to pay Foreign Customer a substitute dividend. Thereafter, on May 7, 2007, Foreign Affiliate terminates the swap and repurchases the Reference Shares from the swap counterparty. Upon termination, Foreign Affiliate receives a net payment equal to the dividend payment and appreciation, if any, less depreciation, if any, on the Reference Shares, and interest, plus a fee. On May 7, 2007, Foreign Customer terminates the stock loan. Foreign Customer returns the cash collateral to Foreign Affiliate, plus any applicable rebate fee. Foreign Customer retains the $36,000 of interest earned on the collateral as a borrowing fee. Foreign Affiliate returns the Reference Shares to Foreign Customer. Finally, Foreign Affiliate retains $18,000 of the payment received pursuant to the swap, equaling 10% of the underlying dividend.

As explained in the advice memorandum, a securities lending transaction, such as the one described by the IRS, may be disregarded by the common law economic substance doctrine. If it is, the tax benefits from the transaction are disallowed, even where the transaction satisfies the technical requirements of the tax law. Generally, the economic substance doctrine requires a taxpayer to show that the transaction has economic substance without taking into consideration any associated tax benefits. To evaluate economic substance, courts have typically applied a two-part test focusing first on the business purpose of the transaction and, secondly, on the economic substance of the transaction apart from its tax effects. These two prongs are generally known, respectively, as the subjective and objective components of the common law economic substance doctrine. In either case, the analysis is highly factspecific.

The IRS concluded that the hypothetical securities lending transaction lacked subjective economic substance. In so doing, it noted several characteristics of the transaction that failed to demonstrate a nontax business purpose, such as the fact that the stock loan had off-market terms, the stock loan was marketed as a means to avoid U.S. withholding tax, Foreign Customer failed to demonstrate a bona fide reason for lending the Reference Shares, and, finally, the stock loan lacked potential to generate any meaningful profit.

Specifically, with respect to the terms of the stock loan, the IRS pointed out that Foreign Customer received a fee that was substantially greater than the borrowing fee paid in a typical bona fide securities loan. To add insult to injury, the IRS explained that this excessive fee was justified because it was subsidized by the government in the form of the tax savings generated by the transaction. Indeed, the IRS explained that Foreign Affiliate received "implicit" compensation in the form of the retained dividend.

Likewise, the IRS determined that the stock loan lacked objective economic substance. Central to its conclusion, the IRS reiterated the fact that Foreign Customer was unable to derive any meaningful profit aside from the tax benefits. However, when the tax benefits were included in the profit computation, the stock loan generated significant profit for the Foreign Customer, as the tax savings realized by avoiding U.S. withholding taxes were shared by the parties through the enhancement fee received by Foreign Customer under the terms of the agreement.

Finally, the IRS cautioned in the advice memorandum that other judicial doctrines, such as the step transaction doctrine, may also apply to disregard securities lending transactions.

IRS Rolls Out FATCA Intergovernmental Agreements

Since the United States announced an intergovernmental approach to FATCA compliance in its joint statement with five European countries earlier this year, the U.S. Department of the Treasury stated its intention to conclude intergovernmental agreements ("IGA"s) with the following countries by the end of 2012: France, Germany, Italy, Spain, Japan, Switzerland, Canada, Denmark, Finland, Guernsey, Ireland, Isle of Man, Jersey, Mexico, the Netherlands, and Norway. This intergovernmental approach provides an alternative means to FATCA compliance for foreign financial institutions doing business in a FATCA partner country.

The U.S. has entered into two varieties of IGAs. The Model 1 IGA requires a foreign financial institution (FFI) to report financial information directly to its own governmental authority, which then automatically transmits such information to the IRS pursuant to an income tax treaty or information exchange agreement. The U.S. Department of the Treasury has published agreements it has signed with the UK, Denmark, and Mexico, which follow the Model 1 architecture.

The U.S. released a Model 2 IGA on November 14. The Model 2 IGA takes a slightly different approach to FATCA reporting and compliance. Under the Model 2 approach, an FFI within a FATCA partner country will be required to report financial information directly to the IRS. Such information may be supplemented with requests by the IRS for information pertaining to recalcitrant account holders or non-consenting account holders pursuant to an information exchange agreement. The Model 2 approach is similar to the method contemplated in the joint statements made by the U.S. and Switzerland and the U.S. and Japan; however, the Model 2 IGA differs in some respects in that it does not require each FFI to enter into a FATCA agreement with the IRS as was contemplated in the Swiss joint statement, rather the Model 2 approach requires FFIs to register with the IRS and, thus, to comply with FATCA requirements.

Notably, the Model 2 IGA contains many similar provisions to the Model 1 IGA.

First, both agreements provide that an FFI may be treated as a participating FFI or a deemed-compliant FFI if certain requirements are met even if such FFI has a related entity or branch in a country which would otherwise prevent it from being FATCA compliant, for example, due to local privacy laws. Both types of IGAs provide a FATCA partner country "most favored nation status" with respect to other jurisdictions. Finally, both IGAs provide for each party's commitment to accomplish certain policy objectives with respect to withholding on foreign passthru payments and gross proceeds, and reciprocal information collection and exchange by the U.S. with respect to the FATCA partner country's accountholders. While the IGAs provide insight into alternative methods for complying with the legislation, the U.S. Treasury Department's soon-to-bereleased FATCA regulations should provide additional guidance with respect to the rules for complying with FATCA.

As of the end of 2012, the U.S. has completed IGAs with the United Kingdom, Denmark, Mexico, and Ireland.

IRS Proposes Regulations on New Medicare Tax

On December 5, 2012, the IRS published proposed regulations under Section 1411, addressing the new 3.8 percent Medicare tax on "net investment income" that took effect January 1, 2013. According to the proposed regulations, the purpose of Section 1411 is to "impose a tax on unearned income or investments of certain individuals, estates, and trusts."

As applied to individuals, Section 1411 imposes a 3.8 percent tax on the lesser of (i) net investment income or (ii) modified adjusted gross income over a threshold amount. Therefore, an unmarried U.S. citizen (who has a threshold amount of $200,000) with modified adjusted gross income of $190,000 and $50,000 of net investment income owes no Section 1411 tax because her modified adjusted gross income does not exceed the threshold amount. If the same unmarried U.S. citizen had modified adjusted gross income of $220,000, however, she would owe tax on 3.8 percent of $20,000, or $760.

The definitions of net investment income, modified adjusted gross income, and threshold amount constitute the bulk of making sense of the Section 1411 tax. Modified adjusted gross income is simply adjusted gross income as defined in Section 62, with certain amounts added back that were excluded by Section 911, pertaining to U.S. taxpayers living abroad. The threshold amount varies depending on the status of the taxpayer. Married taxpayers filing jointly, and surviving spouses, have a threshold amount of $250,000. The threshold amount for married taxpayers filing separately is $125,000. The threshold for all other individuals is $200,000. The proposed regulations specify that threshold amounts do not pro rate for shortened tax years, except in the case of a shortened tax year due to a change in accounting method. Therefore, the threshold amount for an unmarried individual during a six-month tax year remains $200,000.

The definition of net investment income is at the heart of Section 1411, and the proposed regulations. Net investment income comes from three sources. First, net investment income includes income from interest, dividends, annuities, royalties, and rent. These types of income are not included if they were earned in a trade or business, unless it is a trade or business subject to Section 1411 tax (described below). According to the preamble of the proposed regulations, gross income from a notional principal contract is not included under this prong of net investment income, but may be included under the other prongs of net investment income. Substitute dividend or interest payments are also included under this prong.

As described above, these types of passive income are not included in net investment income if it is derived in the ordinary course of a trade or business other than a trade or business subject to Section 1411 tax. General tax principles apply for determining when income is earned in a trade or business, and the preamble to the proposed regulations cites the administrative guidance and case law interpreting Section 162 as guidance for determining when activities rise to the level of a trade or business. An individual earning passive income via a passthrough entity that is not engaged in a trade or business will not be viewed as earning the income through a trade or business, regardless of whether the individual or any intervening passthrough entities are engaged in a trade or business.

A trade or business is subject to Section 1411 tax and is not eligible for the "trade or business exception" if it is a passive activity described in Section 469, or if it is a trade or business of trading in financial instruments or commodities. When determining whether an individual is engaged in a passive activity for purposes of Section 1411, the principles of Section 469 apply. Therefore, an individual will not be eligible for the "trade or business exception" if the trade or business is viewed as a passive activity with respect to the individual under Section 469. On the other hand, the determination of whether income is derive from the trade or business of trading in financial instruments or commodities is made at the entity level. Income earned through a passthrough entity engaged in the trade or business of trading in financial instruments or commodities will retain its character as it passes from the entity to the taxpayer and will not be eligible for the "trade or business exception."

The second prong of net investment income is gross income derived from a trade or business subject to Section 1411 tax. As described above, these are trades or business that are passive activities with respect to the taxpayer or trades or businesses engaged in trading financial instruments or commodities.

The third prong of net investment income is net gain attributable to dispositions of property not held in a trade or business (other than trades or business subject to Section 1411 tax, described above). The regulations make clear that this prong of net investment income includes the proceeds from a deemed sale as a result of marking to market assets under Section 1256. Additionally, the term "net gain" contemplates a positive number, so that losses in excess of gains are disregarded. The proposed regulations also make clear that general tax principles of gain and loss recognition continue to apply in the context of Section 1411. Therefore, for example, property disposed of in a like-kind exchange under Section 1031 will not trigger "net gain" for purposes of Section 1411.

Finally, taxpayers are permitted to offset these three sources of net investment income with deductions that are properly allocable to the sources of net investment income. Significantly, the proposed regulations do permit net operating losses to offset net investment gain (although net operating losses are taken into account in determining modified adjusted gross income). The regulations cite the difficulty of earmarking portions of net operating losses as allocable to Section 1411, but invite comment on this issue.

Although the proposed regulations are not due to take effect until after December 31, 2013, the Section 1411 tax is scheduled to come into effect for tax years beginning after December 31, 2012. Taxpayers are permitted to rely on the proposed regulations before their effective date.

MoFo in the News

On October 9, 2012, MoFo partners Tom Humphreys and Remmelt Reigersman held an IFLR Webinar entitled "Are you FATCA Ready?" The webinar explained the background and mechanics of FATCA, and discussed the impact of the legislation on capital markets transactions including equity and debt offerings, swap transactions and other structured products.

MoFo Partner Tom Humphreys spoke on a panel at the 2012 California Bar Tax Conference in Coronado, California on November 3, 2012, with Stephen. R. Larson, Associate Chief Counsel for Financial Institutions and Products, and Steven Rosenthal, Visiting Fellow at the Urban-Brookings Tax Policy Center in Washington, D.C. The panel discussed tax issues involving the use of financial products in the post-Dodd-Frank era, including swaps, credit default swaps, options, structured notes, "prepaid forwards," and other complex derivatives used in investing, hedging, and speculative contexts. The panel reviewed recent court cases, plus recent activities of Congress, Treasury, and the Internal Revenue Service.

On November 14, 2012, MoFo Partners David Lynn and Anna Pinedo, along with Ethisphere, presented "Dodd-Frank: Not Just for Financial Institutions," the second part in a series of Dodd-Frank webcasts. The webcast addressed how the new law affects industries other than financial services, and what companies can do to prepare.

MoFo Partner Oliver Ireland spoke at The Clearing House's Second Annual Business Meeting & Conference on November 14- 16, 2012. The conference examined the dynamic banking regulatory and payments landscape in the post Dodd-Frank era. The event featured discussions and keynote addresses by senior regulators, business leaders, legislators, and academics focused on the commercial banking and payments industry.

On November 27, 2012, MoFo Partner Jay Baris participated on a panel during the BoardIQ November webcast, which focused on "Parsing Out the Reserve Fund Ruling." The panel offered insights on what the jury's decision means for money funds and their boards.

MoFo Partner Barbara Mendelson spoke at the 2012 IIB/CSBS U.S. Regulatory/ Compliance Orientation Program, held on November 27-28, 2012. The program provided a broad, explanatory overview of the regulatory and compliance requirements applicable to the U.S. operations of internationally headquartered banks, including a description of the examination process.

On November 29, 2012, MoFo Partners Peter Green, Jeremy Jennings-Mares and Anna Pinedo held a webcast entitled "A Sign of Things to Come? European Regulatory Developments Affecting Structured Products." The webcast addressed the ways in which U.S. regulators continue to scrutinize the structured products market and more and more seem to be looking to Europe for "inspiration." The webcast also discussed the proposed new disclosure regime for PRIPs, developments affecting European ETFs and other topics.

MoFo Partner Henry Fields participated in the Grant Thornton and Morrison & Foerster Banking Hot Topics Forum, held December 4, 2012. The forum discussed recent regulatory changes in the banking industry, accounting updates and upcoming trends and key topics tailored to bank executives. Henry Fields spoke on topics including a regulatory update and the future of community banking, BASEL III and its impact on community banks, and accounting updates.

On December 12-13, MoFo Partner Anna Pinedo spoke at PLI's "Understanding the Securities Laws 2012." The program provided an overview and discussion of the basic aspects of the U.S. federal securities laws by leading in-house and law firm practitioners and key SEC representatives. Emphasis was placed on the interplay among the Securities Act of 1933, the Securities Exchange Act of 1934, the Sarbanes-Oxley Act, the Dodd- Frank Act, and related SEC regulations, and on how a securities lawyer can solve practical problems that arise under them in the context of public and private offerings, SEC reporting, mergers and acquisitions, and other common corporate transactions.

As part of the MoFo Teleconference Series, MoFo Partners Lloyd Harmetz, Jerry Marlatt, and Anna Pinedo held a discussion on December 12, 2012, entitled "Foreign Banks Accessing the U.S. Markets." The teleconference addressed the ways in which foreign banks are increasingly seeking to diversify their financing opportunities and how, with careful planning, banks can access U.S. investors without subjecting themselves to the securities registration requirements applicable to public offerings and to ongoing disclosure and governance requirements applicable to U.S. reporting companies.

The MoFo Teleconference Series also included a presentation by MoFo Partners Jerry Marlatt and Anna Pinedo entitled "Foreign Banks Issuing Covered Bonds into the U.S." The discussion centered on the fact that, despite the sovereign crisis and heightened volatility, the covered bond market remains very attractive and foreign banks continue to access the U.S. markets with covered bond offerings.

On December 17, 2012, MoFo Partners Ze'-ev Eiger, David Lynn, and Anna Pinedo presented a teleseminar entitled "SEC Registration for Foreign Banks, " which discussed how foreign banks seeking to diversify their financing opportunities may consider SEC registration. The teleseminar focused on the registration process; disclosure considerations for financial institutions; and compliance, governance, and ongoing reporting.

On January 7, 2013, MoFo Partners Charles Horn, Oliver Ireland and Barbara Mendelson presented a teleseminar entitled "The Federal Reserve's Proposed Prudential Regulations for Foreign Banks," which focused on the Federal Reserve's proposed significant new regulations affecting the operations of foreign banks in the United States. The proposals are designed to implement the enhanced prudential regulation and early remediation requirements of Dodd-Frank Act sections 165 and 166.

MoFo Partners Anna Pinedo and David Kaufman presented a PLI Webcast entitled JOBS Act: Growing Momentum" on January 8, 2013, discussing how, since enactment of the JOBS Act in April 2012, the Staff of the Securities & Exchange Commission has published many of the required studies and release significant guidance concerning many of the JOBS Act provisions. Market practice continues to evolve in relation to emerging growth company IPOs.

On January 10, 2013, MoFo Partner Anna Pinedo also presented at the IFLR Webcast, discussing "How Foreign Banks Can Finance in the U.S." The webcast discussed how foreign banks are increasingly seeking to diversify their financing opportunities and how, with careful planning, they can access U.S. investors without subjecting themselves to the securities registration requirements applicable to public offerings, or ongoing disclosure and governance requirements applicable to U.S. reporting companies.

As part of the ALI CLE Webcast, MoFo Partners David Kaufman and Anna Pinedo gave a talk entitled "New SEC Rules on Clearing Agency Standards for Derivatives and Other Securities Transactions" on January 23, 2013. This webcast provided a concise review of new SEC rules for registered clearing agencies and their implications for risk management and other policies and procedures of participants.

Upcoming Events

MoFo Partners Brian Bates and Scott Ashton will speak at the 26th Annual Private Placements Industry Forum on January 23-25, 2013. The 2013 Private Placement Industry Forum will cover the most pressing issues in the industry including: global deal generation, how rating agencies are affecting deal prices and yields, and an in-depth look at the latest changes in deal documents.

On February 11, 2013, together with Lisa Chippindale, U.S. tax counsel at Royal Bank of Canada, MoFo Partners Remmelt Reigersman and Tom Humphreys will hold an ALI CLE Webcast entitled "FATCA: Does Your Client Comply?" This webcast will discuss a concise overview of FATCA and its impact on the capital markets. Topics will include background of FATCA, the FATCA 30% tax on "withholdable payments" and on "passthrough payments," and FATCA's impact on debt and equity offerings, swap transactions, and other structured products.

MoFo Partner Anna Pinedo will speak at the Broker-Dealer and Adviser Regulatory Compliance Forum on February 20, 2013. Attendees will be provided with expert analysis regarding today's hot topics impacting the relevant regulatory framework, as well as practical considerations regarding the design and implementation of such programs. Anna Pinedo will be speaking on a forum called "Complex Products" examining what types of products are "complex," the FINRA regulatory Notice 12-03, and recent enforcement cases.

On March 12, 2013, MoFo Partners Anna Pinedo and David Kaufman will give a seminar entitled "Navigating the Requirements for Derivatives Trading – Title VII of Dodd-Frank." The seminar will discuss how market participants are preparing themselves to function in a very different derivatives market now that the rulemaking relating to Title VII of the Dodd-Frank Act has been nearly finalized. Title VII imposes a comprehensive regulatory framework for derivatives, and requires both end-users and dealers to adopt new compliance and operating procedures.

Footnotes

1 In addition to the rate increases applicable to items of income generally, the new Medicare tax that took effect on January 1, 2013 (which is not part of ATRA) imposes on individuals a 3.8% tax on the lesser of net investment income or modified adjusted gross income over $200,000 (in the case of an unmarried taxpayer) or $250,000 (for couples filing jointly).

2 See our Client Alert at http://www.mofo.com/files/ Uploads/Images/121015-IOSCO.pdf

3 2012 U.S. Dist. LEXIS 162121.

4 For more information on the outlook for covered bonds, please see our client alert at http://www.mofo.com/files/Uploads/Images/121226-Outlookfor-Covered-Bonds.pdf

5 Section 7701(o), which codifies the economic substance doctrine, was enacted as part of the Health Care and Education Reconciliation Act of 2010. It is generally effective for transactions entered into after March 30, 2010.

6 AM 2012-009 (Nov. 5, 2012).

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved