INTRODUCTION

In purely domestic situations, the Internal Revenue Code (the "Code") provides for the deferral of taxation when certain corporate reorganizations or transactions take place and specific requirements are met. However, the same may not be true when the reorganization or transaction involves a U.S. person and a foreign corporation. In these situations, the Code may trigger gain for the U.S. person. For instance, if a U.S. person contributes shares in a U.S. corporation to another U.S. corporation in a qualifying Code §351 exchange, the U.S. person does not recognize gain on the transaction. However, if the same U.S. person were to contribute shares in a corporation to a foreign corporation, Code §367(a) requires the U.S. person to recognize gain unless certain exceptions apply. This is also the case if a U.S. person is deemed to transfer the shares indirectly, for example by way of a domestic or foreign partnership. An unwary taxpayer with a merely passive interest in the partnership may not realize that he or she has U.S. tax obligations since the transaction took place between foreign entities and their overall interests remain the same.

This article highlights the situation described above where a seemingly foreign transaction may result in U.S. tax consequences to a U.S. person under Code §367(a). While a number of reorganizations can give rise to implications under Code §367, this article will examine the consequences of a Code §351 exchange where a U.S. person directly or indirectly transfers shares in a foreign corporation to another foreign corporation.

SECTION 351 OVERVIEW

A Code §351 Exchange occurs when one or more persons transfer property to a corporation solely in exchange for stock of the transferee corporation and are in control of such corporation immediately after the exchange.1 The phrase "one or more persons" includes individuals, trusts, estates, partnerships, associations, companies, or corporations.2 Control is defined as ownership of at least 80% of the total combined voting power of all classes of stock entitled to vote and at least 80% of the total number of shares of all other classes of stock.3 Where a transaction qualifies as a Code §351 Exchange, no gain or loss is recognized by either the transferor or transferee corporation.4 A carryover basis is taken in the shares received, thereby preserving the exposure to tax on a future sale of the shares received.5

OPERATION OF 367(A)

Notwithstanding the nonrecognition provision under Code §351, Code §367(a) provides that if, in connection with certain exchanges, including Code §351 exchanges, a U.S. person transfers property to a foreign corporation (i.e., an outbound transfer), such foreign corporation will not be considered a corporation for purposes of determining the extent to which gain is recognized. As a result, the nonrecognition treatment under Code §351 is shut off.

For these purposes, a U.S. person is defined in Code §7701(a)(30).6 The Code defines a U.S. person to include a citizen or resident of the U.S., a domestic partnership, a domestic corporation, and any estate or trust other than a foreign estate or trust.

Moreover, if a domestic or foreign partnership transfers property to a foreign corporation, then a U.S. person that is a partner in the partnership will be treated as having transferred a proportionate share of the property for purposes of Code §367(a).7

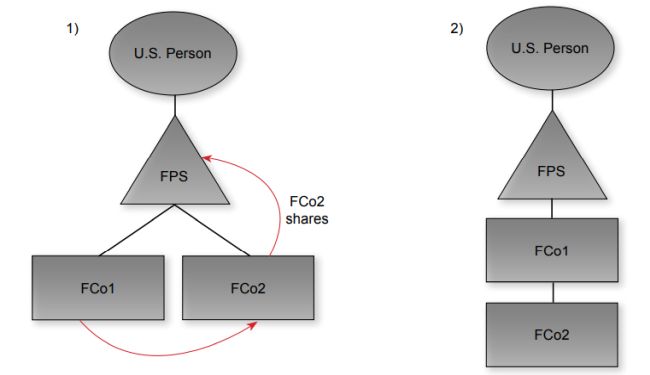

To illustrate, assume a U.S. person holds a passive interest in a foreign partnership in jurisdiction X. The foreign partnership wholly owns two sister foreign corporations in jurisdiction X, FCo1 and FCo2. As part of a restructuring plan, the foreign partnership contributes shares in FCo1 to FCo2 in exchange for FCo2 shares in a §351 exchange. FCo2 becomes the parent of FCo1. The transaction takes place all within jurisdiction X and qualifies as a nonrecognition transaction under the tax laws of jurisdiction X. Notwithstanding the tax-free nature of the transaction under the tax law of jurisdiction X, Code §367(a) may treat the U.S. person as transferring property to a foreign corporation and deny nonrecognition treatment for U.S. tax purposes.

Despite the general operation of section Code §367(a)(1) that restricts the application of the nonrecognition provisions on outbound transfers of property, an exception applies where the transferred property is stock or securities of a foreign corporation. 8 In that case, the regulations provide that the transaction will not be subject to Code §367(a)(1) in either of the following fact patterns:

- The U.S. transferor owns less than 5%9 of both the total voting power and the total value of the stock of the transferee corporation immediately after the transfer.

- The U.S. person transferor enters into a five-year gain recognition agreement ("G.R.A.").10 The relevant provisions about a G.R.A. are discussed below.

To view the full article click here

Footnotes

1. Code §351(a).

2. Treas. Reg. §1.351-1(a); Rev. Rul. 84-111.

3. Code §§351(a) and 368(c).

4. Code §§351(a) and1032(a).

5. Code §§351(h)(2), 358 and 362.

6. Treas. Reg. §1.367(a)-1(d)(1).

7. Treas. Reg. §1.367(a)-1T(c)(3)(i)(A).

8. Code §367(a)(2).

9. Applying the attribution rules of Code §318 as modified by Code §958(b). These rules are outlined in greater detail in Section 2(A) below. Each U.S. person will be attributed stock owned by H.Q.H. and any intermediary entity. No other attribution rules outlined in the Code will apply here to increase a U.S. person's interest.

10. Treas. Reg. §1.367(a)-3(b)(1).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.