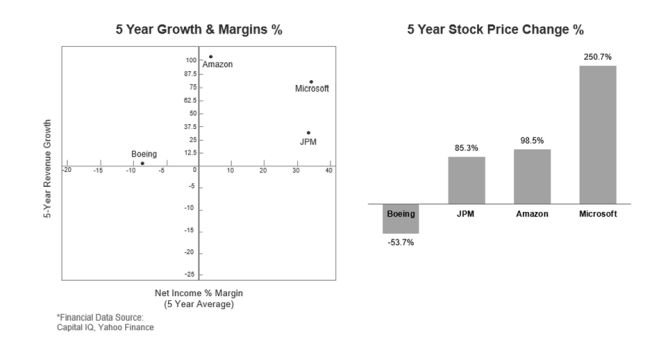

In today's business environment, the tangible pressures to grow profitably are an ever-present challenge. Achieving enduring success demands that companies master a complex balance of growth, investment, and cost management. This trinity of growth, investment, and cost is the playbook for enhancing margins and building healthy companies that are well positioned for the future. Looking to industry leaders like Microsoft,1 Amazon,2 and JPMorgan,3 we see evidence of this success by the significant shareholder and enterprise value created recently. By contrast, companies like Boeing4 have struggled to achieve this balance and are navigating a very different financial reality.

In this article, we explore the approach to business growth that every C-suite leader can apply to help ensure margin optimization.

Importance of Growth

Growth through strategic expansion, technological advancement, and/or acquisition must be top of mind for industry leaders and innovators alike. Growth is the lifeline for raising capital—a robust growth story captivates investors, driving shareholder value and fostering an environment ripe for innovation and expansion. Thriving companies are constantly thinking about how to innovate with new products, services, or adjacent industries, while also growing their core businesses, and maintaining profitability. Companies need to create sources of funding to sustain investments in growth without sacrificing margin.

Need for Investment

Investment is the engine driving this growth, enabling the

acquisition of critical resources—technology, talent,

infrastructure—essential for scaling and the financial

stability needed to weather economic uncertainties and seize growth

opportunities. But here's the catch: this financial fuel must

be meticulously managed

, and captured from cost-saving initiatives throughout

the enterprise without compromising the integrity of the

company's financial health. It's a balancing act of

strategic cost management, where efficiencies are not merely

preserved but transformed into investment capital for

tomorrow's strategic ventures. Companies that navigate this

successfully can take hold of their own financial narrative. This

focus is not merely a tactical choice but a strategic imperative

that aligns closely with the expectations of investors and the

markets at large.

Strategic Cost Management

Strategic cost management plays a pivotal role in unlocking funding avenues for investment. Companies that focus on driving efficiencies in areas like operations or G&A , or managing discretionary spend or working capital with discipline are often those that can generate the most investment for growth. These companies also proactively monitor their expenses and view costs not solely as short-term line items but also to influence long-term strategy and how their companies invest in differentiating capabilities. Strategic cost management needs to be viewed as an enabler of growth, ensuring today's savings become tomorrow's strategic investments.

Learning from Industry Titans

The equation seems simple – growth is critical to a company's longevity. Growth and innovation require investment, and cost savings are a key lever to generate investment. However, it is quite difficult for companies to execute this. The tales of Microsoft, Amazon, and JPMorgan illuminate paths of leading companies, whereas the story of Boeing presents quite a different story, one of rapid decline. The correlation between 5-year growth rates and margins relative to stock performance demonstrates this contrast quite clearly.

Looking Closer

Leading companies have something in common – they are bold in their growth ambitions, strategic in their investments, and manage with operational discipline.

- Microsoft has experienced explosive growth, massive stock price gains, and still has maintained market leading margins.5 The company continues its masterful playbook for investments by leveraging these strong margins and operational discipline with a sharp eye for innovative growth opportunities. Microsoft's Q2 2024 revenues skyrocketed to an impressive $62 billion following a $10 billion collaboration with OpenAI, boosting share price by nearly 13 percent since January.6 Microsoft's knack for blending its ecosystem with acquired ingenuity not only preserves uniqueness but also turbocharges its margins and market prowess, showcasing a sustainable blueprint for future-forward, financially savvy growth and cost management.

- Amazon's transformative journey from a bookstore to a technology behemoth exemplifies the significance of diversification and strategic technology investments. Amazon Web Services (AWS), an ingenious shared infrastructure solution, initially crafted to streamline Amazon's own operations, evolved into a technology powerhouse by 2023, raking in a whopping 67 percent of Amazon's operating income. It's a classic Amazon move:7 turning a quest for efficiency into a goldmine, demonstrating the company's ability to transform cost-saving measures into monumental growth and shareholder value up 98 percent in the past 5-years.

- JP Morgan is a titan in the technology investment arena, investing $12 billion annually8 to keep its innovation engine roaring and its operational gears greased. Beyond growing its own technology capabilities for faster, smarter services, JP Morgan flexes its financial muscles through a Growth Equity Fund, injecting over $1 billion9 in investments into high-growth sectors like software and fintech. This blend of in-house technology elevation and strategic external investments showcases the freedom JP Morgan has achieved through operational discipline resulting in a 10-year share price compound annual growth rate (CAGR ) of over 16 percent and a recent profit margin of 33 percent.

In contrast, companies that struggle with balancing growth, investments, and costs face a significantly more difficult market position.

- Boeing is caught in a financial undertow, struggling against a

tide of climbing costs and shrinking revenues. There has been over

$23 billion lost under its current leadership, as cost-cutting

overshadows growth and innovation stagnates.10 This has

not only eroded Boeing's net income but hampered its

manufacturing and product development, leading to uncertainty with

customers and regulators. These safety crises continue to compound

because of Boeing's 737 MAX jet design and quality control

issues.11 Now, Boeing finds itself navigating a stormy

market, with dwindling margins and a falling share price, trading

31 percent12 lower than its 52-week high, marking a

crossroad that begs for a new course toward innovation and

sustainable growth.

The Path Ahead

In guiding enterprises through the challenges of today's dynamic markets, Directors must take ownership of combining growth with prudent investment and cost management. It is through this balanced approach, taking cues from the titans like Microsoft, Amazon, and JPMorgan; and learning from the likes of Boeing, that one can chart a course towards sustainable profitability and maximizing shareholder value.

Footnotes

1. "FY23 Q4 - Performance - Investor Relations - Microsoft." n.d. Www.microsoft.com. https://www.microsoft.com/en-us/investor/earnings/fy-2023-q4/performance

2. Fontes, Kênio. 2024. "Amazon Stock: The Path to a $3 Trillion Market Cap." Amazon Maven. February 13, 2024. https://www.thestreet.com/amazon/stock/amazon-stock-the-path-to-a-3-trillion-market-cap.

3. Georgescu, Peter. n.d. "JP Morgan Chase Does Well by Doing Good." Forbes. Accessed April 10, 2024. https://www.forbes.com/sites/justcapital/2023/09/08/jp-morgan-chase-does-well-by-doing-good/?sh=59ca01e42ee5.

4. Davis, Tony. 2024. "Tony Davis: What's Most Important to Boeing, Shareholder Value or Passenger Safety?" The Missoulian. March 16, 2024. https://missoulian.com/opinion/column/tony-davis-whats-most-important-to-boeing-shareholder-value-or-passenger-safety/article_5067e872-dfa4-11ee-8d47-07700a4eb7d2.html.

5. FY23 Q4 - Performance - Investor Relations - Microsoft." n.d. Www.microsoft.com. https://www.microsoft.com/en-us/investor/earnings/fy-2023-q4/performance

6. "Microsoft Fiscal Year 2024 Second Quarter Earnings Conference Call." n.d. Www.microsoft.com. https://www.microsoft.com/en-us/investor/events/fy-2024/earnings-fy-2024-q2.aspx.

7. "This Cloud Company Is Less than 1% the Size of Amazon's AWS, but It's Growing Faster and It Expects Double-Digit Growth Again in 2024." 2024. Yahoo Finance. March 24, 2024. https://finance.yahoo.com/news/cloud-company-less-1-size-132900714.html#:~:text=While%20AWS%20made%20%2491%20billion.

8. "This $12 Billion Tech Investment Could Disrupt Banking." n.d. Www.jpmorganchase.com. https://www.jpmorganchase.com/news-stories/tech-investment-could-disrupt-banking.

9. Gildea, M. 2023. "J.P. Morgan Growth Equity Partners Closes $1bn Fund to Invest in Growth Stage Companies." FinTech Global. April 21, 2023. https://fintech.global/2023/04/21/j-p-morgan-growth-equity-partners-closes-1bn-fund-to-invest-in-growth-stage-companies/.

10. Bloomberg.com. 2024. "Fixing Boeing's Broken Culture Starts with a New Plane," April 4, 2024. https://www.bloomberg.com/news/articles/2024-04-04/fixing-boeing-s-broken-culture-starts-with-a-new-plane.

11. Isidore, Gregory Wallace, Chris. 2024. "The FAA Flags More Potential Safety Issues on Boeing's 737 Max and 787 Dreamliner | CNN Business." CNN. March 1, 2024. https://www.cnn.com/2024/03/01/business/faa-boeing-737-max-787-dreamliner-safety-issues/index.html.

12. Bloomberg.com. 2024. "Boeing Extends 2024 Drop Past 25% as Max Crisis Deepens," March 11, 2024. https://www.bloomberg.com/news/articles/2024-03-11/boeing-shares-extend-2024-drop-past-25-on-us-investigation.

Originally published by 10 April, 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.