On May 3, 2019, the Securities and Exchange Commission (SEC) proposed extensive changes to the financial disclosure requirements for business acquisitions and dispositions. The proposed amendments are intended to reduce significantly the complexity and costs associated with the preparation of historical financial statements and pro forma financial information, primarily by amending Rule 3-05 and Article 11 of Regulation S-X. The proposed amendments are a welcome development that represent an additional example of the SEC taking concerted action to ease disclosure requirements with respect to capital formation in a manner that ensures investors continue to have access to meaningful information.

Among the more prominent changes, the proposed amendments would:

- Update the "investment test" and "income test" used to determine the significance of an acquisition or disposition, conform the significance threshold and tests for a disposed business, and expand the use of pro forma financial information in measuring significance;

- Reduce the number of audited and interim periods for which historical financial statements must be presented if an acquisition is determined to be significant;

- Permit abbreviated financial statements of a target business carved out of a broader entity that did not maintain separate financial statements of the target business;

- No longer require separate financial statements for any acquired business once it has been included in the registrant's post-acquisition financial statements for a complete fiscal year;

- Expand the use of, or reconciliation to, International Financial Reporting Standards as issued by the International Accounting Standards Board (IFRS-IASB);

- Ease the requirement to provide financial statements and pro forma financial information for "individually insignificant acquisitions"; and

- Modify the form and content of pro forma financial information by replacing the current restrictive criteria imposed on pro forma adjustments with two new categories of adjustments to be presented as separate columns: (i) "transaction accounting adjustments" that would reflect the estimated purchase accounting under U.S. generally accepted accounting principles (GAAP) or IFRS-IASB, and (ii) "management adjustments" that would include reasonably estimable synergies, and other transaction effects that have occurred or are reasonably expected to occur.

The proposed amendments would not apply to target company financial statements required to be included in a proxy statement or registration statement on Form S-4 or Form F-4 but would apply to the pro forma information provided therein pursuant to Article 11 and any financial information for other acquisitions and dispositions that would be required to be disclosed in the registration statement pursuant to Rule 3-05 or Rule 3-14 (e.g., registrant or target company acquirees).

The proposal will have a 60-day public comment period following its publication in the Federal Register.

Background

When a registrant acquires a significant business, other than a real estate operation, Rule 3-05 generally requires disclosure of separate audited annual and unaudited interim preacquisition financial statements of that business if it is significant to the registrant (Rule 3-05 Financial Statements). Significance is determined by applying investment, asset and income tests set forth in Rule 1-02(w) of Regulation S-X. Similar rules apply to real estate operations and are set forth in Rule 3-14 of Regulation S-X.

Article 11 of Regulation S-X provides that registrants required to file Rule 3-05 or Rule 3-14 historical financial statements are additionally required to file unaudited pro forma financial information relating to an acquisition or disposition, which typically includes a pro forma balance sheet and pro forma income statements based on the historical financial statements of the registrant and the acquired or disposed business. Pro forma financial information includes adjustments intended to show how the acquisition or disposition might have affected those financial statements.

Updates to Significance Tests

The SEC has proposed revising the significance tests in Rule 1-02(w) that are used to determine whether a registrant is required to provide the historical financial statements of a business it acquires and, if so, how many periods must be presented. The proposed changes, which would revise the calculation of significance under the Investment Test and the Income Test of Rule 1-02(w), while leaving the Asset Test substantively unchanged, are aimed at helping registrants make more meaningful significance determinations and reducing the need for registrants to seek SEC staff relief under Rule 3-13 of Regulation S-X in the case of anomalous results.1

Investment Test

Currently, the Investment Test compares the registrant's investment in the target business to the registrant's total assets to determine significance. The revised test aims to align itself more closely with the economic significance of the acquisition to the registrant by comparing the registrant's investment in the target business to the "aggregate worldwide market value of the registrant's voting and non-voting common equity," when available. The new Investment Test would require market value (which would include common equity held by affiliates) to be determined as of the last business day of the registrant's most recently completed fiscal year prior to closing the acquisition. Where a registrant does not have an aggregate worldwide market value, the SEC proposed to retain the existing Investment Test.

Income Test

Currently, the Income Test evaluates significance by comparing the target and the registrant's income from continuing operations before taxes, extraordinary items and cumulative effects of changes in accounting principles. The current Income Test is subject to anomalous results because it focuses only on a single component: net income, which can include infrequent expenses, gains and losses.

The revised Income Test would add a new revenue component, which would compare the target's revenue to the registrant's revenue. The registrant would use the lower of the current income component of the test and the new revenue component of the test to determine the significance of the acquisition. Where a registrant or target does not have recurring annual revenues, only the net income component would apply.

The revised Income Test also would change the net income calculation to use income or loss from continuing operations after taxes. The change to allow the use of after-tax income from continuing operations rather than pretax income from continuing operations would permit a registrant to use line item disclosure from its financial statements, simplifying calculations.

Significance Threshold and Tests for Dispositions

Currently, pro forma financial information is required upon the disposition or probable disposition of a significant portion of a business either by sale, abandonment or distribution to shareholders by means of a spin-off, split-up or split-off, if that disposition is not fully reflected in the financial statements of the registrant. A disposition of a business is considered significant if it meets the conditions of a significant subsidiary under Rule 1-02(w), using a 10% significance threshold.

The proposed amendments would raise the significance threshold from 10% to 20% to align with the threshold for acquisition significance. In addition, the tests used to determine significance of a disposed business would be conformed to those used to determine significance of an acquired business.

Pro Forma Financial Information to Measure Significance

Significance determinations generally are required to be made by comparing the most recent annual financial statements of the target to those of the registrant prior to the date of the acquisition. A registrant, however, is permitted to use pro forma, rather than historical, financial information to determine significance if the registrant has made a significant acquisition subsequent to the last fiscal year and has filed the target's historical financial statements and pro formas on a Form 8-K. There is no analogous provision in Rule 3-05 for registrants to use pro forma financial information depicting significant dispositions or for registrants filing initial public offerings (IPOs).

The proposed amendments would expand the circumstances for using pro forma financial information in measuring significance. In addition to significant acquisitions, the amendments would allow registrants to measure significance using filed pro forma financial information if the registrant has made a significant disposition subsequent to the last fiscal year, as long as pro forma information has been filed for the disposition. In addition, the amendments would allow the use of such pro forma information for significance testing in IPOs. The proposed changes would not, however, permit registrants to include the "management adjustments" described below when using pro forma financial information to determine significance. Rather, the pro forma financial information must be limited to the applicable subtotals that combine historical financial information of the registrant and the acquired business and "transaction accounting adjustments."

Financial Statements of Significant Acquisitions: Periods to Be Included

Under the current rules, Rule 3-05 Financial Statements may be required for up to three years depending on the relative significance of the acquired or to-be-acquired business. The proposed rule changes would reduce the number of years of required Rule 3-05 Financial Statements from three years to up to two years, depending on the relative significance. According to the SEC, two years of preacquisition financial statements "would be sufficient to allow investors to understand the possible effects of the acquired business on the registrant," and "older financial statements, such as the third year of Rule 3-05 Financial Statements, can be less relevant for evaluating an acquisition because, due to their age, they are less likely to be indicative of the current financial condition, changes in financial condition and results of operations of the acquired business."

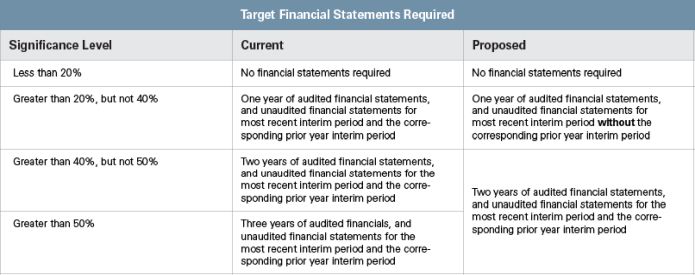

Under the proposed rules, Rule 3-05 Financial Statements would be required as follows:

Abbreviated Financial Statements for Partial Components of an Entity

Registrants frequently acquire a component of an entity, such as a product line or a line of business contained in more than one subsidiary of the selling entity that is a "business" as defined in Rule 11-01(d) of Regulation S-X but does not constitute a separate entity, subsidiary or division. These businesses may not have separate financial statements or maintain separate and distinct accounts necessary to prepare Rule 3-05 Financial Statements because they often represent only a small portion of the selling entity. Historically, registrants would need to seek relief from the SEC staff or rely on informal guidance to provide abbreviated financial statements in such situations.

Recognizing that making relevant allocations of the selling entity's corporate overhead, interest and income tax expenses necessary to provide Rule 3-05 Financial Statements for the target business may be impracticable, the proposed amendments would add a new rule, Rule 3-05(e), to allow companies to provide audited statements of assets acquired and liabilities assumed, and statements of revenues and expenses that exclude allocations of corporate overhead, interest and income tax expenses, which the SEC refers to as "abbreviated financial statements," if the following requirements are met:

- The business constitutes less than substantially all of the assets and liabilities of the seller and was not a separate entity, subsidiary, segment or division during the periods for which the acquired business financial statements would be provided;

- Separate financial statements for the business have not previously been prepared; and

- The seller has not maintained the separate accounts necessary to present financial statements that include the omitted expenses, and it is impracticable to prepare such financial statements.

A registrant would not be able to exclude from abbreviated financial statements various items such as interest expense for debt assumed from the seller or various operating expenses paid by or on behalf of the business, such as selling, distribution, marketing, general and administrative, and research and development expenses. The notes to the abbreviated financial statements also would have to include disclosure about the type of omitted expenses, the reasons why they were excluded and how the statements are not indicative of the acquired business going forward, as well as available information about the operating, investing and financing cash flows of the business.2

Omission of Acquired Business Financial Statements

Currently, Rule 3-05 Financial Statements are not required in a registration statement or proxy statement once the operating results of the target business have been reflected in the audited consolidated financial statements of the registrant for a complete fiscal year, unless (i) the financial statements have not been previously filed (as often is the case with an IPO company) or, (ii) even if previously filed, the acquired business is of major significance (i.e., significant at the 80% level) to the registrant. In the former case, an IPO company will need to go back and obtain (or create) audited historical financial statements for any target business, even after the target has been consolidated in its financial statements for more than a year. In the latter case, the registrant will need to include historical financial statements of a now-consolidated target business that may no longer be as significant to the registrant as it was at the time of the acquisition.

Under the proposed amendments, financial statements no longer would be required in registration statements and proxy statements once the target business is reflected in filed post-acquisition company financial statements for a complete fiscal year. This change would eliminate the requirement to provide financial statements when they have not been previously filed or when they have, but the acquired business is of major significance.3

Foreign Businesses

The test to determine whether a target is a "foreign business" — permitting Rule 3-05 Financial Statements to be presented in IFRS-IASB instead of U.S. GAAP — is more stringent as it relates to certain equity ownership requirements than the "foreign private issuer" definition. The divergent definitions have created a circumstance where an acquired business that does not meet the definition of foreign business, but would otherwise be permitted to present its financial statements using IFRS-IASB as a foreign private issuer, is not permitted to use financial statements prepared in accordance with IFRS-IASB for its Rule 3-05 Financial Statements even when those financial statements are already available. Instead, the Rule 3-05 Financial Statements must be prepared in accordance with U.S. GAAP, which can result in a significant cost to the registrant.

The proposed amendments would permit Rule 3-05 Financial Statements to be prepared in accordance with IFRS-IASB without reconciliation to U.S. GAAP if the acquired business would qualify to use IFRS-IASB if it were a registrant. The proposed amendments also would permit foreign private issuers that prepare their financial statements using IFRS-IASB to provide Rule 3-05 Financial Statements prepared using home country GAAP to be reconciled to IFRS-IASB rather than U.S. GAAP. Doing so would provide investors with more comparable information and avoid a one-time presentation of the U.S. GAAP reconciling information in Rule 3-05 Financial Statements of the target.

Individually Insignificant Acquisitions

Under the current rules, if a registrant acquires unrelated businesses that do not individually meet the significance test but that together would exceed 50% significance, it must file historical audited financial statements and related pro forma financial information for those businesses constituting the mathematical majority of the group. The practical effect of this requirement is that registrants often provide separate, audited historical financial statements for acquired businesses that are individually not material to the registrant as well as pro forma financial information that does not fully depict the aggregate effect of the "individually insignificant businesses."

The proposed amendments would still require pro forma financial information depicting the aggregate effects of all such acquisitions that together exceed 50% significance, but historical financial statements would only be required for those businesses whose individual significance exceeds 20% (but are not yet required to file financial statements).

Pro Forma Financial Information

Pro forma financial information is intended to reflect the impact of an acquisition on an ongoing basis, and typically includes the most recent balance sheet and most recent annual and interim period income statements. Pro forma financial information for a business acquisition combines the historical financial statements of the registrant and the target business, and is adjusted for certain items provided specified criteria are met. The current rule permits balance sheet adjustments only if they are directly attributable to the transaction and are factually supportable. In the income statement, any adjustments must also be expected to have a continuing impact on the registrant.

The proposed amendments would replace the existing adjustment criteria with simplified requirements, creating two categories of pro forma adjustments: (i) Transaction Accounting Adjustments and (ii) Management Adjustments. These new adjustment categories would be required to be presented in separate columns after the presentation of the combined historical information of the registrant.

Transaction Accounting Adjustments would depict in the pro forma balance sheet and income statement the required accounting (GAAP or, if applicable, IFRS-IASB) of the acquisition, disposition or other transaction.

Management Adjustments would be required for and limited to synergies and other effects of the transaction, such as closing facilities, discontinuing product lines, terminating employees, and executing new or modifying existing agreements, that are both reasonably estimable and have occurred or are reasonably expected to occur. For effects that are not reasonably estimable, the proposed amendments would require disclosure of qualitative information in the explanatory notes to the pro forma financial statements in order to ensure a fair and balanced presentation.

For each Management Adjustment, the proposed amendments would require: (i) a description of the synergy or other transaction effects, including material uncertainties; (ii) disclosure of the underlying material assumptions, method of calculation and estimated time frame for completion; (iii) qualitative information necessary to give a fair and balanced presentation of the pro forma financial information; and (iv) to the extent known, the reportable segments, products, services and processes involved, the material resources required (if any), and the anticipated timing.

Other Changes

In addition to the changes described above, the SEC also proposed a variety of smaller changes. While this alert does not cover these in detail, some of the more notable changes include the following.

Real Estate Operations

The proposed amendments would generally align Rule 3-14 of Regulation S-X relating to financial statements for acquired real estate operations with the above-described proposed amendments to Rule 3-05 (where no unique industry considerations exist).

Smaller Reporting Companies

The proposed amendments would make corresponding changes to the smaller reporting company requirements in Article 8 of Regulation S-X. Rule 8-05 would be revised to require that the preparation, presentation and disclosure of pro forma financial information by smaller reporting companies substantially comply with Article 11. Rule 8-04 would be revised to direct registrants to Rule 3-05 for the requirements relating to the financial statements of businesses acquired or to be acquired, other than for form and content requirements for such financial statements, which would continue to be prepared in accordance with Rules 8-02 and 8-03. Because Part F/S of Form 1-A refers to Rule 8-05, the proposed revisions to Rule 8-05 would apply to issuers relying on Regulation A.

Footnotes

1 In addition to the proposed changes to the significance tests, the SEC is proposing clarifying amendments to the definition of "significant subsidiary" to label the conditions as the Investment Test, the Asset Test and the Income Test.

2 The proposed amendments would create similar requirements in new Rule 3-05(f) for businesses engaged in oil and gas producing activities.

3 The proposed amendments would require inclusion in all 12 months of the registrant's most recently completed audited fiscal year. They would not permit reducing the 12-month period through analogy to Rule 3-06 or by the number of months of preacquisition historical financial statements that may be provided.

To view the original article, please click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.