On August 23, 2023, the Securities and Exchange Commission (SEC) released final rules under the Investment Advisers Act of 1940 (Advisers Act), focused on private fund disclosures and sponsor practices (New Rules).

In their Adopting Release, the SEC addressed questions from commentators on the initial proposed set of rules as to whether the proposed rules, once adopted, would apply to advisers whose "principal office and place of business" are outside the United States (each, a non-U.S. adviser), including in cases where such non-U.S. advisers have non-U.S. fund clients (i.e., the funds that they manage are formed outside of the U.S.), even if those non-U.S. fund clients have U.S. investors in them.

Application of New Rules to non-U.S. fund clients

The SEC reconfirmed its historical position that most of the substantive provisions of the Advisers Act do not apply to non-U.S. fund clients (including private funds) of an SEC-registered non-U.S. adviser. It further confirmed that the New Rules are "substantive rules" under the Advisers Act that will not apply to the non-U.S. fund clients of non-U.S. advisers. Finally, the SEC further clarified that the New Rules (and specifically the preferential treatment rule and restricted activities rule, which apply to all advisers and not just those that are registered with the SEC) also do not apply to non-U.S. advisers that are not registered with the SEC with respect to their non-U.S. fund clients. It views this position as consistent with its historical treatment of non-U.S. advisers (including exempt reporting advisers).

That said, the SEC is clear that the New Rules do apply to all U.S. fund clients (i.e., funds that are formed within the U.S.) of any adviser, regardless of the location of the adviser's principal office and place of business, and regardless of whether or not such U.S. fund has U.S. investors.

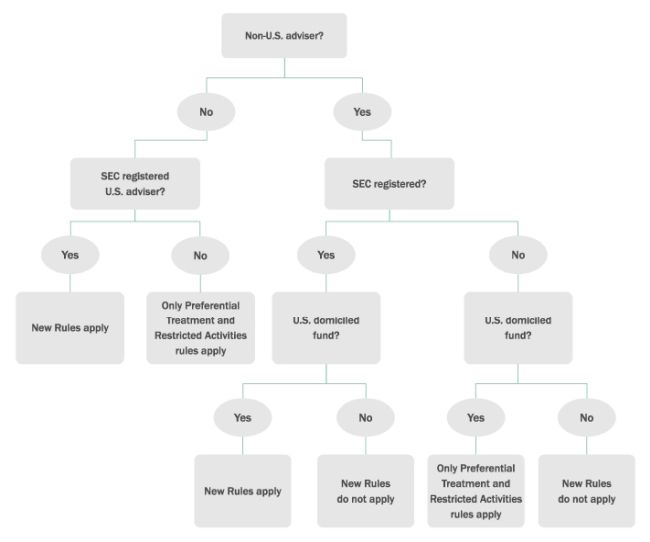

The below figure breaks down the application of the New Rules to advisers based both in and outside the U.S., taking into account registration status and the jurisdiction of the relevant advisers' fund clients.

Transition periods for New Rules

The SEC has offered certain transition periods before advisers will be required to comply with the New Rules applicable to them. For the Quarterly Statement Rule and the Annual Audit Rule, the SEC adopted an 18-month transition period. For the GP-Led Secondaries Rule, Restricted Activities Rule and Preferential Treatment Rule, advisers with less than $1.5 billion in private funds assets under management will have an 18-month transition period, and advisers with at least $1.5 billion in private funds assets under management will have a 12-month transition period. Compliance with the requirements in respect of the written documentation of an adviser's annual review will be required 60 days after the publication of the New Rules.

We will continue monitoring the effect of the New Rules and will keep you apprised of any further developments. If you have any questions regarding the New Rules, please feel free to reach out to your Torys team.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.