In Short

The Situation: The Australian Federal Government has extended the JobKeeper Payment Scheme ("Scheme") with modifications for an additional six months, until 28 March 2021. The fortnightly flat rate subsidy of $1500 per eligible employee will be replaced by a reduced, two-tiered payment. The temporary workplace flexibility arrangements under the Fair Work Act 2009 (Cth) ("FW Act") have also been extended for the same period, although these have also been modified.

The Implementation: From 28 September 2020, all employers will need to satisfy modified eligibility criteria and continue to meet their recordkeeping, reporting and minimum payment obligations. Importantly, a modified version of the temporary workplace flexibility arrangements available to eligible employers under the FW Act will be made available to employers who were previously eligible but are no longer eligible for the Scheme, subject to their meeting newly introduced criteria.

Looking Ahead: Employers should begin assessing their eligibility and any arrangements that need to be put in place for the extended period as soon as possible.

In response to the continued economic crisis resulting from the COVID-19 pandemic, the Australian Federal Government has completed all steps required to extend the JobKeeper Payment Scheme into 2021 ("Revised Scheme") from its original legislated end date of 27 September 2020 ("Original Scheme"). Read an overview of the Original Scheme.

The Revised Scheme will operate until 28 March 2021, comprising two distinct periods:

- Period 1: 28 September 2020 to 3 January 2021; and

- Period 2: 4 January 2021 to 28 March 2021.

Changes to Employer Eligibility

During Periods 1 and 2, the eligibility criteria for employers will be amended as follows.

Actual GST Turnover Test. Entities will need to demonstrate a requisite decline (either 30% or 50% depending on the same aggregated turnover thresholds as under the Original Scheme) in actual GST turnover for the September and December 2020 quarters compared to the equivalent 2019 periods (under the Original Scheme, eligibility was instead assessed according to projected GST turnover).

Reassessment. At the beginning of both Period 1 and Period 2, all entities (including those currently receiving the JobKeeper Payment) must reassess their eligibility according to the above criteria.

Entities Qualifying for the First Time. Entities that have not previously participated in the Scheme are required to demonstrate that they satisfy both a modified version of the decline in turnover test under the Original Scheme (projected GST turnover test) and the new decline in turnover test (actual GST turnover test).

Changes to Employee Eligibility

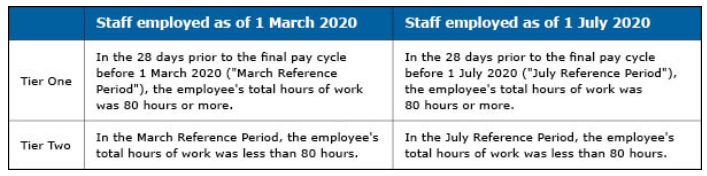

Under the Original Scheme, eligible employers received a flat $1500 per fortnight payment for each eligible employee. Under the Revised Scheme, a two-tier payment system will be introduced based on the average weekly hours worked by the affected employee as follows.

img src="/images/article_images/998966a.jpg" width="703" height="125" alt="998966a.jpg" />

Employees fall into either Tier One or Tier Two. Entities will need to nominate which tier employees fall into based on their actual hours worked in one of two reference periods.

An employee's total hours of work includes any hours for which they received paid leave (e.g. annual, long service, sick, carers and other forms of paid leave) or paid absence for public holidays. The 28-day period is designed to align with existing payroll and rostering systems (i.e. two consecutive fortnightly pay cycles or one four-weekly pay cycle). If the pay cycle for the employee is longer than 28 days (e.g. monthly), a pro-rata proportion of the total hours of work is to be used.

Entities are entitled to select the most beneficial reference period when determining which tier an employee qualifies for. For example, if an employee qualifies for a Tier One payment using the March Reference Period but qualifies only for a Tier Two payment using the July Reference Period, the entity is entitled to the more beneficial Tier One payment under the March Reference Period.

Aside from these changes to the rates payable, the other requirements relating to payment of the JobKeeper subsidy have not been modified and are described in our summary of the Original Scheme.

Extension of Temporary Changes to the Fair Work Act 2009 (Cth)

The modifications to the Revised Scheme also include important changes to the temporary JobKeeper provisions in the Fair Work Act 2009 ("FW Act"), which were introduced alongside the Original Scheme and empowered employers receiving the JobKeeper payment to issue "JobKeeper Enabling Directions" and make "JobKeeper Agreements" with eligible employees. Details of these FW Act provisions can be found in our summary of the Original Scheme.

Employers Eligible to Receive the JobKeeper Payment

Under the Revised Scheme, employers receiving the JobKeeper Payment ("Qualifying Employers") can continue to take advantage of these FW Act provisions until 28 March 2021. Directions and other arrangements already in place will remain in place until this date unless the direction itself specifies an earlier end-date (in which case, it may need to be reissued).

The only material change for Qualifying Employers is that, after 27 September 2020, employers can no longer enter into or enforce agreements relating to the taking of annual leave (although other non-JobKeeper options may be available).

Employers No Longer Eligible to Receive the JobKeeper Payment

Under the Original Scheme, if an employer ceased to qualify for the JobKeeper Payment, the employer was no longer able to issue JobKeeper Enabling Directions. Under the Revised Scheme, however, employers who previously received the JobKeeper Payment prior to 28 September 2020 but subsequently ceased to qualify ("Legacy Employers") will be able to access a modified version of these FW Act provisions.

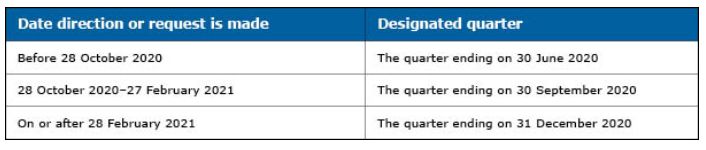

To make use of this modified regime, Legacy Employers must hold a certificate from a tax agent, BAS agent or qualified accountant stating that they experienced a 10% decline in actual GST in the below designated quarters compared to the equivalent period in 2019.

If eligible, Legacy Employers can issue the following types of JobKeeper Enabling Direction to those employees for which it previously received JobKeeper Payments:

- Stand Down Direction: Reduce the hours or days the employee works, provided the reduction in hours is not less than 60% of the employee's ordinary hours of work as at 1 March 2020 and does not result in the employee working less than two hours on any given day;

- Duties Direction: Have the employee undertake alternate duties; and

- Location Direction: Have the employee work at alternate locations (including at the employee's home).

Additionally, Legacy Employers can enter into agreements with affected employees to work alternate days or hours (so long as total hours worked is not reduced), which the employee must consider and not unreasonably refuse.

The conditions that apply to these directions and agreements are largely similar to those that apply for Qualifying Employers. The most significant difference is that whereas Qualifying Employers are required to provide only a three-day consultation period before issuing a direction, Legacy Employers must provide a seven-day window.

Critically, employers transitioning from being a Qualifying Employer to a Legacy Employer must reissue any existing directions or agreements and undertake a fresh round of consultation with affected employees. This process can begin while the entity is still a Qualifying Employer to ensure that the reissued direction takes effect from the date of transition.

JobKeeper Enabling Directions and JobKeeper Agreements given by Legacy Employers stop applying on 28 October 2020 or 28 February 2021 if:

- On 28 October 2020, the employer does not hold a 10% decline in turnover certificate for the quarter ending on 30 September 2020; and

- On 28 February 2021, the employer does not hold a 10% decline in turnover certificate for the quarter ending on 31 December 2020.

Prior to 28 October 2020 and 28 February 2021, a Legacy Employer must notify the employee in writing if the direction or agreement will stop applying (including when it will stop applying) or if the direction or agreement will continue to apply.

THREE KEY TAKEAWAYS

- The JobKeeper Payment Scheme has been extended with modifications until 28 March 2021, separated into two periods that effectively mirror the December 2020 and March 2021 quarters. From 28 September 2020, eligible employees will be split into two tiers based on their average hours worked in an applicable reference period. In the December 2020 quarter, Qualifying Employers will be subsidized $1200 and $750 per fortnight for each Tier One and Tier Two employee respectively. In the March 2021 quarter, they will receive $1000 and $650 per fortnight for each Tier One and Tier Two employee respectively.

- Other than those related to annual leave, the temporary workplace flexibility arrangements in the Fair Work Act 2009 (Cth) have been extended for Qualifying Employers in full. Qualifying Employers should seek further advice as to whether Directions or arrangements in place will continue to have effect into the Revised Scheme or whether they need to be reissued.

- Legacy Employers who can show a 10% reduction in actual GST turnover compared to the same quarter in 2019 will have a modified version of the workplace flexibility arrangements available to them, although they will need to reissue any directions currently in place and comply with additional notice and consultation requirements.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.