We're back with another update on recently-introduced tax legislation. As discussed last week, we continue to see bills reintroduced that expired at the end of the last session. Two of the more interesting proposals include a bill addressing the taxability of carried interest for investment management services and another proposing a new personal income surcharge on high-income residents of New York City.

- B. 999 – Tax Treatment of Carried Interest for Investment Management Services

This bill, a reintroduction of S.B. 303 from the last session, seeks to close the so-called carried interest tax loophole in New York by treating certain income earned by hedge fund managers and private equity investors—known as carried interest—as ordinary earned income rather than the capital gain treatment that it currently enjoys. At present, this income is not subject to New York tax when received by a nonresident due to its capital gain treatment, however that would change if the income was instead treated as ordinary income.

This bill also proposes a "carried interest tax fee" of 19% on income from certain investment management services.

State-level taxation of carried interest has been a hot topic of discussion in recent years as states look for revenue sources. If S.B. 999 is enacted, its effective date is tied to the date on which Connecticut, Massachusetts, and New Jersey enact similar legislation "having an identical effect."

- B. 1194 – Personal Income Surcharge on High Income Residents of NYC

This bill, a reintroduction of S.B. 3246 from the last session, would authorize NYC to impose a personal income surcharge on high income residents to fund transit improvements and reduced fares for low income residents. The justification explains that this legislation would provide a new, dedicated revenue stream to fund the projects critical to the MTA's operations and would ensure that the MTA will have the money to take immediate remedial action, and establish long-term financial stability.

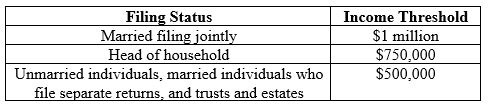

The bill would impose a 0.534% income tax surcharge on NYC residents' income in excess of the following thresholds, depending on filing status:

- B. 1406 – Repeal Rebate of Stock Transfer Tax

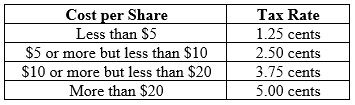

This bill, a reintroduction of S.B. 6203A, would repeal the 100% rebate for the stock transfer tax and dedicate the estimated $13 billion revenue to various state infrastructure action programs. New York currently imposes the stock transfer tax, but has provided a rebate for the amount of the tax since 1979, effectively nullifying the tax. The stock transfer tax is a revenue generator that operates as an indirect tax, rather than a direct tax like property or income. The tax would be imposed as follows:

- B. 1612 – Surcharge on Online Deliveries in NYC

In addition, transfer of stock or certificates other than by sale would have a tax rate of 2.50 cents. While the tax itself is quite small, it is estimated that the volume of trading could drive this revenue stream to at least $13 billion.

This bill, a reintroduction of A.B. 6078B from last session, would add a $3 surcharge to online delivery transactions terminating within New York City. The estimated $300 million in revenue generated from this measure would be used to fund the operating costs of buses and subways in New York City.

The bill defines delivery transactions subject to the surcharge as "a transaction that results in the delivery of any item purchased online to the purchaser." The $3 surcharge would be imposed on the seller, but would permit the cost of the surcharge to passed on to the purchaser and separately stated on the receipt. Notably, the bill would exempt deliveries of essential medical supplies, food deliveries, in addition to SNAP and WIC deliveries (supplemental nutrition assistance program and special supplemental nutrition program for women, infants, and children deliveries).

- B. 854 – Legalizing Adult-Use Recreational Marijuana

This bill would enact the Marihuana Regulation and Taxation Act ("MRTA"), which builds upon a similar plan introduced last year. The intent of this act is to regulate, control, and tax cannabis. The MRTA is expected to generate more than $463 million in new tax revenue for the State and another $336 million for New York City, among other things.

On the tax side of things, the bill would add a new Article 20-C to the Tax Law, titled "Tax on Adult-Use Cannabis Products," which would impose an 18% excise tax on the wholesale-to-retail transfer of cannabis products. There would also be a 1% tax for counties or cities with a population of at least 1 million and a 3% tax for municipalities. The new Article 20-C would also require licensees to file for a certificate of registration and to maintain complete and accurate tax records. Lastly, the bill would amend the Tax Law to exempt adult-use cannabis products from sales tax.

The Assembly's version of the bill can be found here.

This nuances of this bill will continue to be explained and updated by our Hemp & Medical Cannabis Practice as more details emerge.

- B. 1183 – Authorization of Mobile Sports Wagering

This bill would authorize the state to regulate and tax traditional and mobile sports wagering in New York. Among the requirements, the bill would require registration and reporting of mobile sports wagering licensees and a license fee of $12 million for each agent authorized to conduct mobile sports wagering. Additionally, the bill would require casinos to pay a state tax of 8.5%, on gross revenue from traditional sports betting and state tax of 12% on gross revenue from mobile sports betting.

- B. 168 – Graduate Outreach Assistance Law

This bill would enact the Graduate Outreach Assistance Law and exempt from state income taxation the first $250,000 earned by four-year college graduates, with a maximum $50,000 cap per year. Further, the bill would exempt from state income taxation the first $150,000 earned by two-year graduates, with a maximum $25,000 cap per year.

- B. 535 – Limiting Sales Tax on Storage Charges to In-State Facilities

This bill seeks to clarify the sales tax rules applicable to charges for storing tangible personal property. The bill would specifically provide that sales tax applies only if the storage facility is located within New York, regardless of where the items being stored are received from the customer. This would be accomplished by amending Tax Law § 1105(c)(4) to read as follows:

"[F]or purposes of the imposition of the sales tax under this paragraph, the tax shall only be assessed for the provision of a place for the storage of goods and/or tangible personal property provided that the physical location of the storage facility itself that is providing the safekeeping of goods and/or tangible personal property is actually located fully within the physical boundaries of the state of New York . . . ."

Thus, in the case of personal property moved from New York to a storage facility outside the state, storage charges would not be subject to New York's sales tax.

- B. 20 – Deduction for Retirement Plan Distributions Used for Long-term Care Insurance

This bill, a reintroduction of S.B. 2684, would grant a personal income tax deduction for retirement plan distributions, and would exempt distributions from individual retirement accounts and individual retirement annuities from personal income tax, when used to purchase long-term care insurance. In doing so, the bill would allow tax-free withdrawals from retirement IRA's and retirement annuities for the purchase of the premiums for long-term care insurance.

If passed, these new pieces of legislation could have a significant impact on New York taxpayers, so we plan to keep these bills on our radar and track their progression as the new Legislative Session moves forward.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.