As Electric / Autonomous Vehicle (E/AV) technologies continue to gain traction, E/AV companies are increasingly vying for funding in order to accelerate the rate of innovation. To stand-out amongst their peers and attract investors, E/AV companies should consider a deliberate schedule for filing patent applications. A patent portfolio is a key asset owned by the company and is often highlighted to investors as an indication of a company's innovativeness and robust research and development pipeline. Thus, Companies can impress investors with a consistent rate of patent filings leading up to, and following, the closing of an investment round.

The following charts overlay the number of patent filings/month with funding events for some five well-funded E/AV Companies. Funding events are according to CrunchBase, and patent filings are determined from the USPTO's public patent database, both as of September 2020. It should be noted that patent applications typically do not become public until 18 months after filing, so the following charts represent patent filings as of February 2019.

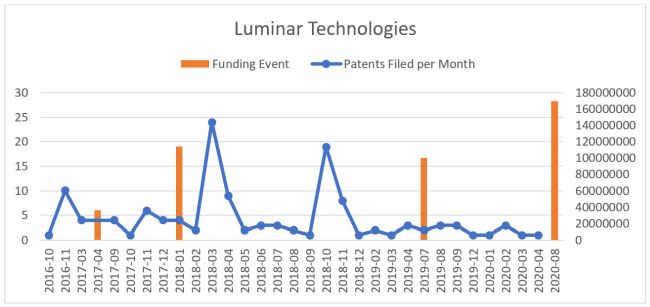

Figure 1: Luminar Technologies patent application filings / month and funding events

Luminar Technologies had nine months with patent filings between March 2017 and February 2018, with an average of about 5 applications filed per month. Soon after receiving funding for $114 million in January 2018, Lumniar Technologies peaked with 24 patent applications in March 2018, and then returned to an average of 4-5 applications per month until again spiking with 19 applications filed in October 2018. This second spike was soon followed by another significant funding event in July 2019.

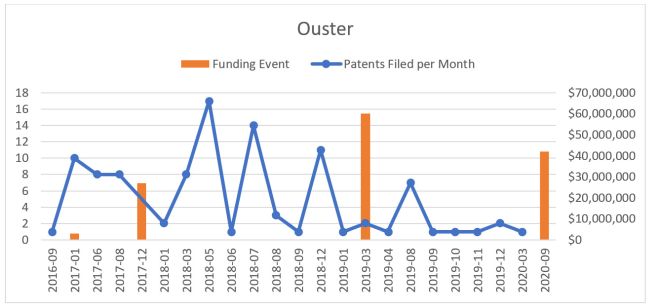

Figure 2: Ouster patent application filings / month and funding events

Ouster, from the start, ramped up its patent filings to 10 applications filed in January 2017 contemporaneously with its first funding event for $3 million. Ouster continued with two more months of filing 8 patent applications per month until its next funding event of $27 million in December 2017. Again, Ouster continued its patent program by filing 17, 14, and 11 patent applications in May 2018, July 2018, and December 2018, which was followed by its biggest funding event of $60 million in March 2019.

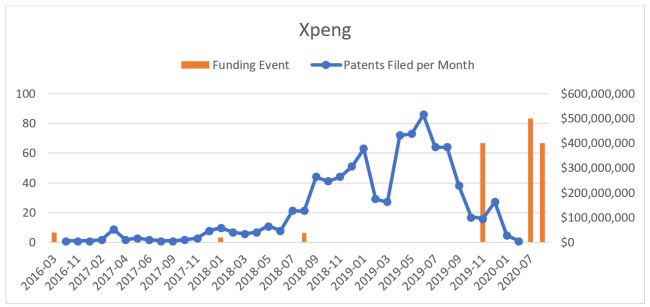

Figure 3: Xpeng patent application filings / month and funding events

Xpeng had an initial funding event of about $20 million in March 2016. Thereafter, Xpeng consistently filed patent applications almost every month until August 2018. After August 2018, Xpeng increased its patent filings to upwards of 80 patent applications in a single month until a large funding event in November 2019 for $400 million, which was subsequently followed by two more funding events for $500 million and $400 million in 2020.

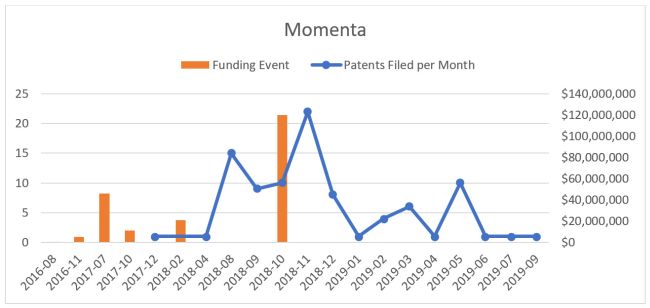

Figure 4: Momenta patent application filings / month and funding events

While Momenta had several funding events between August 2016 and February 2018, one of which was a $46 million raise in July 2017, Momenta did not file its first patent until December 2017. However, soon after Momenta's fifth funding event, Momenta filed 15 patent applications in August 2018, 9 patent applications in September 2018, and 10 patent applications in October 2018, which concluded with a raise of $120 million in October 2018. After this raise, Momenta continued this filing trend with 22 patent applications filed in November 2018, and regularly filing several patent applications a month from February 2019 to May 2019.

In summary, three out of four of these relatively well-funded companies had a spike in patent filings either right before or after a significant funding event. However, Xpeng, on the other hand, consistently filed a significant number of patent applications on a regular basis over the course of 2 years, which was followed by three funding events each above $400 million within the span of 8 months! Thus, E/AV companies should consider the optics of a consistent, deliberate patent program and how it can attract investors or result in a more significant raise.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.