From 2016 to 2020, Apple bought the most AI companies. Of the AI companies Apple acquired during this time, the following appear to provide technology (e.g., vehicular technology, visual or image processing, or facial recognition) at least tangentially applicable to the autonomous vehicle ("AV") or electric vehicle ("AV") sectors: Drive.ai, Emotient, Vilynx, Xnor.ai, Lighthouse AI, Spectral Edge, and Spektral.

Table 1 illustrates, based on publicly available records, the number of years from company founding to acquisition by Apple (based on date founded indicated by Crunchbase and year of acquisition indicated by GlobalData), the estimated acquisition amount or valuation at acquisition, and the number of United States patent assets (including issued patents and pending published patent applications and determed based on USPTO public records).

| Company | Estimated Acquisition Amount / Valuation at Acquisition (millions) | Years to Acquisition | Patent Assets |

| Drive.ai | $200 | 4 | 19 |

| Xnor.ai | $200 | 4 | 20 |

| Emotient | $100 | 4 | 22 |

| Vilynx | $50 | 9 | 5 |

| Spektral | $30 | 3 | 2 |

| Lighthouse AI, Inc. | $17 | 5 | 8 |

| Spectral Edge | $8.1 | 8 | 4 |

Table 1: Estimated Acquisition Amount, Years to Acquisition, and Patent Assets

While there are various factors leading to any acquisition and valuation, Table 1 illustrates that the three AI companies (Drive.ai, Xnor.ai, and Emotient) Apple acquired for over $100 million each had approximately 20 patent assets. Each of these three companies went from founding to acquisition at a breakneck pace of four years. The company with the next highest acquisition amount had only a quarter of the number of patent assets, and took nine years to be acquired.

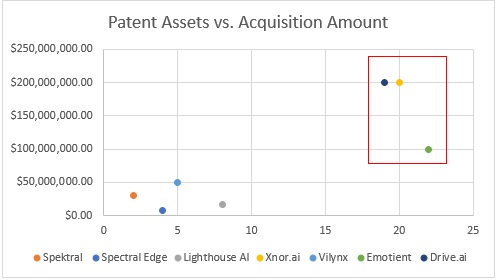

The following Figure 1 is based on the data in Table 1. As illustrated in Figure 1, the companies in the top right quadrant had the highest acquisition amount and largest patent portfolio, relative to the companies in the bottom left quadrant.

Figure 1: Patent Assets vs. Acquisition Amount

In view of the above, while there are many ways for companies to distinguish themselves from competitors and successfully exit for the highest amount, the patent portfolio of an AI company with AV/EV-related technology appers to be correlated with both the acquisition amount and number of years to acquisition. Thus, as an AI company developing AV/EV-related technology seeks funding or an exit, it can leverage a patent portfolio to indicate how innovative the AI company is, its proprietary technology, and multiply its valuation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.