On the evening of June 30, 2020, a few hours before the Paycheck Protection Program ("PPP") loan application deadline was set to expire, the U.S. Senate unanimously passed a bill amending the Coronavirus Aid, Relief, and Economic Security Act ("CARES Act") to extend the deadline from June 30 2020 to August 8, 2020. In order for the extension to take effect, the House of Representatives, which is scheduled to adjourn later this week for a reported two week recess, would need to pass the amendment, and the President would need to sign the measure into law.

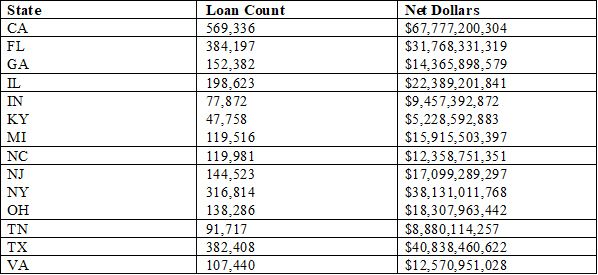

The CARES Act, which became law on March 27, 2020, initially made $349 billion in PPP funding available, but, in response to high demand, an additional $320 billion was later approved for this popular stimulus program. Through June 27, 2020 and in a period spanning just a few months, the U.S. Small Business Administration ("SBA") approved 4.8 million PPP loans for an aggregate amount of approximately $519 billion. The average PPP loan size is $108,000, and there are nearly 30,000 loans of over $2 million. The latest SBA reported data for select states follows:

Recent reports indicate that more than $130 billion in PPP funding remains available for prospective borrowers.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.