Financial markets rallied furiously on November 9th on the news that Phase 3 trial results to date for the Pfizer/BioNTech COVID-19 vaccine were 90% effective in preventing symptomatic COVID among 96 test patient cases where the virus was detected, considerably better than the 60%- 70% effectiveness that was expected from the first vaccines. Markets rejoiced as if the end zone was in sight, though much remains unknown about the Pfizer vaccine — including its long-term efficacy and side effects, its availability timetable, its ability to prevent transmission of the virus, and its effectiveness across demographic and ethnic groups.

The Phase 3 trial will continue until another 70 COVID-19 cases are detected. Pfizer's vaccine soon will receive emergency FDA approval, but it's not expected to be widely available to the general public any sooner than springtime. Despite these various unknowns, equity markets rallied 2%-3% on that very day while corporate high-yield bond spreads dropped more than 50 basis points, to their lowest yields ever, amid an economic recovery that is uneven and decelerating. Stocks reeling from high exposure to the economic impact of COVID-19, such as airlines and travel & leisure companies, soared that week. Just one week later, Moderna announced that its COVID-19 vaccine was 95% effective in early clinical trials, and the market rally continued. Apparently, financial markets were not anticipating that early vaccines would be so effective in clinical trials.

The sense that most aspects of American life will return to normal in 2021 has become palpable in financial markets, though many credible consumer surveys conducted throughout this pandemic continue to indicate otherwise. Are survey respondents unreliable when it comes to predicting their own behaviors, or are markets mostly ignoring what they are saying? The answer to that question will only become clear as 2021 unfolds.

Consumer surveys remain as popular as ever, especially during the pandemic, despite the common criticism that people's behavior is often inconsistent with their stated intentions. For instance, holiday surveys often show that respondents intend to be disciplined with their holiday spending—only to subsequently blow through their budget during the season. An intention doesn't necessarily translate into a consistent behavior. Regarding COVID-19, a slew of credible surveys tells us that consumer behaviors won't be the same on the other side of the pandemic. Let's see what they are saying on the big issues.

- — A survey of 10,000 adults conducted by Pew Research Center in September indicated that the percentage of respondents who would definitely or probably get a COVID-19 vaccine if it were available has dropped sharply compared to May. Only 51% of respondents said they definitely (21%) or probably (30%) would get the vaccine compared to 72% back in May. Those who said they definitely would get the vaccine dropped from 42% in May to 21%, while those who said they definitely wouldn't get the vaccine more than doubled to 24% in September from 11% in May. There were some notable response differences by political affiliation, age and race/ethnicity, but the percentage of respondents willing to get a vaccine declined across all groups compared to the May survey. Most interestingly, respondents' specific reasons for not getting a vaccine varied widely, ranging from concerns about safety, side effects and effectiveness to concerns about the speed of the vaccine development process. Moreover, it's hard to imagine that the many millions of Americans who refused to wear masks at the height of the pandemic will be lining up for a vaccine.

- Another survey conducted by Pew Research in September indicated that 51% of respondents said they expect their lives "will remain changed in major ways" after the pandemic is over compared to 48% who said their lives "will basically go back to normal." Women (54%) were more likely to say their lives will remain changed in major ways than were men (47%), while 60% of Democraticleaning respondents said their lives will remain changed in major ways compared to 40% for Republican-leaning respondents. White respondents were more likely to say their lives will go back to normal than were non-white racial/ethnic groups. By age cohort, the "change in major ways" response was strongest among young adults (57%) compared to Gen X and Young Boomers (50%) and Seniors (47%).

- The Passenger Confidence Tracker developed by Inmarsat based on

surveys of 10,000 global airline passengers indicated that:

- 83% of respondents said their travel habits will change post-COVID-19, including 41% who said they will travel less by any means. For U.S. respondents, only 11% said their travel habits will not change postCOVID-19 compared to 17% for all respondents.

- Among business travelers, 47% said they would be traveling less by any means post-COVID-19, while 40% said they would travel less by air.

- These responses have implications beyond just airlines, including lodging and hospitality and other travel & leisure segments.

- A U.S. consumer survey by Jefferies conducted in September indicated that 47% of respondents intend to do at least one-half of their total spending online post-COVID-19 compared to 40% prior to COVID. About 20% of respondents intend to do at least 80% of their total spending online going forward compared to approximately 13% prior to COVID-19. It's nearly inevitable that accelerated online shopping trends will stick after the pandemic has passed.

- In the same Jefferies survey, 46% of respondents who never worked from home prior to COVID-19 plan to do so more frequently going forward, including 33% who plan to work from home either two to three days per week (10%) or four to five days per week (23%).

The prevailing theme that most of us won't be returning to our pre-COVID lifestyles even when it is safe again underlies many survey findings on the topic. Anecdotally, most of us have had months to reflect on why we ever crammed into those packed planes, subways and gyms with regularity in the first place. That is not to say we won't ever be doing these things again, but we won't likely be doing them nearly as often, and these shifts, if realized, have tremendous economic implications. It would suggest that sudden overcapacity in the consumer discretionary sector in 2020 — whether that means too many airplanes, rental cars, hotel rooms, restaurants, office buildings, shopping malls, movie theatres, etc. — will remain a critical issue well beyond the end of the year. This excess capacity eventually must be rationalized. That won't happen immediately, as affected businesses hold out hope that Americans will eventually return to their old ways with enough time. For the most exposed industries, nobody knows exactly if or when the current glide path moving back towards normal will plateau short of pre-COVID levels of activity.

Should most people stick to their intentions, such a scenario would entail prolonged economic pain as these businesses contract to meet lower demand. Novel solution providers that have filled the gaps during the pandemic (and perhaps permanently), such as Zoom Video, Instacart or Etsy, tend to be technology driven and cannot come close to generating the economic activity or replacing the human capital drained from displaced incumbents. This retrenchment scenario would entail a lengthy period of elevated business failures, ongoing rounds of layoffs by afflicted industries, and the specter of several million working-age Americans permanently displaced from the labor force. Fed Chairman Jerome Powell might have said it best and most succinctly when he commented recently that, "We're recovering, but to a different economy."

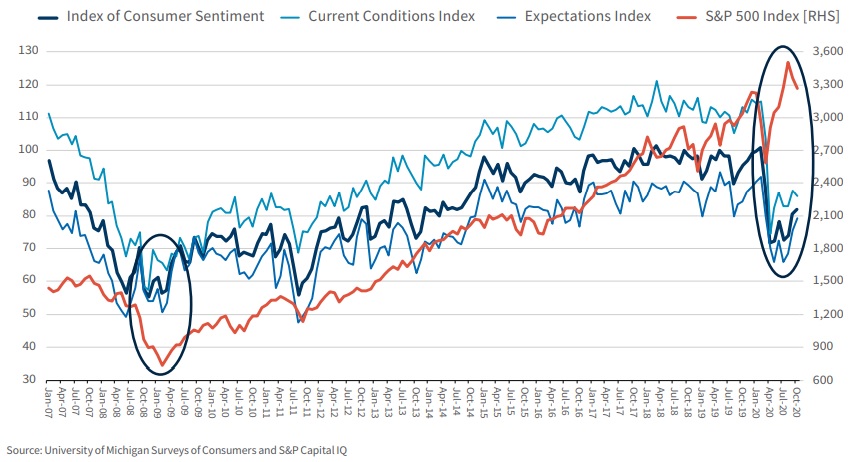

Consumer sentiment remains in the doldrums, above its lows of midyear but far below its pre-pandemic levels. Financial markets couldn't care less, and the contrast with the recession of 2008-2009 is stunning (Exhibit 1). Are survey responses about a post-COVID-19 world akin to New Year's resolutions, that is, intentions of future behavior with little follow-through? We'll have a better idea in about a year or so.

Exhibit 1: University of Michigan's Surveys of Consumers

Footnotes

1 U.S. Public Now Divided Over Whether to Get the COVID-19 Vaccine, Pew Research Center, September 17, 2020.

2 About Half of Americans Say Their Lives Will be Changed in Major Ways When the Pandemic is Over, Pew Research Center, September 17, 2020.

3 Passenger Confidence Tracker, Inmarsat Aviation, November 2020.

4 Cooped Up But Coping: A Fresh Look at Consumer Intentions, Jefferies LLC/ Jefferies Research Services LLC, September 10, 2020.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.