Canadian M&A activity remained strong in 2017, as low financing costs, an expanding U.S. economy and sustained domestic growth fueled a positive M&A environment. In 2017, 1,558 Canadian companies were sold, a 3.9% increase over the previous year, with disclosed enterprise values totaling $88 billion (9.1% over 2016). Of the transactions completed in 2017, 71.6% were domestic acquisitions, which is in line with historical averages.

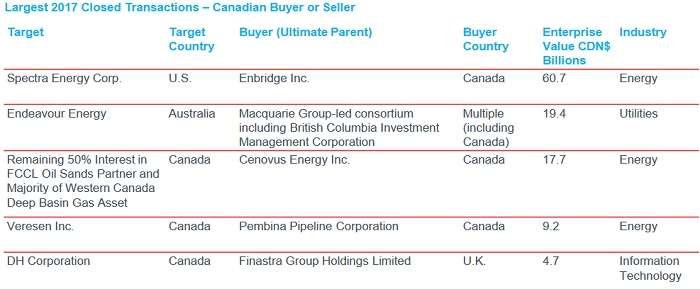

While the number of megadeals1 decreased from 74 in 2016 to 55 in 2017, the average size of such deals were larger, at CDN $3.2 billion in 2017 compared to $2.4 billion in the year prior. The largest deal of 2017 was Enbridge Inc.'s acquisition of Spectra Energy Corp. for $60.7 billion. The acquisition makes Enbridge the largest energy infrastructure company in North America, with a total enterprise value of $166 billion at the time of closing. In addition, in August 2017, Calpine Corporation, a U.S.-based energy utility company, announced its $22 billion sale to a consortium of investors led by CPPIB and Access Industries.

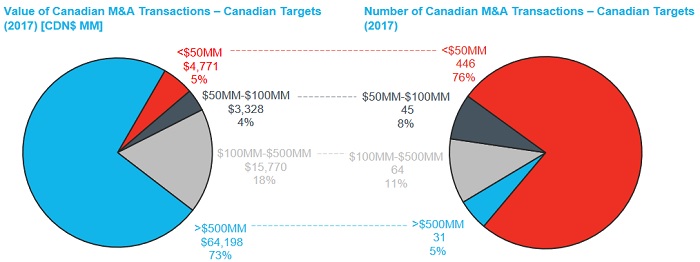

While the market experienced an uptick in both the number of deals and total deal size, the median value of disclosed transactions was CDN $10 million in 2017, compared to $11 million the year prior. The increased size of megadeals helped offset the lower transaction size (see slide 3). While only totaling 5% of all transactions, megadeals represented 76% of total deal value. Of note: Since the values of many smaller transactions are not disclosed, the actual median is likely lower.

To view the article please click here.

Footnotes

1 Deals involving a Canadian company as the buyer or seller with an implied enterprise value of $500 million or more.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.