Nearly a majority of tech industry dealmakers reports that their M&A activity has picked up over the past half-year, and even more expect their activity to increase through 2013, according to the latest edition of the M&A Leaders Survey issued jointly by global law firm Morrison & Foerster and 451 Research, a technology research firm. The survey gathers data and perceptions from players across the tech dealmaking community, including CEOs, CFOs, business development executives, in-house counsel, venture capital and private equity firms, and investment bankers.

This is the third semi-annual survey produced by MoFo and 451, seeking respondents' views on:

- the level of M&A activity in the past six months, as compared to the previous two years;

- their expectations of M&A activity over the next six months compared to the same period in 2012; and

- deal structures, including stock consideration and provisions for the operation of the target company's business between the signing and the closing.

1. Market Analysis and Outlook

Dealmakers see modest gains in remainder of 2013, though economic uncertainty remains

Respondents were slightly more likely than not to say their M&A activity has picked up over the past half-year, compared to the same period in the previous two years. Some 40 percent indicated they had been more active in the market, compared to the 36 percent who indicated they had been less active. The results are nearly identical to the responses from our survey in October, but represent roughly a 10-percentage-point swing from our inaugural survey last April.

With more than one-third of respondents saying they had slowed their acquisition activity in recent months, we asked what is keeping them out of the market. The dominant response was doubts about the sustainability of economic growth, cited by 79 percent of respondents as a strong factor for 2012's M&A decline.

Those doubts may bring less concern looking forward. Asked what changes they expected in key factors influencing M&A activity in 2013, some 68 percent cited stock market performance, and 62 percent cited U.S. corporate growth rates. Fewer than 40 percent expect obstacles related to U.S. tax or regulatory policy, or hurdles related to the European debt crisis, to be strong influences, suggesting that some of the grayest macroeconomic clouds - and deal inhibitors - of 2012 have dissipated.

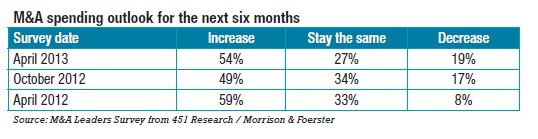

Consistent with this assessment of influential factors going forward, 54 percent expect increased activity for 2013, including 5 percent looking for a significant jump in deals. At the same time, the percentage saying they expect to be less busy with deal-making ticked up slightly to a new high-water mark of 19 percent.

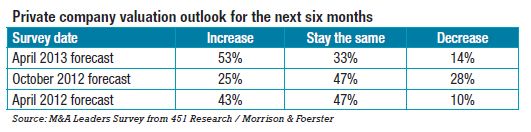

In terms of valuations, the bull market that has pushed U.S. equity markets to record highs since our last survey appears to be carrying over for private companies as well. The percentage of respondents who expect M&A valuations for private companies to rise in the coming months doubled to 53 percent from just 26 percent in our October survey. Just one in seven respondents (14 percent) forecast lower prices for this year.

High valuations are a double-edged sword, however, as some respondents consider target companies to be overvalued. One respondent observed that "increasing consolidation and overvalued share prices are reducing activity." Another noted, "The reason we do not pursue or close most deals is not macroeconomics or concerns about our business, but unrealistic valuation expectations on the part of the target(s)."

That perception may stem from a technology market "bifurcated" between highly valued players and those perceived as "also rans," according to Brenon Daly, 451 Research's lead M&A research analyst. One respondent asserted, "This will likely be a dual personality market. The 'high-traction' emerging companies will likely continue to have no trouble raising capital from the fewer remaining active VCs. The rest of the pack will likely have a more difficult time as fewer VCs have sufficient undeployed capital to support expansion-stage companies." Another foresees a winner-take-all market: "Hot sectors will remain strong, and tired sectors remain weak, widening out valuation differences between haves and have-nots."

Those "tired sectors" appear to refer to the shifting platforms on which people do their computing. One respondent noted, "The 'decline of the PC' is impacting companies across the software landscape as they wrestle with figuring out their mobile strategies. We think this is impacting companies in software sectors . . . whose businesses are heavily tied to the PC." Another remarked that the "quality of targets [is] going down in the software industry (due to consolidation), unless you look for new generation stuff, which is mostly hyped (but very good stuff!)."

II. Deal Structure

In addition to tech dealmakers' take on the direction of the M&A market, the Leaders Survey also seeks their views on key elements of deal structure. In this survey, we focused on the use of stock consideration vs. cash as deal currency, as well as the provisions in acquisition agreements aimed at the operation of the target company's business between the signing and the closing.

- Cash is king, but stock has its advantages

Cash is still king among the majority of our respondents, with only about 26 percent indicating they might be more likely to consider stock in a buy-side situation this year compared to the past two years. That signals very limited use of stock, as more than two-thirds of respondents said that since the beginning of 2011 they or the companies they advised used stock in acquisitions in just one percent to 20 percent of deals, while just 15 percent used stock in more than 41 percent of deals.

Respondents were brief and to the point in explaining why cash is their preferred currency. "No sense in using stock when cash is earning nothing," one explained. Another provided a take on the prevailing mentality: "Equity. Really?"

In M&A transactions where stock is used, the extra advantages of deferring gains taxes, participating in the upside of the business and capitalizing on the trading price of the buyer's stock were deemed the strongest deciding factors. More than 65 percent of our respondents found the potential to enable target stockholders to participate in the upside of stock the most appealing factor in considering stock.

- The importance of appropriate pre-closing covenants for preserving value

Approximately two-thirds of respondents agreed on the importance of pre-closing covenants as a means of preserving the value of the target business, with 65 percent also seeing them as a way to set expectations for the target in operating the business pending the closing. Fully 82 percent agree that the covenants reduce the risk of disputes at closing. One respondent put the utility of covenants in perspective: "a long pre-close process is a greater risk than any of the above items."

Not surprisingly, the pre-closing covenant category to which respondents assigned the highest single value was "no shop" provisions and non-solicitation agreements. More than 90 percent rated these provisions as important, and 62 percent rated them "very important."

Also among the most significant of the pre-closing covenants are those dealing with the workforce. A resounding 86 percent of respondents affirmed the importance of the covenants regarding the post-closing treatment of continuing employees, and 81 percent assigned a high level of importance to maintenance of target workforce and good relations with customers and suppliers. Together, these show the perception of where value lies in tech companies.

III. Respondent Demographics

The third edition of the MoFo - 451 M&A Leaders Survey is based on responses from approximately 200 tech dealmakers from a variety of company types and sectors. Respondents include 23 percent working in corporate or business development, 16 percent C-level executives, 11 percent general counsel, 37.6 percent in investment banking and 7 percent in venture capital or private equity.

Among those respondents working for IT companies, 20 percent work in applications software, 17 percent in infrastructure software, 9 percent in internet content or e-commerce and 4 percent in mobile.

Geographically, the largest number of respondents was concentrated in the San Francisco/Silicon Valley region, historic home of the largest technology and venture capital communities, followed by participants in the Southern California, mid-Atlantic, New York City and Boston areas. Other respondents hailed from the Midwest and other parts of the United States, Canada, Asia-Pacific Rim countries, the UK and Continental Europe.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved