Overview/Executive Summary

In response to the recent collapse of several prominent banking institutions, Morrison Foerster conducted a brief poll to gauge how companies and their employees are faring in the wake of these historic events. Our goal is to understand how this situation has impacted these organizations, including delving into which issues and challenges, if any, will be top of mind for business leaders and their respective organizations in the weeks and months ahead.

Methodology

The survey was conducted across the market between March 17 and March 24. Our report includes quantitative and qualitative feedback from 70 respondents from various industries (including Finance, Tech, and Life Sciences) and companies, ranging from small (up to 50 employees) to large (50+ employees) organizations.

Key Insights

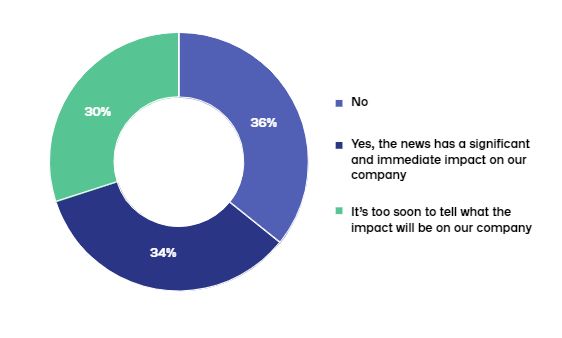

- Respondents were almost evenly split across the board in terms of the impact the current banking crisis is having on their businesses. Of respondents polled, 36% said the situation has no immediate impact on their business; conversely, 34% cited the situation as having a significant impact on their business, while 30% said it is too early to tell what the impact will be.

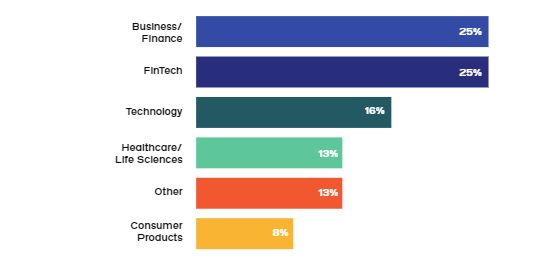

- Business/Finance, Fintech, Technology, and Life Sciences sectors emerged as those industries most impacted by the banking crisis.

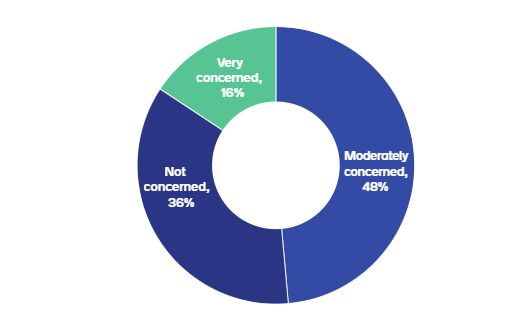

- A vast majority of respondents are either moderately or very concerned about the effect of the banking crisis on their businesses.

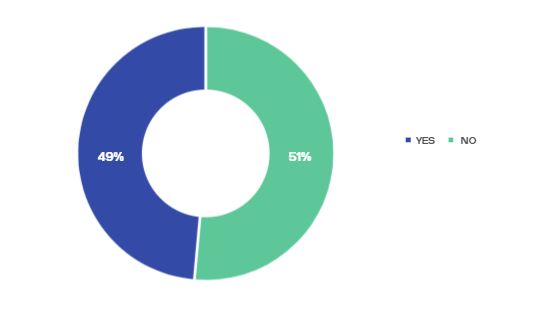

- When it comes to crisis management and preparedness, a little over half of respondents said they have an existing plan in place to deal with this type of a situation; by stark contrast, nearly the entire other half said they do not.

- According to respondents, three key themes emerged as priorities for safeguarding their businesses in the future: 1) ensuring more diversification of banking institutions; 2) making more conservative investments; and 3) bolstering current policies, procedures, and operations.

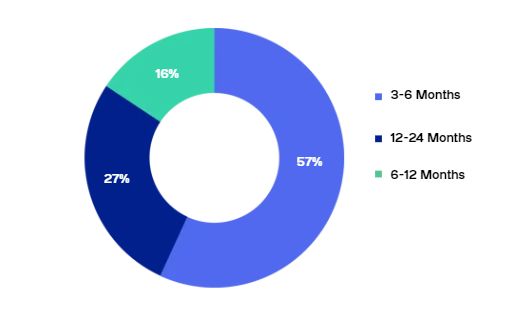

- A vast majority of respondents believe the situation will only have a short-term impact on their companies.

Read our full report to gain deeper insights into how these businesses are navigating this evolving situation.

Findings

Was your company impacted by the recent disruption in the banking industry?

If your company was impacted, please select the industry that applies to your business.

Does your company have a crisis management plan in place to address such a situation?

"The organizations that were best placed to respond to the banking crisis were those that had crisis management and business continuity plans in place to clarify decision making authority, ensure resiliency, and to provide a roadmap for response. The next crisis likely won't involve the collapse of a bank, but the basic framework for crisis decision making will likely be very similar," said Alex Iftimie, co-chair of Morrison Foerster's Global Risk and Crisis Management Group.

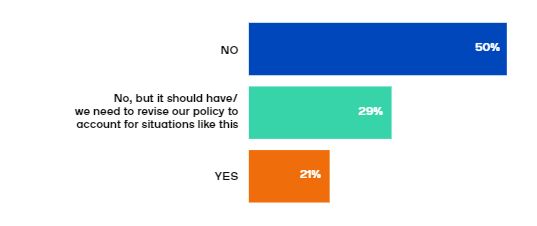

Did the banking sector turmoil trigger your organization's crisis management procedures?

"While crisis management is intended to be proactive, it can benefit from being reactive. The wake of an unexpected crisis is precisely the time to explore where your organization is most vulnerable and how to better prepare for those vulnerabilities in the future," said Brandon Van Grack, co-chair of Morrison Foerster's National Security and Global Risk + Crisis Management Groups.

When asked the following open-ended questions—Are you making any changes to safeguard your business against another similar situation from happening in the future? If so, what precautions are you taking?—three primary themes emerged:

1) Diversification of Funding

- "Diversify our banks and monitor their status." [respondent quote]

- "Additional 'life boat' accounts at other financial institutions. Will utilize only 'money center' size banks for such." [respondent quote]

2) Conversative Investments

- "Ask more questions about insurance. Review them on a regular basis." [respondent quote]

- "One operating account with a stable/boring regional bank." [respondent quote]

3) Bolster Policies, Procedures, and Operations

- "If anything, this tested our foresight into possible situations. . . We're a 'sleep at night' kind of company. I am shocked that others didn't prepare." [respondent quote]

- "We implemented safeguards over 23 years ago. We've been marginalized for our risk management by clients and colleagues alike, though now our work becomes an enduring strategic advantage. We're actively looking for ways we can be helpful now that our point of view is at least timely and relevant." [respondent quote]

"In any crisis, regulated entities, such as banks, are expected to examine their operations to identify and mitigate risks. While the current banking crisis was not caused by Banking as a Service or strategic partnerships with Fintechs, regulators will undoubtedly be carefully scrutinizing many banks that serve as sponsor banks. We expect that scrutiny will move downstream to Fintech partners. As such, it would be advisable for Fintechs to proactively 'get their houses in order' and be prepared to promptly respond to sponsor bank requests for information and/or update policies and procedures," said Crystal Kaldjob, co-lead of Morrison Foerster's Fintech Practice and Financial Services Group partner.

How concerned is your business about the availability of capital?

"Never let a good crisis go to waste. The recent bank failures teach us that companies of all sizes and maturity level should focus on financial resiliency. Financial resiliency, however, is not solely about banking relationships, but also liquidity, cash flow management, investment strategy and overall financial controls. From a board oversight perspective, in light of the speed of the recent banking crisis, it is imperative that boards assess what is material to the business and prioritize their time and efforts to mitigate future internal and external risks based on the company's risk profile," said Jackie Liu, Morrison Foerster corporate partner.

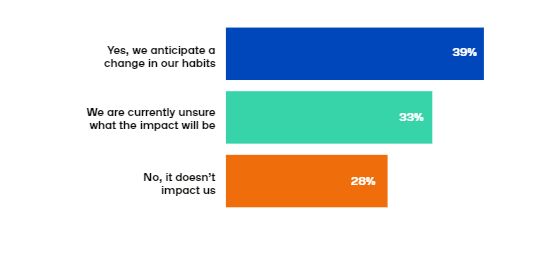

Does this situation impact your company's long-term banking and spending habits?

"Liquidity is key. It may be tempting to continue business as usual, but every dollar out the door now may be a cause for regret later," said Jennifer Marines, Morrison Foerster vice chair and co-chair of the firm's global Business Restructuring & Insolvency Group.

If applicable, how long do you envision this disruption

in banking will impact your company?

"While the crisis appears to be on its way to a resolution, the high-interest rate environment and rumors of an upcoming recession continue to persist. Companies should be prepared for the possibility that they may have to deal with similar issues in the future," said Ben Butterfield, partner in the firm's Business Restructuring & Insolvency Group.

"Companies should always be prepared for a crisis, particularly as it relates to maintaining sufficient liquidity. The banking crisis happened swiftly and without meaningful notice. Many companies were unprepared to quickly address challenges related to employees, vendors, lenders, and investors. A healthy liquidity position is paramount to retaining flexibility when crisis strikes. So too is a clear crisis management plan that addresses cash withholdings, priority of payments, avenues to additional capital, and communications with key constituents," said Jennifer Marines, Morrison Foerster vice chair and co-chair of the firm's global Business Restructuring & Insolvency Group.

Conclusion

We hope this Banking Disruption Pulse Survey has been insightful and acts as a starting point in thinking about your own business crisis plan.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved