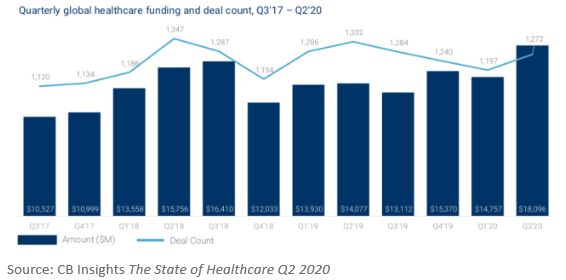

CBInsights recently hosted a webcast, The State of Healthcare Q2 2020. Capital raising by companies in the global healthcare sector yielded a historic high of $18.1 billion in the second quarter of 2020, and deal volume rose 6% quarter-over-quarter. Total funding was boosted by six mega-rounds, or capital raises over $100 million, in the regenerative heath subsector accounting for a combined total of about $1.3 billion. In the second quarter of 2020, North American healthcare companies raised $10.5 billion, dipping slightly from the prior quarter. Despite the global increase in private venture funding, amounts raised in early stage deals continued to decline, continuing the declining trend since the third quarter of 2019.

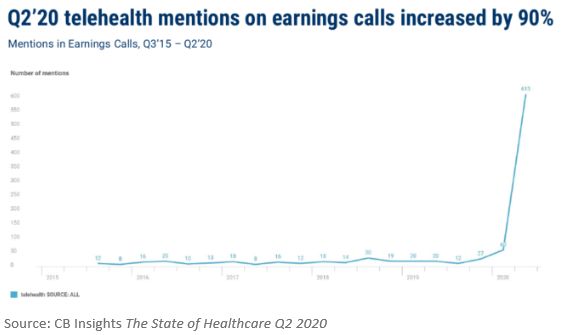

Funding for digital health companies rebounded 22% quarter-over-quarter to $5.8 billion. Seven mega-rounds, one less than in the first quarter of 2020, were completed by U.S. digital health companies. Telehealth companies continued to attract investors due to an increased demand for virtual mental health services. While telehealth companies saw an increase in deal volume, funding decreased 18% quarter-over-quarter. As healthcare products diversified, digital platforms for women's health also gained traction this quarter.

The telehealth and medical devices sectors experienced an increase in M&A activity. There were 22 telehealth startup M&A exits. Medical device company exits included 34 M&A exits and 12 IPOs. The consolidation and funding growth in this sector can be attributed to regulatory developments and increased interest in digital therapeutics and at-home testing. Artificial intelligence companies in the healthcare sector saw a 14% increase in quarter-over-quarter funding and raised over $1 billion in venture funding. The highest funding rounds in the sector were drug research and development. The largest mega-round in the healthcare AI sector raised over $143 million for a company developing machine learning to simulate potential drug targets for clinical trials.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe - Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.