Highlights

- The Centers for Medicare & Medicaid Services (CMS) released the Calendar Year (CY) 2023 Medicare Physician Fee Schedule (PFS) Proposed Rule on July 7, 2022, which impacts Medicare Part B payments starting Jan. 1, 2023. Comments are due on 6, 2022.

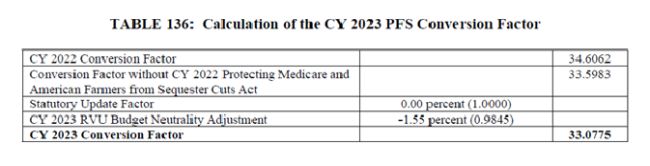

- The proposed CY 2023 PFS conversion factor is $33.08, a roughly 4.4 percent decrease from CY 2022 due to a zero percent update factor required under the Medicare Access and CHIP Reauthorization Act (MACRA), expiration of a temporary 3 percent positive adjustment to mitigate previous coding changes, and the statutorily-required budget neutrality adjustment.

- CMS proposes several payment policy changes, including rebasing and revising the Medicare Economic Index, revaluing remaining evaluation and management codes, continuing its four-year phase-in of clinical labor pricing updates, and delaying changes to redefine the substantive portion of a time-based split/shared visit until 2024.

The Centers for Medicare & Medicaid Services (CMS) released the Calendar Year (CY) 2023 Medicare Physician Fee Schedule (PFS) Proposed Rule on July 7, 2022, which impacts Medicare Part B payments starting Jan. 1, 2023. Comments are due on Sept. 6, 2022.

CMS proposes several payment policy changes, including rebasing and revising the Medicare Economic Index, revaluing remaining evaluation and management codes, continuing its four-year phase-in of clinical labor pricing updates, and delaying changes to redefine the substantive portion of a time-based split/shared visit until 2024.

In addition, CMS includes policies that would impact Advanced Alternative Payment Model (AAPM) participants, including substantial changes to Medicare's Shared Savings Program and a request for feedback on potentially transitioning to making Qualified Participant threshold determinations at the clinician, rather than AAPM Entity level.

This Holland & Knight alert provides a summary of the proposed rule and other key provisions.

Additional details can be found in these CMS resources:

- Press release

- Proposed Rule Fact Sheet

- CY 2023 Medicare Shared Savings Program Proposals

- CY 2023 Quality Payment Program Proposed Changes

CY 2023 Conversion Factor Updates

The proposed CY 2023 conversion factor is $33.08, a 4.4 percent decrease from the CY 2022 PFS conversion factor of $34.61. This accounts for the zero percent update factor required under the Medicare Access and CHIP Reauthorization Act (MACRA), expiration of the 3 percent flat increase included in the 2022 omnibus package to mitigate the impact of previous Evaluation and Management (E/M) visit coding changes, and the statutorily required budget neutrality adjustment. See Table 136.

Individual coding changes may result in additional increases or decreases by specialty, which are summarized in Table 138, and further broken down by setting in Table 139.

Notably, these changes to the conversion factor would not include an additional 2 percent in Medicare sequester cuts, or an additional 4 percent in so-called "PAY-GO" rules if Congress does not intervene. Notably, the 5 percent Advanced Alternative Payment Model (AAPM) lump sum payment is also set to expire at the end of 2022.

The proposed CY 2023 anesthesia conversion factor is 20.7191, a decrease of 3.9 percent compared to the CY 2022 conversion factor (see Table 137).

Medicare Telehealth Services

CMS proposes to add 40 additional services to the Medicare Telehealth Services List on a Category 3 basis (i.e., require additional evidence before being added on a permanent basis), which would guarantee their inclusion through at least 2023 (see Tables 7 and 8). Notably, CMS did not include Telephone E/M visit codes to this list. CMS also proposes to add three prolonged service codes to the permanent list of Medicare telehealth services (see Table 9). The complete list of Medicare telehealth codes will be posted on the CMS website.

CMS proposes to codify several telehealth flexibilities that were extended for 151 days after the end of the Public Health Emergency (PHE) under the Consolidated Appropriations Act, including waiving of geographic and site of service requirements, covering audio-only services, allowing additional Medicare provider types to furnish such services, a revised payment methodology for Federally Qualified Health Centers (FQHCs) and Rural Health Clinics (RHCs), and waiving in-person initial visit requirements for mental health services. CMS also proposes several specific services that would continue to be available via telehealth for the same time frame (Table 10).

CMS notes that after this 151-day period, Medicare telehealth services will no longer require Modifier 95, but the appropriate place of service (POS) indicators (POS 10 for in a patient's home and POS 2 for anywhere else) will continue to be required and all payments will revert to facility rates. Starting Jan. 1, 2023, Modifier 93 should be affixed to audio-only telehealth claims, including those delivered by RHCs, FQHCs and opioid treatment programs (OTPs). Starting the Jan. 1 following the end of the PHE, direct supervision requirements would revert to physical presence, rather than real-time audio/video technology, though CMS seeks comment on making this policy permanent. The proposed CY 2023 telehealth originating site facility fee is $28.61.

Evaluation and Management (E/M) Visits

As a continuation of its multiyear effort to update coding and payment for E/M visits, CMS proposes coding and revaluation policies for the remaining E/M visits beginning for CY 2023. These include inpatient and observation visits, emergency department (ED) visits, nursing facility visits, domiciliary or rest home visits, home visits, and cognitive assessments and care planning, but excludes critical care services. Collectively, these services comprise approximately 20 percent of all allowed charges under the PFS. CMS proposes to consolidate inpatient and observation care into a single code set, and to consolidate home and domiciliaries into a single home or residence-based services code set, which would cover assisted living facilities, group homes, custodial care facilities and residential substance abuse treatment facilities.

Generally, CMS aligns the billing framework for these services with the recently updated framework for office/outpatient (O/O) E/M visits. Specifically, total practitioner time (including qualifying activities by the physician or non-physician practitioner/NPP) or medical decision-making (MDM) would be used to select the E/M visit level; history and physical exam would no longer be used. CMS would consider a billable unit of time to have been attained when the midpoint is passed.

CMS generally proposes to adopt the Current Procedural Terminology (CPT) Editorial Panel's recommended individual code and descriptor updates, except for prolonged service codes, for which it proposes new G-codes (GXXX1-GXXX3) that would be applied within the hospital inpatient/observation, nursing facility and home/residence-based code families respectively. Existing CPT codes for prolonged services would no longer be billable. This aligns with its approach for O/O E/M visits. CMS proposes to accept many, but not all Relative Value Scale Update Committee (RUC)-recommended code valuations, noting that the values established for the revised O/O E/M codes were based on making a separate payment for the new complexity add-on code G2211, which was delayed until at least Jan. 1, 2024 under the Consolidated Appropriations Act. CMS proposes to slightly increase the work relative value unit (RVU) for cognitive assessment and care planning services to recognize their inherent time and complexity.

CMS would continue not to recognize subspecialties, nor recognize physicians and NPPs as having the same specialty. However, it does propose to slightly modify its definitions for initial and subsequent services whereby an initial service would be one where the patient has not received any professional services from any physician or other qualified health care professional of the same specialty who belongs to the same group practice and a subsequent service would be one where the patient has received any professional services from any physician or other qualified health care professional of the same specialty who belongs to the same group practice.

Split/Shared Services

In the CY 2022 PFS final rule, CMS finalized a policy to allow payment to a physician for a split/shared facility-based visit (including prolonged visits), where a physician and NPP provide the service together (not necessarily concurrently) and the billing physician personally performs a substantive portion of the visit, as defined by patient history, exam or MDM, or more than half of the total time spent by the physician and NPP performing the visit. In this rule, CMS proposes to delay implementation of its definition of the substantive portion as more than half of the total time until Jan. 1, 2024, to allow for coding and payment changes for remaining E/M visits to take effect (summarized above). CMS also makes several technical corrections and clarifies that its policy for split/shared critical care services is the same regardless of whether the patient receives care from one physician, multiple practitioners in the same group and specialty providing concurrent care, or physicians and NPPs billing critical care as a split/shared visit.

Rebasing and Revising the Medicare Economic Index (MEI)

CMS proposes to revise and rebase the MEI, which was last updated in 2014. Specifically, the agency proposes to rebase the index for 2017, use several additional data sources and further disaggregate certain categories. In the end, the percent change of the proposed updated MEI would be an increase of 3.8 percent, one-tenth of a percentage point higher than what it would be under the previous methodology (using current projections). Tables 30 and 37-39 help to illustrate the impact of the proposed updated methodology and its comparison to the previous methodology. CMS proposes to delay implementation to allow for public comment, and so as not to interfere with proposed GPCI updates. The agency seeks comment on implementation time frame, including a possible multiyear transition period given the significance of the proposal.

Behavioral and Mental Health Services

CMS proposes to amend direct supervision requirements for "incident to" services to allow behavioral health services to be furnished under general (as opposed to direct) supervision. The agency proposes to create a new G code (GBHI) for behavioral health integration performed by clinical psychologists (CPs) or clinical social workers (CSWs) when mental health services are the focal point. Psychiatric diagnostic evaluations (CPT code 90791) would serve as the initiating visit for GBHI1. Like other behavioral health services, GBHI1 services could be billed as incident to under general supervision and during the same month as chronic care management (CCM) and transitional care management (TCM) services, provided all requirements are met and time and effort are not double counted. Patient consent requirements would apply to each service independently. CMS also proposes to remove the restricted procedure status indicator for family psychotherapy services and seeks comment on whether current payment policies adequately cover intensive outpatient mental health services, including substance use disorder services, as well as the indirect costs for furnishing mental health services in nonfacility settings.

Chronic Pain Management (CPM) Services

CMS proposes to create two new Healthcare Common Procedure Coding System (HCPCS) G-codes (GYYY1 and GYYY2) for bundled monthly CPM services beginning Jan. 1, 2023. CPM services would include a person-centered care plan, health literacy counseling and administering pain rating scales. The initial visit must be face-to-face, though subsequent visits could be delivered via telehealth. At the initial visit, the beneficiary would need to be educated as to what CPM services are, how often they occur and any applicable cost sharing, and must provide their verbal consent, which must be documented in their medical record. CMS proposes to define chronic pain as persistent or recurrent pain lasting longer than three months. Beneficiaries who have previously been diagnosed with chronic pain or those newly diagnosed during the visit would both be eligible. CPM codes could be billed in the same month as CCM services, TCM services, behavioral health integration (BHI) services or bundled payments for opioid use disorders. However, time may not be double counted and CPM services could not be billed on the same date of service as new office/outpatient visits. CMS proposes to limit CPM codes to in-office or other outpatient or domiciliary settings. Up to two practitioners could bill GYYY1 for the same patient per month.

Opioid Use Disorder (OUD) and Opioid Treatment Programs (OTPs)

For CY 2023 and subsequent years, CMS proposes to revise its methodology for pricing the drug component of the methadone weekly bundle (HCPCS codes G2067 and G2078) to the CY 2021 payment amount updated annually to account for inflation. For 2023 rates, CMS would account for inflation for both CY 2022 and CY 2023. The proposed CY 2023 methadone payment amount would be $39.29, a 5.1 percent increase from 2022 rates. CMS will update this methodology as necessary to account for significant changes in acquisition costs and use updated data sources if they become available. For the nondrug component, CMS proposes to update the base rate for individual therapy to 45 minutes, as opposed to 30 minutes, raising the 2020 base rate from $68.47 to $91.18. CMS would then apply the MEI updates for 2021, 2022 and 2023 to this adjusted rate to determine the CY 2023 payment amounts. CMS clarifies that the accompanying 30-minute add-on code (HCPCS code G2080) may continue to be applied.

CMS proposes to clarify that services furnished via OTP mobile units will be considered for reimbursement under Medicare OTP bundled payment codes and/or add-on codes, and would be treated as if they were furnished at the physical location of the OTP. CMS notes that the prohibition on billing OTP services for the same beneficiary more than once within a contiguous seven-day period would apply regardless of location. The agency proposes to allow services to initiate treatment with buprenorphine (not methadone) be furnished via two-way audio-video communications technology (or via audio-only if audio-video is not available to the beneficiary) and seeks comment on whether these flexibilities should be extended beyond the COVID-19 PHE.

Practice Expense (PE) Updates

- Clinical Labor Pricing: CMS will continue its four-year phase-in of the clinical labor pricing update that began last year (See Table 4) and proposes several additional updates, including adjustments to several tasks associated with digital technology (See Table 5).

- Equipment and Supplies: CMS proposes to update the prices of eight supplies and two equipment items (Table 15).

- Indirect Practice Expenses: CMS seeks comment on possible new data sources and methodologies for regularly updating indirect practice expenses, including how evolving market trends and technologies may impact these calculations.

- Global Surgical Codes: CMS seeks comment on strategies to improve payment accuracy for global surgical codes, including accounting for the impact of recent E/M coding changes.

- Direct Practice Expenses: See the rule's downloads section for proposed CY 2023 direct PE inputs and Table 14 for code-specific refinements to RUC-recommended direct PE values.

Tables 12-17 contain work and PE relative value units (RVUs) for new, revised and potentially misvalued codes.

Potentially Misvalued Services

- Home-Based Visit Codes: CMS is separately addressing home-visit codes and therefore will not treat them as potentially misvalued.

- Cataract Surgery and Retinol Procedure Codes: CMS notes their complex nature and seeks comment on continuing to reimburse these codes in facility-based settings only.

- Add-On Code for a Structural Allograft for Spine Surgeries: CMS determines the code does not meet criteria for being potentially misvalued as it is solely an add-on code.

Geographic Practice Cost Indices (GPCIs) (352)

CMS proposes new GPCIs for CY 2023 (Table 19) along with a geographic adjustment factor (GAF) for each (Addenda D and E). Half of the proposed GPCI adjustment would be phased-in starting in CY 2023, with the remaining half in CY 2024. The proposed GPCIs reflect the 1.0 work GPCI floor, which was extended through 2023 by the Consolidated Appropriations Act. CMS notes that the proposed rebasing of the MEI cost weight methodology would not impact calculation of 2023 GPCIs. CMS also proposes to consolidate the number of unique fee schedule areas in California, underscoring that the changes would not have any payment implications. CMS proposes technical changes to improve the accuracy of the GPCI methodology, including making changes to occupation codes and groups, and calculating each locality's GAF based on CY 2020 Medicare utilization data, rather than the 2006-based MEI cost share weights (Table 22). CMS noted that in response to calls from stakeholders, it evaluated eight possible alternative data sources for calculating the physician office rent component of the PE GPCI, but all failed on at least one key criterion and will continue to use American Community Survey data.

Malpractice (MP) RVUs (387)

CMS calculated the proposed CY 2023 MP RVUs using updated MP premium data obtained from state insurance rate filings. The agency notes that the methodology largely mirrors that used in 2020, with some technical modifications. To mitigate the negative impact on certain specialties and promote payment stability, for specialties for which the use of newly available premium data would result in a 30 percent or greater reduction in the risk index for CY 2023 as compared to the current risk index value for CY 2022, CMS proposes to phase-in the reduction in MP RVUs over three years (See downloads). CMS proposes to exclude the same specialties for purposes of calculating MP RVUs that it already excludes for PE RVUs and seeks comment on the list of specialties excluded on the basis of low volume service codes (See downloads).

Multiple Procedure Payment Reduction (MPPR) Cap

The following new and revised imaging services would qualify toward the MPPR cap: CPT codes 0493T; 0640T; 0641T; 0642T; 0651T; 0658T; 0689T; 0690T; 0694T; 0700T; 0701T and 76XX0.

Administration of Preventive Vaccines and Therapies (983)

CMS proposes to use GAFs to geographically adjust administration services for all preventive vaccines for CY 2023 and subsequent years, which can be found in Addendum D. CMS also proposes to update the payment based upon the annual increase to the MEI. CMS proposes to continue the additional payment of $35.50 when a COVID-19 vaccine is administered in a beneficiary's home under certain circumstances through the end of CY 2023. CMS additionally proposes that this add-on payment would be adjusted for geographic cost differences using the GAF for each PFS area and would also be updated using the MEI.

Following the end of the CY in which the PHE expires, CMS will transition to treating monoclonal antibody therapies used to treat COVID-19 as biologicals under the applicable payment system and geographically adjust payments using GAFs, but would not annually update them according to the MEI. Monoclonal antibody products used as pre-exposure prophylaxis for prevention of COVID-19 would continue to be paid under the Part B vaccine benefit, would be geographically adjusted according to regional GAFs, and also would not receive an annual update. The policies in this section are summarized in Tables 71 and 72.

Request for Information (RFI): Community Health Workers (CHWs)

CMS is interested in hearing how CHWs may warrant separate Medicare reimbursement for providing reasonable and necessary services to Medicare beneficiaries. Specifically, whether existing supervision requirements would accommodate CHWs, the extent to which CHWs are already compensated by other sources and how qualifications for CHWs vary state to state.

RFI: Potentially Underutilized Medicare Services

CMS seeks comment on ways to identify and define high-value services that promote the health and well-being of Medicare beneficiaries and may reduce unnecessary spending, as well as ways to overcome potential barriers, particularly for underserved populations.

Valuation of Specific Codes

CMS proposes valuations for the following specific codes:

|

Code Group |

CPT codes |

|

Anterior Abdominal Hernia Repair |

157X1, 49X01, 49X02, 49X03, 49X04, 49X05, 49X06, 49X07, 49X08, 49X09, 49X10, 49X11, 49X12, 49X13, 49X14 and 49X15 |

|

Removal of Sutures or Staples |

15851, 158X1 and 158X2 |

|

Arthrodesis Decompression |

22630, 22632, 22633, 22634, 63052 and 63053 |

|

Total Disc Arthroplasty |

22857 and 228XX |

|

Insertion of Spinal Stability Distractive Device |

22869 and 22870 |

|

Knee Arthroplasty |

27446 and 27447 |

|

Endovascular Pulmonary Arterial Revascularization |

338X3, 338X4, 338X5, 338X6 and 338X7 |

|

Percutaneous Arteriovenous Fistula Creation |

368X1 and 368X2 |

|

Energy Based Repair of Nasal Valve Collapse |

37X01 and 30468 |

|

Drug Induced Sleep Endoscopy (DISE) |

42975 |

|

Endoscopic Bariatric Device Procedures |

43235, 43X21 and 43X22 |

|

Delayed Creation Exit Site from Embedded Catheter |

49436 |

|

Percutaneous Nephrolithotomy |

50080 and 50081 |

|

Laparoscopic Simple Prostatectomy |

55821, 55831, 55866 and 558XX |

|

Lumbar Laminotomy with Decompression |

63020, 63030 and 63035 |

|

Somatic Nerve Injections |

64415, 64416, 64417, 64445, 64446, 64447, 64448, 76942, 77002 and 77003 |

|

Transcutaneous Passive Implant-Temporal Bone |

69714, 69716, 69717, 69719, 69726, 69727, 69XX0, 69XX1 and 69XX2 |

|

Contrast X-Ray of Knee Joint |

73580 |

|

3D Rendering with Interpretation and Report |

76377 |

|

Neuromuscular Ultrasound |

76881, 76882 and 76XX0 |

|

Immunization Administration |

90460, 90461, 90471, 90472, 90473 and 90474 |

|

Orthoptic Training |

92065 and 920XX |

|

Dark Adaptation Eye Exam |

92284 |

|

Anterior Segment Imaging |

92287 |

|

External Extended ECG Monitoring |

93241, 93242, 93243, 93244, 93245, 93246, 93247 and 93248 |

|

Cardiac Ablation |

93653, 93654, 93655, 93656 and 93657 |

|

Pulmonary Angiography |

93XX0, 93XX1, 93XX2, 93XX3, 93563, 93564, 93565, 93566, 93567 and 93568 |

|

Quantitative Pupillometry Services |

959XX |

|

Caregiver Behavior Management Training |

96X70 and 96X71 |

|

Cognitive Behavioral Therapy Monitoring |

989X6 |

|

Code Descriptor Changes for Annual Alcohol Misuse and Annual Depression Screenings |

HCPCS codes G0442 and G0444 |

|

Insertion, and Removal and Insertion of new 180-Day Implantable Interstitial Glucose Sensor System |

HCPCS codes G0308 and G0309 |

Non-Face-to-Face/Remote Therapeutic Monitoring (RTM) Services

CMS proposes to create four new HCPCS G-codes (Table 28). GRTM3 and GRTM4 would expressly facilitate RTM services furnished by qualified non-physician healthcare professionals who cannot bill incident to. GRTM1 and GRTM2 would include clinical labor activities that can be furnished by auxiliary personnel under general (as opposed to direct) supervision by a physician. CMS additionally proposes to accept the RUC recommendation to temporarily accept contractor prices for CPT code 989X6, a PE-only device code for RTM services, and will work with regional Medicare Administrative Contractors (MACs) to better understand the types of devices commonly used and associated costs.

Skin Substitutes

CMS aims to create a consistent payment approach for skin substitute products across nonfacility settings, including establishing a HCPCS Level II code and uniform benefit category (regardless of whether it is synthetic, or human- or animal-based). CMS proposes to replace the term "skin substitutes" with the term "wound care management." For CY 2023, skin substitute products that were previously assigned Q codes will continue to be paid under the current Average Sales Price (ASP)+6 payment methodology. However, effective starting CY 2024, these products would be considered incident to supplies. Accordingly, CMS proposes to discontinue Q codes at the end of CY 2023 and establish "A" codes for all skin substitute products meeting the criteria for a HCPCS Level II code, and to contractor price these codes effective Jan. 1, 2024. Accordingly, CMS would also evaluate products through its biannual coding cycles for nondrugs and nonbiological products.

Allowing Audiologists to Furnish Certain Diagnostic Tests Without a Physician Order

CMS proposes a limited exception to the order requirement for certain diagnostic hearing testing services furnished by audiologists for non-acute hearing conditions (Table 29). Notably, this would not include higher level vestibular function tests or balance assessments used for patients with disequilibrium. CMS proposes to create an accompanying HCPCS code (GAUDX) for such services performed without an order, which can be billed once every 12 months per beneficiary.

Dental Services

CMS seeks to clarify its existing coverage policies concerning medically necessary dental services provided in conjunction with other Medicare-covered services, including that such dental services could be appropriately furnished in inpatient or outpatient settings, could be delivered incident to, and could cover related ancillary services such as anesthesia, diagnostic x-rays or operating room expenses, provided the primary procedure is itself covered. The agency also proposes specific additional dental services that would meet criteria for Medicare coverage, including dental or oral examinations as part of a comprehensive workup prior to an organ transplant, cardiac valve replacement or valvuloplasty procedure, and necessary dental treatments and diagnostics to eliminate the oral or dental infections found during a dental or oral examination as part of a comprehensive workup prior to such procedures. Finally, CMS seeks comment on additional services that may meet this criteria, how to reimburse them appropriately (including coordination with other clinical care providers) and the potential need for establishing an annual review process for such services. CMS specifically seeks clinical evidence regarding the importance of dental exams and infection treatments prior to certain head and neck cancer and joint replacement surgeries.

Manufacturer Refunds for Discarded Single-Use Drugs

The Infrastructure Investment and Jobs Act (Act) requires drug manufacturers to refund CMS for certain discarded amounts from refundable single-dose containers or single-use package drugs. CMS proposes that the policy would apply to Medicare Part B drugs that are described as being supplied in a "single-dose" container or "single-use" package based on U.S. Food and Drug Administration (FDA)-approved labeling or product information, including drugs described as a "kit" intended for a single dose/use. To qualify, all national drug codes (NDCs) assigned to the drug's billing and payment code must be single-dose containers or single-use packages. CMS may develop unique billing and payment codes for drugs as needed. Certain types of drugs are excluded, including radiopharmaceuticals and imaging agents, drugs requiring filtration and those new to Medicare Part B reimbursement (fewer than 18 months). CMS notes that the existing JW modifier used to indicate discarded amounts on claims is often omitted, and it is unclear whether this indicates that there were no discarded amounts or that the modifier was incorrectly omitted from the claim. CMS proposes to create a separate "JZ" modifier for claims when there are no discarded amounts. Accordingly, starting in 2023, all claims for applicable drugs must include either a JW or JZ modifier.

The refund amount for which the manufacturer is liable would be the product of the total number of discarded units (per quarter) and the drug's payment limit amount exceeding a certain percentage of the drug's total Medicare estimated charges, which would generally be 10 percent, although CMS seeks feedback on drugs for which a higher threshold may be warranted. CMS is required under the Act to provide each manufacturer with a report containing the total number of discarded units for each quarter and the total refund amount for which they are liable. CMS proposes starting in 2023, it would provide such an annual report to manufacturers by Oct. 1 each year reflecting one year's worth of claims data ending the preceding March 31, with payments owed by Dec. 31 each year. Manufacturers would be able to dispute their owed amount, in which case they would have 30 days after the dispute has been settled to make payment. Any amount overpaid or underpaid due as additional claims run out would be reconciled, though CMS estimates the impact would be small (<1 percent of claims). If manufacturers do not make prompt payment, they would be liable for the original amount plus 25 percent. CMS would also periodically audit applicable manufacturers and claims for accuracy and compliance.

Rural Health Clinics (RHCs) and Federally Qualified Health Centers (FQHCs)

CMS proposes to allow separate payment for CPM services in RHCs and FQHCs. However, rather than use new GYYY1 and GYYY2 codes, CMS proposes to incorporate CPM services into the general care management HCPCS code G0511.

CMS proposes to make conforming regulatory changes to telehealth policies under the Consolidated Appropriations Act. Specifically, payment for telehealth services furnished by FQHCs and RHCs would be extended for 151 days after the end of the COVID-19 PHE. During this period, CMS would also continue to waive geographic and site of service requirements, allow audio-only services and waive in-person requirements for all mental health services.

For purposes of establishing the payment limit for grandfathered provider-based RHCs, CMS proposes that MACs generally use the cost report ending in 2021. If the 2021 report does not have 12 consecutive months of data, the MAC should use the next most recent report that does. For non-grandfathered provider-based RHCs, the proposed 2021 MEI percentage increase update would not be applied, since the MEI is already built into the rate for 2021 services.

Clinical Diagnostic Laboratory Tests (CDLTs)

CMS proposes to make confirmatory regulatory changes for policies included in the 2021 omnibus bill, which mandates that payments for CDLTs may not be reduced for 2021 and may not be reduced more than 15 percent each year for CYs 2023 through 2025. CYs 2022 and 2023 Clinical Laboratory Fee Schedule (CLFS) payment rates will be based on 2016 data. The law also further delayed the next data reporting period for CDLTs until Jan. 1-March 31, 2023, which will be based on data from Jan. 1-June 30, 2019, and will be used to set CDLT payment rates for CYs 2024-2026. Reporting will then occur on a three-year cycle.

In response to the COVID-19 PHE, CMS established that Medicare would temporarily pay a nominal specimen collection fee and associated travel allowance to independent laboratories for the collection of specimens for COVID-19 CDLTs for homebound and nonhospital inpatients. CMS proposes to codify several technical clarifications regarding specimen collection and travel allowance policies currently in Medicare Claims Processing Manual, Chapter 16, § 60.2 and supplemental guidance. CMS also proposes a travel allowance mileage rate policy that includes a flat-rate option for short trips to a single location (10 miles or less) or a HCPCS code to bill on a per-mile travel basis for longer and multidestination trips. Finally, the agency solicits comments regarding specimen collection by physician office laboratories.

Colorectal Cancer Screenings

CMS proposes to reduce the minimum age for the Medicare-covered colorectal cancer screening tests from 50 years old to 45 years old to align with updated clinical recommendation guidelines. The agency also proposes to expand the definition of colorectal cancer screenings to include follow-up screenings following a positive stool test result, which would make it a preventive service and therefore waive any beneficiary cost-sharing. Frequency limitations would also not apply.

Removal of Selected National Coverage Determinations (NCDs)

CMS seeks comment on its proposal to remove NCD 160.22 (Ambulatory EEG monitoring) because it is outdated and unnecessary, which would allow MACs to make determinations.

Nonemergency, Scheduled, Repetitive Ambulance Services

The Repetitive, Scheduled Non-Emergent Ambulance Transport (RSNAT) Prior Authorization Model was recently expanded nationwide. In this rule, CMS proposes to clarify documentation and medical necessity requirements for qualifying services. The agency also clarifies that coverage includes observation or other services rendered by qualified ambulance personnel.

Medicare Provider and Supplier Enrollment

CMS proposes to expand the categories of parties covered by its denial and revocation provisions to include: 1) managing organizations; and 2) officers and directors of the provider or supplier if the provider or supplier is a corporation. The agency clarifies that "high" screening levels would apply in situations where an organization with multiple enrollments has had an action imposed against it or against one of its enrollments, or if it undergoes a change in ownership. CMS also proposes to elevate skilled nursing facilities (SNFs) to a high level of screening. Durable Medical Equipment, Prosthetics, Orthotics and Supplies (DMEPOS) suppliers would also be required to be in compliance with all conditions of payment at the time the item or service was provided, including any state licensure requirements.

Electronic Prescribing for Controlled Substances

CMS proposes to extend the warning letter phase to CY 2024. CMS previously extended the date for additional compliance actions until Jan. 1, 2025, and seeks comment regarding potential penalties and compliance activities, which might include a corrective action plan, public posting of noncompliant status and referral for further investigation. CMS proposes to use evaluation year data when determining whether a prescriber qualifies for a low-volume exception (rather than the preceding year).

Medicare Ground Ambulance Data Collection System (GADCS)

CMS proposes certain editorial changes to improve the clarity of certain instructions and questions and respond to stakeholder comments and questions, and better align the printable and web tools. A summary of all of the proposed changes and other information can be found on the CMS website. The agency notes that it regularly updates the set of FAQs and that additional questions may be directed to AmbulanceDataCollection@cms.hhs.gov. Finally, CMS notes it is in the process of developing the web-based GADCS reporting portal and intends to launch a web-based portal for submitting hardship exemption and informal review requests in late 2022.

Medicare Shared Savings Program (MSSP)

CMS proposes several major modifications to the program, including increased participation incentives for Accountable Care Organizations (ACOs) that are new, small, independent and/or serving complex or underserved patient populations. The agency also proposes benchmark revisions designed to enhance long-term program participation. CMS projects that the cumulative changes will yield $650 million in added shared savings payments to ACOs and an additional $14.8 billion in savings to Medicare, and says that it will continue to consider the ongoing impact of COVID-19 on ACOs, though it does not propose any specific policies in this rule. Major proposed changes are summarized below.

Advance Investment Payments (AIPs): CMS proposes to provide advance payments for certain new, low-revenue ACOs starting in CY 2024. To be eligible, ACOs must be new to the program, not include a hospital (except for critical access or small Inpatient Prospective Payment System hospitals) and not be owned or operated by a health plan. CMS will prioritize ACOs in rural locations and regions with low ACO penetration. AIPs would include a one-time fixed payment of $250,000, followed by a quarterly risk-adjusted payment tied to the number of beneficiaries (up to 10,000) for the first two performance years of an ACO's five-year agreement period. Payments would scale incrementally based on the proportion of dual eligibles and level of deprivation. AIPs may only be used for allowable expenses such as increased staffing, infrastructure and enhancing care for underserved beneficiaries, including addressing social determinants of health. ACOs must submit a plan detailing how funds would be spent as part of their application and must segregate AIPs into a separate account from all other revenues except shared savings payments. ACOs would also be required to report annually the total amount of AIPs received and itemize spending, noting any changes from the original spend plan. AIPs would be recouped from future shared savings payments, though ACOs would never owe more than they earn in shared savings. ACOs that terminate early from the program would be obligated to repay any AIPs received in full.

Slower Transition to Risk for New ACOs: CMS proposes to allow new ACOs to remain in one-sided risk options for up to seven years, and increase from two years. New proposed participation options are summarized in Table 45.

Shared Savings/Losses: Starting in 2024, low-revenue ACOs participating in the BASIC track would be eligible to share in savings even if they do not meet the full minimum savings rate. If an ACO meets the quality performance standard, it would be eligible to share in half of the maximum sharing rate for that level. If it does not meet the full quality performance standard but scores above the 10th percentile on at least one of the four outcome measures, it would be eligible to share in savings at a lower rate calculated by multiplying the maximum sharing rate by its quality performance score. Smaller, rural ACOs would earn higher payments. ACOs in the ENHANCED track would owe shared losses according to a similar sliding scale approach, rather than automatically being subject to the maximum loss rate of 75 percent. Proposed new supplemental payments under the Medicare Hospital Inpatient Prospective Payment System (IPPS) for Indian Health Service (IHS)/Tribal hospitals and hospitals located in Puerto Rico would be excluded from expenditure calculations. CMS also proposes to clarify what circumstances constitute "good cause" for reopening shared savings evaluations.

Quality Performance and Data Reporting: The measure set largely aligns with last year and is summarized in Table 52. CMS proposes to extend the incentive for reporting clinical quality measures through 2024 to align with the sunsetting of CMS Web Interface and proposes changes to Web Interface measure specifications to align with clinical quality measure workflows and clinical guidelines. CMS seeks feedback on two potential social determinants of health measures (Screening for Social Drivers of Health and Screen Positive Rate for Social Drivers of Health) and several patient experience survey questions related to price transparency. The agency also requests feedback on whether it should create a shortened version of the patient experience survey that would be more applicable to specialty groups. For performance year 2023, the performance standard would be set at the 30th percentile, and would increase to the 40th percentile for performance year 2024 and subsequent years. Table 51 summarizes the proposed reporting requirements and quality performance standard. Finally, CMS proposes to recognize ACOs structured as organized healthcare arrangements for data sharing purposes.

Health Equity Adjustment: CMS proposes a new health equity adjustment that would be worth up to 10 bonus points for ACOs serving a minimum level of disadvantaged beneficiaries and meeting certain data completeness requirements. CMS expects approximately 30 percent of ACOs would qualify. The amount would be scaled based on an ACO's proportion of underserved beneficiaries (the proportion of dual eligibles or the proportion of beneficiaries residing in areas of high socioeconomic disadvantage, whichever is higher). ACOs that qualify would earn bonus points for scoring in the top or middle third of performers on each measure.

Benchmark Changes: CMS proposes multiple revisions to its benchmarking methodology starting in performance year 2024 to strengthen incentives for ACOs to enter and remain in the program long-term. First, the agency proposes to incorporate a prospectively-set, risk-adjusted national fee-for-service (FFS) spending growth factor known as the Accountable Care Prospective Trend (ACPT) into a three-way blend with national and regional growth rates to update an ACO's historical benchmark. Importantly, the ACPT would not be impacted by any additional savings that an ACO itself generates and would remain unchanged throughout an ACO's five-year agreement period, providing a degree of certainty. CMS would also institute a "guardrail" whereby it would apply the two-way blend if the losses were smaller. CMS notes that 62 percent of ACOs fared better under the revised approach. CMS also notes that it may reduce the weight placed on the ACPT on an ad hoc basis if actual expenditures vary significantly from projections.

The agency would also rebase benchmarks to account for past savings for certain ACOs, which it hopes will help to mitigate the rebasing ratchet effect on an ACO's benchmark, as well as an ACO's own impact on its regional service area spending. To be eligible for this adjustment, an ACO would have needed to generate positive average prior savings across the three years immediately preceding the start of its current agreement period, have had its benchmark reconciled for at least one of those three years and have been fully compliant with all program requirements. CMS would remove any years during which the benchmark was not reconciled from the calculation. CMS would adjust the past savings adjustment amount by changes in case mix and severity, as well as population size. Finally, if the ACO's regional adjustment is positive, CMS would take the greater of the regional adjustment or the adjustment for prior savings. If the ACO's regional adjustment is negative, CMS would net out a negative regional adjustment with the prior savings adjustment. No ACOs would receive a lower benchmark as a result of this policy, but approximately 22 percent would receive a higher benchmark.

The agency also proposes changes to stabilize the impact of regional markets on ACOs by gradually decreasing the negative regional adjustment amount as an ACO's proportion of dual eligibles and/or its risk score increases, and by lowering the cap on negative regional adjustments from minus 5 percent to minus 1.5 percent of Medicare Parts A and B spending. CMS additionally proposes to assign regional beneficiaries based on the same assignment window that corresponds to the ACO's selected assignment methodology for consistency.

Finally, CMS seeks comment on moving toward benchmarks that would be completely decoupled from ongoing FFS spending and based on prospectively assigned annual growth rates including a regional efficiency adjustment.

Risk Adjustment Cap: CMS proposes to increase the cap on positive risk score growth over the course of an ACO's agreement period from 3 percent overall to the ACO's aggregate growth in risk scores between base year 3 and the performance year plus 3 percentage points and seeks comment on this proposal as well as two alternatives.

Beneficiary Assignment: CMS proposes to revise the definition of primary care services used for assignment to include the following additions: 1) Prolonged services HCPCS codes GXXX2 and GXXX3, if finalized; and 2) Chronic Pain Management HCPCS codes GYYY1 and GYYY2, if finalized. The agency will consider services furnished by the new classification of rural emergency hospitals the same way that it does for those furnished in hospital outpatient departments for assignment purposes. CMS will now periodically identify CMS Certification Numbers (CCNs) associated with ACO participant tax identification numbers (TINs) periodically verify throughout the performance year to ensure accuracy for assignment purposes. Deactivated CCNs would count for the remainder of the same year.

Reducing Administrative Burden: CMS proposes to eliminate the requirement to submit marketing materials to CMS for review and approval prior to dissemination, loosen the narrative requirements for skilled nursing facility (SNF) 3-day rule waiver applications, and reduce the frequency of required beneficiary notifications from annually to once per agreement period with a verbal or written follow-up within 180 days. The agency proposes to clarify that ACO participants are required to post signs in all facilities and make standardized written notices available upon request in all settings in which beneficiaries receive primary care services.

Updates to the Quality Payment Program (QPP)

MIPS Value Pathways (MVPs)

CMS continues to press forward with its new MVP framework, to which it intends to eventually shift Merit-Based Incentive Payment System (MIPS) entirely. Advancing health equity continues to be a major focus, along with APM alignment. CMS proposes revisions to the seven MVPs that it finalized last year, including adding new quality measure options. In addition, the agency proposes to add five new MVPs (Advancing Cancer Care; Optimal Care for Kidney Health; Optimal Care for Neurological Conditions; Supportive Care for Cognitive-Based Neurological Conditions; and Promoting Wellness). Any proposed changes to Promoting Interoperability (PI) measures under MIPS would also apply to MVPs. The proposed 2023 inventory of MVPs can be found in Appendix 3.

Regarding development of new MVPs, the agency proposes to post draft versions of MVPs on the QPP website for a 30-day comment period. In addition, stakeholders would be encouraged to submit written revisions on a rolling basis throughout the year, and if CMS is seriously considering revisions to an existing MVP, it would host a webinar for additional public feedback.

Subgroup reporting will be voluntary for performance years 2023-2025, after which time it will be mandatory. CMS clarifies that individual clinicians may only register for one subgroup and that the MIPS low-volume threshold will apply to subgroups. CMS would evaluate subgroups at the TIN-level for population- and outcomes-based administrative claims quality measures. Specialty types would be assigned using Medicare Part B claims data (as opposed to PECOS). Group TINs would be required to list and describe each subgroup registered under their TIN during the subgroup registration process. Those that register for subgroup reporting can still report data and be scored as individuals or under a group's TIN if no data is received under the subgroup. Finally, subgroups would be ineligible to report via the APM Performance Pathway.

Merit-Based Incentive Payment System (MIPS)

Because of the ongoing COVID-19 PHE, CMS proposes to use 2019 data as the basis for setting the CY 2023 performance threshold at 75 points, which it anticipates would subject approximately one-third of MIPS eligible clinicians to negative payment adjustments for the CY 2023 performance period. MIPS scores at or below 18.75 would earn the full minus 9 percent penalty, and scores of 89 points or higher would be eligible for the MIPS exceptional performance bonus. Scoring policies are summarized in Table 91. CMS also proposes to permit facility-based measurement of virtual groups. Additionally, CMS proposes the following category-specific changes:

- Quality: CMS proposes to increase the data completeness criteria threshold from 70 percent to 75 percent starting with 2024 performance. CMS proposes modifications to the quality measure set, summarized in Appendix 1. Among other changes, CMS proposes to designate all health equity quality measures as high priority measures and seeks feedback on adding additional health equity quality measures, as well as adding questions related to health disparities and price transparency to the Consumer Assessment of Healthcare Providers and Systems (CAHPS) for MIPS Survey. Moving forward, CMS proposes that administrative claims measures (only) would be scored using performance year data (as opposed to a prospective benchmark from past data). Finally, CMS seeks feedback on updating the complex patient bonus to account for health equity and/or safety net providers.

- Cost: CMS proposes methodological updates to the Medicare Spending Per Beneficiary measure. Retroactive to the 2022 performance year, CMS proposes to award a small amount of credit for cost improvement, capped at 1 percent of the cost category score. CMS notes that there are seven episode-based measures under development and four more set to begin development this year.

- Improvement Activities: CMS proposes to add five new activities related to reducing health disparities. In addition, the agency proposes to retire and modify a handful of activities to avoid duplication. The proposed updated inventory of activities can be found in Appendix 2.

- Promoting Interoperability: CMS proposes several measure-specific changes for this category, including: 1) making the Query of Prescription Drug Monitoring Program (PDMP) measure mandatory (with two exclusions) and modifying it slightly; 2) adding an alternative option to satisfy the Health Information Exchange / HIE) Objective (Enabling Exchange under Trusted Exchange Framework and Common Agreement / TEFCA); and 3) for the Public Health and Clinical Data Exchange Objective, CMS would require active engagement on each measure and require clinicians to report their level of engagement, which must be either: 1) preproduction and validation, or 2) validated data production. Additionally, CMS proposes that clinicians could only spend one year in preproduction and validation before being required to move to validated data the following year. CMS proposes to increase the Public Health and Clinical Data Exchange Objective from 10 points to 25 points and reduce the Provide Patients Electronic Access to Their Health Information measure by the same amount. The agency also proposes to discontinue its reweighting policy for the PI category for nurse practitioners (NPs), physician assistant (PAs), certified registered nurse anesthetist ( CRNAs) or clinical nurse specialists (CNSs) starting next year, but seeks feedback on this. CMS would continue reweighting for physical therapists, occupational therapists, qualified speech-language pathologist, qualified audiologists, clinical psychologists, clinical social workers and registered dieticians or nutrition professionals (which are newer MIPS reporters). Tables 84, 86 and 87 summarize the proposed CY 2023 PI measure set and scoring methodologies, including reweighting policies. CMS also seeks feedback on a potential new measure that would promote patient access to personal health information.

RFI: Advancing Digital Quality Measurement, Fast Healthcare Interoperability Resources (FHIR) and the Trusted Exchange Framework and Common Agreement (TEFCA)

CMS seeks feedback on how to define digital quality measures, particularly challenges related to non-Electronic Health Record (EHR) data sources, how to standardize data across platforms, including how best to leverage existing implementation guides developed by HL7, and strategies to optimize uninterrupted data flow and aggregation across multiple practices and EHR platforms via FHIR application programming interfaces. In addition to the proposed new measure in the PI performance category, CMS seeks feedback on other ways to advance information exchange under TEFCA, such as incentives or value-based payment models for both providers and payers. Finally, CMS is considering opportunities for information exchange under TEFCA for activities such as submitting clinical documentation to support claims adjudication or prior authorization.

APM Performance Pathway (APP)

CMS notes that in 2020, nearly 43 percent of MIPS eligible clinicians that received a payment adjustment participated via the APP. CMS proposes that APM Entities would be able to report data for the PI performance category at the APM Entity level. The agency would also add two new quality measures related to screening for social drivers of health.

Third-Party Intermediaries

CMS seeks comment on including national Continuing Medical Education (CME) accreditation organizations for submitting certain improvement activities. CMS proposes to delay Qualified Clinical Data Registry (QCDR) measure testing requirements until at least CY 2024 because of the ongoing impact of the COVID-19 PHE. CMS also proposes to tighten oversight by adding requirements for Corrective Action Plans (CAPs), terminating QCDRs and Qualified Registries that fail to submit data for three continuous performance years, and requiring intermediaries to provide CMS contact information for all clinicians on whose behalf they submit data so that they may be contacted for audit purposes. The agency also requests stakeholder feedback on third-party intermediary support of MVPs.

Medicare Compare Tools

To make data more meaningful to patients, CMS proposes to collapse the various HCPCS codes into procedural categories. The agency would exclude nonspecific procedure codes, such as office visit E/M codes and low complexity procedures, such as basic wound care or vaccine administration. CMS would also add a telehealth indicator for clinicians that offer telehealth services. The agency seeks input on how to appropriately incorporate health equity data.

Advanced Alternative Payment Models (AAPMs)

CMS solicits comment on ways to continue incentivizing AAPM participation given the 5 percent lump sum AAPM Incentive is scheduled to end at the end of the 2022 performance year (2024 payment year). Under MACRA, Qualified Participants (QPs) in AAPMs will receive a 0.75 percent annual update to their Medicare CF (which is 0.25 percent higher than for MIPS participants), but that would not begin until the 2024 performance year (2026 payment year), which means there would be a one-year gap in performance year 2023 during which there would be zero update to the Medicare CF and no AAPM Incentive Payment for AAPM participants. Under current statute, the QP thresholds are also set to increase from 50 percent to 75 percent for the payment amount threshold, and from 35 percent to 50 percent for the patient count threshold. This effectively raises the bar for the level of AAPM participation required to become a QP. Intervention on either front would require an act of Congress.

CMS is seeking comment on potentially transitioning to making QP threshold determinations at the clinician, rather than AAPM Entity level. The agency believes this may prevent some AAPM Entities from selectively excluding certain clinicians, particularly specialists, from participation lists because of the impact that they would have on patient attribution, benchmarks or payment thresholds. CMS also believes this would prevent "windfall" payments to clinicians that are listed on an AAPM Entity's participant list but have minimal personal involvement in AAPMs overall.

CMS proposes to permanently establish the revenue-based nominal amount standard at 8 percent, rather than potentially increase it in the future. This standard determines which models have sufficient risk to qualify as an AAPMs and would not impact individual AAPM Entities.

CMS proposes to apply the 50-eligible clinician limit directly to the AAPM Entity participating in the Medical Home Model, rather than the parent organization through which the AAPM Entity is owned and operated.

Finally, CMS proposes to move up the date by which QPs must notify them of an appropriate TIN for purposes of rendering an AAPM Incentive Payment in cases where CMS cannot identify one. CMS proposes to require this by Sept. 1 (rather than Nov. 1) of each payment year, or 60 days from the notice of the initial round of incentive payments, whichever is later.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.