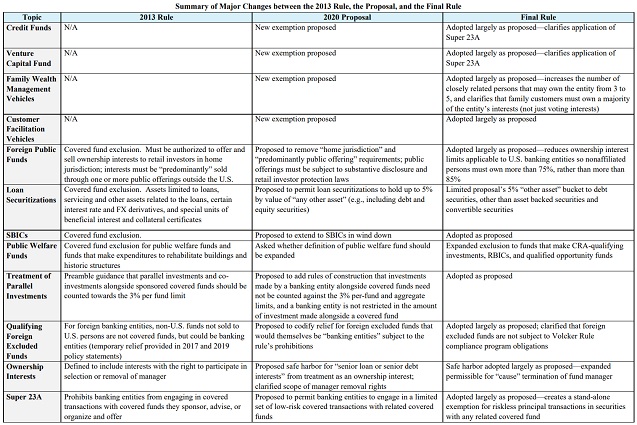

On June 25, the five regulatory agencies responsible for implementing the Volcker Rule approved a Final Rule that makes significant revisions to the "covered funds" provisions of the current implementing regulations. The amendments in the Final Rule represent a significant narrowing of the covered funds prohibitions to better focus on the risks the Volcker Rule was intended to address, and should provide new flexibility for banking entities to engage in both fund investment and customer-driven asset management activities inside and outside the United States. Key elements include:

- New exclusions for credit funds, venture capital funds, family wealth management vehicles, and client facilitation vehicles, and an expanded scope for the public welfare fund exclusion.

- Revisions to address practical obstacles to reliance on the existing exclusions for loan securitizations, foreign public funds, and small business investment companies ("SBICs").

- Clarifications about when debt interests in covered funds could be characterized as "ownership interests", including the treatment of creditor rights upon default and "for cause" removal rights, and a safe harbor for senior loans and senior debt interests.

- Limitations on the rule's extraterritorial impact for the non-U.S. funds activities of foreign banks by codifying existing no-action relief related to controlled qualifying foreign excluded funds.

- Exclusions from the "Super 23A" prohibition for certain low-risk transactions, such as intraday extensions of credit, credit extended in connection with payment clearing and settlement activities, and riskless principal transactions.

- Clarification that otherwise permissible direct investments alongside covered funds should not be counted towards the 3% limit on what a banking entity can hold in a sponsored covered fund.

The Final Rule made only a few changes to the proposal released on January 30 (the "Proposal"). Most of those were helpful technical fixes, and the expansion of the public welfare funds exemption and clarification of permitted voting rights for debt securities are notable improvements. Still, there were a number of opportunities to provide additional flexibility suggested in comments that the Agencies declined to adopt, and in a few cases—including the definition of the permitted bond bucket for loan securitizations and in the conditions on some of the new exemptions from Super 23A—commenters are likely to be disappointed with the Agencies' narrow approach. This memorandum updates our February 12 memorandum summarizing the proposal, and highlights key changes in the Final Rule.

The Final Rule is effective October 1, 2020. A link to the Final Rule is available here , and blacklines against the current rule text and the January proposal are available here and here .

To view original article, please click here

Originally published 29 June, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.