We looked at 28 deals across Asia that were signed or closed pre-COVID in which the buyer or a group of affiliated buyers acquired all or a significant majority of the outstanding equity of the target, examined the common key terms in these deals, and have sought to provide our insights on the patterns that the results reveal.

Approximately one third of these deals involve a target in Southeast Asia. Another third involves a target in Korea, with 25% involving a target in China or Hong Kong and 7% involving a Japanese target.

Following Part I of this Report in which we looked at consideration mechanics and Part II in which we examined sellers' disclosures against warranties, this week we turn to the use of escrow. In summary:

- The basis upon which the amount in escrow can be claimed should be specific. Parties must clearly agree on how escrowed funds can be released.

- Sale and purchase agreements should contain detailed provisions as to when claims can be made and the supporting documents required to initiate a claim.

- The use of warranty and indemnity (W&I) insurance does not necessarily mean no escrow will be required. Escrows are often used as a "proof" that the buyer have the funds to complete the transaction and/or to ensure that there are funds post-closing to settle the seller's liabilities—in particular, when such liabilities are not covered by W&I insurance. Escrow is also used to boost the seller's confidence that the buyer will ultimately complete the deal.

PURPOSES OF ESCROW

We set out below a non-exhaustive list of common reasons that parties put funds in escrow in an M&A transaction:

- Signing or Pre-Closing Deposit.

- A seller often asks for a deposit to be paid at signing or shortly after signing when a seller begins the transfer of the ownership of shares or other assets to a buyer before the buyer pays the purchase price. This is usually due to delays through registration of ownership transfer with local authorities where the seller has to commence the process much earlier than the scheduled closing date and the buyer seeks to defer payment of the purchase price until such transfer is confirmed or the process required to transfer is substantially completed.

- Sellers also often request a deposit in auction or competitive sale processes where the sellers are likely to suffer loss of opportunities if, for any reason, the buyers walk away from the deal. In those cases, a buyer will typically be asked to place money in escrow, which allows it to perform due diligence while providing comfort to the seller that, if all conditions are met, the buyer will be able to make the payment for the transaction.

- China Withholding Tax Liabilities. For offshore transactions involving underlying Chinese onshore entities or other Chinese assets, buyers are generally required under State Administration of Taxation Announcement [2015] No. 7 (commonly referred to as "Announcement 7") to withhold tax from the purchase price (equal to 10% of the sellers' applicable gains), unless the sellers independently settle their taxes with the tax authorities. For this reason, a buyer would typically withhold an amount from the purchase price that is held in an escrow account to be released to the seller only after seller has discussed with the tax authorities and settled its tax payment.

- Adjustment Escrow. As discussed in Part I of this Report, completion accounts remain a common consideration mechanics in Asia. To ensure the parties prepare the estimated closing statement and the final closing statement diligently and properly, the estimated amount of adjustment to be made will often be deposited into an escrow account and will only be released upon the parties reaching an agreement on the final closing adjustment or, in case of a failure to come to such agreement, until the court, arbitration tribunal, or independent third party designated by the parties to make the final decision makes such determination.

- Other Post-Closing Liabilities. Other than post-closing purchase price adjustment, for an agreed period after closing, buyers often have the right to seek indemnity from the sellers for any breach of representations or warranties or specific indemnity for losses arising from certain identified non compliance or risks. Part of the purchase price is usually held back in an escrow account in transactions involving privately held sellers to address the buyer's concerns over the seller's financial ability to satisfy the seller's obligations under these provisions. From the point of view of some sellers, such as venture capital funds, angel investors, and even the relatives of the founders, escrow may be an attractive alternative as they normally don't want to be involved in any court or arbitration proceedings to handle claims made by the buyers and thus may agree to set up an escrow to hold certain funds pending the lapse of the post-closing liability claim period.

In any of these cases, parties typically engage an independent, professional third-party escrow agent (e.g., J.P. Morgan) that can assure the relevant funds will only be transferred upon the corresponding transfer of a deliverable or completion of an obligation by the sellers.

W&I insurance does not eliminate the need to consider an escrow.

W&I insurance does not eliminate the need to consider whether an escrow is required. Escrows are often used as a "proof" that the buyer has the funds to complete the transaction and/or to ensure there are funds post-closing to settle the seller's liabilities, in particular when such liabilities are not covered by W&I insurance—for example, identified due diligence issues, liabilities from tax investigation, or audits known prior to signing (though the extent of liabilities or the issues underlying such investigation or audits may be unknown at the time of signing) and, in Asia particularly, as a tool to give the seller the comfort that the buyer is able to close the deals, in particular when the buyer comes from a different jurisdiction where cross border payments are subject to foreign exchange control.

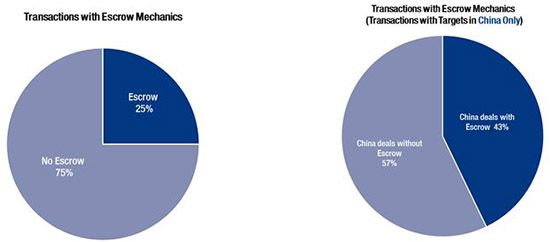

ONE IN EVERY FOUR DEALS (AND CLOSE TO TWO IN EVERY FOUR CHINA DEALS) FEATURE ESCROW.

Escrow is more common in China than in the rest of Asia and more common with corporate sellers than financial sellers.

In 25% of our sample deals, part of the consideration was held in escrow. Many of the sellers requested a signing deposit in escrow to ensure that the buyers can pay the consideration at closing or break fees (if any).

For deals involving targets in China, the percentage of deals with an escrow goes up to 43%. Unsurprisingly, the purpose of a number of the escrows in these deals was to settle the China withholding tax liabilities. In other China deals without escrow, it is possible that the parties agreed to a holdback mechanism or similar arrangement to address the Announcement 7 tax without the need for an independent escrow, or the buyers were comfortable relying solely on the seller indemnity in the event sellers do not settle their Announcement 7 taxes. It is also possible that the parties determined that Announcement 7 did not apply to the transactions or that the sellers did not have any capital gains.

Parties transacting on targets in Southeast Asia and Korea also use escrow as a means to hold break fees, signing deposits, and keep an amount for settling post-closing adjustment or deferred consideration.

Below is a table summarizing the purpose of the escrow in our sample deals:

|

Purpose of the Escrow |

% of Deals with Escrow |

|

(i) Break Fee |

28.6% |

|

(ii) Signing Deposit |

42.8% |

|

(iii) China Withholding Tax Liability |

42.8% |

|

(iv) Post-Closing Liabilities (Warranty Breach/Indemnity) |

14.3% |

|

(v) Post-Closing Adjustment/Deferred Consideration |

14.3% |

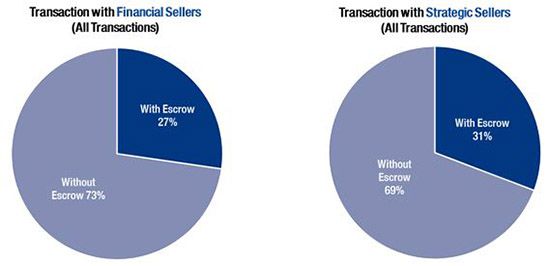

Both financial sellers and strategic sellers could agree to a holdback in escrow.

In our sample deals, 27% of the financial sellers agreed to use escrow. Of the strategic sellers, 31% agreed to leave part of the consideration in escrow. These statistics suggest that both types of sellers are willing to consider the use of escrow where necessary or appropriate.

While there has been a perception that financial sellers will only agree to leave part of the consideration in escrow if escrow is needed to deal with the buyers' request for signing deposits or break fees, we note that, based on our sample deals, some financial sellers agree to escrow on the basis that funds in escrow will be the only recourse of the buyers and effectively use escrow as a means to limit the sellers' exposure and to facilitate distribution to their investors.

OTHER KEY POINTS

Other than the purpose of the escrow (i.e., the obligations covered by the escrow), before an escrow agent is engaged, parties often agree on three basic points:

- Whether the escrowed funds should be held in one account, even if they are securing multiple obligations. If the escrow funds are not required to be ring-fenced for the different obligations, are placed for the benefit of the same party, and are to be released in the same currency without exposure to currency exchange fluctuation, one account may be sufficient;

- The amount of the escrow and length of the escrow period—see below; and

- The release of escrowed funds—see below.

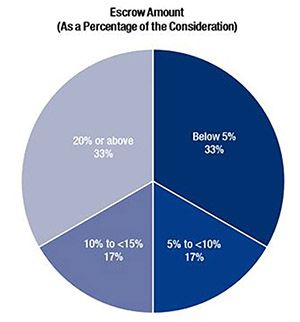

The size of the escrow can vary.

The exact percentage of the consideration held in escrow varied widely. In one third of the deals, the escrow size represents less than 5% of the consideration (including all the deals with total consideration of USD500 million or more). In another one third of the deals, the escrow size represents 5-15% of the consideration. The remaining deals are smaller deals, each of a consideration below USD200 million. The escrowed funds in those deals represent 20% or more of the consideration.

These statistics suggest that the size of escrow buyers request is not tied strictly to a percentage of the consideration but can vary depending on the deal size and the issues that may be identified in the course of buyer due diligence.

The release of escrowed funds and the mechanics to resolve disputes should be agreed in the escrow agreement and the purchase agreement.

For the final allocation of the funds kept in the escrow, the parties have to either serve a joint notice to release the payment or agree at the outset with the escrow agent under what specified circumstances a party can unilaterally serve a release notice. If a unilateral release instruction is contemplated, the escrow agent will likely require at least a third-party law firm's confirmation or a reference to publicly available information as the trigger for release of the funds in escrow. The escrow agreement should contain clear and unequivocal provisions setting out what triggers payment and how payment will be released.

PRACTICAL POINTS IN USING AN ESCROW

Last but not least, we highlight three key practical considerations for the parties who decide to use an escrow:

- Escrow can be particularly helpful when there are multiple sellers making it difficult for the buyer to settle any claims. The existence of many sellers, including individual sellers, can give rise to difficulty in assuring the payment of cash and delivery of assets to the parties involved. An escrow will give the buyer some comfort that there are funds available to settle the sellers' obligations after closing. However, it is key to ensure that any release of the funds from the escrow would not require all sellers to act (e.g., provide signatures), and a seller's representative is given full and irrevocable authorization to agree to a release on behalf of all the sellers.

- Identify a clear and unequivocal release trigger. To avoid any dispute over when the escrowed fund can be released and any unnecessary delay, parties should agree clearly (a) who can sign the joint notice to release the payment and (b) the specific deliverables that will need to be provided to the escrow agent before it will release the escrowed fund. The escrow agreement should contain clear and unequivocal provisions setting out what triggers payment, how payment is released, and what follows if dispute arises. Where appropriate, parties should consider building in a unilateral release mechanism to avoid delay due to a party refusing to execute the joint release notice.

- An experienced escrow agent will enhance the process. Agreeing to keep certain funds in escrow is only the first step in the process. Prior to the setup of the escrow account, the parties have to complete know-your-client (KYC) procedures with the third-party escrow agent. Having an experienced escrow agent who can clear KYC procedures quickly and without delay to the execution timetable and who will act responsively and proactively is critical. After closing, the escrow agent will remind the parties of any pre-agreed timeframe for releases (especially when the parties agree for periodic releases or a portion of the fund in escrow to be released after the lapse of a certain time period). It is critical for the parties to use independent third-party escrow agents with a good reputation to whom they can delegate the time-consuming governance and administrative aspects of the post-closing settlement. It is crucial that the agent has a strong internal control system and robust compliance framework and has ready access to sound corporate cash management and banking platforms that can support the currencies in which the escrowed funds are to be released.

If you are interested in the content of our full report, please reach out to us, and we will be happy to discuss other aspects of the report with you.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved